YvanDube

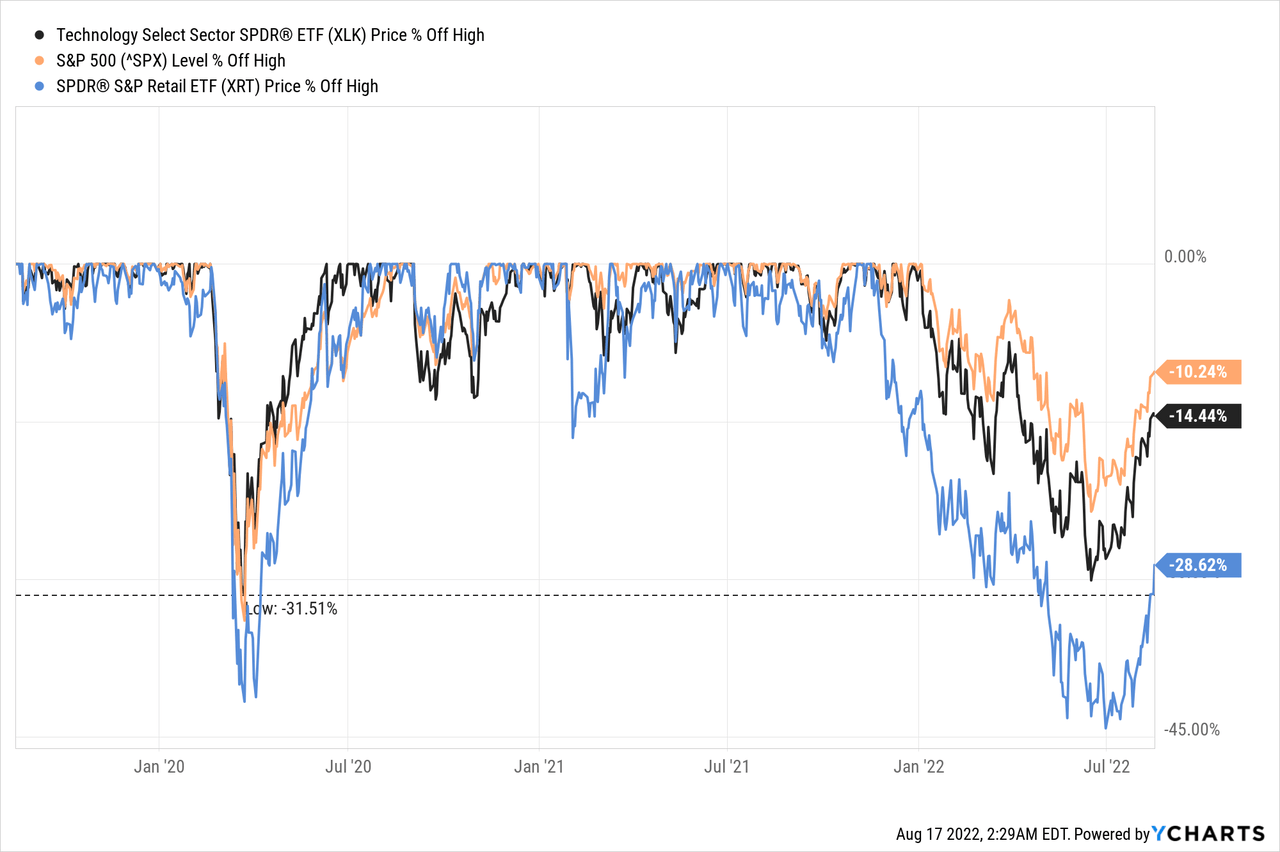

The last few months certainly were interesting and exciting although most investors probably didn’t enjoy that time. While the U.S. stock market – exemplified by the S&P 500 (SPY) – entered a bear market, not every company (and every sector) performed the same. For me, it felt like technology companies and retail companies performed particularly bad. And while that feeling might just be the result of myself focusing on several companies from these two sectors, that statement can also be underlined by numbers: Technology stocks as well as retail stocks underperformed the market in the last few months and declined steeper than the S&P 500.

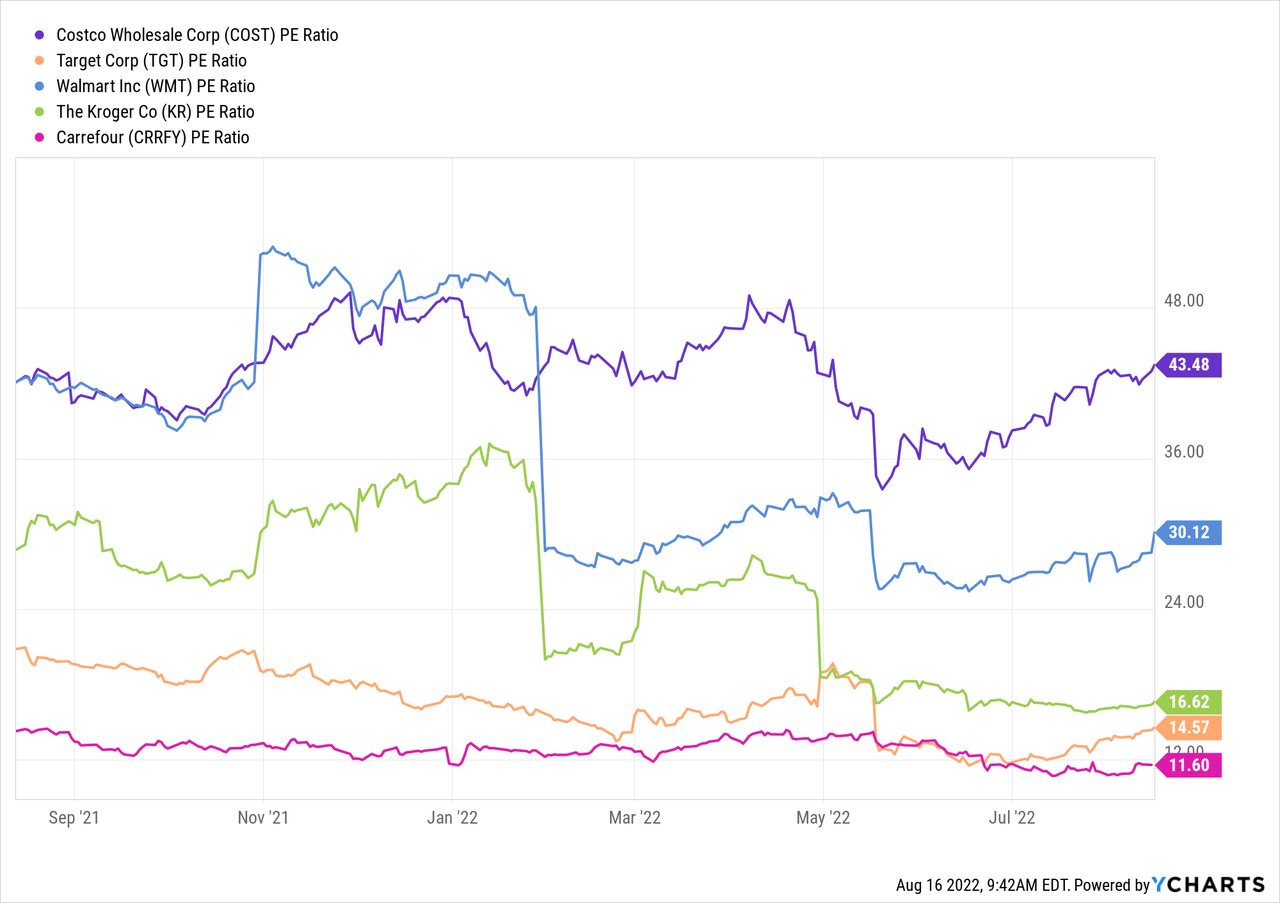

Especially the retail sector underperformed the S&P 500 in a dramatic way and as a Target (TGT) shareholder I was hit hard by Target losing almost 50% of its value (Target is the second-biggest position in my portfolio). But not every retailer (and every stock) performed similar and while Target is still trading clearly below its all-time highs, other retailers like Costco Wholesale Corporation (NASDAQ:COST) are coming close to previous all-time highs again. And considering the high valuation multiples Costco is trading for (while other high-quality companies are trading in the low teens), we seriously must ask the question if Costco is a good investment and if the current stock price is justified.

Quarterly Results

When trying to answer that question, we can start by looking at the results Costco is reporting right now, because the stock trading close to its all-time high is not an argument for overvaluation by itself.

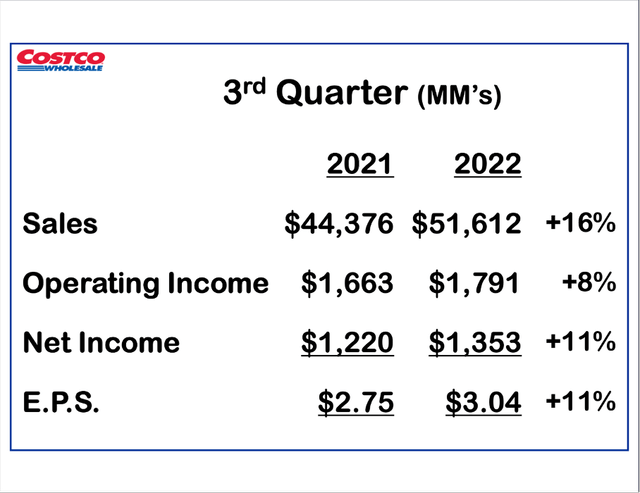

In the third quarter of fiscal 2022, Costco reported a total revenue of $52,596 million and compared to $45,277 million in revenue in the same quarter last year this is an increase of 16.2% YoY. And while membership fees increased from $901 million in Q3/21 to $984 million in Q3/22 (9.2% YoY growth), net sales increased from $44,376 million one year ago to $51,612 million right now (16.3% YoY growth). Costco could not only increase the top line, but operating income also increased 7.7% YoY from $1,663 million to $1,791 million. And finally, diluted net income per share increased from $2.75 in the same quarter last year to $3.04 this quarter – reflecting 10.5% YoY growth.

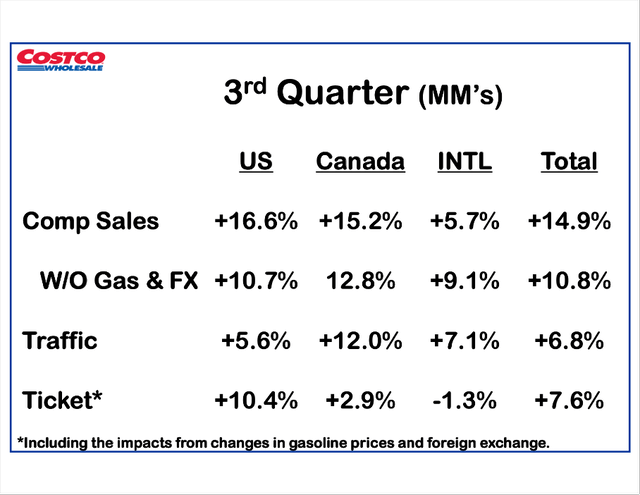

When looking at the results in more detail, we see comparable sales increasing 14.9% with traffic contributing 6.8% to growth and ticket (which is including the impacts from changes in gasoline prices and foreign exchange) contributing 7.6% growth. And while comparable sales growth was especially high in the United States and Canada (the two most important markets), it lagged a bit in the other countries (the international business).

No matter how we look at things, these are great results and compared to other retailer which presented mixed results in several cases, Costco is holding up quite well. Costco also saw increasing inventory levels over the last few quarters – like most other retailers – but the increase in the last few quarters were rather moderate compared to peers like Walmart (WMT) or Target.

|

Current quarter compared to: |

Three quarters ago |

Two quarters ago |

Previous quarter |

Inventory Current Quarter |

|

Costco |

+24.0% |

+4.0% |

+6.9% |

$17,623 million |

|

Walmart |

+34.9% |

+33.3% |

+6.0% |

$59,921 million |

|

Target |

+67.7% |

+41.6% |

+8.5% |

$15,083 million |

At least when looking at the last quarterly results, we don’t find many reasons to punish the stock right now and the earnings release is not really giving us a reason why Costco shouldn’t trade near all-time highs. And when looking at sales results for the last few weeks (data that was not included in the last quarterly results) we still see high growth rates. In the five weeks ending July 3, 2022, comparable sales increased 18.1% (13.0% when excluding the impacts from changes in gasoline prices and foreign exchanges) and in the four weeks ending July 31, 2022, comparable sales increased 10.0% (when excluding above-mentioned effects again, growth was 7.0%).

Recession

Many retailers were punished in the last few months due to growth slowing down and increasing inventory levels. Another reason for lower stock prices might be the fear of investors that a potential recession could hit the United States and lead to much lower earnings per share.

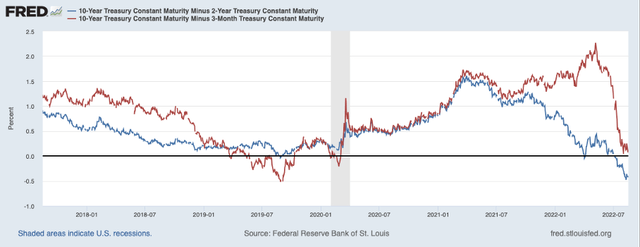

I often state that the risk for a recession is high without explaining why. At this point, we can’t really go into detail and just present one piece of data why I think a recession is upon us in the next few months or quarters. One early warning indicator that was working extremely well in the last few decades is the U.S. treasury yield curve. When the treasury yield inverted the U.S. economy was entering a recession in the next few quarters. And the inverted yield curve can either be demonstrated by the 10-year minus 2-year treasury yield or – even better – the 10-year minus 3-month treasury yield. Especially the last one is an extremely good warning sign and when it was going below zero, a recession followed every time in the last five decades. And – similar important – the indicator didn’t generate false signals.

While the 10-year minus 2-year treasury is now already in the negative territory for several weeks, the 10-year minus 3-months treasury yield is very close to zero and it seems like a recession is on the horizon.

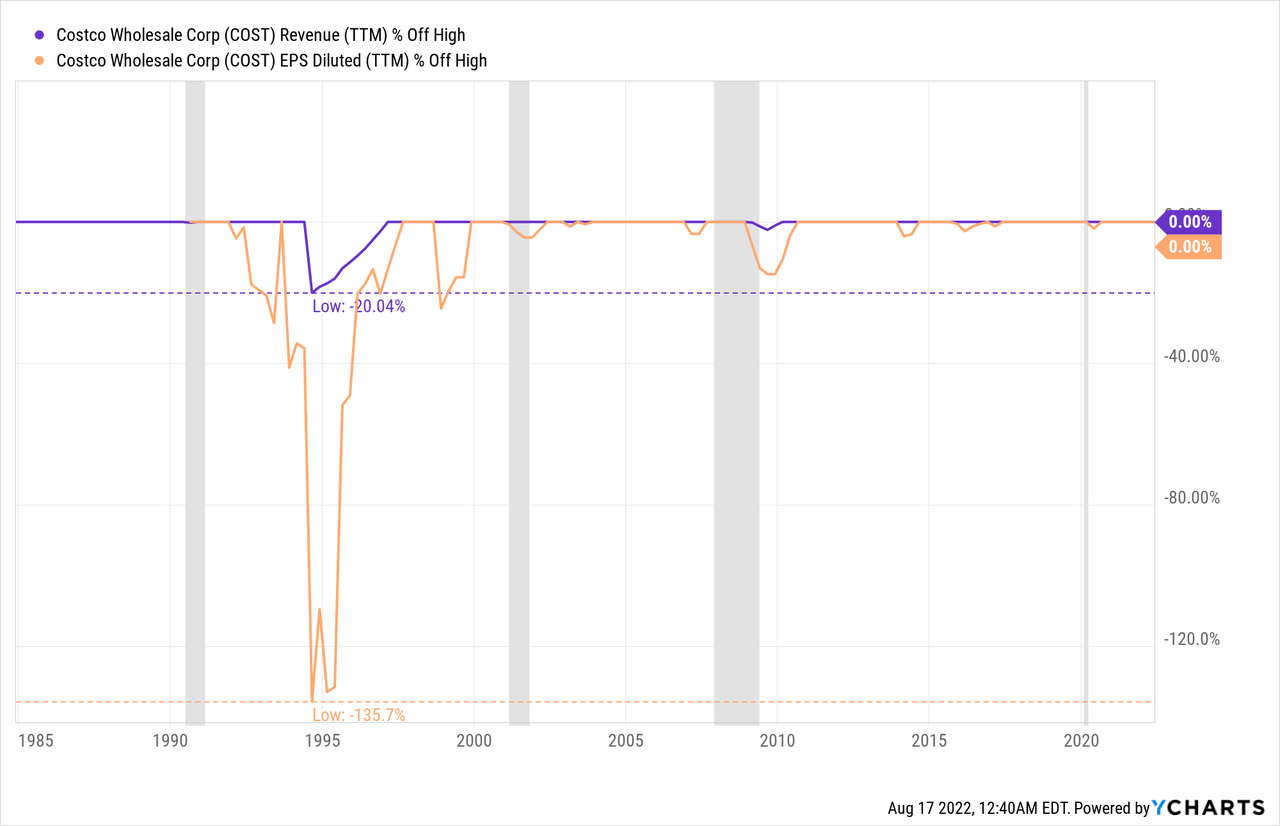

This is the one of the reasons why I include a section about the performance of the companies during a recession in almost every article. In case of Costco however, we don’t have to worry. The company seems to be pretty resilient to a recession. When looking at the data of the past decades, we see a steep decline in the 1990s for revenue as well as earnings per share. But this decline can’t really be connected to a recession.

When looking at the last three recessions, we can see that revenue is hardly reacting at all to a recession. This is not surprising as we got a similar picture in our most recent articles about Target as well as Kroger (KR) – most retailers are able to keep revenue at least stable during recessions. These companies are mostly selling essential items customers also must purchase during economic downturns leading to stable revenue. However, when looking at earnings per share, Target and Kroger are reacting much more to a recession than Costco. During the last three recessions, earnings per share for Costco did not decline more than in the low teens, which is quite remarkable, and we can therefore describe the company as very resilient to recessions. Of course, nobody can guarantee the performance in the next potential recession being similar.

Intrinsic Value Calculation

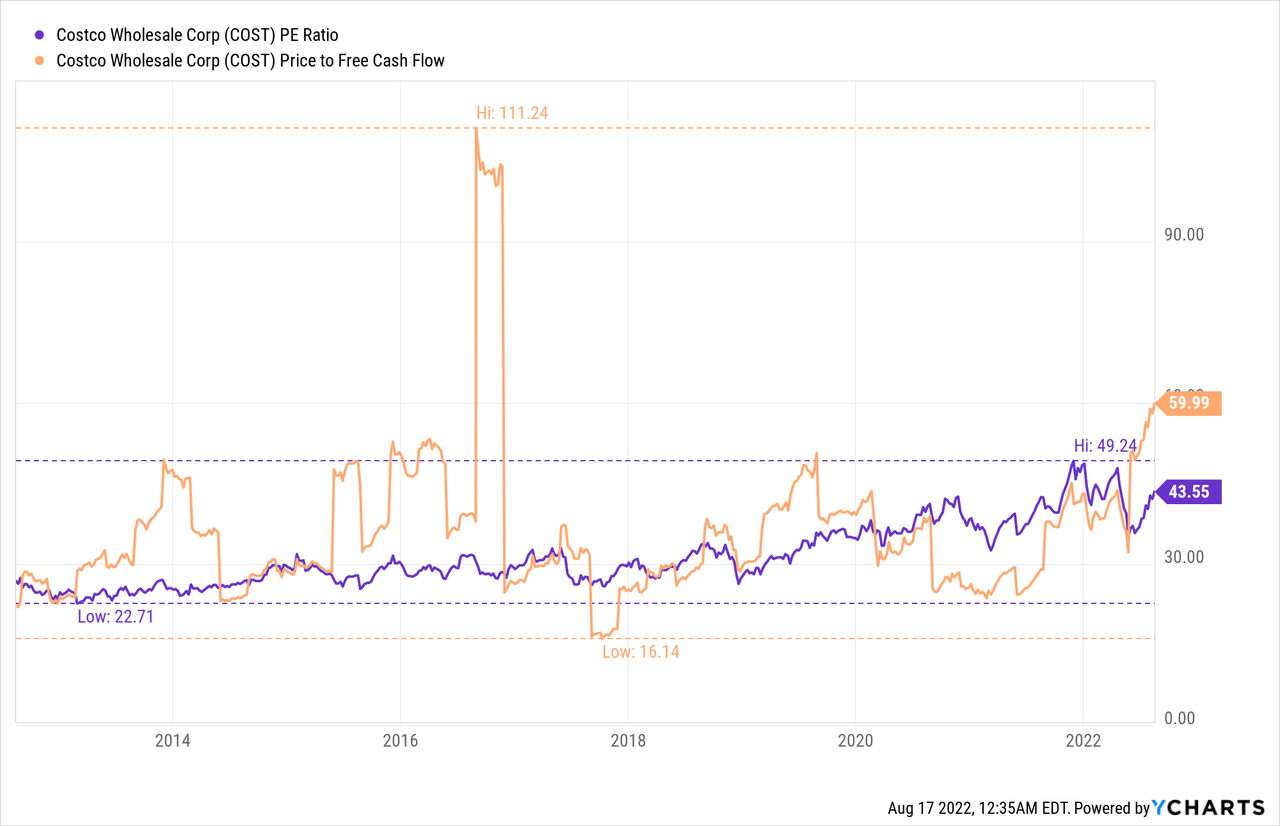

Despite being almost recession-proof and still reporting high growth rates (while other retailers are struggling), I don’t see Costco as a good investment right now. The current P/E ratio and P/FCF does not seem sustainable and is indicating that the stock is overvalued. Even if Costco will perform solid in the coming quarters and years, the high valuation multiples are not justified.

I basically can repeat what I wrote in my last article about Costco’s valuation multiple. And right now, Costco is trading at the same price-earnings ratio as when my last article was published:

In case of Costco, we can just look at the price-earnings ratio or price-free-cash-flow ratio to see that the stock is rather “expensive”. Right now, Costco is trading for about 45 times earnings, which is not only very close to the highest P/E ratio of the last ten years, but also above the 10-year average (30.7 times earnings). And the picture for the P/FCF ratio is similar. Right now, Costco is trading for 40 times free cash flow, which is also above the average P/FCF ratio of 34.8. And when ignoring the historic P/E and P/FCF ratios of Costco: Valuation multiples between 40 and 50 are rather high – even for high-quality businesses with a wide economic moat. When stocks are trading for such high valuation multiples, we always must be careful not to overpay for a business.

Costco is trading for a similar price-earnings ratio as when my last article was published and it is trading for a much higher price-free-cash-flow ratio – right now, Costco is trading for 60 times free cash flow.

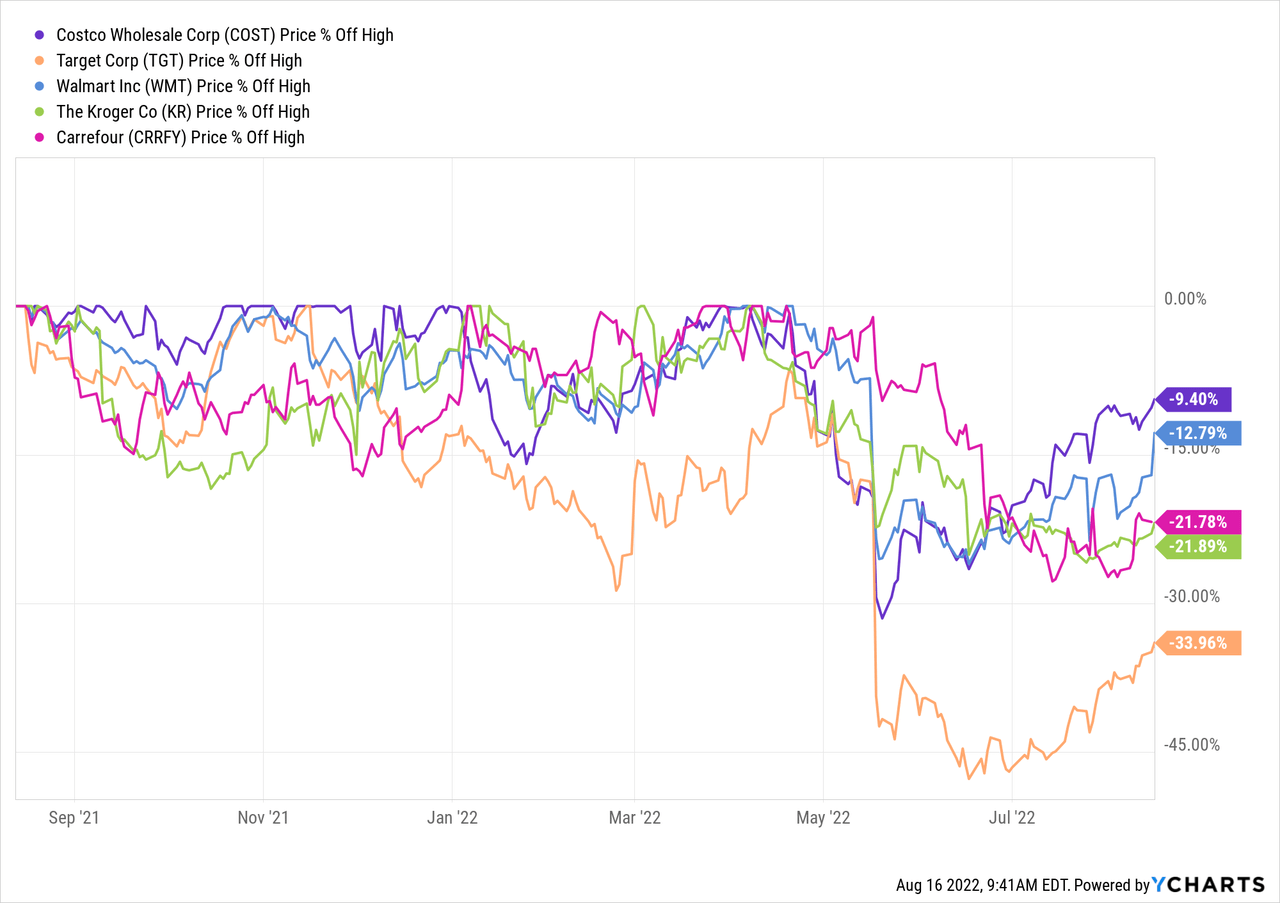

Comparison to Competitors

Costco is without much doubt one of the best retailers in the United States and a great business with a wide economic moat. Nevertheless, it is not really a great investment at this point, and I would pass up on Costco as the current price is not justified in my opinion. When comparing Costco to other retailer, there might be companies and stocks which are a better investment right now. Kroger is trading 22% below its previous high and Target is trading even 34% below its previous all-time high.

But of course, we are not just looking for stocks trading below the all-time high. When looking at the price-earnings ratio, Kroger and Target also seem to be a much better investment. Right now, Kroger is trading for 16.6 times earnings and Target is trading for 14.6 times earnings.

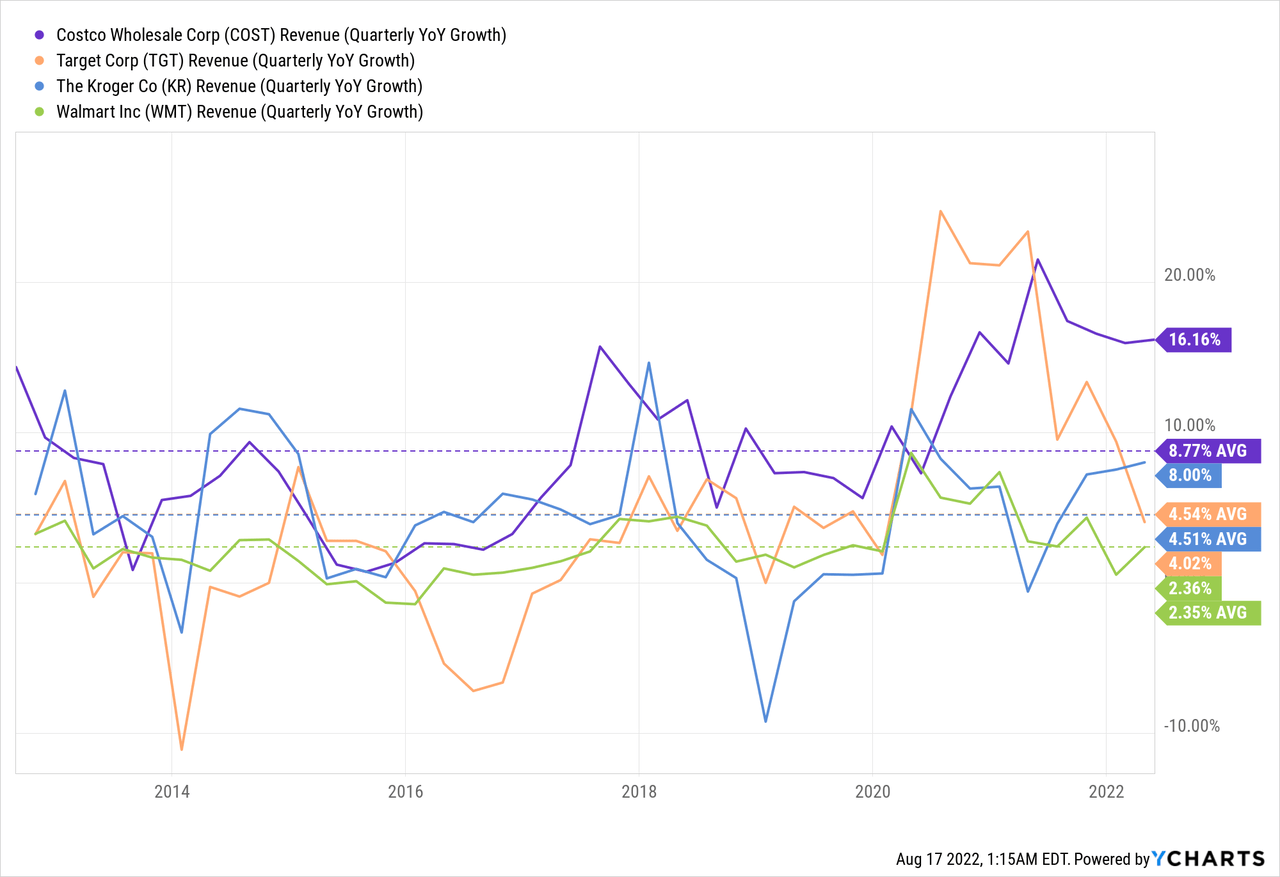

Kroger and Target might not be able to grow with a similar pace as Costco (for example when looking at the average revenue growth rate in the last ten years), but the price-earnings ratio of 44 for Costco is not justified by the higher growth rate.

When one is about to invest in a retailer right now, I would rather choose Kroger or Target as they might be a better long-term investment with a higher yield right now.

Conclusion

Costco is still overvalued right now and not a good investment in my opinion. The company is still reporting high growth rates and a potential recession in the next few quarters won’t slow the business down much (revenue probably won’t decline at all and earnings per share might also decline only slightly).

At this point, I would rather choose Target or Kroger as an investment if you want to invest in a retailer and pass up on Costco. Long-term, Costco might have the better business model and grow with a higher pace, but the current stock price is not justified.

Be the first to comment