Nikada/iStock Unreleased via Getty Images

Intro & Thesis

On December 12, 2021, I published my first article on Apple Inc (NASDAQ:AAPL), stating that the stock of the world’s largest company will become attractive again after a 15-20% decline:

I think the stock is overheated and has a good chance of correcting when supply chain problems come up. The stronger demand that Mr. Cook referred to, of course, will allow closing the gap in volumes by increasing selling prices. But I do not think the company’s products have such low price elasticity to fundamentally correct the current situation.

Therefore, I conclude that AAPL is currently a strong HOLD so to say. It will be a BUY though on the first major dip of 15-20%.

Source: From “Apple Will Be A Buy, But Let It Drop A Little” dated 12/12/2021

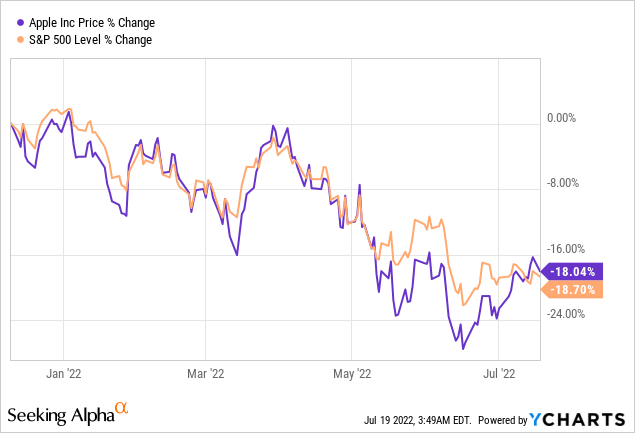

A lot has happened in the market since then – there is a war in Eastern Europe that has crippled Europe and has led to a supply shock in energy and commodities in general. Investors have become much more cautious and have started to divest from some long-duration assets, i.e., stocks of fast-growing companies. Fortunately for Apple shareholders, as I wrote in my last article, the stock has the characteristic of not only growth but also value, so the quotes have since fallen without leverage to the market:

Since the main condition of my last article was met – the stock fell by a value in the range of 15-20% – I decided to re-evaluate the company’s prospects and share my findings with the Seeking Alpha community.

Based on the information I have gathered and analyzed, I have concluded that my earlier assumption that a 15-20% drop is the ideal time to go LONG was quite optimistic. Another 15-17% drop seems to be a new target for dip buyers.

Why do I think so?

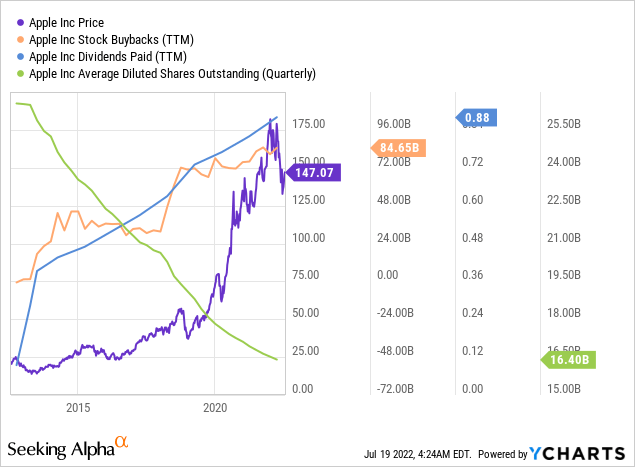

Apple has been one of the largest and most stable companies for many years. Its shares are perceived by some investors as perpetual bonds (so to speak) with growing returns that constantly benefit shareholders in the form of buybacks and dividends. In Q2 2022 alone, the company bought back $22.9 billion worth of shares, and more than $500 billion since December 2012 (data from YCharts).

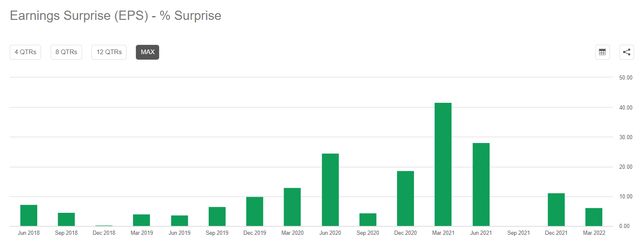

Analysts have consistently underestimated the company’s growth in earnings per share and revenue – despite COVID -19 Apple has consistently exceeded all forecasts and continued to grow, with the majority of cash flow going into share buybacks.

Seeking Alpha, AAPL’s Earnings data

But has it always been this rosy?

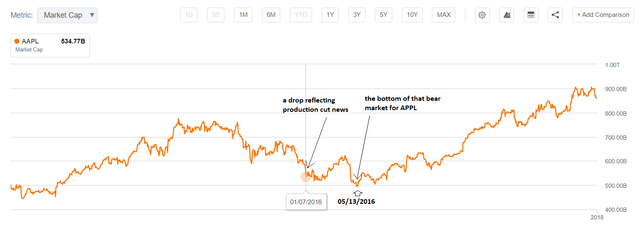

One relatively recent example comes from 2015-2016 when the company was having trouble with demand:

According to Japan’s Nikkei, Apple will slash production of models of its iPhone 6S and 6S Plus by 30% during the second quarter of Apple’s fiscal year.

The report says Apple initially told parts makers in Japan and South Korea to maintain production at the same level as last year, when the company launched the iPhone 6 and 6 Plus. However, slower sales prompted Apple to adjust production.

Source: USA Today [January 5, 2016]

This news was immediately reflected in the share price – the market capitalization of AAPL subsequently fell by 6.61% in one day – but that was not the end of the downward trend. It took another ~7.3% for the stock to find a bottom – with interruptions for a bearish rally – until mid-May (i.e. almost six months later).

Seeking Alpha Charting, author’s notes

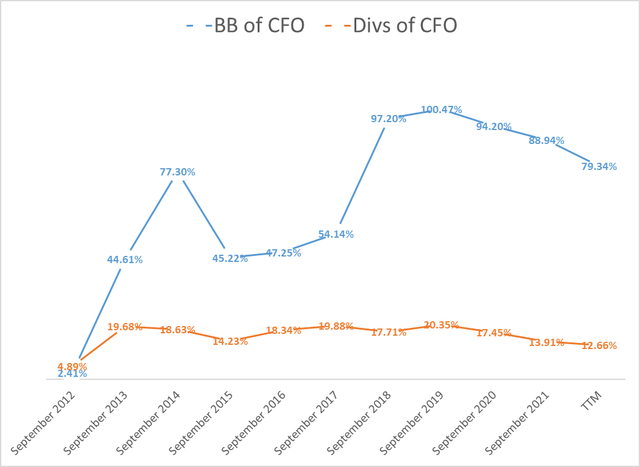

In the same year, buybacks did not do much for investors, as their share of CFO (cash flow from operations) fell sharply and remained consistently low (compared to historical levels) until the end of 2017:

Author’s calculations, Seeking Alpha data

I believe that now that the BB-to-CFO is more than half of what it was in 2016 and the company continues to lose market capitalization, investors need to think about how sustainable this safe haven will be if this ratio returns to the levels of the last crisis.

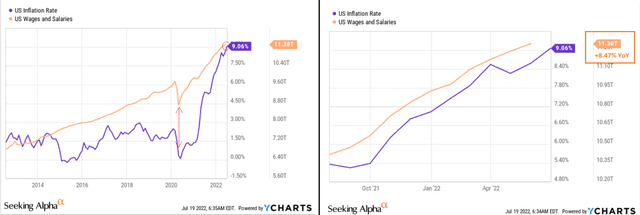

There is also a good chance that demand for Apple products will decline again, as it did a few years ago, due to declining real incomes in the United States. Inflation may have peaked, but it is growing faster than Americans’ incomes, so their consumption is shifting to price-inelastic goods.

Apple’s iPhones, which account for nearly 52% of the company’s total sales, will always be popular thanks to their brands, but the sales figures they have in mind will naturally come under fire if the consumer sentiment index reaches multi-year anti-records.

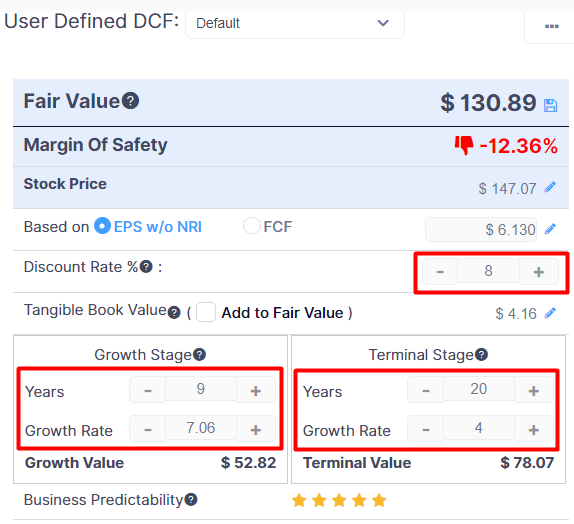

With the yield on 10-year U.S. notes approaching 3%, I now estimate the company’s WACC at 8% rather than 6% (as last time) assuming a beta of about 1. Using analyst forecasts for EPS growth through 2031 (9-year CAGR of 7.06%) and assuming the company maintains today’s historically maximum net margin (TTM 26.41%), I get an overvaluation of >12% instead of an undervaluation (as last time):

GuruFocus.com, AAPL, author’s inputs

In my opinion, the current price of AAPL stock does not fully reflect the change in the Fed rate. The market is expecting the earnings surprises the company has shown in recent years to continue and drive the quotes to new heights. However, given the current economic situation and the possible change in consumer behavior, I believe that the company may not be able to withstand the demand pressure in the coming quarters and will be forced to curb its appetite for share buybacks. Of course, no one is going to stop buybacks completely – I am just talking about a possible reduction in the program’s size. This could impact earnings per share growth, and the overvaluation that we see today will quickly shrink in this case.

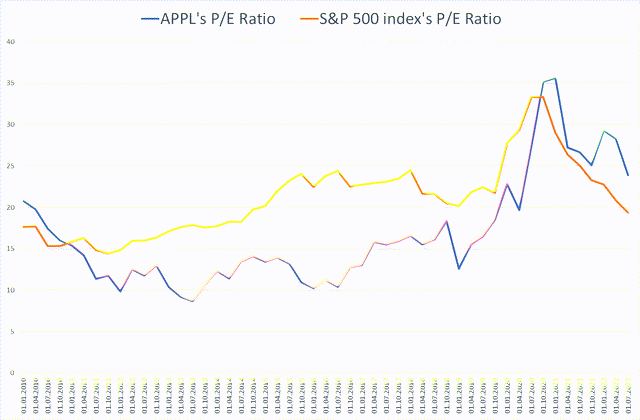

Author’s calculations, based on MacroTrends and Multpl

As we can see from the chart above, Apple stock traded significantly cheaper than the S&P 500 Index from 2015 to 2019 due to demand issues, and now the company’s valuation is still well above the broader market despite a 19.2% YTD decline.

Bottom Line

I like this company in the long run – despite all the difficulties, it continues to grow and return a large part of the cash earned to its shareholders in various forms, including the launch of new promising projects.

This article is just to remind you that the current dip may not be the last and the bottom may be deeper than the bulls think. Historically, AAPL shares are still quite strong, both in absolute valuations and relative to the broader market.

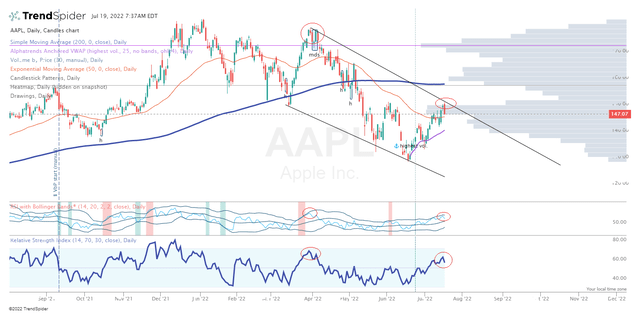

Yesterday’s inability of the stock to gain a foothold above the significant $147-148 level suggests the possibility of a new move lower – horizontal volume points to a $133-134 per share level – suggesting a downtrend of about 9.5%, although I think it’s worth getting in even lower – at $121-124 per share (~16% from current price).

TrendSpider Software, author’s notes

Of course, there is an opportunity cost risk when the Fed starts to inject liquidity back into the market. But until then, the bears still have time, in my view.

Happy investing and stay healthy!

Be the first to comment