Oleg Elkov/iStock via Getty Images

Air Lease (NYSE:AL) is part of an oligopolistic market whose business is focused on acquiring aircraft from the manufacturers Airbus (OTCPK:EADSF) and Boeing (NYSE:BA) and subsequently leasing them for periods of 8 years to small airlines that cannot directly access the order book of the large manufacturers. The business has grown its rental income at a rate of 20% per year since its IPO while its book value has grown at rates greater than 10% in the same period. On top of all this, the company’s founder, Mr. Udvar-Hazy, owns over $200 million in stock, making him highly aligned with shareholders. I believe that after two years of difficulties in the world of commercial aviation, the company has the capacity to continue executing its growth plans prior to the great crisis of 2020.

Aircraft Acquisition and Leasing

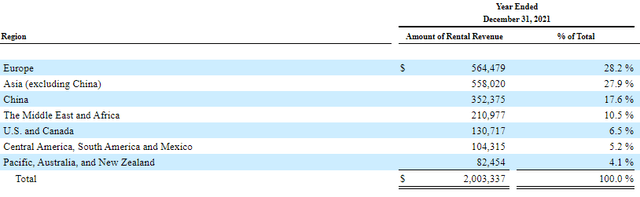

Air Lease’s main source of revenue comes from acquiring commercial jets to the two main manufacturers (Airbus and Boeing) and leasing the aircrafts to airlines that they consider trustworthy and with whom they have long term relationships. Air Lease is focused on providing leasing services around the globe, with special presence in emerging markets such as Asia and Africa, where the expansion of the middle class in the future years will increase air traffic and the demand for new jets in the airlines’ fleets. Although Air Lease has operations in the European and US market, the saturation is higher and the need for new airplanes is lower, that is the main reason why Air Lease has a lot of exposure to Asian and African markets.

Air Lease’s Rental Revenue (sec.gov)

One of the keys of success of the company is maintaining a fleet with low average age which will be able to satisfy the replacement needs of airlines in emerging countries, as well as in elder aircrafts that may be present in Europe or the United States.

The fact that the company is in the first delivery positions of the large producers allows many small airlines, through rental contracts, to be able to use relatively new fleets at a reasonable price. Otherwise, it would be very difficult for small airlines to quickly access the order books of Boeing and Airbus.

The aircraft acquisition strategy is carried out with a combination of cash, equity, debt and cash flows generated by the rental of other aircrafts. In general, the investment community is usually concerned about the debt of leasing companies, but in my opinion it is not particularly dangerous for two reasons: it is backed by assets without a high risk of terminal value and it is signed at a fixed rate. The composite cost funds of Air Lease is currently of 2.8%, a low number compared to the cost of debt of other publicly traded companies.

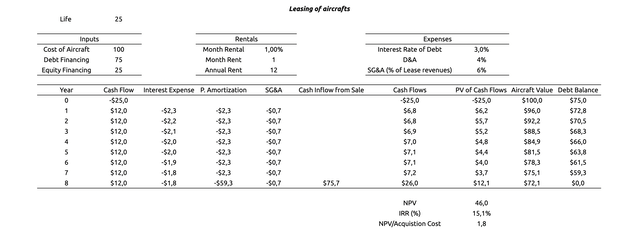

Internal rate of return for Aircraft Leasing (Own Models)

The table above clearly shows the financial return for Air Lease when purchasing an aircraft using leverage (25% of the value is financed with equity and the rest is debt). The company is able to sell the aircraft above book value at the end of the period and the internal rate of return obtained in these operations is around 15%. The useful life of the aircraft is assumed to be of 25 years and they operate it in the first third of the useful life. The present value of the aircraft based on the rental cash flows that it will generate is almost 2 times higher than the own capital that they are using to finance the operation.

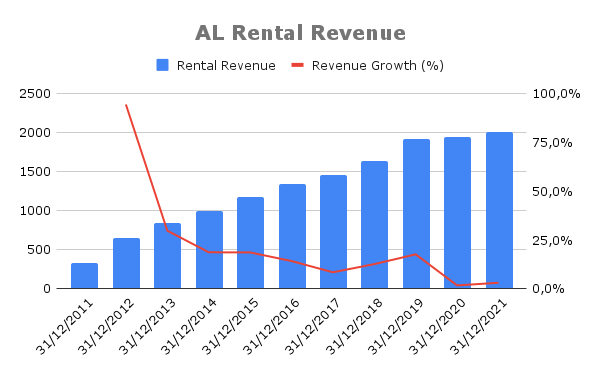

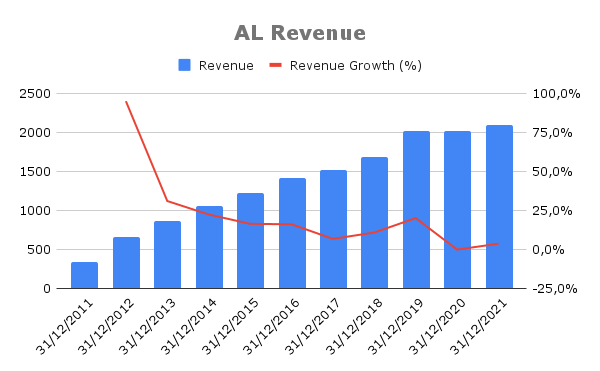

Air Lease Rental Revenue and Growth (%) (Own Models)

In relation to the evolution of rental income, it can be seen how they have been growing systematically and uninterruptedly, even during the coronavirus crisis. This shows the great strength of Air Lease and the resilience of its earnings in adverse economic environments. The fact that rental income has been stable during a period in which commercial aviation was completely stopped is due to the careful selection of clients that the company makes. Long-term relationships are sought, and airlines with a competitive position, good management teams and good financial performance are more suitable candidates for becoming lessees.

In the event that a client goes bankrupt, there is no high risk for the company, since it only has to go with a pilot to gain control of the plane and rent it to another company.

Disposal of Aircrafts

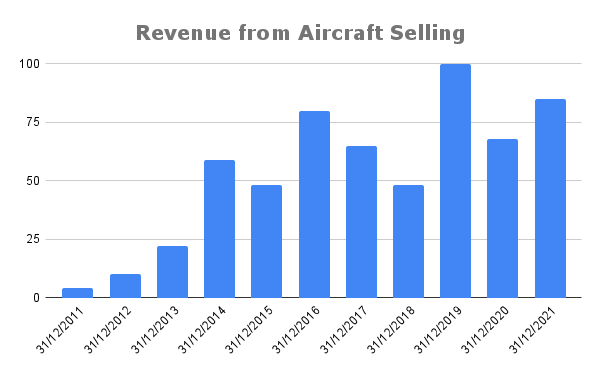

Another of Air Lease’s sources of income is the sale of aircraft that reach the age they consider critical: the first third of the useful life of an aircraft, approximately 8 years, which is the most common rental period. After the leasing contracts with any airline expire, the company sells the aircraft to maximize the return of assets they want to be disposed of. The main buyers of this type of aircraft are small airlines, cargo aircraft leasers (such as ATSG, the main supplier of Amazon cargo aircraft) and other commercial aviation leasers, as well as banks and financial companies.

Revenue from aircraft selling (Own Models)

These types of activities allow the company to maintain a renewed fleet of aircraft, with an average life of 4-5 years, ideal for companies that want to provide air transport services to passengers with quality and at a relatively low price, due to the efficiency of the new jets.

Management team

Undoubtedly, another of the keys to Air Lease’s long-term success is the exceptional management of the company that its founder and current president, Udvar-Hazy, has done over time. This Hungarian immigrant, now an American citizen, is an expert in the world of commercial aviation, and has always known how to anticipate the demand for commercial aviation that was to come. Such is his control of the industry that he has talks with aircraft manufacturers in which he invites them to make modifications to the aircraft to better suit the needs of the airlines.

Udvar-Hazy currently owns 5% of the company’s outstanding shares, that is, he has more than $200 million in listed shares. His equity in shares is much higher than his salary, which guarantees full alignment with all shareholders (institutional and minority) of the company.

Financials

Once the business has been understood qualitatively, it is necessary to understand the evolution of sales and other important financial metrics. It should be noted that Air Lease is not an industrial company – it does not manufacture aircraft – but rather it is a financial entity. That is why the best ways to approximate the value of Air Lease are through the Net Income and the book value, which measures the difference between all the assets and all the liabilities of the company.

Air Lease Revenue (Own Models)

In the first place, revenues from aircraft rentals and sales have been growing at high rates in the years prior to the COVID crisis. Although 2020 and 2021 have been difficult years for commercial aviation, IATA estimates that growth will return and the pre-COVID trend can be recovered in the coming years. This will boost commercial aviation and the demand for Air Lease services, which will grow again at intense rates in the next decade.

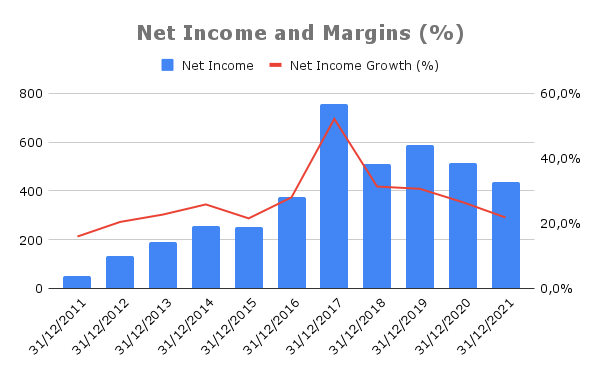

Net Income and Margins (%) (Own Models)

In addition to the good evolution of the income (and its resilience in the time of the coronavirus), the company’s net profit has been much better than could initially be expected.

Although 2020 and 2021 have been bad years for the company, at no time has it stopped losing money and has continued to earn cash from the rental of the aircraft it operates. With the recovery of air traffic in the coming years, the company will be able to continue increasing its profits at the rate it did before the negative impact of the pandemic on the world of aviation.

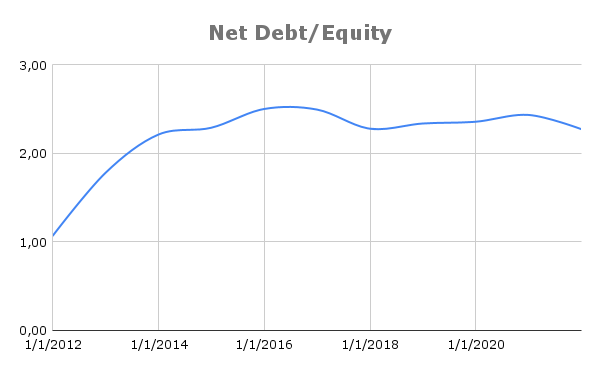

The main negative point for the market is that Air Lease is a finance company and as such needs a lot of debt to operate on a large scale with the assets it holds. Leverage is currently high (about 2.5 debt/equity), although in no case is the amount of debt greater than the total value of the company’s assets.

Net Debt to Equity (Own Models)

Although a priori the debt seems exorbitant, the company finances more than 95% of the debt at a fixed rate (at a rate close to 3%), which, together with the high predictability of its cash flows, makes it practically impossible for the company to go bankrupt. The company could stop aircraft purchases for 5 years and with the cash flows repay half of the debt without increasing rents to the lessees.

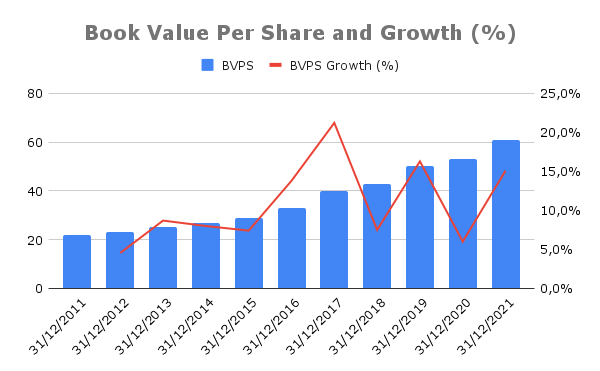

It is important to study what has been the evolution of the company’s book value, since being eminently financial, the company’s book value plays a central role: it represents the total value of its assets compared to the debts that the company has contracted for the financing of those operating assets.

BVPS and growth (Own Models)

It can be seen how the company has systematically increased its book value over time, especially in the last two years. Its main competitor, AerCap (AER), despite having increased its value in the same period, has had more difficulties during the COVID pandemic. This last thing shows the resilience of the company and its ability to grow more than its main competitor.

Risks

- Capital structure and debt: the company’s capital structure is heavily dependent on debt to continue their main operations. Although most of the debt is at a fixed rate, a very aggressive hike of rates could make access to credit more difficult and would affect Air Lease’s ability to acquire new aircrafts at a reasonable interest rate.

- Operational risks: poor capital management, which can lead to the purchase of obsolete or low-demand aircraft, can hamper the company’s ability to generate revenue.

- Excessive dependence on two sole suppliers: The long-range commercial aircraft manufacturing market is highly dependent on two manufacturers: Airbus and Boeing. Failures in some model (for example the 737 Max) or delays in deliveries can compromise the financial situation of the company.

- Age of the fleet: A key element in Air Lease’s thesis is its ability to offer relatively new aircraft to small airlines that are unable to access deliveries from Boeing and Airbus in a short period of time. Air Lease must continue to use debt conservatively to increase its assets and keep the average age of its fleet below 8 years, which is the point at which they sell aircraft that are already obsolete.

- High dependence on Udvar-Hazy: Udvar-Hazy has proven to be a person with a lot of anticipation in the commercial aviation industry. His departure may mean that Air Lease’s ability to make acquisitions is diminished over time.

Personally, I believe that an economic crisis or a global pandemic, while they would have short-term negative effects on the business (declining rentals and reduced aircraft sales), would not affect the long-term fundamentals of this excellently managed company.

Valuation

Air Lease is a financial company and, as such, it should be valued using its Net Income or via the Equity Method. The following lines will assess the valuation of the company and determine whether there is enough margin of safety for Air Lease to become an attractive investment in the following years.

To determine the possible growth of the company in the next few years, I think it is necessary to consider what percentage is being reinvested in the business (it is cash from operations that is not used to pay a dividend) multiplied by the return on equity, which includes the leverage used by the business to expand its operations.

I estimate that the ROE will remain around figures close to 9-10% (there will be a strong recovery in rental income) and the leverage will range between 2-2.5 times debt/equity between which it has moved during the last 6 years. Normally the company has paid around 10% of what it generated in dividends, so that the remaining 90% was reinvested in the core business. This would generate an estimated growth of 8% in profits in the coming years. I think the board should focus on maintaining-reducing the dividend and focus on repaying debt and continuing to expand the business conservatively. In this way, the value that would be generated for the shareholder would be extraordinarily high.

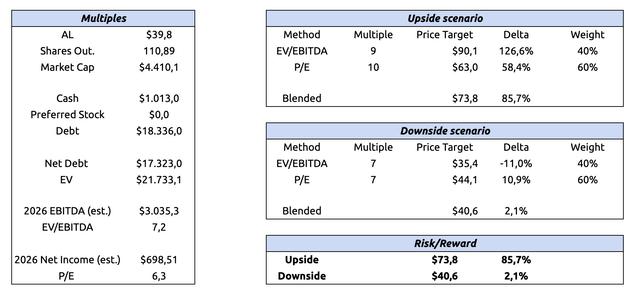

Different Future Scenarios for Air Lease (Own Models)

The previous image shows the conservative estimates of profit and EBITDA that the company would generate by 2026. I believe that Air Lease could be an asymmetric investment because in a normal scenario the potential upside would be around 86% in six years, something higher than the expected return of indices such as the S&P 500 or the Dow Jones Industrial. In addition to this, the downside is quite limited due to the low valuation at which the company is trading at these moments. It should not be forgotten that Air Lease, after 8 years of leasing commercial aircrafts, can sell them at 1.1-1.2x book value, and right now the company is trading at 0.7x book value per share.

Conclusions

Air Lease is an exceptionally managed company that has proven to be resilient to crises and has highly predictable cash flows. Although indebtedness is high, all companies in the industry need debt to function. Although a priori the investor is averse to debt, if used properly, it can be an instrument for generating extraordinary returns. Currently the company is at a very attractive valuation and the upside it offers for the coming years is really interesting. I think every long-term investor should be aware of this company and be ready to buy if its price drops too low.

Be the first to comment