simpson33

Netflix’s (NASDAQ:NFLX) stock has struggled in recent months, amid large drawdowns in tech stocks, a post-pandemic hangover and rising competition. The stock’s positive response to weak Q2 2022 earnings is indicative of how negative sentiment towards the company had become. Looking further ahead, Netflix’s value will be driven by its ability to monetize content investments. So far, Netflix’s ability to do this in a way that rewards shareholders has been poor. The rollout of advertising and a crackdown on account sharing in the next 12-18 months are high risk / high reward events that will be critical for the company.

Accounts

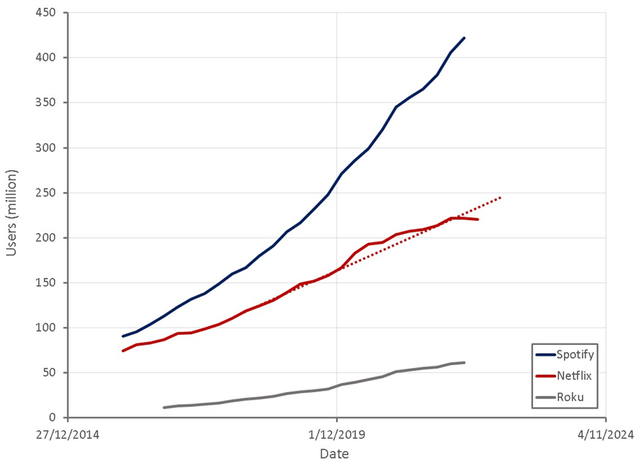

Netflix’s account growth has stalled in recent quarters, some of which can be attributed to a post-COVID performance hangover. This can be seen in declining user growth for a number of digital businesses. Netflix has also attributed some elevated churn to Russia’s invasion of Ukraine, with a number of central and eastern European countries impacted. Netflix stated that the 200,000 subscriber decline in Q1 would have been a 500,000 subscriber gain excluding the impact of Russia. In the most recent quarter, subscribers declined by a further 1 million. Subscribers are flat or declining in all geographies except for APAC, indicating that this is a broad-based problem. Netflix is forecasting a 1 million subscriber increase in Q3, which may have allayed fears of further declines and contributed to the positive stock response to earnings.

Beyond macro issues and a post-COVID normalization of behavior, there are also Netflix specific issues causing elevated churn, which appears to be the result of increased competition. This is a far more concerning issue for Netflix as it will be ongoing, and it is likely the driving force behind their decision making in areas like gaming and advertising.

Figure 1: Netflix Subscriber Numbers (source: Created by author using data from company reports)

Despite slowing subscriber growth, Netflix believes they are still relatively early for a number of reasons:

- Hundreds of billions of dollars are spent on direct-to-consumer entertainment annually

- There are over 700 million pay-TV households globally.

- There are nearly 1 billion broadband homes globally

- Netflix’s share of TV time in the US is under 10%

Netflix estimates they have only penetrated 60% of their market and hence can eventually get to over 500 million subscribers.

Headcount

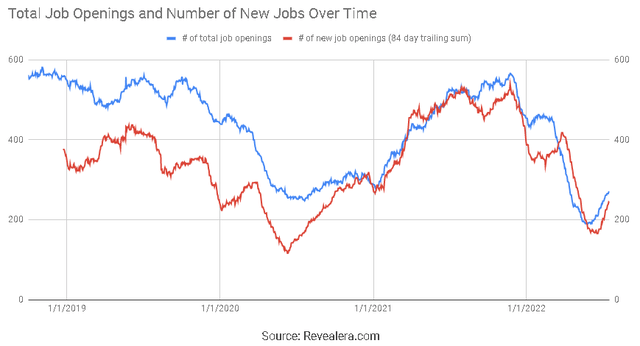

Netflix laid off 150 employees in May, including executives within its Drama Series, Spectacle and Event TV, and Comedy Series Divisions. They also laid off an additional 300 employees in June. Netflix’s pace of hiring has also slowed down significantly, all of which point towards deterioration in the fundamentals of Netflix’s business.

Figure 2: Netflix Hiring Trend (source: Revealera.com)

Account Sharing

Part of Netflix’s issue is the fact that account sharing is so prevalent that they are probably a lot closer to market saturation than many realize. Netflix has stated that 100 million households use shared passwords, which puts the number of households with access to Netflix well over 300 million.

Netflix is currently working on reducing this sharing, or at least monetizing it. Given the potential 100 million households, this could be a large growth lever for Netflix, but there is also an associated risk of increased churn. Netflix is currently trialing an additional fee for account sharing in five Latin America countries. Users would have to pay an extra fee if they use an account for more than 2 weeks outside their primary residence. The countries chosen by Netflix is likely to have minimal revenue contribution, reflecting a desire to get the account sharing strategy right before rolling it out in markets which could impact the company’s financials. A wider rollout is expected in 2023.

Pricing

Pricing is another potential growth lever for Netflix, and this is something that many investors have long pointed to as a reason to be bullish on Netflix. With Netflix’s subscriber growth stalling and an ad-supported tier being introduced, this narrative must now be seriously questioned. Netflix has previously stated that price increases are accretive even if they increase churn, which is not surprising as their service is relatively low cost and as a subscription, likely to be fairly sticky.

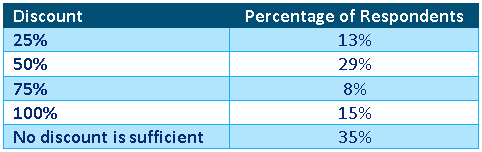

A small survey of students indicated a price elasticity of demand for Netflix of 0.6. Netflix’s 2019 price increases for US subscribers of 13-18%, caused 24% of survey respondents to consider cancelling, 3% to definitely cancel and another 10% to consider downgrading. These figures again point towards relatively inelastic demand.

Past data indicating inelastic demand support Netflix’s strategy of increasing prices, but Netflix’s sudden pivot towards advertising makes little sense unless demand has become more elastic, likely as a result of increasing competition.

Advertising

Hulu’s ad-supported plan only costs 54% of their ad-free tier and approximately 70% of subscribers are on the ad-supported plan. Hulu’s annual ad revenue per user is probably in the vicinity of 50 USD, which makes up a significant portion, but not all, of the ad-supported plan discount. Approximately 60% of Spotify (SPOT) users utilize the ad-supported service. These ad-supported users only generate approximately 10% of the revenue of premium subscribers. Roku’s (ROKU) average revenue per user for their platform is approximately 40 USD. This compares unfavorably with Netflix’s average revenue per subscriber in the US of 177.6 USD.

Based on these numbers it is likely that a large number of Netflix users would opt for the ad-supported tier and that these users will generate less revenue. An ad-supported tier must therefore significantly increase the number of subscribers to be revenue accretive.

Table 1: How Large a Discount is Required to Accept Ads (source: Created by author using data from www.soda.com)

Netflix’s ad-supported tier will also face a cold start problem of sorts. For advertising to work Netflix must have enough users to attract a sufficiently large and diverse base of advertisers. Without advertisers the service will bring in limited revenue and could alienate users by showing them repetitive ads.

Netflix had previously stated that they planned to remain focused on content and allow a third-party to manage the adtech. They clearly view production and the user experience as the value creators, rather than technology. While it is no surprise that they have outsourced the development of adtech, their selection of Microsoft (MSFT) is somewhat surprising. Microsoft is not particularly well known for their adtech, but they do have their own large advertising business. Microsoft also acquired Xandr from AT&T (T) last year. Microsoft planned to use the acquisition to accelerate the delivery of digital advertising solutions for the open web. Xandr was a dominant player in the programmatic display ad space, that began to focus on video advertising when acquired by AT&T in 2018. Microsoft’s relative inexperience managing a third-party adtech business has raised some questions and could delay the launch of Netflix’s service until late 2023.

Netflix likely had limited viable options when selecting an advertising partner, as potential vendors like Google (GOOG) (GOOGL), Comcast (CMCSA) and Roku have their own streaming platforms. Microsoft is a neutral party and offered Netflix the flexibility to innovate over time on both the technology and sales side, as well as strong privacy protections.

It has also been suggested Netflix may be positioning themselves to be acquired by Microsoft. While Microsoft is not currently in competition with Netflix, given the changing approach of the FTC under Lina Khan, it is possible that this transaction would attract close scrutiny. There are a number of potential strategic reasons for an acquisition:

- Microsoft has been developing in-game advertising for its Xbox platform and this experience could be of interest for Netflix.

- Microsoft would gain content production capabilities, which would allow for adaptations of its video game IP.

- Xbox’s game streaming and Game Pass could also be combined with Netflix’s game division.

Content

As competition amongst streaming services increases, Netflix faces the risk of rising content costs and reduced access to a range of content (e.g. Marvel, Star Wars, Star Trek). Netflix’s original content has therefore become core to the company (60% of net content assets on the balance sheet are Netflix produced), and the long-term value of this content versus its cost will ultimately determine Netflix’s stock price.

The second quarter saw a strong content lineup for Netflix, which may have helped drive better than expected results and could create carryover momentum into Q3. The release of Stranger Things season 4 attracted a lot of viewers and also dramatically increased viewership of previous seasons. The quarter also saw the release of season 3 of Umbrella Academy and the final season of Ozark. Big name releases may have created a temporary boost that makes for difficult comparisons next year though.

Unscripted Content

Original unscripted universes (Too Hot To Handle, Ultimatum, and Selling Sunset) continue to be a focus for Netflix. This type of content likely has a high ROI for Netflix but in some ways undermines the company’s positioning as a premium subscription service.

Gaming

Netflix now has 24 games in their portfolio, but has given limited information on the traction of these games with subscribers, stating only that millions of members have played them.

Netflix is developing a game and animated series around the Exploding Kittens IP, which they believe is indicative of their strategy. Maximizing the value of IP, in a manner similar to Disney (DIS), is something that Netflix has not really done so far. This could be a large additional source of revenue though and help to maintain customer loyalty.

Local Content

Netflix’s ability to identify local content that resonates globally is a large differentiator for the company.

Financial Analysis

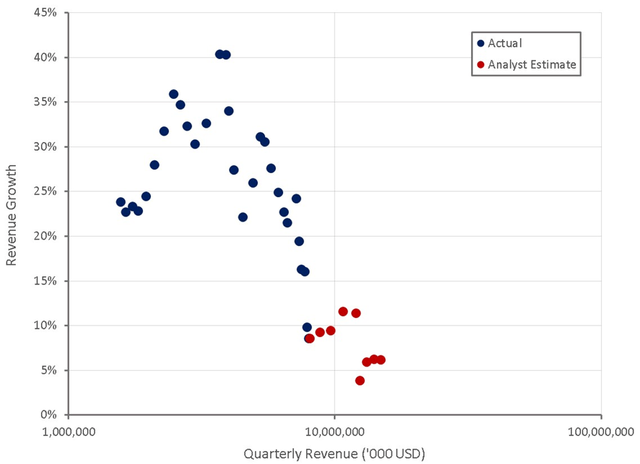

Netflix’s revenue growth continues to moderate post-pandemic as the company matures. Foreign exchange had a relatively large impact in the most recent quarter, reducing Netflix’s growth rate by approximately 4%. Netflix is forecasting Q3 revenue growth of approximately 5% (12% on a constant currency basis). Foreign exchange will continue to be a headwind for Netflix going forward, making YoY comparisons look poor, as nearly 60% of the company’s revenue comes from outside the US.

Going forward, Netflix aims to better monetize their audience through optimized pricing structures. How well they can do this without increasing churn remains to be seen though. With subscriber growth stalling and Netflix’s pricing power now questionable, it is not clear that Netflix has easy growth options remaining.

Figure 3: Netflix Revenue Growth (source: Created by author using data from Netflix and Seeking Alpha)

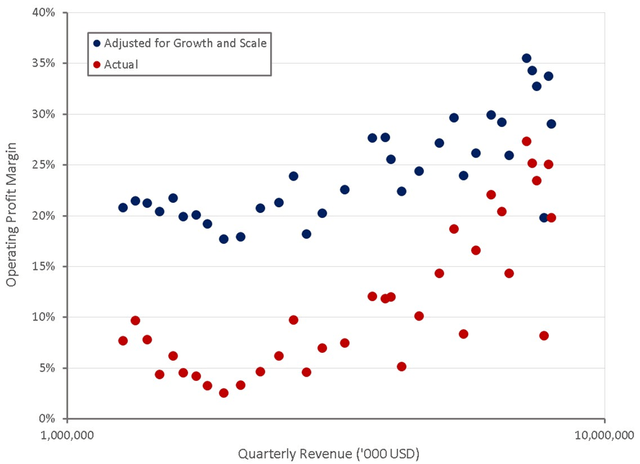

Content contributes roughly 50% of Netflix’s costs, and hence is the primary driver of profitability. Netflix has stated that other costs are not optimized, which could be a source of margin improvement going forward as Netflix is forced to become more disciplined. Margins in Q2 were depressed by approximately 1.9% by severance costs and impairment of real estate leases.

Figure 4: Netflix Operating Profit Margins (source: Created by author using data from Seeking Alpha)

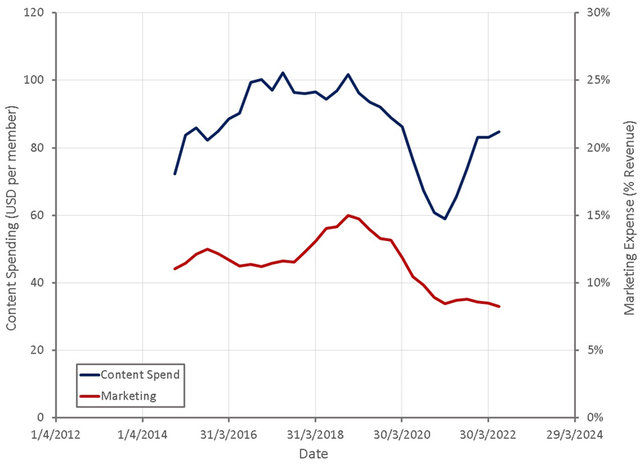

Netflix’s business model is based on content expenses being spread across an increasingly large subscriber base, leading to improving margins. So far, Netflix has shown limited ability to do this in practice. Content spend relative to the subscriber base has been fairly constant, apart from a temporary dip during the pandemic. If and when growth in content spending moderates will be crucial to Netflix’s cash flows and valuation.

Netflix’s marketing expenses have been declining relative to revenue, which should be expected as the company scales and growth moderates. An increased churn rate and slowing subscriber growth could pressure marketing expenses though, leading to an erosion of margins. Netflix’s churn has historically been around 2.3%, much lower than the weighted industry average of approximately 6%, excluding Netflix and Hulu. Churn has recently ticked up to 3.3%, with subscribers abandoning the service at a significantly higher rate following Netflix’s price increase in January. YouTube TV had 4.3% monthly churn and Disney+ has an 8% monthly churn.

Figure 5: Netflix Content and Marketing Expenses (source: Created by author using data from Netflix)

Netflix expects to be free cash flow positive this year (approximately 1 billion USD FCF), although this will largely depend on the amount of content spending. Netflix’s cash flows improved substantially through the pandemic as its ability to spend on content was diminished. It is questionable whether this improvement can be maintained going forward, particularly as competition increases and Netflix faces increased churn. The gap between operating profit and free cash flow will decline over time as content spend and amortization approach each other, but the time frame for this to occur and Netflix ultimate free cash flow margins are uncertain.

Valuation

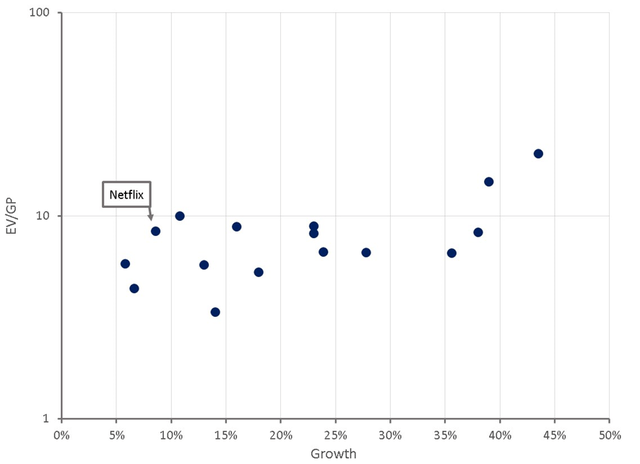

While Netflix’s stock has declined significantly, it is still not particularly cheap. On a relative basis there are many companies that appear less expensive given their growth prospects and ability to generate free cash flow. Netflix has likely been shielded somewhat from further declines by the fact that it is profitable and as a subscription service, viewed as relatively defensive.

Figure 7: Netflix Relative Valuation (source: Created by author using data from Yahoo Finance)

Netflix’s high-growth days are behind them though and the company has demonstrated limited ability to generate free cash flow, despite their profitability. Given the fact that competition is increasing and Netflix faces a large risk associated with the introduction of advertising, Netflix is probably fairly valued.

Conclusion

Netflix’s pricing power has likely been overestimated in the past due to a lack of competition, and it is not clear that the company can continue to raise prices to drive revenue growth. Advertising and a clampdown on account sharing could both be significant growth drivers, but represent enormous risks to the business if executed poorly.

Absent easy growth options, Netflix must now prove it can generate free cash flows which justify the company’s stock price. With competition increasing, there is a risk that marketing and content expenses limit profitability.

Be the first to comment