RHJ

Introduction

Being contrarian in the silver sector is a necessity. In fact, the best moment to buy silver stocks is when they are thoroughly out of favor. The reason is that sentiment can get so depressed that stocks trade at very cheap valuations. Such cheap valuations are rare to find in today’s market, which, with some notable exceptions, such as the energy sector, still looks overvalued.

On the other hand, when the wind turns, silver equities typically react explosively to the upside. Since there are only a handful of stocks with significant exposure to silver, and they often have relatively small market caps, and they are highly leveraged to the metals, their share prices can rise dramatically in a very short timespan.

Silvercorp Metals (NYSE:SVM, TSX:SVM:CA) is a Canadian miner producing mainly silver, as well as gold and other base metals (zinc, lead). Its share price has fallen almost 75% from its recent highs in 2020, massively underperforming with respect to both silver (down 35%) and the Global Silver Miners ETF (down more than 40%). Increasing costs, falling realized prices and compressing margins have clearly affected all miners. In the case of SVM, the drawdown has been exacerbated by the increased political discount due to the company’s concentration in China and geopolitical events.

Nonetheless, after the sell-off, SVM is now extremely cheap, trading at approximately 1x EV / FCF. In addition, it has a strong balance sheet, is already generating substantial FCF, and is in the process of almost doubling its production. While the silver price is still under pressure, the medium and long-term fundamentals underpinning the silver market remain intact, as I discussed in a recent article. For all these reasons, I give SVM a BUY rating.

Summary of factors affecting the share price

There are a few bearish factors in relation to the company’s share price, i.e.:

- Falling silver prices

- Exposure to China

- Uncertainty over the company’s future strategy

On the other hand, there are also several bullish factors at play:

- Low-cost and long-lived assets

- High profitability

- Operational excellence

- Growth potential

- Robust balance sheet

- Shareholder-friendly policies

- Cheap valuation

- Silver fundamentals

Plus, the following catalysts may help to turbo-charge returns when the silver bull market gets back on track:

- Potential acquisition: the company intends to deploy its cash position to acquire a high-quality asset to develop in a safe jurisdiction.

- Increase in production: production is expected to almost double. The market is not yet pricing in that SVM is turning into a growth story.

- Updated NI 43-101 for the Ying Mining District: SVM has been adding a lot of new ounces via an aggressive drilling campaign.

- Mining permit for the BYP gold project.

In the rest of the article, I will unpack the above points.

Negative factors

Falling silver prices

The obvious culprit for the sell-off is the silver price. Silver has fallen by more than a third from its highs. Miners are leveraged to the metal, which magnifies losses during downturns. Moreover, the production costs of miners are increasing because of inflation, just as revenues are falling, so their margins are contracting.

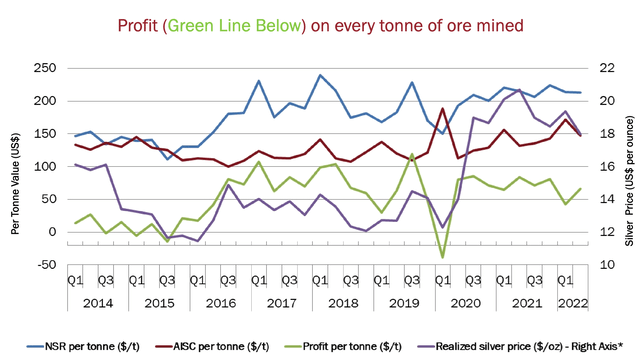

However, again, when we look at the financial results in detail, SVM is holding up quite well. Compared to other miners, it is proving more resilient in controlling prices.

More generally, I believe precious metals are in the process of bottoming out and will be the first to react powerfully to the upside as soon as the Fed signals a slowdown or a pivot in the pace of rate hikes. In the tentative timeline I drew up in my previous article, this could happen by mid-2023.

Exposure to China

The price of geopolitical risk has risen significantly following the Russian invasion of Ukraine. It is therefore likely that an important factor in the price decline of SVM is the increased political discount attached to it. Many investors observe the frictions between the US and China over Taiwan, and draw parallels with the situation over Ukraine. Given what happened to Russian stocks, these fears are legitimate.

However, there are reasons to believe the Chinese discount is overpriced. Recency bias tends to exaggerate the importance of current events. Moreover, facile extrapolations can lead one to believe that situations that look superficially similar are actually identical. In this case, these extrapolations can lead one to believe that the probability of a conflict over Taiwan has increased dramatically given what happened in Ukraine. While this probability may well have increased, most geopolitical commentators agree that the two situations are radically different and a hot war over Taiwan is highly unlikely.

There may also be a form of association bias at play. The Chinese government has recently cracked down on many Chinese tech companies and the Chinese economy is signaling a slowdown and a potential recession. Therefore, lower multiples are being applied to Chinese equities. This discount may also be affecting companies that are perceived to have any kind of exposure to China.

Clearly, SVM has all its operations in China, which by itself warrants a discount compared to producers that are diversified across multiple jurisdictions. Clearly, China is not the best jurisdiction either. But nothing has really changed in recent times to explain by itself the brutal sell-off. The company has been operating in China without a hitch since the early 2000s. Licenses are being renewed regularly and smoothly by Chinese authorities. There is no recent news that may be a reason for concern. And, unlike Russia, China has deep economic ties with the US, with many US companies having operations in China, which makes it unlikely that there will be an economic confrontation between China and the West as serious as with Russia any time soon. Besides, the company is planning to expand its operations outside China in the future.

Uncertainty about future strategy

Silvercorp has expressed the intent to perform an acquisition, to both further expand its production profile and diversify away from China. The company is looking for a high-quality asset to develop, at a reasonable price.

In 2020, SVM entered into a definitive agreement to acquire Guyana Goldfields, the operator of the Aurora gold mine, an asset which would have checked all the boxes. Unfortunately, in the end the company was outbid by Zijin Mining at a price roughly three times the original offer. SVM still got paid a 20 million fee, but obviously this acquisition would have been a game changer. In particular, it would have dispelled a lot of uncertainties regarding the company’s future strategy, a factor that is still weighting heavily on sentiment.

The (perceived) problem is that now SVM is sitting on a lot of cash, with no clear plan about how to deploy it. The market might be scared that the company is going to make some expensive acquisition and destroy value for shareholders.

However, I see the lack of hurry as a sign of careful prudence. Guyana Goldfields made sense at the time; afterwards, it may just have been difficult to find similarly attractive opportunities. With precious metals in a correction and many junior companies suffering big drawdowns, as the Fed tightens monetary policy, I am more optimistic that the right opportunity will be found going forward.

Positive factors

Low-cost and long-lived assets

Silvercorp is sitting on 115 million ounces of silver in P&P reserves (210 million M&I resources). Ying has almost 20 years of mine life remaining and GC over 10 years, with many opportunities to extend it. Overall, the company has some of the lowest breakevens in the industry, with AISC around $9.25 per ounce.

AISC and profit per tonne (Company presentation)

High profitability

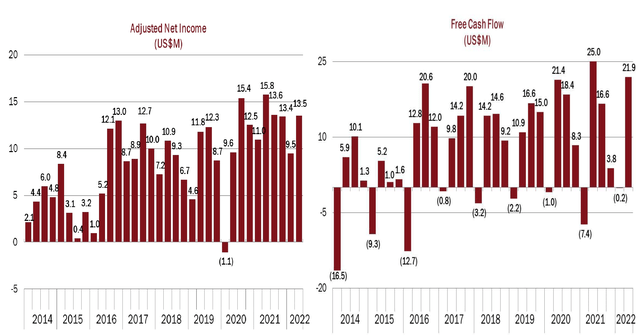

The company has always been focused on generating substantial amounts of free cash flow, as evidenced by the following graph.

Adjusted NI and FCF since 2014 (Company presentation)

Only in the last quarter, FCF came in at $24.2 million, despite falling silver prices and rising costs.

Operational excellence

The company has a long history of delivering solid results, which is not that common among silver miners. Looking at last quarter’s results, Silvercorp managed to beat EPS expectations, while many of its peers had a very challenging quarter.

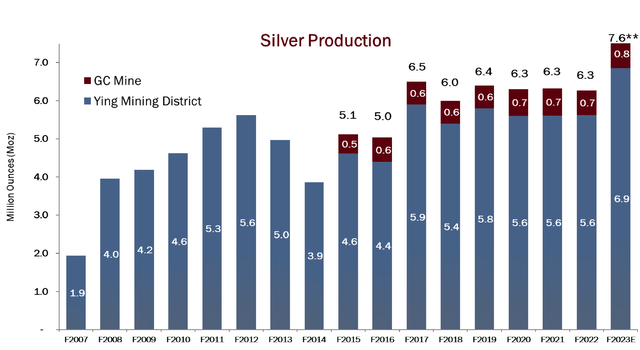

A 13% year-over-year (YoY) decrease in the realized silver price was offset by higher production. Mined ore increased by 30% YoY and milled ore by 23% YoY, for a total production of 1.9 million ounces of silver, 1,100 ounces of gold, 19.1 million pounds of lead, and 6.9 million pounds of zinc. These figures represent an increase of 26% for silver, 10% for gold and 20% for lead (and a decrease of 4% for zinc). The company confirmed its full-year guidance of 7 to 7.3 million ounces of silver, 6,300 to 7,900 ounces of gold, 68.4 million to 71.3 million pounds of lead, and 32.0 million to 34.5 million pounds of zinc.

Costs per tonne were negatively impacted by inflationary pressures in material, energy and employees’ salaries, partially offset by a 2% YoY depreciation of the Chinese yuan relative to the US dollar. The net result was a 12% increase in AISC per tonne of ore processed.

The silver lining is that the company proved resilient at generating FCF thanks to its expanding production. Despite the lower silver price, revenues were still up 8% to $63.6 million YoY. Operating cash flow was up 10% to $40.2 million. Free cash flow was $24.2 million, after subtracting $16 million of capital expenditures.

Growth potential

The exciting part about Silvercorp is that the company is planning to expand production significantly. During Q1 2023 alone, SVM has drilled an incredible 122,930 metres and dug more than 700 km of tunnels, for the purpose of both exploration and underground development. In addition, the company has applied for a new permit for the Kuanping project, a satellite project in the Ying Mining District. Then, there is the BYP gold project, which is currently under care and maintenance and should generate around 30-40 thousand ounces of gold per year. Finally, construction of the new 3,000 tonne per day floatation mill (the “New Mill”) and the new tailings storage facility (the “TSF”) proceeds as planned. The New Mill is going to increase processing capacity to 5,000 tonne per day.

From the Company’s Q1 results press release:

The preliminary design and engineering survey, the water and soil conservation studies for the New Mill and the TSF, and the feasibility study for the TSF have been completed. The Company also received the construction permit for the New Mill and is in the process of negotiating purchases of major equipment for the New Mill. The Company expects that the final approval of the environmental and safety assessment studies, and the detailed engineering design of the New Mill and the TSF will be granted in the second quarter of Fiscal 2023.

I estimate that via all these organic growth initiatives Silvercorp will be able to almost double its silver production, up to 12-14 million ounces of silver per year. This will probably be achieved without significant dilution, since the cash flow from operational activities appears to be enough to finance the expansion plans.

Silvercorp historical production (Company presentation)

Solid balance sheet

The balance sheet remains rock-solid. The company has no debt, plus it sits on $216 million in cash (equivalent to more than 50% of its entire market capitalization!).

Besides, Silvercorp holds a significant portfolio in other companies, including:

- 28% interest in New Pacific Metals (NEWP)

- 29% interest in Whitehorse Gold (OTCQX:WHGDF)

This portfolio was valued at $147.4 million, as of June 30, 2022.

Returning capital to shareholder

SVM has recently announced a new normal course issuer bid (NCIB) starting on August 29, 2022, aimed at acquiring up to 7 million shares, or approximately 4% of the common shares outstanding. The Company intends to cancel all shares acquired under the NCIB. It also pays a dividend, equivalent to around a 1% yield.

Given how undervalued the company is (to be discussed next), Silvercorp could be much more aggressive about buybacks/dividends. However, the intention is to diversify away from China via an acquisition, and this is the reason why they are hoarding cash for the time being.

Cheap valuation

Besides operational excellence, growth potential, low-cost assets and a robust balance sheet, the main reason for optimism is that SVM is really cheap.

The market cap is around $400 million, with no debt. Its portfolio in associates and other companies is valued at $147.4. Let’s knock it down to $120 million because silver equities have recently suffered a significant drawdown. Considering it also has $216 million in cash and cash equivalents, the EV is around $70 million. This is a very cheap price for a company that generated $53.4 million for 2022 and $41.3 million the year before, and this year has already generated $24.2 million in the first quarter.

Conclusion

Silvercorp is an extremely cheap silver miner, suffering from its Chinese exposure and falling silver prices. However, it is always darkest before the dawn. The company intends to diversify away from China through a value-creating acquisition and the big upwards move in real interest rates is probably already behind us.

Silver has strong long-term fundamentals. Besides, Silvercorp has a strong balance sheet, is already generating substantial FCF, and is in the process of almost doubling its production.

The market seems to be ignoring all of these, and just focusing on the obvious negatives.

Be the first to comment