Drazen_/E+ via Getty Images

Investment Thesis

Coupang (NYSE:CPNG) is down 60% since its IPO. Even though investors’ enthusiasm for Coupang has mostly gone, I believe that its stock offers investors a rewarding investment opportunity.

In my previous article I said, “Coupang’s revenue growth rates are rapidly slowing and leave much to be desired. That is a headline risk.”

And while I recognize that I was too early to call the bottom on this name, I believe that this time it’s different.

Coupang has been focusing its narrative away from its topline growth to a strategy of profitable growth. And it’s easy to see that it’s succeeding.

All considered I believe that 1x next year’s revenues, is an attractive valuation for a business that clearly has a moat around its operations.

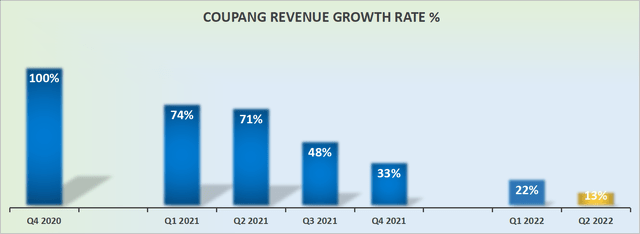

Revenue Growth Rates Rapidly Slow Down

On the surface, the graphic above doesn’t inspire much confidence. It’s a business that is consistently slowing down its revenue growth rates.

But when we spend a little more time, we can see two different conclusions.

In the first case, not shown above, is that on a currency-adjusted basis, revenues were up 27% y/y. That’s clearly a fair revenue growth rate.

Secondly, last year’s comparisons were really tough. Particularly H1 2021. For the remainder of 2022, the comparisons rapidly become significantly better.

What’s Next For Coupang?

Coupang is a Korean eCommerce player. Coupang aims to be the fastest e-commerce delivery service in Korea. As Coupang’s founder and CEO says, Coupang wants to wow its customers, going so far as to call its version of Prime customers, WOW members.

In an effort to wow customers, it continues to find ways to get more mindshare with its customers, by offering free Rocket deliveries (grocery offering), and free Coupang Play video content.

As you know, Korea’s population is small, at approximately 51 million.

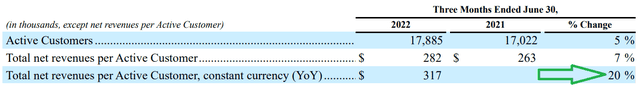

But Coupang’s mission isn’t on getting to saturation. In the table above we see the bull case depicted. Cross-selling into its Active Customer base was up 20% y/y at constant currency, green arrow.

Clearly, customers are resonating with Coupang. There’s no other reason why this far into lapping Covid, customers would be increasing their average order value.

What’s more, keep in mind what Coupang proclaims,

While we’ve grown to significant scale, we remain a small portion of what is expected to soon become the third largest e-commerce opportunity in the world.

We are eyeing up a business that could well become a leading e-commerce player in the third largest e-commerce country in the world, ahead of Japan and the UK.

I believe that the best way to ensure wallet share with consumers throughout the economic cycle is by being the low-cost platform, something that KPNG found to be in a recent study. At its core, that’s a moat that is not so different from other investors’ favorites such as Costco (COST).

Path to Profitability Continues to Pick Up Momentum

As I’ve maintained for a while, Coupang had expected to exit Q4 with EBITDA profitability, so that it would enter 2023 EBITDA profitable.

However, given that the first half of 2022 saw a negative $25 million of EBITDA, the best that Coupang could previously offer was to reach under negative $400 million of EBITDA for 2022. This was the guidance provided back in Q4 2020.

But this has now all changed. Indeed, Coupang now declares that rather than 2022 seeing a less than negative $400 million, it would actually finish the year at breakeven, an approximate $400 million improvement from its Q4 2021 guidance.

It now seems very possible that when Coupang exits Q4 2023, it could be on a run rate of at least $500 million of EBITDA.

That would put the stock priced at 62x next year’s EBITDA.

However, if my estimate turns out to be too conservative, and Coupang’s exit rate from Q4 2023 ends up being around $700 million, Coupang’s multiple would drop to 44x next year’s EBITDA.

CPNG Stock Valuation — 1x Next Year’s Revenues

I believe that Coupang could grow 2023 its revenues at 25% CAGR on a currency-adjusted basis. While analysts following the stock only expect around 16% CAGR next year.

Thus, if we were to downwards revise my expectations and slightly upwards revise analysts’ estimates we get to 20% y/y revenue growth rates for Coupang.

That would put Coupang on a path to report approximately $25 billion in revenues. Meaning that this now profitable company is priced at 1x next year’s revenues.

The Bottom Line

Could Coupang’s normalized revenues grow at a 20% CAGR? Indeed, if Coupang could convincingly grow at 20% CAGR on a currency-adjusted basis, that would bring about a very different type of strategy for the company. A strategy that is focused more on profitable growth, rather than growth for growth’s sake.

Concurrently, that would also bring about a different sort of shareholder. That change in its shareholder base wouldn’t happen overnight, but it would certainly bring a different sort of shareholder.

A shareholder that would be satisfied with Coupang’s slower growth rates and be willing to pay up for a steady growth story, with some potential for growth, provided that Coupang was making profitability its north star. All aspects that I assert Coupang is delivering upon. Get long this name.

Be the first to comment