Bennett Raglin/Getty Images Entertainment

Genius Brands (NASDAQ:GNUS) has been pushing forward with its Kids content expansion as subscription service ‘Kidaverse’ was launched in April and the (internally) highly anticipated launch of ‘Shaq’s Garage’ is planned for Q4 ’22.

Despite GNUS growing at a fast clip, this has been achieved from a small base with a large inorganic contribution. My investment thesis is still bearish on GNUS, much of the core offerings and content have gained little traction among consumers and it’s reflected in the results.

Fast growth…from a tiny base

The Q2 results press release was delivered with an (unsurprising) eye-catching headline:

Genius Brands Q2 PR Headline (Genius Brands)

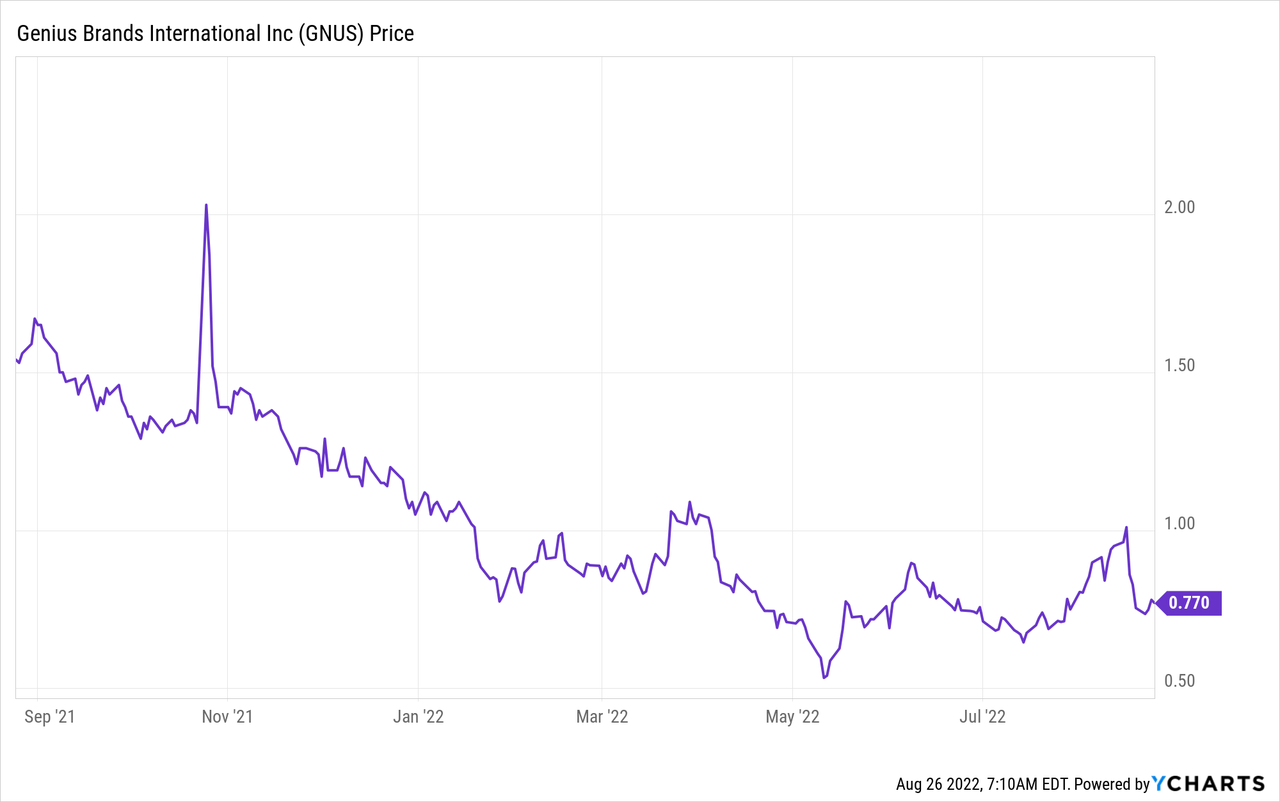

For those who aren’t familiar with Genius Brands, the company is known for releasing exuberant press releases like these in relation to a lot of business developments. The company’s meteoric stock price rise in May of 2020 was fueled by numerous striking back-to-back press releases, with the announcement of ‘Stan Lee’s Superhero Kindergarten’ being the most notable of those. That market excitement soon started to steadily abate over time as the company significantly diluted shareholders and the hype didn’t convert into financial gains, since March 2020 the total outstanding share count increased more than sixfold and many of the highly anticipated developments failed to deliver much shareholder value. The majority of this increase came in 2020/21 but even in the last six months, the outstanding share count has increased by nearly 14 million.

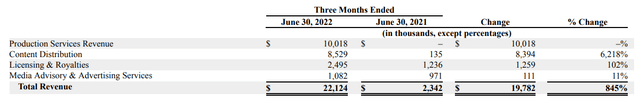

On the headline, GNUS achieved outstanding revenue growth, but a large amount of this growth can be attributed to the acquisition of Wow which closed in April of this year:

Revenue breakdown (Genius Brands 10Q)

The segment that delivered the biggest revenue contribution was production services, which relates wholly to ‘Wow’. ‘Wow’ revenues also make up the majority of content distribution revenues. In Q1 of this year, prior to the ‘Wow’ acquisition GNUS revenues were just $1.4M. Nearly all of GNUS’s purported strong growth is inorganic, which I think is disappointing considering the fact it’s been 18 months since the launch of ‘Kartoon Channel!’ (KC). Over the last year, GNUS has significantly expanded the reach of KC, launching on the likes of Pluto TV and Roku. Yet this has brought little success so far, the only real success GNUS has seen is through acquisitions, which have boosted revenues and expanded content.

High costs and cash burn

Operating costs totaled $30.7M in Q2, this was up nearly 200% from Q1. The majority of this rise was a result of direct operating costs. This was caused by the consolidation of service salaries and channel expenses related to the ‘Wow’ acquisition. Now that GNUS has benefited from ‘Wow’s’ scale, operating margins have improved, but the company is still reporting a wide absolute operating loss ($8.6M). Cash burn is also very high, Operating Cash Flow was -$17.6M in Q1 alone, more than doubling Y/Y. Free Cash Flow was -$10.11, a $6M greater loss sequentially.

Genius Brands funded a large amount of these losses and acquisitions by borrowing more capital on its margin loan ($56.6M). Investors will note this loan is recorded under current liabilities, here’s why (in 10Q):

The investment margin account borrowings do not mature but are payable on demand as the custodian can issue a margin call at any time.

So essentially GNUS can be ordered to pay back the $56.6M in full at any time, with just $7M Cash on hand how would the company pay this back? Well, Genius Brands holds $97M in marketable securities on its balance sheet, these are all liquid and Genius could sell these quickly to pay back the loan if necessary. Considering the high cash burn, I suspect they will sell some of these marketable securities to fund operations over the coming quarter. If the company opts not to sell marketable securities, the risk of further dilution through more equity offerings is real in order to cover the cash burn which is likely to remain at the current levels as we near the launch of Shaq’s Garage.

Shaq’s Garage

I believe a lot of the future success of Genius Brands hinges upon the success of the upcoming launch of Shaq’s Garage. A lot of capital has been pumped into this release, in the last quarter Film and Television costs increased by $15m, $9.5M of that was from ‘Wow’ and the rest primarily due to Shaq’s Garage production. This means unlike a lot of other content rolled out on KC, Shaq’s Garage needs to drive some ROI or market sentiment will worsen.

Following the acquisition of Wow, there is some margin of safety as the company is able to fall back upon a bigger operating footprint. If they hadn’t diluted shareholders sixfold to fuel inorganic growth, there would be a vast array of content across its channels but no substantial revenues to highlight the success of that content. Nonetheless, GNUS is still a growth business and it needs projects like Shaq’s Garage to perform well in order to have any chance of becoming profitable. Shaq is a big name that attracts a lot of attention, but he’s also a successful entrepreneur and knows a good deal when he sees one. The payment GNUS offered him to produce Shaq’s Garage was likely too good to ignore.

The Bottom Line

Genius Brands is burning through large amounts of cash as it reinvests into its content library. KC has brought little success to the kids content outfit since its launch. Kidaverse, a $3.99 a month channel, has now also been launched but is entering a very competitive subscription streaming market. I don’t believe that Shaq’s garage is going to buck the trend of relative content underperformance at Genius Brands. Sell.

Be the first to comment