guvendemir/E+ via Getty Images

Background

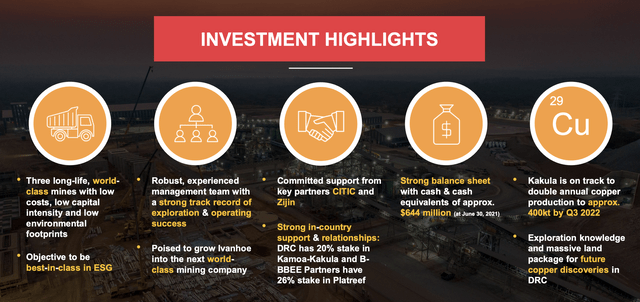

Ivanhoe Mines Ltd. (OTCQX:IVPAF) is a large mining and mineral conglomerate that debuted on the Toronto stock exchange in October 2012. Shares since have grown 63%. Many recent developments and geopolitical risks have made Ivanhoe Mines a promising investment and increased the value of its already strong production.

Recently, the company’s stock price has been rapidly rising, but I believe there is still an opportunity and that this is only the beginning of a long bull cycle that is coming for Ivanhoe Mines. During a period of rapid increase in the price of commodities, Ivanhoe’s market cap should be materially higher. While much of this may be priced in already, I believe investors have an excellent opportunity at these levels.

Ivanhoe Mines September 2021 Investor Presentation

The company has been making rapid fundamental improvements that will help bolster shares. Notable progress has been made to improve Ivanhoe operations and the entire supply chain and cut cost when necessary. In addition, Ivanhoe has been diversifying along the mining supply chain. While Ivanhoe never operates outside its geological expertise, management shows commitment to cost-cutting and operations improvement despite sector headwinds.

African and International Operations are Generating Shareholder Optimism

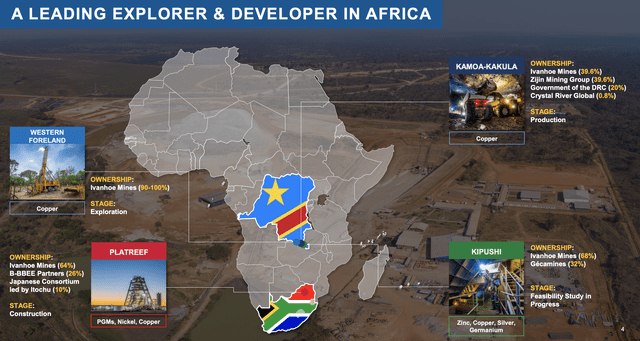

Operations have been improving, and the company continues to branch out to different countries. With new operations in Africa, there is a clear indication that the company wants to expand but stay inside the area it knows. The variety of mines in Africa will determine operations and future cash flows.

Ivanhoe Mines September 2021 Investor Presentation

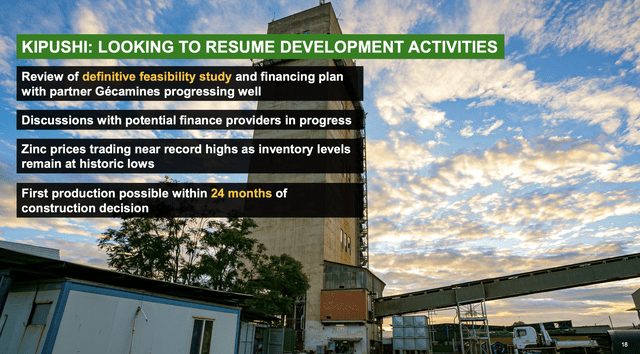

Specific operations are realizing the vision of Ivanhoe moving forward. The Kipushi mine, for instance, is promising, because roughly $85 million dollars will be achieved in production by July 2021. This has only improved since then, and the YOY production has increased. I believe this will help support Ivanhoe’s share price.

Ivanhoe Mines September 2021 Investor Presentation

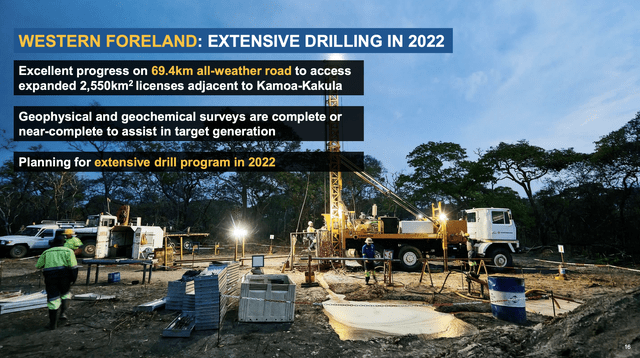

The western forelands will only add to Ivanhoe’s profit gains. With licenses near for the Kamoa-Kakula mine and the geochemical surveys done, mining will commence shortly. These will be immensely profitable, and these mines should move send company earnings materially higher. The company has already shown dominance elsewhere in the region and this should play out at Kamoa-Kakula, too.

Ivanhoe Mines September 2021 Investor Presentation

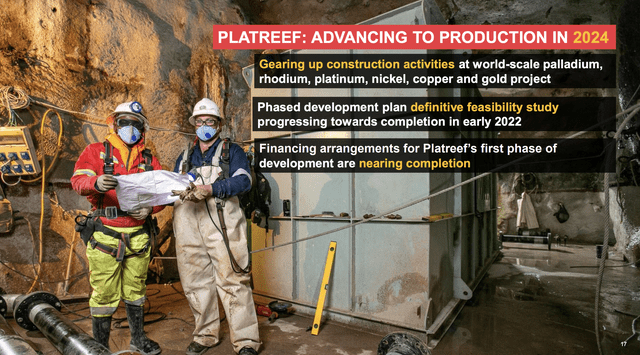

Ivanhoe Mines has made sure to bolster its portfolio will projects that will generate a diversity of revenue streams given the current undersupply of metals. The first phase of completion at Platreef will produce a variety of metals and rich deposits of copper, nickel, platinum, and more. Overall, Platreef has great potential, but investors must wait and see what production will genuinely look like.

Ivanhoe Mines September 2021 Investor Presentation

Kipushi is particularly important. It could prove to be a crucial part of Ivanhoe’s entire African mining plan. With production possible soon, it should impact shareholder returns by generating future material earnings. Overall, Ivanhoe appears to have an excellent African mining plan despite not having a great variety of locations, and its minerals should generate further share price appreciation.

Financials are steady and growing at more stable rates

Ivanhoe’s financials have been steady and will increase as more of these mines come online, although this may not be the case in the next few quarters. Looking forward to 2023 and 2024, Ivanhoe will remain at the top of my watchlist due to the promising mining projects I mentioned above.

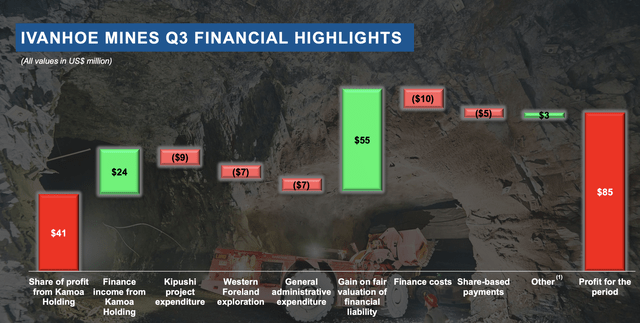

Source: (Ivanhoe Mines November 2021 Investor Presentation)

Earnings have been steadily improving, but the overall cash flow difference from debt payments will not be material and could affect shares. Profit potential from a variety of income streams shows the resilience Ivanhoe could have in an economic downturn. One reason Ivanhoe has been on such a run recently is because of the recent bear market in equities, and if this continues, Ivanhoe shares could move much higher.

Risks will not be material to future earnings reports

There are several risks with this type of investing. There may be civil unrest and fighting between villages, for instance. While this can take place in areas near the mine, it hasn’t proven to be a significant issue for Ivanhoe’s success in the past. With the momentum from production, Ivanhoe mines are ready for an earnings expansion due to their operations and reliability in getting these mines up and running in very remote parts of the world.

Another risk is that, unlike in the US and Western Europe, there is no existing infrastructure in many of these mining areas. Thus, Ivanhoe has to make or buy most of their infrastructure. This can be overwhelming for a small mining conglomerate, but, so far at least, this hasn’t proven to be a problem for Ivanhoe.

Sector-wise, Ivanhoe stands out from its peers due to its geopolitical and fundamental strengths. Any further geopolitical uncertainty may push shares higher due to Ivanhoe’s ability to do deals with both the western and eastern world.

Valuation looks ripe for further improvement

Ivanhoe Mines still has a unique market opportunity, despite much of its potential already being priced in. I believe the fundamental improvements the company has made will bring growth and returns to shareholders. Peers have performed in line with Ivanhoe, but as time goes on, there is a good chance Ivanhoe could outperform due to their expanded operations abroad.

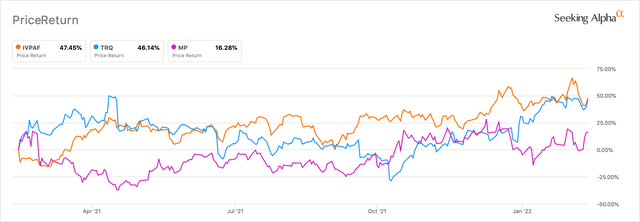

I compared Ivanhoe Mines to a couple of competitors that are experiencing similar macro pressures, Turquoise Hill and MP Materials. Turquoise Hill Resources (TRQ) is a Canadian mineral and exploration company that mines gold, uranium, copper, and other minerals. MP Materials (MP) is a company I’ve written about multiple times, most recently here. MP operates out of Thacker Pass, Nevada, USA, and has the only NdPr mine in the United States. Both of these companies are high-growing mining conglomerates, and Ivanhoe deserves to be talked about and put in the same league as those two (see price return chart below).

Ivanhoe Mines Seeking Alpha Price Return Peer Comparison

The overall price return of these companies has been quite nice over the past couple of months. Ivanhoe has performed just as well as Turquoise Hill, yet it is basically overlooked. Ivanhoe deserves to be in the picture as a major mining conglomerate with expanding internal production.

Conclusion and rating

Ivanhoe has a significant market opportunity in the coming quarters and years. The upcoming mining operations are a central bright spot, and financials are well-positioned to survive turmoil in the future. I rate Ivanhoe a Strong buy and recommend investors keep this on their watchlist. I will continue to cover Ivanhoe and similar stocks in the future.

Be the first to comment