Khanchit Khirisutchalual/iStock via Getty Images

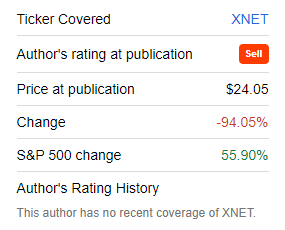

Several years back I wrote an article on Xunlei (NASDAQ:XNET) in which I explained why I had taken a short position in the stock.

As the stock has fallen precipitously since then, I’m now reversing my stance; and have taken a small long position in the company. In this article I explain my very straightforward reasoning for this decision.

The Company

XNET is a Chinese company providing cloud computing, blockchain and live streaming internet services. The most recent quarter’s total revenues of $78.3M were split as follows:

- Cloud computing $28.3 (36.1%)

- Blockchain subscription $25.4M (32.4%)

- Live streaming $24.5M (31.3%)

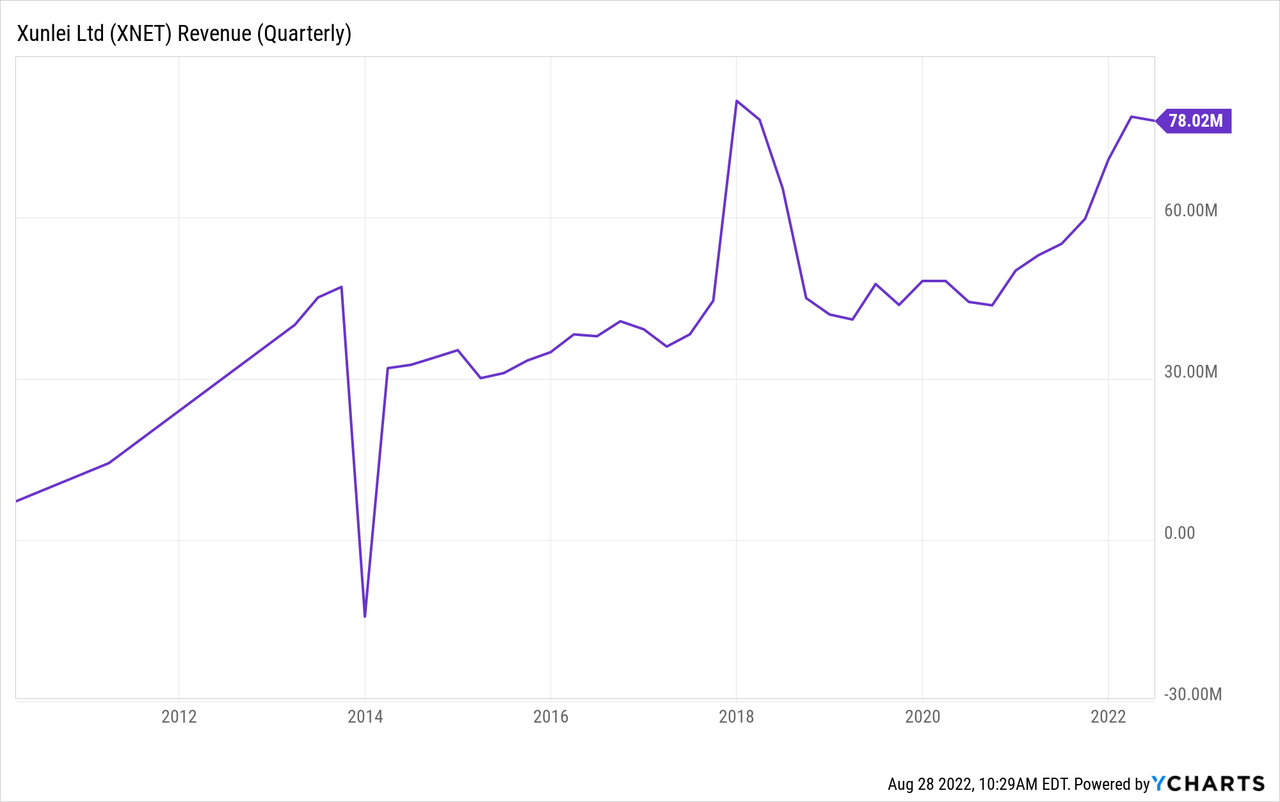

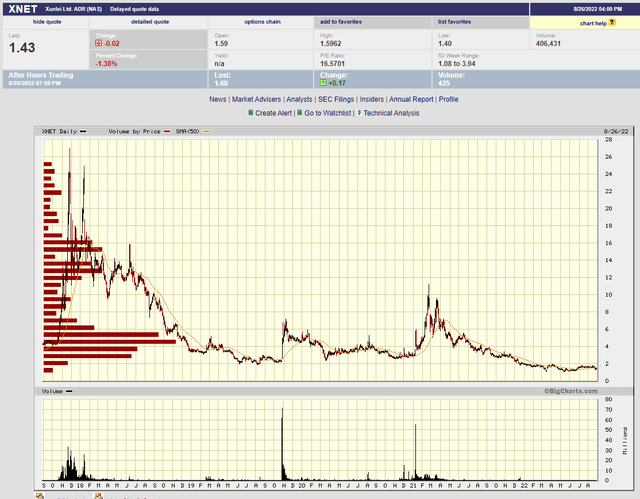

As can be seen from the quarterly revenue chart below, the company has been growing steadily since inception. Thus it is an ongoing business, yet, as I show below, it trades as though it were a proverbial “cigar butt” stock.

Furthermore, the company has guided 3Q revenues in the range of $82M to $87M which would represent record quarterly revenues.

Realizable Cash & Shares Outstanding

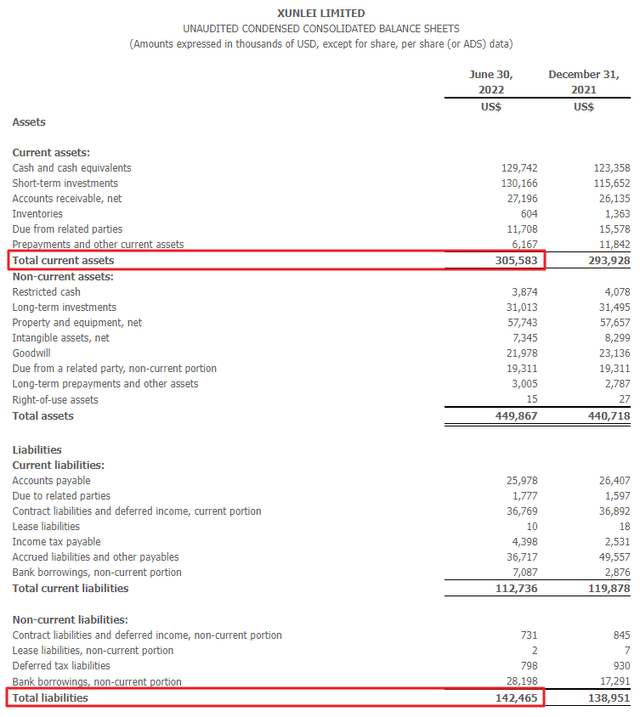

Here is the company’s latest balance sheet, dated June 30, 2022, as shown in the quarterly earnings release of that same date.

Strictly speaking, net current assets is calculated by subtracting total current liabilities from total current assets, but since all liabilities eventually must be paid (while some long term assets, like Goodwill, may never be realized), I find it more conservative to consider realizable cash as total current assets less total liabilities. In this case that calculation gives realizable cash of $163M. The company ADRs have a ratio of 5:1 to the ordinary shares, such that currently there are 68.06M ADRs outstanding, so XNET’s realizable cash per ADR is equal to $2.40, yet the ADRs currently trade at $1.43 (i.e. a 40% discount!). This is the biggest reason to be bullish on the shares.

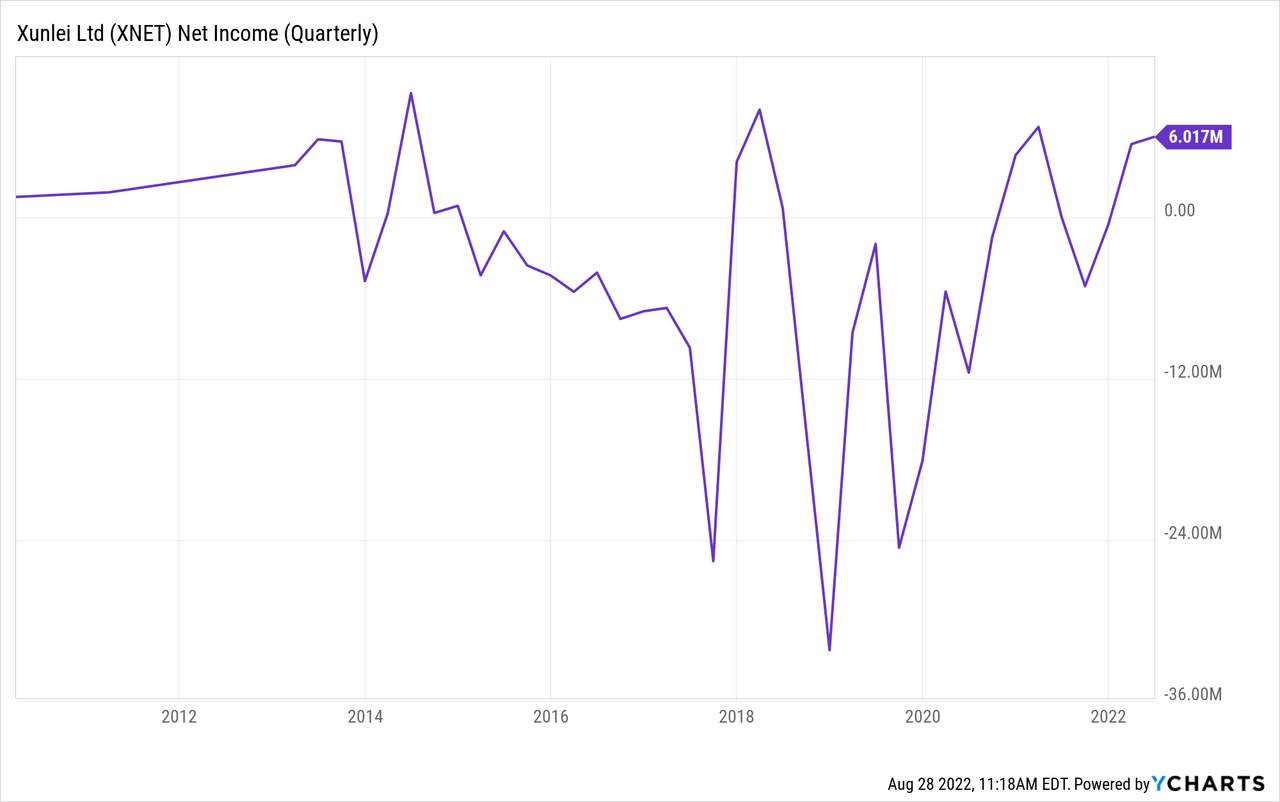

The risk with this type of situation is always that the company will lose money over time, and will thereby deplete the net current assets. To investigate this, let’s look at:

Profitability and Valuation

As shown in the chart below, the company has recently moved towards profitability, but it doesn’t yet have a track record of consistently making money. I think if it can show sustained profitability for a few more quarters then there’s a good chance the market will re-rate the stock and give full credit for the net current assets per share.

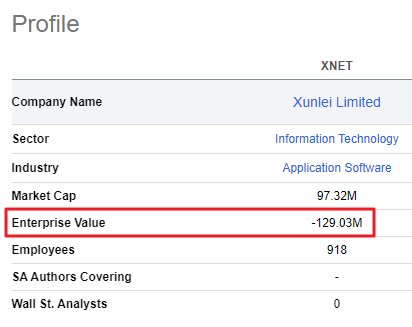

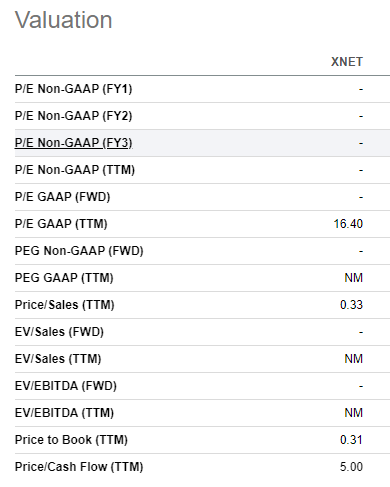

In terms of valuation, the company looks good across all metrics (note that because of the large cash position, the company’s EV is a negative $129M so the EV ratios show as not meaningful).

Seeking Alpha Seeking Alpha

Share Buyback

Another catalyst that might help the company begin trading above net current assets is its recent share buyback authorization. Here is the latest update on this from the most recent earnings report:

In March 2022, Xunlei announced that its Board of Directors authorized the repurchase of up to $20 million of its outstanding common stocks over the next 12 months. As of June 30, 2022, the aggregate value of purchased shares was approximately US$1.74 million.

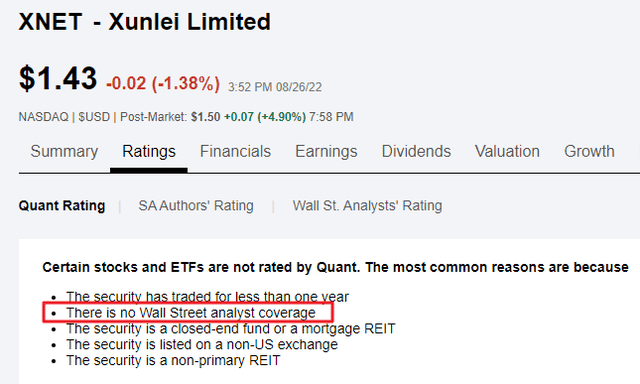

Underfollowed

Yet another catalyst for a re-rating of the stock price is that the company is relatively unknown on Wall St. For example, Seeking Alpha doesn’t yet have a quant rating for the stock. There are number of reasons why this could be the case, but one of them could be that, as of yet, there are no analysts covering the stock. I imagine that if and when coverage begins, SA would have a relatively positive rating given the extremely low valuation the company is currently trading at.

Risks

The biggest risk with XNET, in my opinion, is the same one that plagues most Chinese stocks, i.e. the company is a VIE and thus shareholders don’t actually own the company. Here is a good link describing this risk. In any case, though I rate XNET a “Strong Buy” given that it is profitable and trading well below net current assets, I personally have only taken a speculative-sized position given this particular risk.

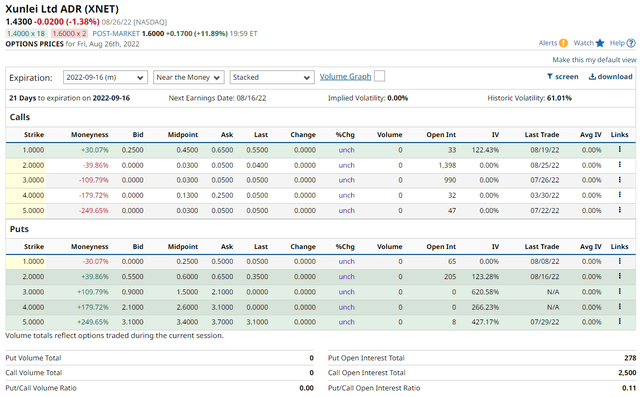

Options

For those so inclined, XNET does trade options, and the Sep $2 calls have about 1,400 contracts of open interest.

Conclusion

XNET has been consistently growing revenues and has recently turned profitable. It trades at a substantial discount to its realizable cash and thus I’m long the stock and rate the company a “Strong Buy”. Nonetheless, as with all Chinese-listed stocks, there is a substantial risk due to its VIE structure, and hence my position size is small despite my bullish stance.

Be the first to comment