NicoElNino/iStock via Getty Images

“High inflation is destroying demand. Markets are pricing in the fact that the Fed is forced to hike rates into a slowdown [that could easily become a recession].” Economic Advisor and Business School Professor. CNBC Squawk Box. July 5, 2022.

Following the six months ended June 30, 2022, The Wall Street Journal headlined the period as the “worst first half of a year in over five decades” for U.S. stocks. Regardless, analysts and market observers, like the CNBC guest we quote above, are widely predicting the worst is yet to come!! That is an eventuality we believe is unknowable and unpredictable. I believe this to be the case, because in my 52-year Wall Street career, I have never known anyone to accurately and consistently predict markets… economies…interest rates…inflation…oil prices…wars…commodity prices…and election outcomes. Not Warren Buffett…not Elon Musk…not Fed Chairmen…not my friend Peter Lynch…not me…and not even my doorman…who, for several years, as I reported to you in my March 31, 2022 “Letter from Ron,” had profitably invested in Bitcoin…

Since stock prices of a remarkable number of rapidly growing small businesses and highly regarded large companies have fallen so materially over the preceding eight months, we believe they are unusually attractively priced. This is relative to their businesses’ long-term growth prospects, earnings potential, and interest rates. Accordingly, on June 17, I emailed Becky Quick, a CNBC Squawk Box anchor, that I regarded the current period as offering “generational investment opportunity.” I told Becky I hoped she could find some other investors like me who could also provide Squawk’s viewers with a helpful, long-term, optimistic perspective. Becky and Joe Kernen spent several minutes on air discussing my note.

It is obvious that we unabashedly agree with Peter Lynch’s observation:

“Far more money has been lost by investors trying to anticipate corrections than has been lost in corrections themselves.”

Our ideas, like Peter’s, are relatively straightforward. We invest for the long term (meaning years…often decades…not quarters) in terrific, competitively advantaged, growth businesses managed by exceptionally talented individuals…whom we trust.

Regarding inflation, we think that is about the only macro anyone can predict with certainty. Nearly everything doubles in price about every 14 to 15 years. “You could look it up,” as Casey Stengel, the manager of numerous New York Yankees championship teams, used to say. My December 31, 2021 “Letter from Ron” included a table listing the cost of cars, tuition, salaries, food, commodities, houses, food, and gasoline during my lifetime. All have doubled in price about every 14 or 15 years, which means that the purchasing power of your savings falls on average about 4% to 5% per year over the long term.

During the 1970s, inflation and interest rates were high and rising. In 1982, the Fed under Paul Volker, like it is now under Jerome Powell, was trying to reduce inflation by raising rates. Although inflation made the replacement value of businesses underlying stocks more valuable in nominal dollars, share prices made little progress when interest rates were increasing. This is due to a higher discount rate on earnings. Just like now when share prices have been steadily declining for the past eight months. When inflation begins to cyclically fall again, you should expect stock prices to increase materially.

The first painting Judy and I purchased in 1978 was painted by abstract expressionist artist Willem de Kooning in 1976. It was a picture of a woman painted on a Sunday New York Times Real Estate section. The Times then advertised apartments for rent. I wanted to purchase the picture since I thought someday it would be interesting to see what apartment rentals cost in 1976.

The estimate for that painting at Sotheby’s was $12,000. When the bids passed $12,000, I turned to Judy. “I guess I lost it,” I said. “You didn’t lose it,” she replied. “You will just have to pay more. If you really want it, you should buy it.” We were sitting in the second row of the auction. When the auctioneer gaveled that I had purchased the picture for $18,000, I wasn’t sure if I should be happy or upset. That question was answered quickly when the woman seated behind me tapped me on the shoulder and handed me her card. “I have one just like it at home. Call me.”…which didn’t exactly make me feel like I had made a bargain purchase.

That de Kooning newspaper real estate painting hangs in the dining room of our weekend home in East Hampton. Last week I looked at the picture to see what a one-bedroom rental apartment at 235 East 87th Street cost in 1976. It was $375 to $425 per month. We then looked up rent online for the same apartment today. It is now $4,000 per month! That represents a 5.13% compounded annual increase for 46 years. The value of our painting?

$250,000!!!!

That represents a compounded annual increase of 6.16% per year for 44 years. I guess I should have called the woman who had one “just like it at home.”

The New York Times no longer advertises apartments for rent. CoStar Group, Inc. (CSGP) is the owner of Apartments.com which advertises apartments for rent online. Baron Growth Fund purchased shares of CoStar in 2004. The purchase price was $4.18 per share. Its recent price after a sharp decline over the past eight months is $61.87 per share! The increase in value represents a CAGR for over 17 years of 16.51% per year! So…although you can’t enjoy looking at stocks…they really are better investments than real estate…or art…and beat inflation by a lot!!!

We agree with institutional investor Baillie Gifford’s quarters.” Baillie Gifford was founded in Edinburgh, Scotland in 1908…74 years before Baron.

“Grandpa, I just got overtime!!!” That was how Roger Penske’s grandson excitedly informed him that the 16-year old was now being paid overtime for a summer job cutting grass at Roger’s 3,000 acre, family-owned, Indianapolis Speedway.

Roger Penske. November 2021.

“Few children who attend Greenwich Academy have any idea what the phrase ’overtime‘ means,” Roger Penske proudly told me. That was what the former champion race car driver, an exceptionally successful, self-made, transportation entrepreneur, told me when he visited me for breakfast last fall. Baron had been an important shareholder for several years in Roger’s Penske Automotive Group, the second largest new car dealer in America. Although Penske Auto Group’s (PAG) new car dealerships were profitable and grew strongly, Penske Truck leasing, a private company, 28% owned by PAG and more than 50% owned by Roger’s family, grew exponentially.

About 85% of freight in America is moved by truck. Therefore, trucking offers a cyclical opportunity to participate in the growth of America’s economy. Roger’s Penske Truck leasing business, though, seemed almost immune to cycles. It has grown from 300 trucks 50 years ago to more than 350,000 trucks at present…and Roger expects to grow his fleet to more than 500,000 vehicles by 2026! This makes it easy to see why we thought Roger’s truck leasing was such a cool business. Roger also owns about 50% of the publicly traded $8 billion market cap Penske Automotive Group.

As important to Roger as the success of the businesses he founded is that his three sons have all become very successful businessmen in their own rights…while his daughter, a mother of six, is a prominent lawyer. If you met Roger just once you would know immediately why he’s an extraordinary individual…and why you’d want to invest with him. He exudes intelligence, confidence, high ethical standards, hard work…and, with his obvious, unimpeachable character, you’d be certain he was trustworthy. That his sons and daughter are as hard working as he is, and that his grandchildren seem equally driven, speaks volumes about the values he has instilled in his family. Roger embodies what I mean when I say, “Baron invests in people.”

In 2014, before we began to invest in Tesla (TSLA), I called Roger to ask whether he thought Elon Musk’s electric car business would succeed. I did not believe that Roger, an owner of dealerships that sell cars powered by internal combustion engines (ICE) would likely have a favorable opinion of Tesla’s prospects. That was principally for two reasons:

- First, automobile manufacturing and distribution is unusually complicated, capital intensive, and highly regulated, which makes profitability problematic;

- second, cars with ICE motors require extensive annual maintenance, and dealer services revenues, not profits from automobile sales, are the most important contributor to profits of perpetual licensed ICE car dealerships.

Penske Automotive Group is principally an ICE car dealer. Since electric cars are powered by batteries and need little service, franchised dealerships are incented to sell ICE not EV automobiles. Further, Roger had been a long-term director of General Motors (GM). General Motors’ ICE automobile business would be disrupted if Tesla were successful.

Regardless, I was right to have spoken with Roger. That was since he outlined numerous issues we needed to consider, study, and question before we determined whether we believed Tesla could be a successful business…before we ultimately chose whether to invest in that company.

When we completed our initial due diligence on Tesla, which diligence has been ongoing since 2014, we decided to invest $360 million in Tesla over the next two years. I then called Roger and outlined why I thought we could earn 20 times our capital over the next 10 years. Roger was so certain I was wrong that he offered to bet me $1 million that Tesla would fail. “Roger, I can’t bet you a million dollars. First, if you are right, I couldn’t afford to pay you. Second, if I’m right, you’re my friend, and I couldn’t take your money.” We settled on a dinner bet.

Last summer, I was interviewed by David Rubenstein for his Bloomberg television program. During that interview, I mentioned my dinner bet with Roger that he had clearly lost but had not yet acknowledged. Roger called me that afternoon, immediately after my interview was broadcast. Roger apologized for forgetting our bet and congratulated us on our $7 billion Tesla profit. Roger and I settled our bet by him coming to my office for breakfast! It was an unbelievably fun couple of hours. Not just for our discussion about Tesla and electric cars and trucks, but to hear again his amazing life story. When I asked the 85-year-old CEO what his long-range plans were, he told me retirement was not in the cards. “What would I do?” he asked. “I understand,” I answered. As I’ve said many times, “we invest in people.” There can be no better example than investing in a person with competence, vision, values, and character than Roger Penske.

“Good afternoon, People! How was lunch? Ron has clearly been very successful managing your money. He also tells you what a good judge of people he is. But…twenty five years ago the man who picks your stocks thought I wouldn’t be successful…and chose instead to invest in the DONUT!!! (We had a small investment in Krispy Kreme at the time.) What do you think he will invest in next? Pizza?”

Jerry Seinfeld. Baron Investment Conference. 2008.

My cousin Cliffy has been one of Jerry Seinfeld’s best friends since they were six years old. They grew up in Massapequa, Long Island. Their friendship began when they learned to ride their two-wheeler bicycles together. Jerry now includes Cliffy in his Porsche race car lessons in the Las Vegas desert.

Cliffy is a doctor. In 1985, he lived in Seattle and enrolled in an advanced physician practice course at Cornell Medical School in New York City. “Can I stay with you and Judy for six weeks?” he asked me. “Of course.” On the Friday before Cliffy was about to return home to Seattle, he told me his best friend, Jerry, was performing stand up that evening at “Catch a Rising Star” comedy club in New York. “Do you remember meeting him when we were young?” “Cliffy, I was 16 and he was 6, and he didn’t make a particularly strong impression. So, the answer is ‘No, I don’t remember Jerry.’ “ Cliffy then asked if Judy and I would like to come to watch Jerry perform that evening. “Nah. Thanks, anyway. We’re both pretty tired. We’ll pass.” “Well, can I bring Jerry back after the show?” “Sure. That would be great. See you later.”

A little after midnight, Cliffy and Jerry showed up. We sat and talked for a few minutes before Judy said she was exhausted and needed to go to bed. (David and Michael were then 5 and 4 years old, so that was understandable.) I stayed up and talked to Jerry and Cliffy until about 2:30 in the morning. Jerry made me laugh uncontrollably, I suppose, for nearly the entire two and a half hours. When he left our home, Cliffy asked me, “Well, Ronnie, what do you think?” “Cliffy, Jerry is incredibly funny. I had a great time. Thank you for bringing him home. But, I don’t know…a skinny, Jewish kid from Long Island? He’s funny to me…but I don’t think I am exactly representative of American audiences.” So, yes, Jerry was right. I missed it with him.

In October 2008, a little more than a week before our annual conference, stocks in America were in free fall amid the 2008-09 financial panic. The market, as measured by the Dow Jones Industrial Average, had just fallen by more than 500 points that afternoon when Linda came to my office. “Ron, I have some bad news for you.” “Linda, haven’t you been watching markets today? They are crashing. Stocks were trading ‘limit down.’ What could possibly be worse news?” “Rod Stewart, our conference surprise headliner next week, was performing in Kazakhstan last night and became sick and had to be airlifted to a hospital in London for emergency care. He won’t be able to make the conference. We have 5,000 guests planning to attend. How will we possibly replace a performer we contracted with six months ago…in less than a week?”

I immediately called Caroline, Jerry Seinfeld’s sister, who reached Jerry performing in Las Vegas. Despite me underestimating Jerry’s appeal to American audiences all those years ago…although I clearly got his humor…Jerry agreed in a moment to perform at our meeting the following week. Amazing. Since Jerry made such a huge effort to help us, while I didn’t predict his enormous success, I clearly didn’t misjudge his friendship with my cousin…and was spot on in my view that in addition to being a really funny guy, he’s a really good guy. So, thank you, Jerry, again.

On June 22, Kiplinger’s Personal Finance magazine published an extensive article about our business and investment process and performance as well as an interview with me. The titles of the articles, “Baron Funds: The Masters of Growth Investing” and the q and a, “Ron Baron: A Fund Legend Shares Stock-Picking Secrets,” were incredibly flattering.

We are appreciative of the time and effort Kiplinger’s Andrew Tanzer spent with our executives and me trying to learn and understand how we have managed to perform as well as we have over the long term…and to describe our process to Kiplinger’s subscribers. Just like Baron’s annual meetings, quarterly shareholder letters, appearances on CNBC Squawk Box, and other media efforts enable us to help individuals learn how we invest so they can manage their family’s finances better. Our discussions with Kiplinger’s were part of this effort, which we regard as especially useful. We hope you will make an effort to read Andrew’s article and interview.

Baron 29th Annual Investment Conference. November 4, 2022. Metropolitan Opera House. 40th Anniversary. Baron Capital Founded March 16, 1982. Dow Jones Industrial Average 800!

We hope you will join us at the Met on November 4th for our 29th Annual Baron Investment Conference. We believe you will find this meeting even more special than most. We are trying hard to make sure that is the case. This year we will be celebrating the 40th Anniversary of the founding of our business on March 16, 1982. The Dow Jones Industrial Average was then 800. It is now 31,000! We believe that America’s economy and stock market and our business will do at least as well during the next 40 years as they have during the last 40. We are anxious to help you understand why we believe that is the case.

Respectfully,

Ronald Baron, CEO

July 5, 2022

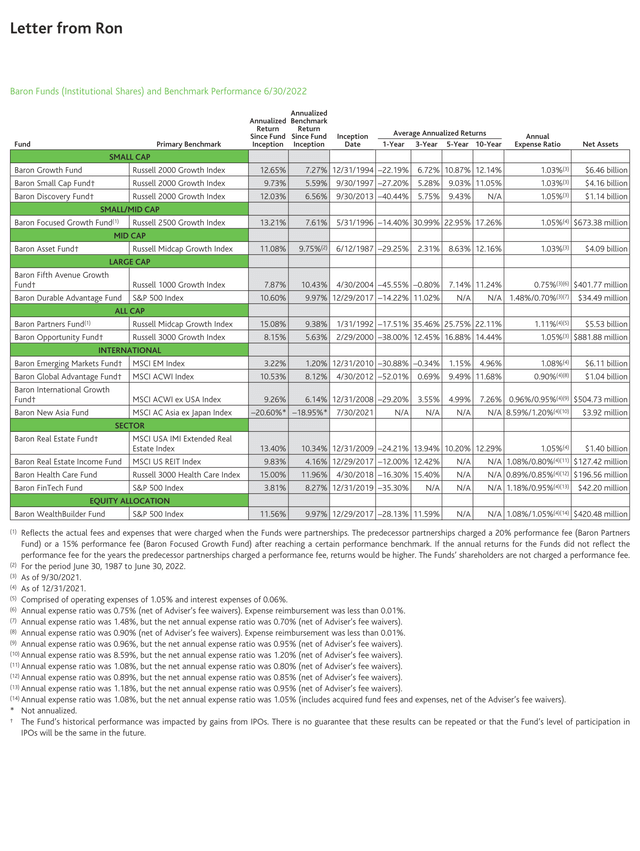

P.S. Few mutual funds have been able to outperform their benchmark indices. Baron is among them. 15 of Baron’s 17 mutual funds representing 98.6% of our firm’s AUM have performed better than their benchmark indices since inception.[1] Six of our 17 mutual funds are the number one performing funds in their categories. Six of our funds are ranked five stars by Morningstar. Five are ranked four stars. We now manage more than $39 billion and have earned more than $35 billion of realized and unrealized gains since 1992 when we had approximately $150 million assets under management. Baron employees are the largest investors in Baron Funds, and my family and I represent approximately 6.5% of our firm’s AUM.

[1] Excess returns and rankings were calculated using the Retail Share Class of our U.S. mutual funds with at least one year of history. The Retail Share Class is the highest cost and oldest share class. AUM reflects assets in all share classes of our U.S. mutual funds. Since Baron WealthBuilder Fund is a fund of funds investing exclusively in other Baron Funds, its AUM is not included in the above calculations.

Investors should consider the investment objectives, risks, and charges and expenses of the investment carefully before investing. The prospectus and summary prospectuses contain this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99BARON or visiting www.BaronFunds.com. Please read them carefully before investing.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment