Moncherie/E+ via Getty Images

Investment Thesis

When inflation rises, the cost of materials also increases. This means that companies that sell products as their service should maximize their efficiency by minimizing costs, in other words, being wise in how the company turns capital into profits. The Vita Coco Company (NASDAQ:COCO) has faced some growth recently, despite the macro pressures. However, the company isn’t that efficient in turning capital into profit and is currently overpriced in the macro situation. Because of this, I am led to rate the stock as a “Sell” until further notice.

Vita Coco’s Price Is Still High

Vita Coco operates in 2 reported geographical segments, the Americas and International, which account for 87% and 13% of the company’s revenue, respectively. Vita Coco is the largest coconut brand in the US, which accounts for 51% of the US coconut water market. Top line-wise, the company has been growing. However, I think the fundamental qualities of Vita Coco are not enough to cover its relatively high price. This means that I slightly contradict what the street thinks, but not quite. I still believe that Vita Coco is an outstanding beverage industry stock, but I’m not a fan of its price.

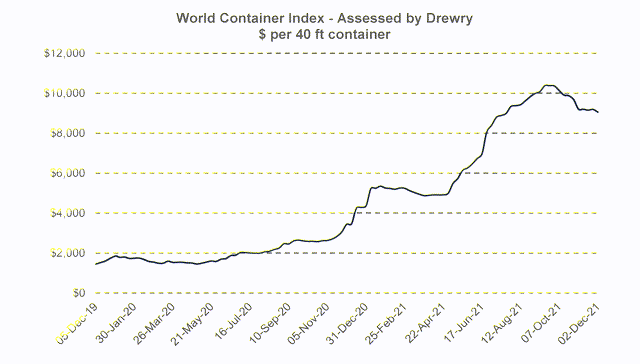

2019-2021 World Container Index – Drewry’s Data

Outside factors, such as high transportation costs in ocean freight back in 2021 of around $9,000 per 40ft. container, affected the company’s margins. The company’s annual COGS grew by 29% in 2021 due to transportation costs, which, again, greatly influenced the company’s gross profit margins. Although these costs are slowly stabilizing, inflationary pressures (with the recently updated inflation rate of 8.2% in the US) are still relatively high, which means that the cost of materials would also increase, driving COGS even higher.

Financial Analysis And Valuation

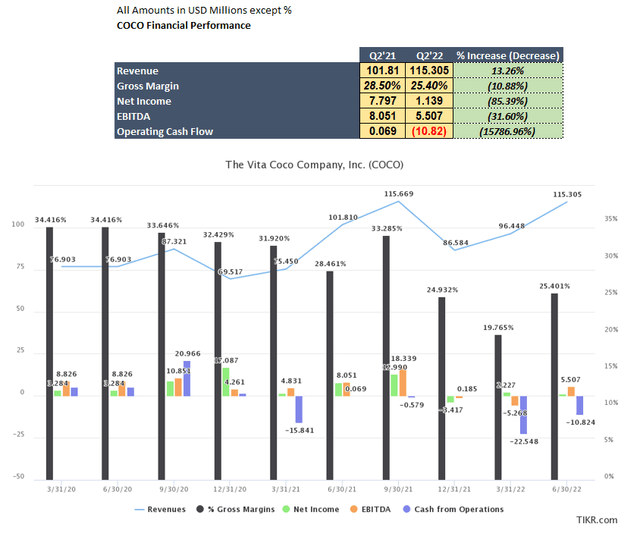

Source – Tikr.com / Table Data by Author

Vita Coco has achieved a tremendous top-line performance. The company had $115 million in its Q2’22 earnings result, a $13.5 million increase in revenue, or a 13% growth, compared to its previous year-over-year performance of $102 million in 2021. However, the increase in COGS was impacted by high transportation costs. High COGS also meant that the company couldn’t keep and maintain its Gross Margins of 28.5% in the year prior, compared to the current margin of 25.4%, which is an 11% decrease year-over-year.

At the same time, the company’s Net Income decreased by 85.39% due to a non-cash market-to-market loss in fair value, which was mentioned in the company’s Q2’22 Earnings Results Call. According to Kevin Benmoussa, Vita Coco’s CFO:

“. . .was negatively impacted by a non-cash mark-to-market loss in fair value on current insurance hedges of $3 million whereas we benefited from gain of $5 million last year. As a result, net income attributable to shareholders was $1 million or $0.02 per diluted share of the second quarter of 2022, compared to net income of $8 million or $0.15 per diluted share in the second quarter of 2021.”

-Q2’22 Earnings Call

Vita Coco also had a 32% decrease in EBITDA, which was anticipated due to high transportation costs, inflationary pressures, and partially because of foreign exchange rates. COCO had $16 million in cash and cash equivalents in Q2’22 compared to last year’s $19 million, which means that the company has a 16% decline in cash due to accounts receivable increase. The company has a significant decline in operating cash flow due to a reduction in working capital because of, again, an increase in the company’s accounts receivable.

Even if Vita Coco has had mixed performances, the company did mention its complete 2022 guidance. Management has a high guidance of $455 million in revenues (or a 20% increase compared to the last year’s performance) and a low guidance of $440 million (or a 16% increase compared to the last year’s performance). They also have an EBITDA guidance range of $27-$32 million, an 11% decrease or a 6% increase, respectively. Management also mentioned that they expect to keep their margins in the mid-twenties.

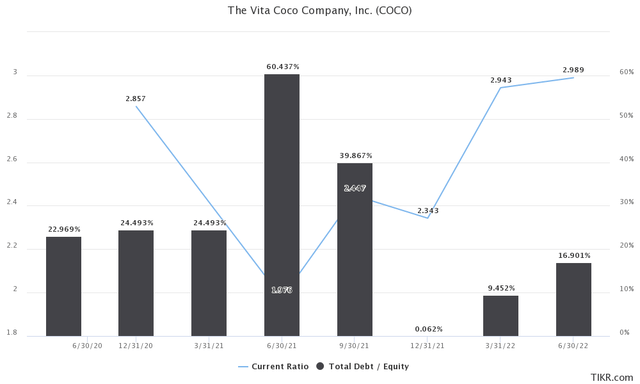

Vita Coco has $188 million in current assets and $63 million in current liabilities, which means we can get a current ratio of 2.9. The company has an enterprise value of $594 million, and if we follow management’s high guidance of $32 million EBITDA, this gives us a relatively high 18.5 EV/EBITDA multiple, which isn’t ideal if you ask me. Since the company has a market cap of $588 million, and if we take the company’s high guidance of $455 million, we’d get a price-to-sales ratio of 1.29, which could be a result of management’s operating inefficiency and increased cost and expenses. Vita Coco does have a relatively low debt-to-equity ratio of 0.16, which is good since it indicates that the company has low debt levels.

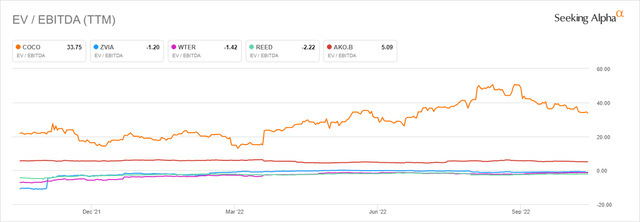

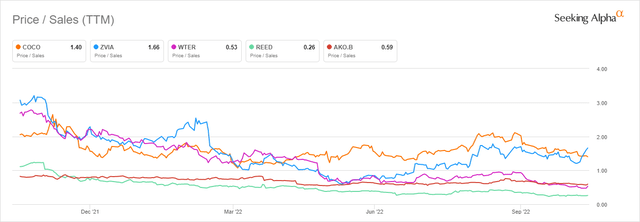

When compared to other similar companies like Zevia PBC (ZVIA), The Alkaline Water Company Inc. (WTER), Reed’s, Inc. (REED), and Embotelladora Andina S.A. (AKO.B), Vita Coco had a very high TTM EV/EBITDA ratio, which signifies that the stock is potentially overvalued.

| Company | EV/EBITDA | Price/Sales |

| The Vita Coco Company | 33.75 | 1.40 |

| Zevia PBC | -1.20 | 1.66 |

| The Alkaline Water Company Inc. | -1.42 | 0.53 |

| Reed’s, Inc. | -2.22 | 0.26 |

| Embotelladora Andina S.A. | 5.09 | 0.59 |

Similarly, the company has a relatively high P/S ratio of 1.4 compared to three of the five companies with a P/S ratio below 1, indicating that the company isn’t that efficient in using investor funds to increase revenues compared to other companies in my comparison.

Overall, I think that Vita Coco is overvalued. The company is spending way too much in costs and expenses, and with the current macro situation, risks such as increasing cost of raw materials and changes in consumer spending decisions can easily be the company’s downfall. Sure, the company had great top-line results, but this doesn’t change the fact that they’re spending way too much on expenses, which can upset investors. It’s trading at higher multiples than other companies, which strengthens my rating of a Sell.

Risks Associated With Vita Coco

Vita Coco’s in the beverage industry means that the company heavily relies on consumer spending and how management invests its money to push more sales. We also have to look at the inventory side of things, and risks can come with Vita Coco if the following happens:

Change in Consumer Spending Patterns. Although Vita Coco accounts for 51% of the US coconut water market share (the US because it accounts for 87% of the company’s revenues), a change in consumer spending can ultimately decrease sales. This means that if inflationary pressures affect the consumers too much, there could be a decrease in demand for Vita Coco’s products.

High Transportation Costs. Since Vita Coco is in the beverage industry, they need to ship products in bulk to ensure that their products are on shelves. In late 2021, there was a price hike in ocean freight, so if that were to happen again, the company could face an increase in COGS and a decrease in its Gross Profit and Net Income margins.

These risks will significantly affect the company’s performance, and management has to address these issues if they occur since an impact on either risk can affect the company’s performance for years, with the uncertainty of bouncing back.

Final Take On Vita Coco

I think that Vita Coco can hold its position as one of the largest coconut water beverages in the US and maybe grow to be a known coconut water brand worldwide. However, with the mixed financial results and the price that it’s currently at, I am not too optimistic about investing. I think it’s overvalued compared to its peer companies, and its EV/EBITDA and P/S ratio show that. I rate this stock as a Sell until further notice and will follow the stock for future news.

I hope you’ve had a good read, have a wonderful day!

Be the first to comment