Lemon_tm/iStock via Getty Images

Today, we take an in-depth look at a cheap diversified financial name with some recent insider buying, now that so much of the market is selling at lower entry points than it was to start the year. An analysis follows below.

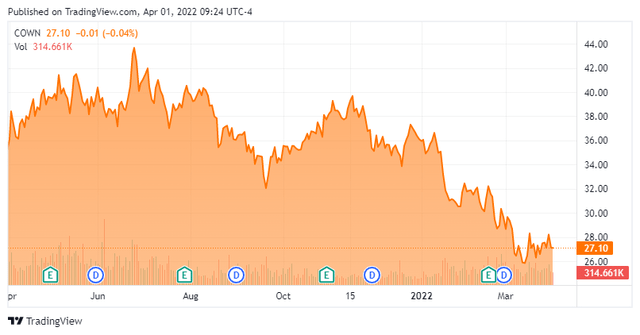

COWN – Stock Chart (Seeking Alpha)

Company Overview:

COWN – Company Overview (February Company Presentation)

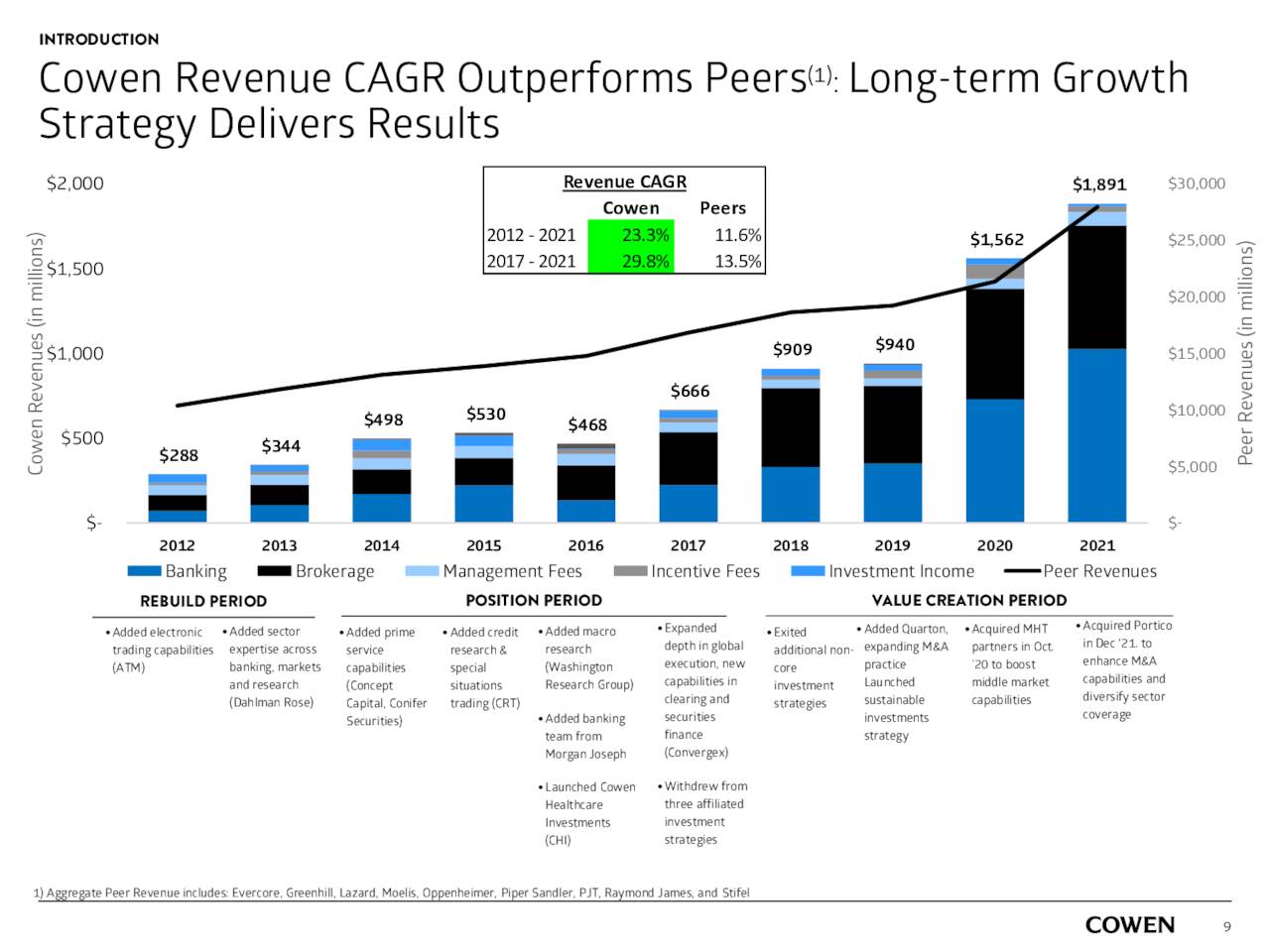

Cowen Inc. (NASDAQ:COWN) is a New York City based financial services firm offering investment banking, sales and trading, research, prime brokerage, and investment management services to over 6,000 institutional and private clients and companies in search of financing. The firm also manages its own investment portfolio, consisting of a few private equity special situations. With that said, it is primarily known as an investment banking boutique. Cowen was formed in 1918, acquired by Société Générale (OTCPK:SCGLF) in 1998, and spun out in 2006 at $60 per share, after giving effect to a 1-for-4 reverse stock split in 2016. Shares of COWN trade at just over $27.00 a share, translating to a market cap of roughly $750 million.

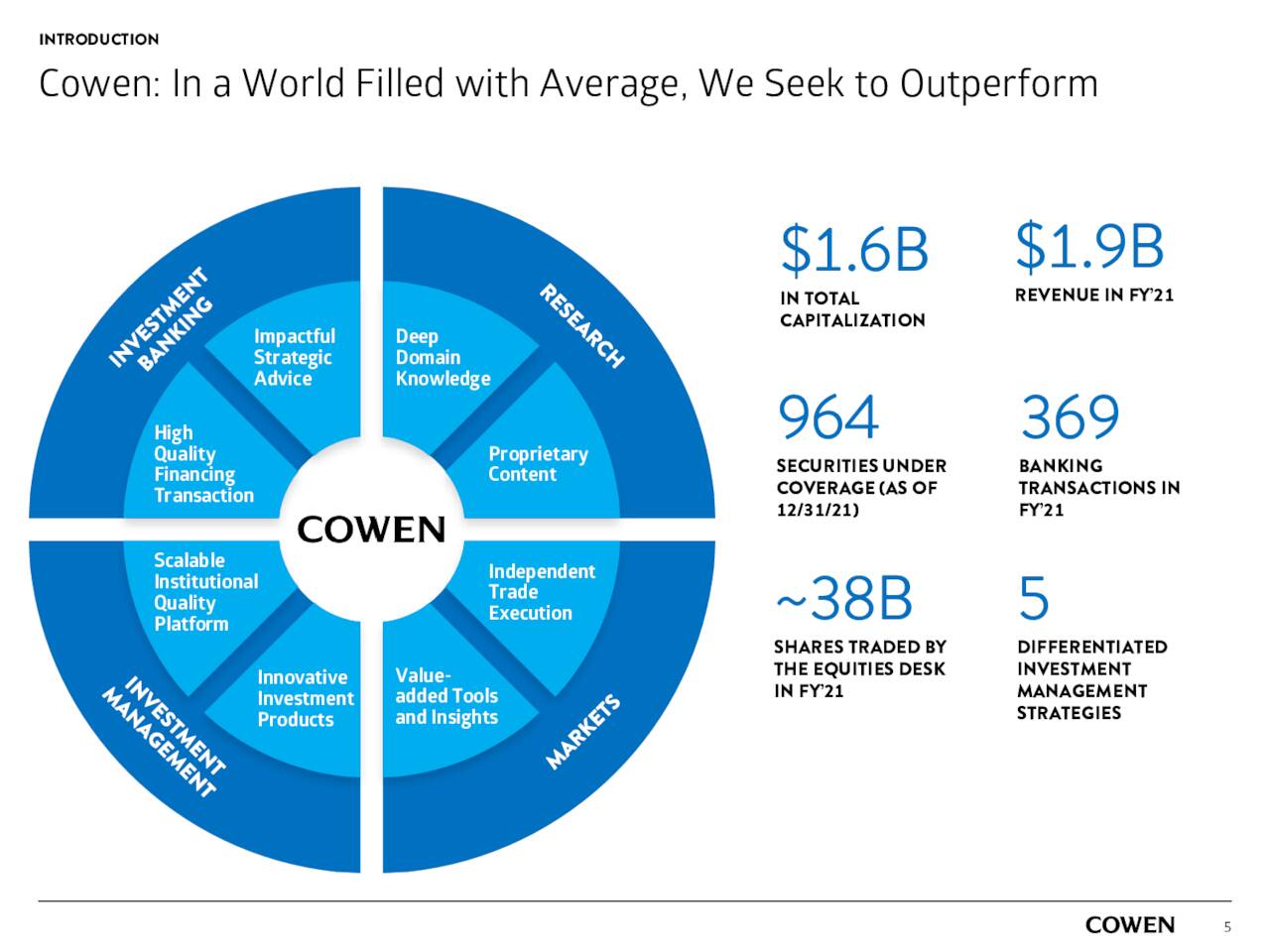

COWN – Company Footprint (February Company Presentation)

Operating Segments

The firm evaluates its performance through two business segments: Operating Company and Asset Company. The latter simply consists of non-core private equity holdings totaling $121.2 million as of December 31, 2021.

Operating Company generates the preponderance of Cowen’s revenue and consists of four divisions, the largest of which is investment banking. It provided revenue of $1.03 billion through 369 banking transactions in FY21, amounting to 54% of the firm’s topline, up 39% from FY20. This division is the backbone of Cowen, consummating 193 underwritten deals (including IPOs, secondaries, ATMs, converts, and debt), 95 M&A transactions, and 81 capital market advisory deals (primarily comprising private placements and PIPEs), and 20 debt transactions in FY21. The firm’s specialty is healthcare transactions, which accounted for 48% of its FY21 investment banking revenues. The firm is also strong in technology, media, and telecom (TMT), energy, as well as the capital and consumer goods verticals. To bolster its M&A advisor business – specifically in software data and analytics – Cowen acquired Portico Capital Advisors for ~$112 million in December 2021. It also generated a significant portion of its I-banking revenue in FY20 and FY21 from underwriting special purpose acquisition companies (SPACs) – more on this dynamic later.

The banking division is supported by a research department that boasts 59 analysts covering 964 stocks, encompassing ~45% of the S&P 500. With that said, approximately two-thirds of its coverage is on stocks with market caps under $10 billion.

Cowen is further buttressed by a large brokerage and services business, as well as a sales and trading operation, the latter of which makes markets primarily in equities and options. Brokerage revenues reached $512.9 million in FY21, up 11% from FY20 versus an industry average increase of 4%. The services business, which consists of prime brokerage, a phasing-out clearing business, and securities financing, generated FY21 revenue of $215.6 million, up 13% from the prior year.

Its investment management division has ~$15 billion of assets under management, providing legacy approaches with a specialty in private equity healthcare, merger arbitrage, activism, and sustainability. It was responsible for FY21 fees of $72.3 million, up 52% from the previous year.

Recent Share Price Performance

From late 2015 until early 2020, shares of COWN spent most of their time trading in the low-to-mid-teens until the pandemic induced selloff of March 2020, when they briefly traded below $6. It then became a twofold beneficiary of the pandemic. First, the substantial market volatility generated higher trading volumes, allowing its institutional brokerage and services revenue to surge 59% from $459.1 million in FY19 to $728.5 million in FY21. Second and more importantly, since the extreme volatility – which normally kills underwriting and M&A activity – was largely confined to six weeks in the spring of 2020, the firm’s investment banking unit benefitted from the greater focus on healthcare during the pandemic, as well as the SPAC craze, which accounted for 53% of the 471 U.S. IPOs in 2020 and 59% of the 1,033 U.S. IPOs in 2021. Cowen cashed in, with 32% of its FY21 banking revenue derived from SPACs. As a result, that division’s revenue rocketed 192% (FY21 versus FY19) to north of $1 billion. The market rewarded this exposure, sending it over $40 a share as late as early August 2021.

However, SPAC has become somewhat of a four-letter word with 82% of the 2021 vintage worldwide still searching for deals. Furthermore, with the biotech sector off nearly 30% since August 2021, it can be argued that IPOs and secondaries in that space will dry up as cash-strapped companies look for less dilutive alternatives while the cash-rich big caps wait for the dust to settle before reentering the M&A arena. Owing largely to these negative investment banking dynamics and the broader Russia-Ukraine uncertainty, shares of COWN are now trading at a trailing PE ratio (non-GAAP) of 2.97.

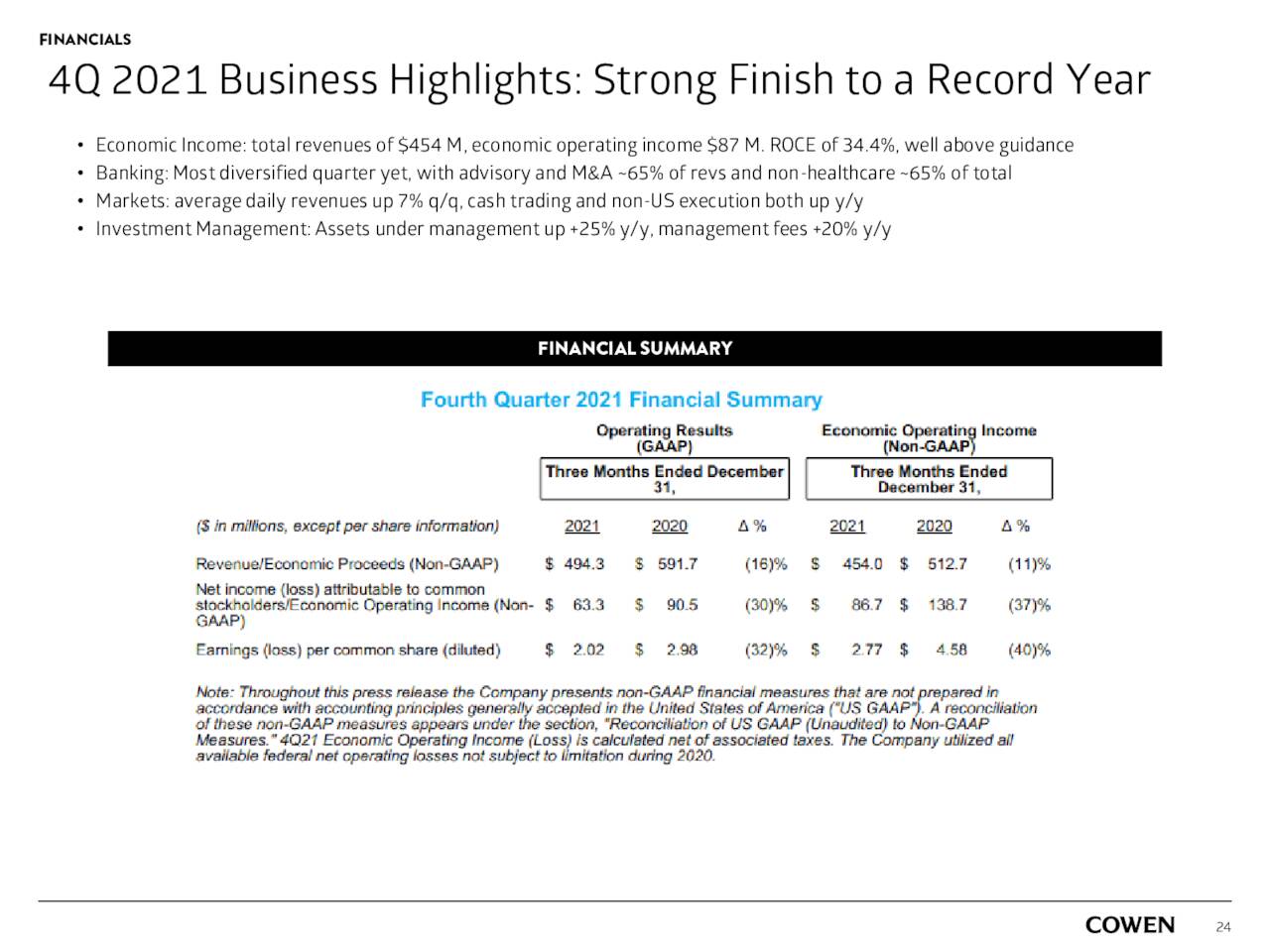

4Q21 and FY21 Earnings

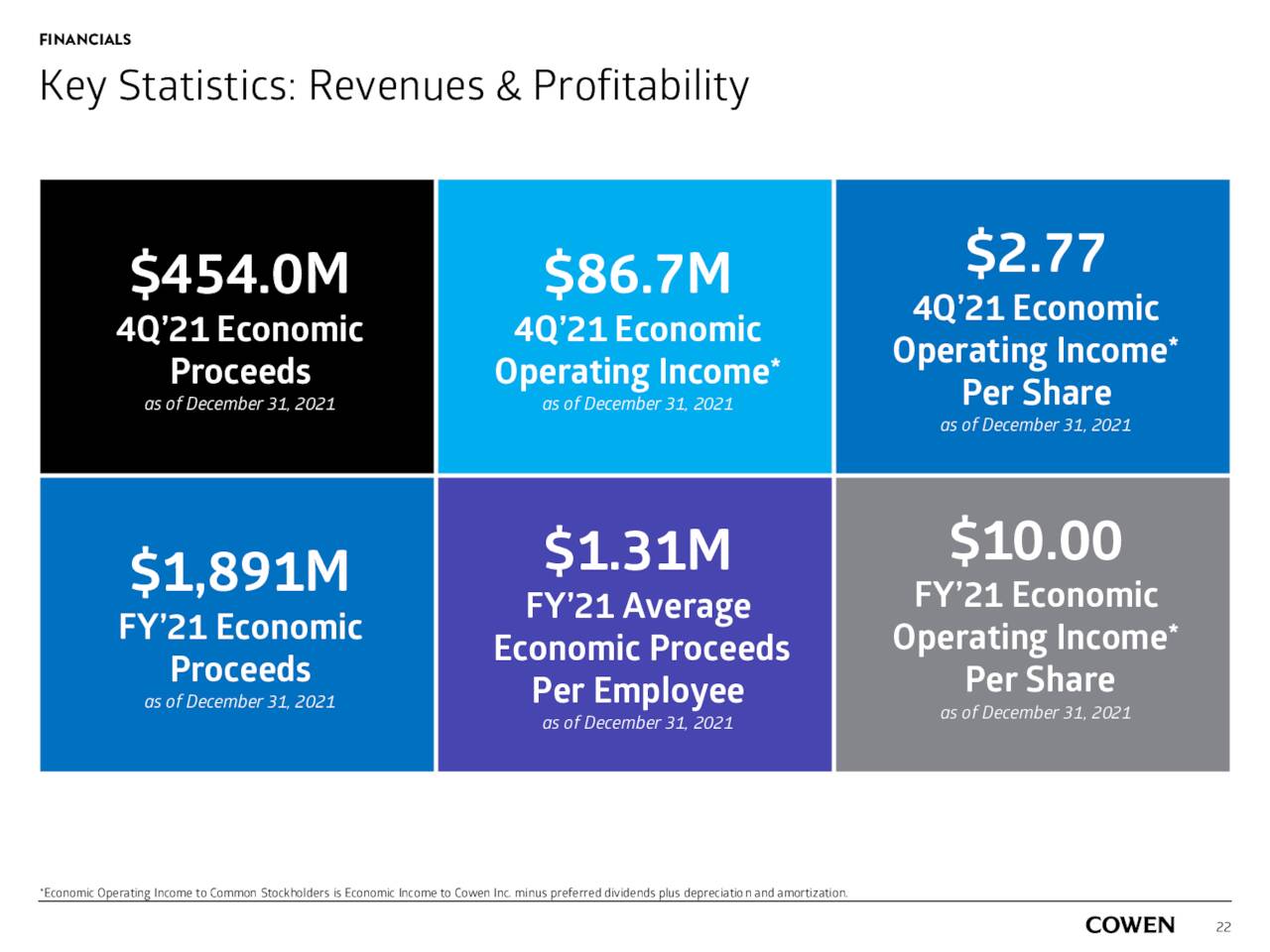

Not many signs regarding this head-scratching valuation were provided in the firm’s 4Q21 report. Released on February 16, 2022, Cowen earned $2.77 a share (non-GAAP) on economic proceeds – a non-GAAP revenue measure with management reclassifications (e.g., investment banking revenue net of underwriting expenses) that better reflects the performance of the core business – of $454.0 million versus $4.58 a share on economic proceeds of $512.7 million in 4Q20, representing 40% and 11% declines and besting Street estimates by $0.81 and $33.9 million, respectively.

COWN – Key Statistics (February Company Presentation)

Investment banking revenue was down 1% year-over-year to $263.8 million while brokerage revenue decreased 8% to $170.3 million as the firm wound down most of its regulatory capital-intensive client clearing activities. The shortfall was in investment income, which plunged $84.7 million to $12.5 million as markdowns in merchant banking investments and lower carried interest (re: lower hedge fund performance fees) hurt performance.

Cowen – Financial Summary (February Company Presentation)

For FY21, Cowen earned $10.00 a share (non-GAAP) on economic proceeds of $1.89 billion as compared to $11.39 a share (non-GAAP) on economic proceeds of $1.56 billion. Essentially, all of the bottom-line shortfall was due to normal income tax expenses versus none in the prior year.

Management admitted that 2022 was off to “a challenging start“, as the current inflationary and geopolitical milieu has hampered the investment banking sector. With that said, Cowen’s backlog of mandated transactions is greater now than at the same point in 2021, with only 3% of that backlog SPAC-related. Also, its brokerage and services businesses were off to a strong first month of 2022, with average daily revenues outpacing 4Q and FY21. After generating returns on common equity of 43.4% and 34.6% in FY20 and FY21 (respectively), the firm reiterated its long-term mantra of mid-teens after-tax returns on an annual basis.

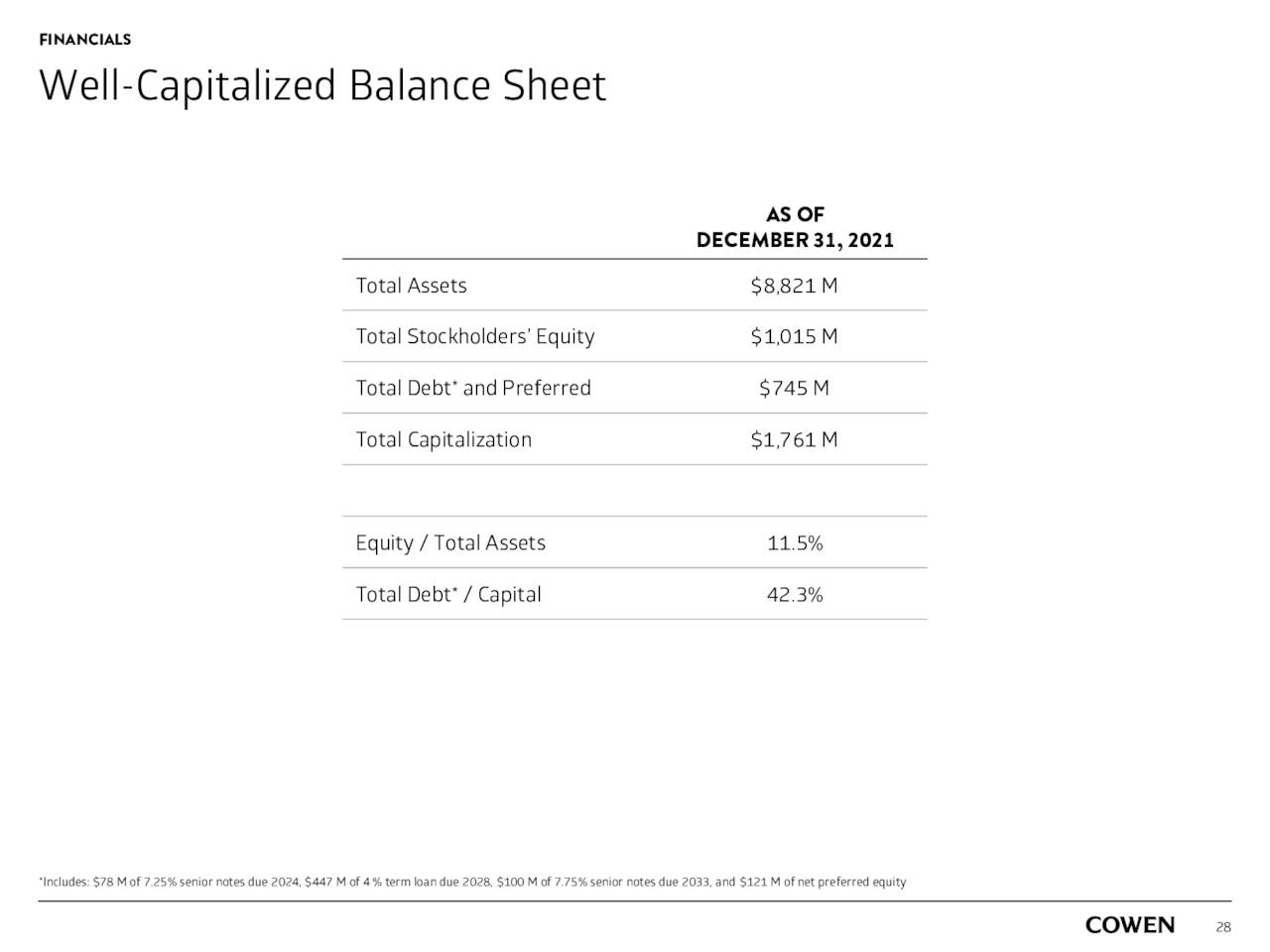

Balance Sheet & Analyst Commentary:

Cowen’s confidence in its outlook was reinforced when it raised its quarterly dividend 20% to $0.12 a share for a current yield of 1.6%. Furthermore, after repurchasing $159.8 million of stock in FY21, the board approved an authorization increase to $50 million in January 2022. Tangible book value per share stood at $26.56 on December 31, 2021.

COWN – Balance Sheet (February Company Presentation)

Street analysts encompass a broad spectrum of opinions regarding Cowen, with Piper and JMP Securities reiterating outperforms with price targets of $68 and $60 (respectively) in March 2021 while Compass Point upgraded the stock from a hold to buy with a price objective of $43 later that month. Goldman Sachs then initiated coverage in September 2021 with a sell rating and a $35 price target, citing its exposure to the SPAC business and the high leverage on its balance sheet. On average, analysts expect Cowen to generate FY22 earnings (non-GAAP) of $6.66 a share on revenue of $1.7 billion, representing 33% and 12% declines; followed by $7.66 a share on revenue of $1.8 billion in FY23.

In addition to the board authorizing share repurchases, the individual members are engaging in the same bullish behavior, with Brett Barth buying 10,000 shares at $28.78 on February 23rd and Lorence Kim purchasing 30,000 shares at $30.03 on February 25th.

Verdict:

Although clearly a beneficiary of industrywide surges in healthcare and SPAC investment banking volumes, as well as significant increases in trading activity, Cowen is emerging from the pandemic as a slightly more diverse company than it entered. As such, it is highly unlikely to return to pre-2018 business levels, as the market appears to be anticipating. Through the net addition of 47 managing directors since YE18 (to a current total of 89), it is expanding into additional banking verticals beyond healthcare and has reduced its dependency on SPAC underwriting while generating over $100 million a quarter in advisory fees. In other words, if market conditions aren’t conducive to healthcare public equity financing, Cowen now offers alternatives. Furthermore, it is picking up market share from its peers in brokerage.

COWN – Peer Comparison (February Company Presentation)

Leverage has increased, but that is a function of its securities financing business, which is a low-risk overnight matched book operation, meaning it is simply matching buyers and sellers. Cowen will have a chance to better articulate its transformation at an Investor Day on May 19, 2022. In the meantime, with its shares trading at a forward PE multiple of just over 4, the risk/reward appears to be asymmetrical, and the shares merit at least a small holding in our view.

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment