Sundry Photography

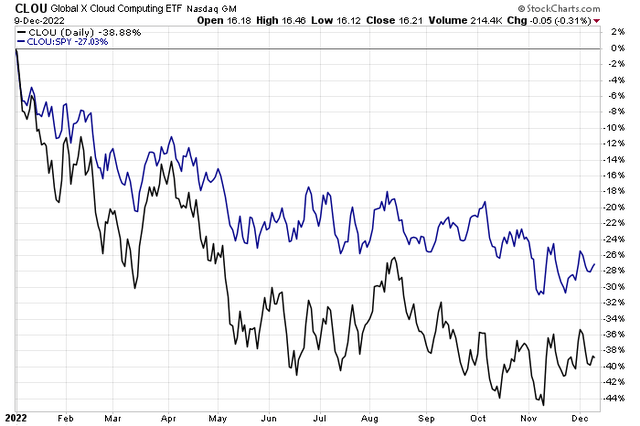

Software and cloud stocks are down nearly 40% on the year, massively underperforming the S&P 500. Also notice in the chart below that the Global X Cloud Computing ETF (CLOU) continues to trend downward even with a recent drop in interest rates.

One of the fund’s biggest positions reports earnings Monday night. Is enough bearish news discounted into shares of Coupa? Let’s investigate.

Cloud Stocks Raining On The Bulls

According to Bank of America Global Research, Coupa Software (NASDAQ:COUP) is a cloud-based platform provider of comprehensive Business Spend Management software. Coupa offers solutions for the entire Business Spend Management cycle, including Procurement, Payment, Expensing, and Invoicing, as well as supply chain management and analytics.

The California-based $4.8 billion market cap Software industry company within the Information Technology sector does not have positive trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

There has been some takeover chatter surrounding Coupa with varying buyout prices mentioned. Still, the stock trades below its Q2 and Q3 highs but is up more than 50% from its November low. Moreover, Piper Sandler reiterated key ongoing competition risks back in October and a premium valuation even after shares have fallen hard. If we see a recession, the company’s exposure to enterprise spending by the corporate world is a major issue. On the upside, COUP generates big annual revenue percentage gains and should be well-positioned if a recession is avoided.

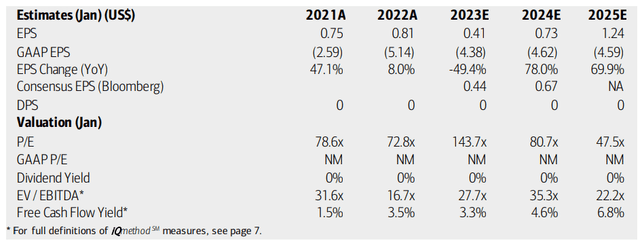

On valuation, analysts at BofA see earnings falling sharply in 2023 before a steep snapback in 2024. Per-share profit growth is then expected to run at a high rate through 2024. The Bloomberg consensus forecast is roughly on par with what BofA expects. GAAP earnings are seen as being sharply in the red, however. Still, the stock trades at a very lofty forward non-GAAP P/E while COUP’s EV/EBITDA multiple is very high. The upside is that free cash flow is positive, unlike many non-profitable software stocks. With a forward PEG ratio still near 5, the valuation remains high and unattractive to me.

Coupa: Earnings, Valuation, Free Cash Flow Forecasts

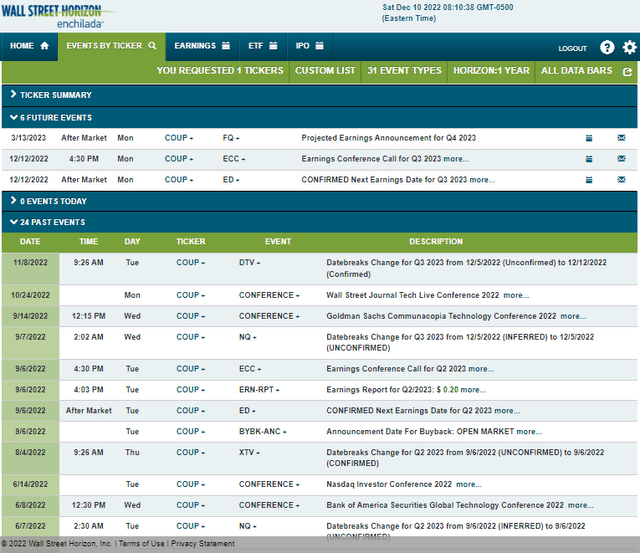

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 2023 earnings date of Monday, December 12 AMC with a conference call immediately after results hit the tape. You can listen live here. The corporate event calendar is light after the quarterly report.

Corporate Event Calendar

The Options Angle

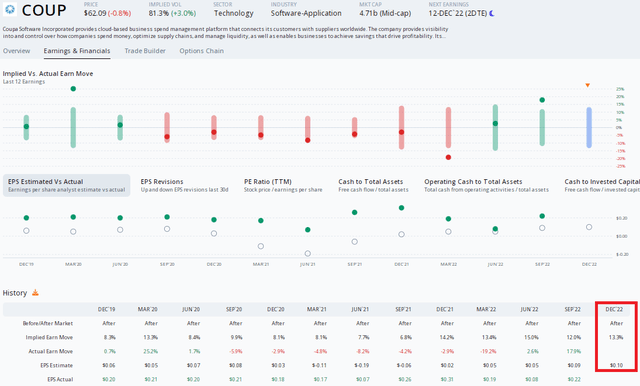

Digging into the upcoming earnings release, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $0.10 which would be a steep decline from $0.31 earned in the same period a year ago. Since the September earnings report, there has been one upward analyst EPS revision. I expect an earnings beat since the firm has topped bottom-line estimates in each of the last 12 quarters, though shares have traded higher post-reporting just twice since September 2020.

Meanwhile, options traders expect a big move in COUP shares after Monday afternoon’s report. With a 13.3% price swing priced in using the nearest-expiring at-the-money straddle, and an 18% change last go around, expect a monster move either way. Let’s dive into the chart to see what direction the stock might be heading for.

COUP: A YoY Earnings Decline Expected. Big Volatility Seen.

The Technical Take

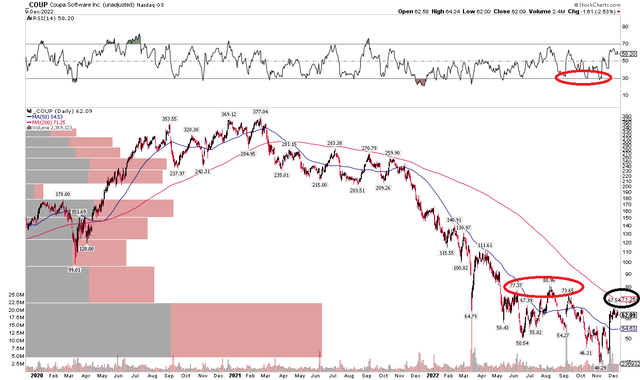

COUP has a messy chart, but it’s at its closest approach to its 200-day moving average in about a year. Even if the stock climbs above that downward-sloping long-term trend indicator, there are a few problem prices for the bulls from earlier this year – notably the $75 to $81 range from peaks in June, August, and September. What’s encouraging, though, is that some recent upward thrusts have come on big volume, so the bulls might be showing some vital signs.

The bears can point to very soft momentum as measured by constant revisits to 30 on the RSI. Overall, I would like to see the stock get above its 200-day moving average since that was important support than resistance from late 2020 through late last year.

COUP: Shares Encroaching on 200dma Resistance

The Bottom Line

COUP’s valuation remains high, and the industry continues to perform poorly. The stock chart, while downside momentum appears to have slowed, is still dominated by the bears. I continue to have a sell recommendation into earnings Monday.

Be the first to comment