Solskin

Overview

To say Bausch Health (NYSE:BHC) has faced a few headwinds this year is an understatement. While broader equity markets have struggled due to rising interest rates, persistent inflation, and fears of an upcoming recession, Bausch Health faced additional challenges. Things first started to go south back in May of this year when the Canadian-based specialty pharmaceutical company reported earnings that were considerably below Wall Street expectations. Around the same time, Bausch Health announced the spin-off of its eyecare business Bausch + Lomb (BLCO). Investors did not respond well to this news; negative profit margins and an underwhelming IPO during poor market conditions were not good for Bausch Health. Shares fell nearly 50% from ~$19/share at the start of May to under $10/share in just a matter of weeks.

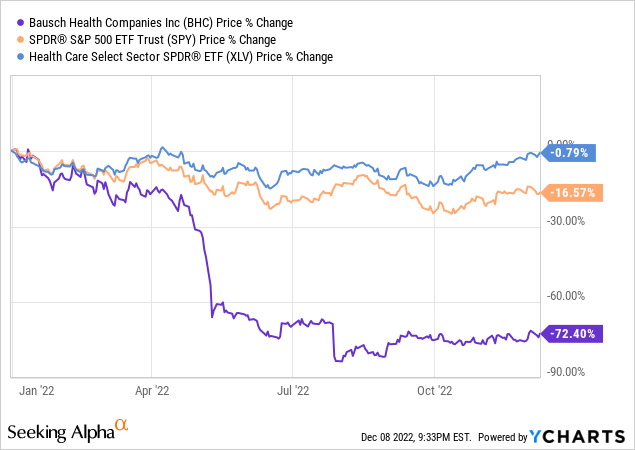

BHC Performance vs. S&P 500 and Health Care Sector

As you can see, it’s been a rough year for Bausch Health equity shareholders. But maybe things aren’t as bad as they seem (sometimes they are!). We all know Wall Street is not immune to overreacting to the latest news for a company, and Bausch Health could be the perfect example of that.

Xifaxan Patent News, Did Markets Overreact?

When news related to the Xifaxan patent was first released earlier this year, shares of Bausch Health declined significantly. Investors initially did not have a lot of details about what was going to happen, and in my opinion, it seemed like everyone feared for the worst: Bausch Health would lose a significant portion of its revenue due to generic alternatives becoming available, and thus, would not be able to pay off its debt. If that were to happen, equity shareholders would likely end up losing a large portion of their investment as they are the lowest claim of ownership. Shares initially fell another 50% from ~$9/share to ~$4.50/share but have recovered modestly since then. Part of it was due to a statement released by Bausch Health saying that it would not expect generic versions of Xifaxan to enter markets until 2029, despite the approval.

Seeking Alpha

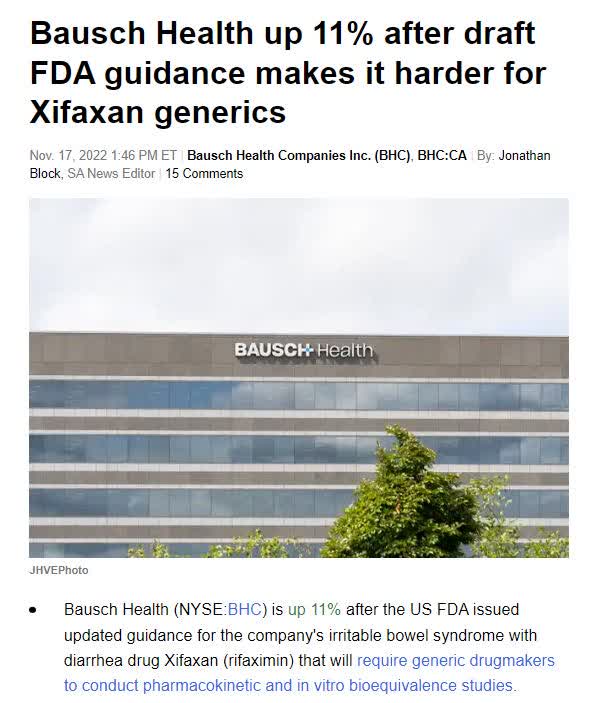

If this were truly the case, Bausch Health has at least another seven years before its revenue would start to become impacted. Was that initial 50% decline justified? I think one can make an argument for both, but I am leaning more toward it being an overreaction. Bausch Health has years to navigate this headwind and continues to fight for its intellectual property in court. Additionally, generic manufacturers are already seeing problems arise since the initial reports came out. A few months after the initial patent news, new headlines emerged:

Seeking Alpha

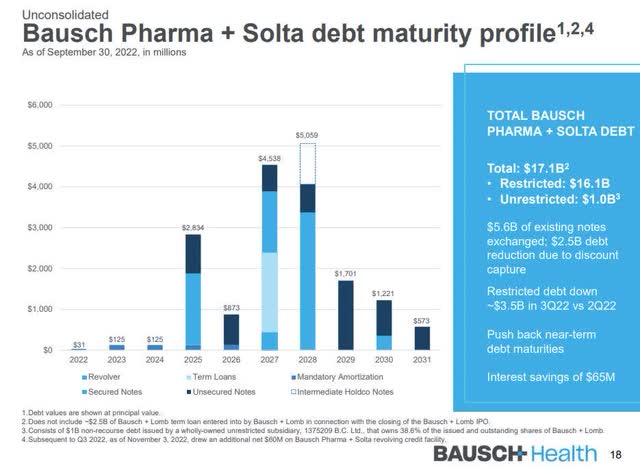

Generic manufacturers would face additional hurdles in developing their own version of Xifaxan. This was very bullish for Bausch Health as it would further delay new competitors from hitting the market. In my opinion, I saw this headline as a lifeline for Bausch Health; the company now has more time to reduce its debt, which as many of you know, is holding the company back. As you can see in the image below, most of the company’s debt doesn’t mature for at least another 3 years.

Bausch Health Investor Presentation

Priority number #1 for Bausch Health should be debt reduction and cost-cutting while the company is still generating relatively stable margins. There are serious liabilities ahead in the next decade that investors don’t believe can be paid. That’s why Bausch Health has such a low P/E ratio and valuation relative to other companies in the industry. If this problem were to be resolved, investors could see a massive reward.

More Signs of Hope For Bausch Health

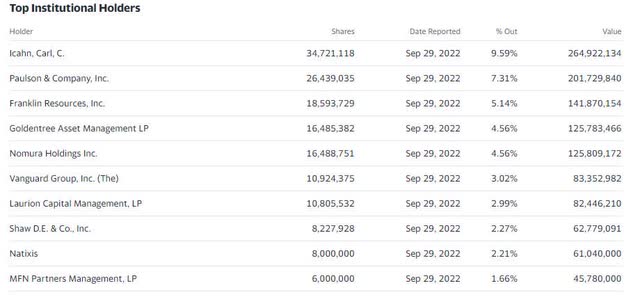

Despite the negative outlook from Wall Street, Bausch Health still has a silver lining in the form of activism. Carl Icahn and John Paulson, who are two of the most respected investors of our generation, combined now own more than 16% of Bausch Health’s shares outstanding. Data below shows the top holders as of Q3 2022:

Bausch Health Top Institutional Holders

Both Icahn and Paulson have a history of making contrarian investments that have paid off big. Could this be another case of a high-risk, high-reward play? No one knows for sure what is going to happen, but it will be interesting to see how vocal both of them are in the coming quarters. Perhaps they could advocate for significant changes that Wall Street will applaud. We’ll see.

Risks To Consider

When it comes to risks for Bausch Health, the list is not short. As previously mentioned, debt is a huge concern for the company. Failure to maintain its current revenue levels and generate reasonable EBITDA margins to help reduce its debt would be disastrous. There’s a reason Bausch Health’s debt has such a low credit rating relative to other pharmaceutical companies. The risk of bankruptcy is very real in the next decade if changes aren’t made. A lot of investors don’t believe in this turnaround story, which is evident through the rising short interest:

Bausch Health’s Rising Short Interest

As you can see in the image above, the number of shares being shorted has risen quite significantly over the last few years. For those unfamiliar, short selling or “being short” simply means an investor is betting against the future outlook of a company. If you believe shares are going to decline, you can borrow them from a long holder, and then sell those shares to someone else with hopes of buying it back at a lower price. After you buy back the shares, you can return it back to the original long holder.

Conclusion

Public markets can be cruel sometimes. Bausch Health has been beaten down relentlessly by short sellers, increased competition, and a challenging macro environment. But when you look at the company on paper, things did not seem so bad last quarter. Bausch Health generated $399 million in net profit or $1.10/share excluding foreign exchange adjustments. It was a great quarter and proved the business model is profitable under the right circumstances. Debt continues to be reduced, but big questions will need to be answered in the coming years as a large portion of their debt matures then.

In simple terms, this is a high-risk investment. Investing in Bausch Health comes with an understanding that losing your entire investment is possible. It also means there’s a chance of the opposite occurring. If the debt problem is resolved and Bausch Health gets a P/E multiple in line with S&P 500 historical averages from public markets, there could be a significant upside to the stock price. Imagine a scenario where Bausch Health is able to repeat its Q3 2022 performance. $1.10/share annualized, call it ~$4.00/share. Applying a 15x P/E multiple (in line with historical S&P 500 averages) means the company would trade at $60/share. Now, this is just a simple valuation estimate that makes a ton of assumptions, most importantly that the debt problem is resolved.

Be the first to comment