DKosig

Fastly (NYSE:FSLY) continues to trade near all-time lows as investors weigh the potential of edge computing against Fastly’s dire financial performance. While there has always been a significant amount of hype around Fastly’s technology, weak revenue growth in the core business suggests there is a problem with either the product or Fastly’s sales organization. Josh Bixby has been replaced as CEO by a former Cisco executive, but it is not clear that Fastly’s problems lie with senior management. Fastly has always positioned itself as a high-performance CDN for large enterprises, which limits their platform’s appeal. Until they can improve profitability and broaden their customer base, Fastly’s stock is unlikely to return to the heady days of 2020.

Signal Sciences

Fastly continues to achieve strong security sales, driven by their next-generation WAF, which is now available for customers to purchase from the AWS marketplace. Fastly has also achieved an integration milestone, with the introduction of a beta version of Signal Sciences agent on the Fastly Edge Cloud.

Management had previously expected Signal Sciences to contribute approximately 10% of the company’s revenue in the second quarter of 2021, but this figure ended up being 13%, indicating that Signal Sciences is outperforming expectations and the rest of Fastly’s business is underperforming.

Fastly’s long-term goal is to increase security revenue 10x, which would be approximately 500 million USD in annual revenue. This does not seem to be a particularly aggressive target given the size of the security market, although is in line with Fastly’s current positioning as more of a niche vendor.

Compute@Edge

Fastly continues to develop their Compute@Edge service, adding features and capabilities to support customers, including support for JavaScript and local testing. They recently leveraged Compute@Edge to introduce Nearline Cache to the cloud market. Nearline storage is a type of data storage that is a compromise between frequent / rapid access and archiving. Fastly’s Nearline Cache allows customers to store content in third-party cloud storage near a Fastly POP. In the event of a cache miss, content that has previously been written to Nearline Cache is fetched from the storage instead of the origin.

Fastly has also stated that Compute@Edge allows them to acquire technology and rapidly release it, although this is not readily apparent from a product innovation standpoint so far.

While Compute@Edge has a lot of potential and hype around this service was one of the drivers behind Fastly’s stock price rise in 2020, the financial impact has so far been muted. In 2021, management was pointing towards 2022 as the year that Compute@Edge would begin to have a material impact on the business, but this has not really been apparent so far. The reason for this is not really clear, but it is possible that Fastly’s inability to engage a broad swath of developers and lack of product innovation has left them in Cloudflare’s (NET) shadow. Fastly is taking steps to correct the lack of developer engagement, including introducing a credit program where customers are offered up to 1 million USD to onboard the Compute@Edge service. Fastly has also introduced a free tier for Compute@Edge developers, which has increased the total number of developers on the platform, but also likely impacted new customer sign-ups at the lower end. It is also possible that edge computing is something of a paradigm shift that will require longer than expected to be fully adopted by customers. Cloudflare launched their edge compute platform 5 years ago and have suggested that it takes 8-12 years for a new developer platform to reach escape velocity.

Edge computing is behind the blurring of the lines between CDN services and cloud computing, something that became visible to many with the launch of Cloudflare’s R2 service in 2021. The hyperscalers have been trying to promote their own CDN services to bring workloads into their own public clouds and Akamai (AKAM) has acquired Linode for public cloud capabilities. The hyperscalers are also looking at providing some edge caching capabilities for certain types of workloads. Fastly do not see themselves as competitors to the hyperscalers though, which points towards their positioning as a high-performance CDN rather than a true edge network.

Glitch

Fastly recently acquired Glitch in an attempt to improve developer adoption. Glitch is a platform used by more than 1.8 million developers to create and share full-stack web apps without having to run the infrastructure or manage tools themselves. Glitch provides an easy-to-use development environment, remixable code, and a community of collaborative developers. Approximately 60% of developers using Glitch are enterprise developers, which is one of the reasons Fastly acquired them.

In the most recent quarter Fastly added over 100,000 developers across Glitch and their Compute@Edge platform. It is not clear what the split is between Glitch and Compute@Edge but adding developers to the Fastly ecosystem should be seen as a long-term positive.

Fanout

Fastly acquired Fanout in the first quarter of 2022 to enable real-time app development at the edge. Fanout’s platform allows developers to build and scale real-time and streaming APIs and will be integrated into Fastly’s Compute@Edge platform. This acquisition will support customers who wish to move away from complicated in-house WebSocket stacks, as well as customers who do not have the resources to build a push architecture for real-time data and communications. Customers will be able to use their existing HTTP origin instead of maintaining a complex WebSocket or other push protocol messaging infrastructure.

Network Capacity

Network performance is at the heart of Fastly’s business, with their network being on average 30% faster in the US and Europe than their largest competitor. Fastly’s network also delivers almost half of the traffic using 98% fewer servers. Over the past few years Fastly has aggressively added to the capacity of its network (likely in an effort to ensure performance), and this is now hurting margins as traffic has not kept up.

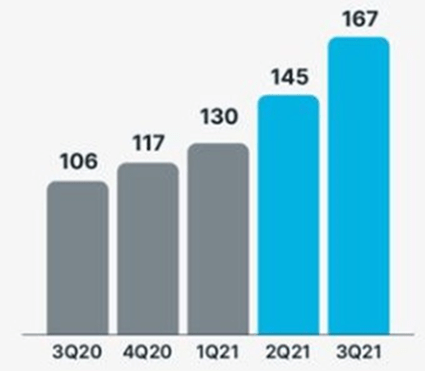

Figure 1: Fastly Network Capacity (Tb/sec) (source: Fastly)

Fastly is currently deploying a new architecture in key metro regions that will increase storage capabilities and merge entire regions into one storage unit, reducing duplication. This involves a temporary duplication of resources as the new architecture is deployed though, which is currently a drag on gross margins. Longer-term, Fastly believe that this new architecture could be accretive to gross margins through greater server efficiency. Fastly transitioned several sites in the first quarter, and more in the second. They expect that in the second half of 2022 the older duplicate sites will be fully decommissioned.

Some of Fastly’s over capacity problem has also likely been driven by hardware supply chain issues and data center availability. Fastly tried to minimize the impact of these by pre-buying and deploying capacity in key markets, but this has contributed to underutilization.

Product Innovation

Product innovation relative to peers has been something of an issue for Fastly in the past, and this appears to be something that they are actively working on. Releases increased from 3 in the fourth quarter of 2021, to 11 in the first quarter of 2022 and 13 in the second.

Fastly’s continued reliance on acquisitions to add capabilities and relatively slow pace of internal innovation should be seen as a red flag. Fastly was hyped as a technology leader that would eventually go on to dominate the market due to its best-in-class capabilities, but their track record just doesn’t support this.

Recent innovations include:

- Global persistent Object Store for compute functions, allowing developers to store, control and cache data to reduce origin dependency and unlock new use cases.

- Deployed HTTP/3 and QUIC, a latency-reducing, reliable and secure internet transport protocol.

- Observability dashboard, which brings delivery, security and application metrics into one window.

CEO Replacement

Todd Nightingale is now the Chief Executive Officer of Fastly, previously working as an executive in Enterprise Networking and Cloud at Cisco. Bixby will remain at the company for a period of time to ensure a smooth transition. This move appears to have been well received by investors, as many of Fastly’s problems have been pinned on poor leadership, although the share price has continued to decline. Fastly’s current issues (customer concentration, inability to win new customers, narrow vision, slow product innovation) pre-date Bixby’s appointment in 2020 though and will likely remain well after his exit.

Financial Analysis

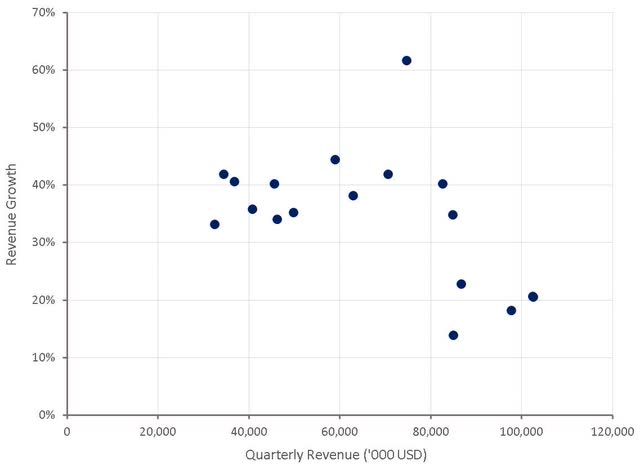

Fastly’s revenue growth decelerated rapidly in 2021 due in large part to difficult comparable periods. After accounting for revenue growth from the Signal Sciences acquisition, it is likely that Fastly’s organic revenue growth was near zero. While revenue growth has improved somewhat since then, it is still relatively weak given the once lofty expectations for the company.

Total revenue for the second quarter increased 21% YoY. Excluding Signal Sciences, Fastly’s growth was approximately 17%. Signal Sciences continues to perform well, growing in excess of 50% annually and now contributes approximately 13% of Fastly’s total revenue.

It should also be kept in mind that Q2 2021 was impacted by a significant outage that resulted in customers removing traffic from Fastly’s platform and delaying the launch of new projects. Fastly’s current revenue growth is off a relatively easy comparable period due to this outage issue.

Fastly increased full-year revenue guidance by 5 million USD in the first quarter of 2022 and by 10 million USD in the second quarter. While guidance is improving, Fastly are still only guiding 19% revenue growth for the year at the mid-point.

Figure 2: Fastly Revenue Growth (source: Created by author using data from Fastly)

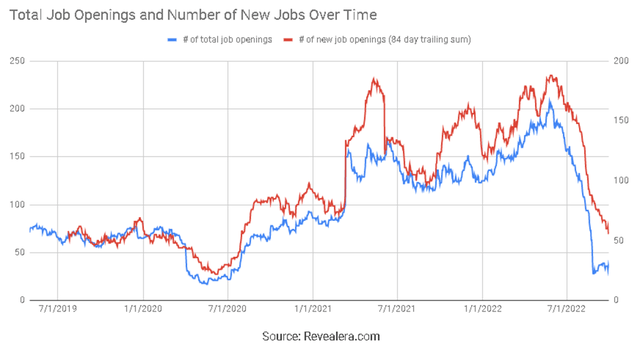

While Fastly’s revenue growth has been fairly stable and guidance has been improving, Fastly are reducing CapEx and slowing their pace of hiring rapidly, which may indicate the business is not performing as well as they had initially hoped internally. In the second quarter, Fastly reduced their guided CapEx range from 12-14% of revenue to 10-12% of revenue.

Figure 3: Fastly Hiring Trend (Revealera)

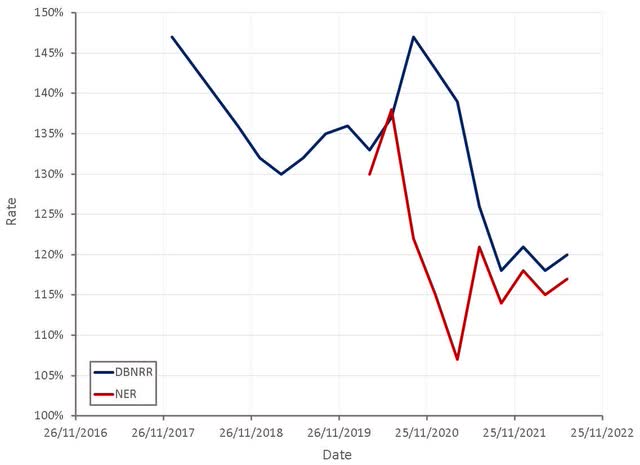

The pandemic related boost to Fastly’s business can clearly be seen from their DBNER, where their usage-based business model resulted in additional revenue growth while internet traffic was elevated during lockdowns. These figures have now stabilized as the impact of the pandemic is in the rear-view mirror, but their current level could be viewed as disappointing in the light of the Signal Sciences acquisition and the launch of Compute@Edge, which provide the opportunity for cross-sell / upsell.

Given Fastly’s small customer base and focus on massive enterprise customers, the ability to expand usage within existing customers is critical to the company’s success.

Figure 4: Fastly Net Expansion Rate (source: Created by author using data from Fastly)

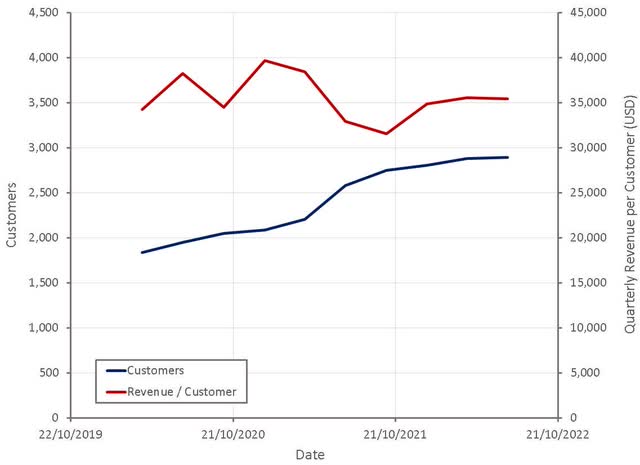

Attracting new customers, both large and small, continues to be an issue for Fastly. The customer base continues to grow, although at a low rate given the company’s limited market penetration. Improving customer acquisition is a key goal for Fastly and they are investing in their sales team and trying to improve lead generation and brand awareness in support of this. Churn is low though (< 1%), indicating that Fastly has no problems retaining existing customers.

Average spend per enterprise customer continues to increase at a modest pace as traffic continues to expand, but this growth is disappointing given the potential for security and edge compute upsell.

Enterprise customers continue to dominate Fastly’s revenue, with close to 90% of revenue coming from enterprise customers. As a result, the customer base also remains somewhat concentrated, with Fastly’s top 10 customer’s contributing 34% of total revenue in the second quarter of 2022.

Figure 5: Fastly Customers (source: Created by author using data from Fastly)

Fastly’s gross margins have been under pressure over the past 18 months, raising questions around the competitive environment. Management continues to reiterate that pricing dynamics have not materially changed and that recent margin declines are being caused by network costs.

Fastly avoids the commodity streaming business, choosing instead to focus on high-value areas, like the streaming of live events where quality is important. This strategy should be supportive of Fastly’s margins, but it is not apparent in the financial data. The architecture of Fastly’s network should also be supportive of Fastly’s margins, but it is difficult to see the benefit in the company’s performance.

Assuming Signal Sciences’ gross margins are around 80%, Fastly’s gross margins are now in the low 40s, which is extremely poor, regardless of any utilization or duplication issues. Longer-term Fastly believe that once the network upgrade and utilization issues are behind them, they can return gross margins to the high 50s, with potential upside as security and Compute@Edge grow in importance. Cloudflare has stated that their Workers service is margin-accretive, even with 78% gross margins.

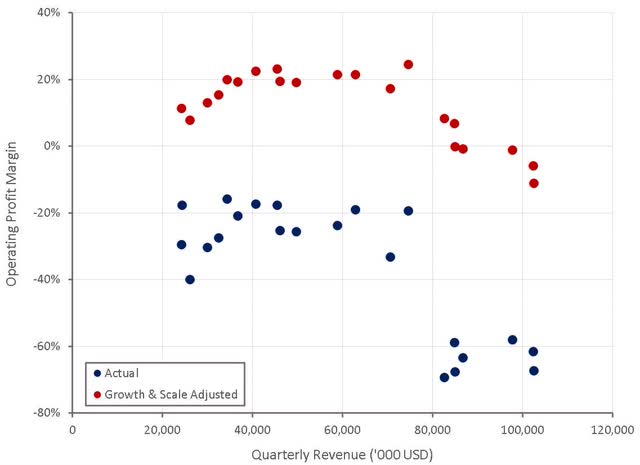

Figure 6: Fastly Profit Margins (source: Created by author using data from Fastly)

Fastly’s operating margins are also poor and have so far shown no tendency to improve as the business scales. This appears to be in large part due employee compensation expenses, with SBC sitting at around 35-40% of revenue. Given the dismal performance of the business, this is inexcusable. At a strategic, product development and sales level, Fastly is underperforming.

Fastly has now put in place additional cost controls and as a result, operating expenses are expected to decline in the second half. Combined with continued revenue growth and an improvement in gross margins, this should lead to a significant bottom line improvement in the second half.

Figure 7: Fastly Operating Profit Margins (source: Created by author using data from Fastly)

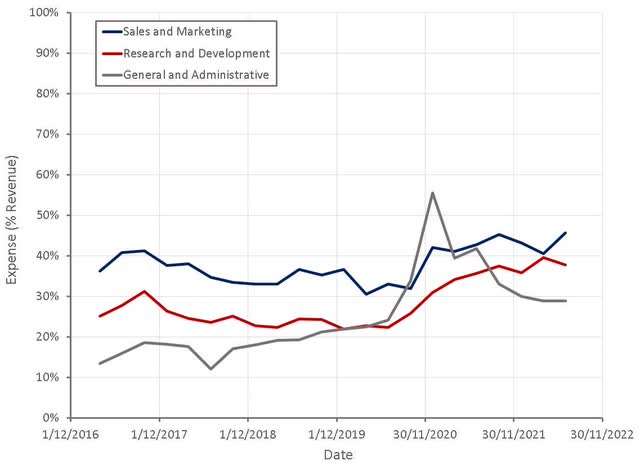

Fastly continues to invest in their sales organization and are bringing in executives with relevant enterprise experience. Fastly has historically not been a partner or channel-based organization, but this is changing. Security products have traditionally been sold through channel partners and the acquisition of Signal Sciences strengthened Fastly’s capabilities in this area. Fastly plans on leveraging these capabilities to sell delivery, security, and compute.

Figure 8: Fastly Operating Expenses (source: Created by author using data from Fastly)

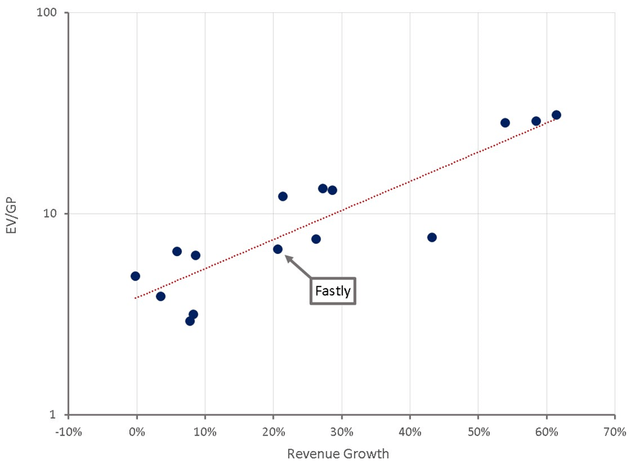

Valuation

While Fastly’s stock now appears relatively inexpensive given the size of the opportunity ahead of it, but this is a reflection of the company’s inability to execute. Based on a discounted cash flow analysis, I estimate that Fastly is worth approximately 16 USD per share. With the current macro environment, Fastly will need to achieve significant improvements in profitability before the stock moves higher.

Figure 9: Fastly Relative Valuation (source: Created by author using data from Yahoo Finance)

Conclusion

How much of Fastly’s problems stem from offering a product with niche appeal versus a go-to-market problem is unclear. The company is trying to address these issues through acquisitions, increased velocity of product development and investments in the sales organization. Fastly is relatively inexpensive given the size of the opportunity ahead of it, but so far, the company has given no indication it can live up to its potential, and the gap between Fastly and Cloudflare appears to be becoming insurmountable.

Be the first to comment