Solskin/DigitalVision via Getty Images

Doximity (NYSE:DOCS) is a high-quality company that we previously covered. At the time we came to the conclusion shares were too expensive. For those not familiar with the company we recommend going back to that article, where we go into more detail as to what the company does and why it is an interesting platform.

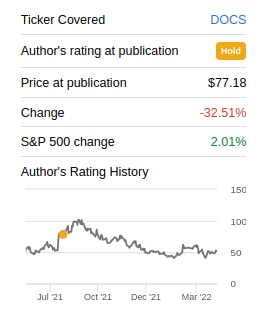

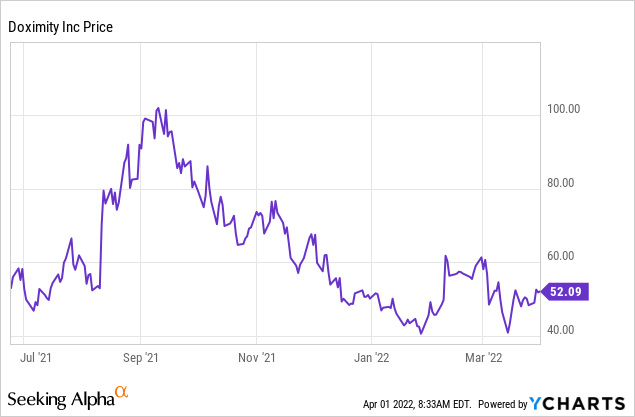

Initially, we looked like complete fools, since shares gained almost 50% after we said we were not willing to buy at the then current price of ~$77, however since then shares have been almost cut in half, bringing us to ask ourselves if perhaps now is the time to start investing in the company.

Seeking Alpha

Financials

Doximity went public at $26.00 per share and has so far never dropped below its IPO price. According to a recent Barron’s article using Renaissance Capital data, three quarters of 2021’s IPOs are now trading below their offering price. Of the few winners, Doximity is currently the one that is trading with the biggest gain, at ~100% gain from its IPO. While that makes it less likely that shares will be a bargain, it does speak to the quality of the company that it is one of the few 2021 IPOs with gains after the market rout.

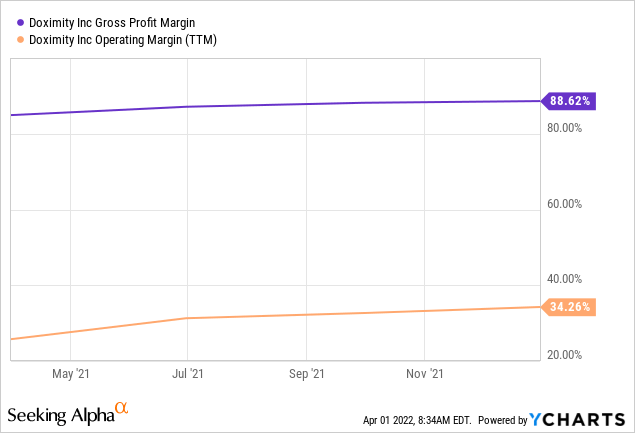

There are a few things in Doximity’s financials that we particularly like. It has very high gross profit margins which hover around 88%, has demonstrated operating leverage, and is now solidly profitable.

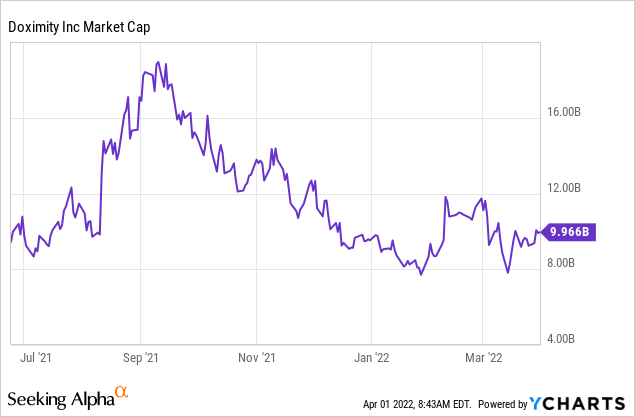

The problem we still have is the price tag, with the company sporting a market cap of ~$10 billion. This is a lot better than when it was trading at roughly $20 billion, but we have trouble paying so much for a company that still generates modest profits. That said, the valuation is starting to make some sense and we believe a case can be made for a starter position at current prices.

Valuation

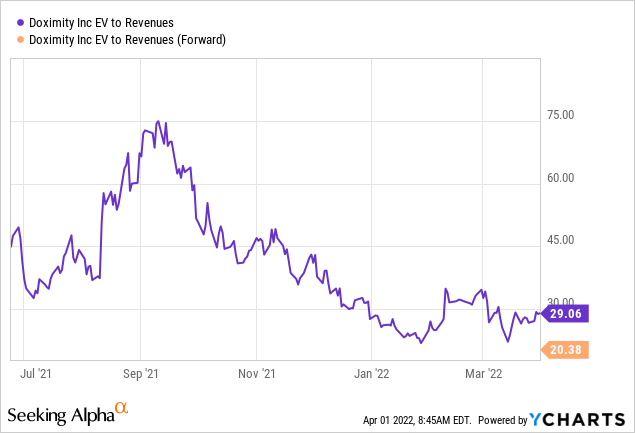

Taking a look at the revenue multiples we see that the company is now trading with a trailing twelve months EV/Revenues of ~29x, and a forward EV/Revenues multiple of ~20x. This is still far from cheap, but at least the company continues to grow revenues at a very rapid pace and is already profitable. It might actually grow into its valuation in a couple of years if it continues on the current path.

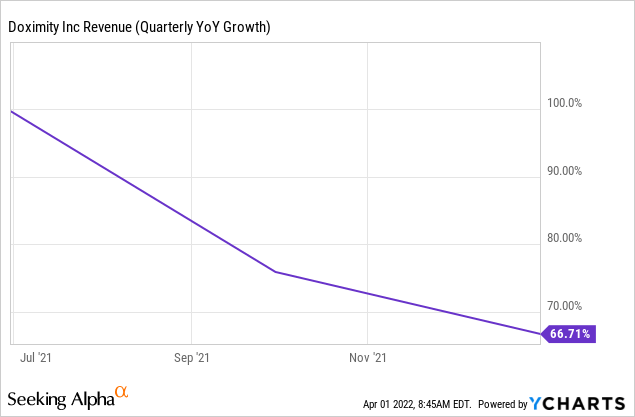

One thing to note is that revenue growth has been decelerating. About a year ago the company was growing revenues at ~100% rate, and it has now decelerated to about 67%. This is something to monitor, since a continued deceleration could change our thesis, and make the company a lot less appealing than it currently is.

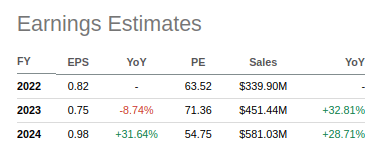

Focusing our attention on earnings we see that shares are currently trading at more than fifty times expected earnings in 2024. That is a very high multiple for something that is expected to happen in two years. Still, given the growth and the quality of the company, it can grow into its valuation and if growth continues at its current rate paying such a high multiple can be justified. The big question is how long the hyper growth phase will last, and we do not have the answer to that. That is why we plan on buying a very small position and to be more aggressive should shares fall to a real bargain level.

Seeking Alpha

Risks

There are a few risks worth considering before investing in Doximity, chief among them is the risk that revenue growth will continue decelerating at a fast pace. We believe the company has attractive platform economics, and therefore profitability should not be too much at risk unless the platform becomes unattractive and users flock to other alternatives like LinkedIn. LinkedIn is much more generic and not tailored to medical professionals, but should they make a serious effort to cater to their needs, this could be a serious risk too.

Conclusion

Doximity is an attractive platform that we would like to own a piece of, but the price remains elevated. We are changing our rating from “Hold” to “Buy” following the significant price decline since our previous article, coupled with continued growth from the company. Together these two factors have brought the valuation close to reasonable, and we will consider a starter position at current prices. This is a great company and hopefully we’ll get the opportunity to buy at more attractive prices.

Be the first to comment