Aslan Alphan

Investment thesis

The GEO Group (NYSE:GEO) has returned 40% profit since my last call on October 23, 2022. The stock has reached my previously announced target and broke out from the discussed overhead resistance until forming a parabolic uptrend on highly increasing volume. This type of situation comes with the risk of seeing a pop-and-drop in the price action, and I consider securing my profits, while I also discuss two strategies investors could consider in order to continue profiting from a possible extended rally.

A quick look at the big picture

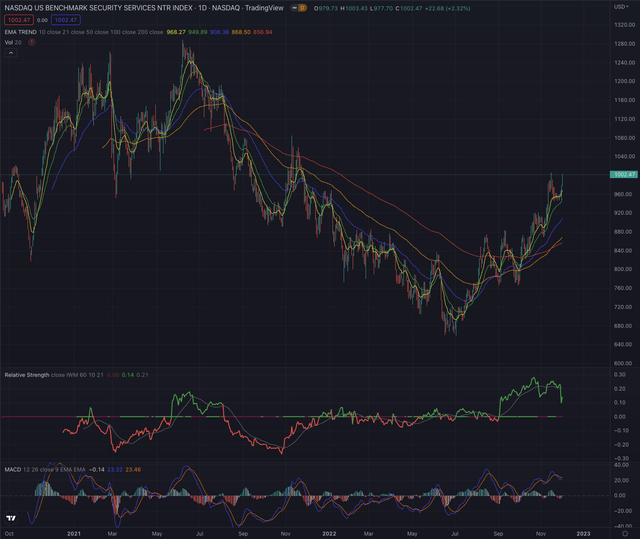

The industrial sector in the US continues to perform better than other groups in the economy, being among the four strongest leaders in the recent stock-market rally. The sector is led by companies in the integrated shipping and logistics industry, companies offering business equipment and supplies, as well as the trucking industry, while companies in the security and protection services industry continue to be laggards, despite showing some moderate relative strength in the past few months.

Considering more specific groups of the industry, the Nasdaq US Benchmark Security Services (NQUSB50205040N) which bottomed on July 5, 2022, has since rebounded, reporting over 50% performance, significantly breaking out from its long-term downtrend. Despite this, more recently the benchmark is struggling to build up more relative strength when compared to the broader iShares Russell 2000 ETF (IWM), which could hint at a slowdown of the retracement.

Where are we now?

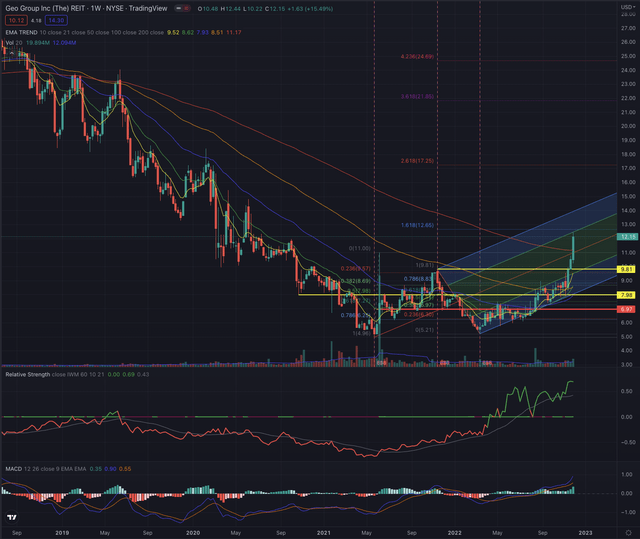

In my most recent article “The GEO Group: Rising From The Ashes” published on October 23, I discussed an investment opportunity, basing my thesis on the likely formed bottom, and the consequent exhaustion of the sell-side, while I observed the strong build-up in momentum likely leading to great short-term opportunities which I quantified by two targets seen at respectively 15-30% higher from the last closing price. GEO has since reached my targets, and I patiently let the stock run even higher, resulting in over 40% performance in a little over one month.

The stock has rallied over its EMA200 on its weekly time frame, a meaningful breakout that should be confirmed in its last trading session of the week. This situation hints at what I described as the most likely outcome in my former article, where I suspected a potential breakout into stage two, as GEO’s bottoming process could have ended. On the weekly chart, we can notice how the stock almost reached the most important Fibonacci extension measured by the last pullback, which defined the formation of a rock-solid bottom.

What is coming next?

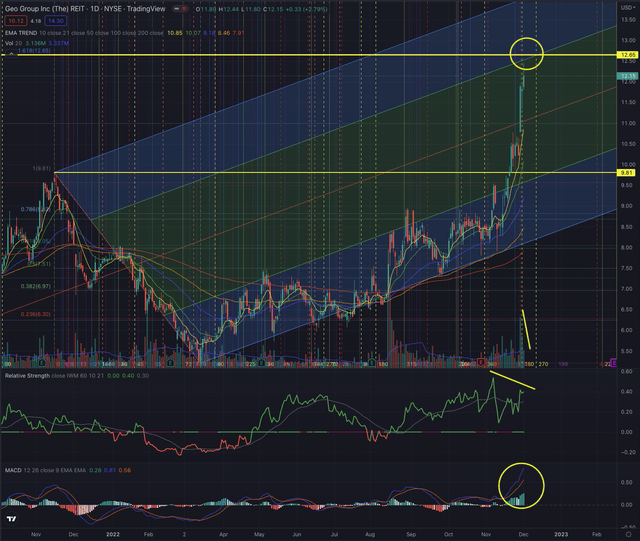

I switch to GEO’s daily chart to discuss my considerations on the probable outcome in the coming weeks. When the stock broke out over my initially set targets, but I observed that the volume was massively increasing and the stock even formed a gap-up over the resistance I suggested at $11, I let it run until the most important extension at $12.65. The stock topped at $12.44 in its last market session, a level I consider close enough to be considered as reaching my target.

When observing the volume of the last days, we can notice a sharp decline. While the momentum seems still rising, the stock’s relative strength compared to the IWM seems to slow down. Those are signs which could hint at a short-term consolidation, as the stock formed a steep parabolic uptrend.

As 40% profits in little over one month are quite satisfying, I now want to secure my gains, at least partially, while I could also consider selling my entire position and nail down the full amount of profits, and wait on the sidelines for a better setup to build up another position.

Investors who want to secure some profits while still taking advantage of a possible extended rally could consider one of the following strategies:

-

Sell half of the position and increase the stop-loss to their entry point at break-even, or at double the initial risk, allowing them to secure their profit on half of the position while financing their risk on the second half for free. For example, if the initial stop-loss was set at -9%, investors could set it either at break-even or at +9% of their initial entry point.

-

Sell half of the position and move up their stop-loss by tracing the EMA21 or more narrowly the EMA10, or fixing an arbitrary percentage trailing stop from the last closing price and let the stock run with the risk exposure that everyone considers as tolerable.

Both strategies would allow investors to finance the risk of half of their position with the profits made with the other half. The worst-case scenario would lead to a break even on the entire position, the other scenarios would allow investors to secure a significant profit while still taking advantage of a continuation of the actual parabolic price action.

In this type of situation, I would not add to my position as the risk of seeing a consolidation of this extreme extension is too high. I prefer to be more patient and wait for a better entry point, as I already let the stock run above my targets and I am not considering giving back all my profits.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

The GEO Group has an interesting technical setup and offered significant opportunities to investors who could take advantage of the actual breakout. While I believe this stock could still significantly rise in the future, I also acknowledge the increased risk of a likely major pullback after the most recent parabolic rally. This type of movement eventually leads to an exhaustion of buyers and a typical pop-and-drop scenario forms. While anyone can predict this with certainty, my targets have been reached and I want to secure my profit while applying strict risk management. Before adding additional positions or entering the stock as a new investor, I would certainly wait on the sidelines and observe the price action, which leads me to change my ranking on GEO to a hold position.

Be the first to comment