Justin Sullivan

Introduction

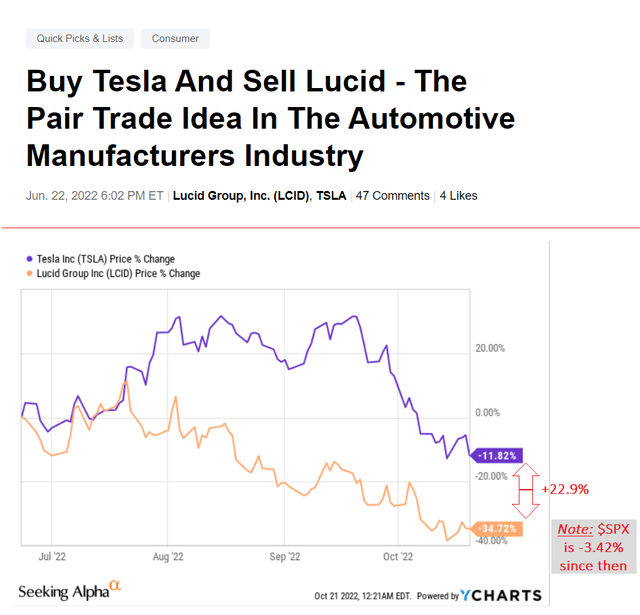

In late June 2022, I posted a pair trade idea in which I recommended buying Tesla, Inc. (NASDAQ:TSLA) and selling Lucid Group, Inc. (LCID) stock short (in equal dollar amounts). My pitch was simple enough. Both companies look overvalued in terms of absolute multiples. Still, due to more efficient operational growth, Tesla should have experienced a much less noticeable multiple contraction than Lucid while receiving much more support from retail investors.

A few months have passed since then. The S&P 500 (SPX) fell even lower, dragging the rest of the market with it, including the companies mentioned above. But my thesis was justified – the difference in the magnitude of the declines in TSLA and LCID would bring a potential investor +22.9% (gross, before deducting brokerage commissions for shorting LCID):

Seeking Alpha, Ycharts, author’s notes

At the time, I recommended holding this deal until the end of the year. However, in my article today, I want to look at the recent banks’ equity research reports on Tesla’s financial results. Let us take a look at them and try to assess how logical their forecasts and conclusions are and whether they should be trusted.

Bank of America – 3Q results look pretty good to us – first take [October 19]

Analysts John Murphy, CFA, John P. Babcock, and Federico Merendi reiterated a Neutral rating on Tesla with a price objective (PO) of $325 per share – that’s 3.17% higher than their previous PO of $315.

Moreover, BofA said much the same thing as I did when I put forward my thesis in June – TSLA’s self-funding status is a notable advantage over some startup competitors in the electric car space, but because its valuation is the result of optimistic projections for a long future (recall the 50% growth target), it will be quite difficult for the quotes to grow strongly in the near future.

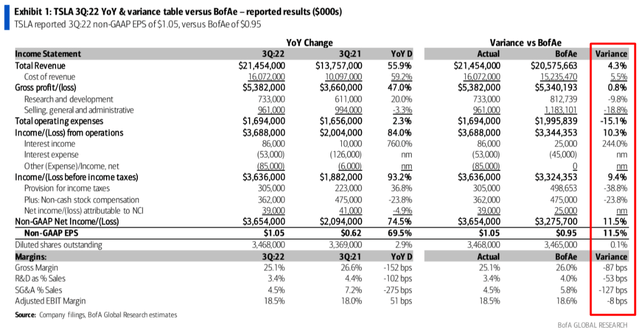

However, why did the bank raise its TSLA price target anyway? The issue is how the actual results differed from what analysts had expected from the company:

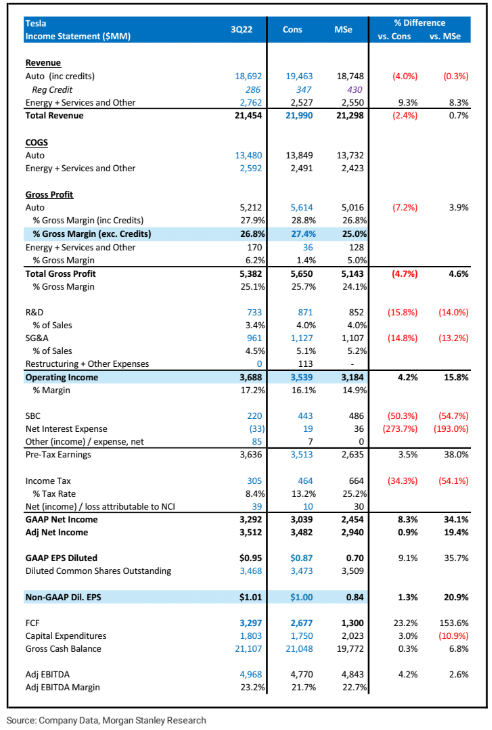

I can understand why the analysts were wrong in forecasting gross profit – the variance seems negligible. But to be wrong on operating expenses (OPEX) by 15% and on taxes by 38.8%? If Tesla really is not just faking its books – we will get into that later – but is working as we see in the statements, then the company’s operating efficiency makes one sit up and take notice because even top analysts could not imagine how Elon Musk could save so much on OPEX this quarter.

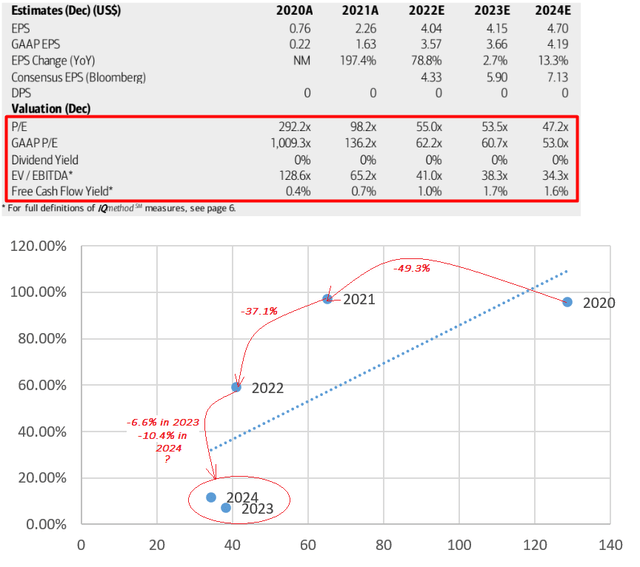

BofA values the company using EV/Sales and EV/EBITDA multiples, but $325/share is too optimistic a target in my opinion. Let us look at their logic. BofA analysts expect EV/EBITDA to be 41x in 2022, down 37.1% from 2021. At the same time, EBITDA growth will be 59.2% in 2022. This is such a sharp decline in the multiple against the backdrop of such a high growth rate in the underlying financial metric. In 2023, however, EBITDA is expected to grow by only 7% – many times less than in the previous year. However, the analysts’ forecast includes a much less modest contraction of 6.6% in 2023, which is not in line with the trend of recent years:

BofA, TSLA report, with author’s calculations and notes

In my view, the EV/EBITDA multiple in 2023 should be at least 30x, if not lower, if the multiple contraction continues – and it should, given lower growth forecasts and a generally higher interest rate environment – implying a 27% reduction in the multiple from 2022 to 2023. At EBITDA of $19.916 billion in 2023 (BofA’s estimate), enterprise value should be about $600 billion – that’s 5.5% below the current one.

Morgan Stanley – 3Q Margins Beat, But FY23 Outlook Still at Risk [October 19]

Analysts Adam Jonas, CFA, Evan Silverberg, CFA, CPA, et al. released an update of their Overweight rating, having $350 per share as a new price objective – below its pre-split target of $1300 (about $433 per share).

Morgan Stanley, like BofA, was wrong about growth in OPEX, interest expense, and stock-based compensation. The company’s lower-than-expected CAPEX coupled with stronger EPS growth resulted in a 153.6% undervaluation of FCF:

MS, TSLA report, October 19

The key takeaways from their analysis of TSLA’s report:

- expected cost inflation related to logistics/shipping as well as adverse timing differences related to supplier payments given significant input cost inflation on the battery and non-battery side. That didn’t happen;

- If one were to inflation adjust the YoY moves in CAPEX and OPEX, Tesla’s clearly doing more with less;

- Supercharging revenue will most likely get above 10% of Tesla’s total revenue within the next 12 to 18 months;

- Production is ramping up at the 40-GWh Megapack factory in California – a solid win for the company, demonstrating its strength and focus on the battery front.

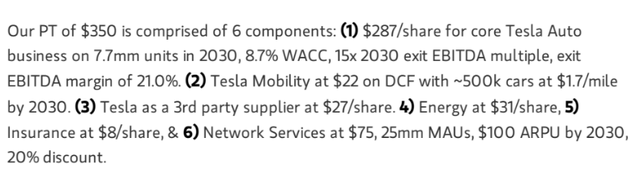

Okay, but why did analysts lower their TSLA price target? Here you have to look at the input data for their SOTP 6-component model:

Our PT of $433 is comprised of 6 components: (1) $203/share for core Tesla Auto business on 8.6mm units in 2030, 8.5% WACC, 15x 2030 exit EBITDA multiple, exit EBITDA margin of 20%. (2) Tesla Mobility at $25 on DCF with ~500k cars at $1.7/mile by 2030. (3) Tesla as a 3rd party supplier at $44/share. 4) Energy at $37/share, 5) Insurance at $12/share, & 6) Network Services at $113, 25mm MAUs, $100 ARPU by 2030, 20% discount.

Source: Investing.com, author’s adjustment for the split (3:1)

| Segment / Date |

Jun 16, 2022 (rounded) |

Now | Change |

| Core Tesla Auto business | $203 | $287 | |

| Tesla Mobility | $25 | $22 | 1.4% |

| 3rd party supplier | $44 | $27 | -38.2% |

| Energy | $37 | $31 | -16.2% |

| Insurance | $12 | $8 | -35.1% |

| Network Services | $113 | $75 | -33.4% |

| Sum Of The Parts | $433 | $450 | 4.6% |

Source: Author’s compilation

If you add up all the parts of the analysts’ outputs, it shows that their SOTP model does indeed show a price target of $453 per share – I suspect that the Morgan Stanley analysts mistyped their report and wrote $287 instead of $187 because the difference is exactly $100 while the WACC is higher and the sales volume is lower than before. Here’s how the above table should most likely look like:

| Segment / Date | Jun 16, 2022 (rounded) | Now | Change |

| Core Tesla Auto business | $203 | $187 | -7.7% |

| Tesla Mobility | $25 | $22 | 1.4% |

| 3rd party supplier | $45 | $27 | -38.2% |

| Energy | $37 | $31 | -16.2% |

| Insurance | $12 | $8 | -35.1% |

| Network Services | $113 | $75 | -33.4% |

| Sum Of The Parts | $433 | $350 | -18.5% |

Source: Author’s compilation

If you look at how the analysts’ assumptions have changed, we see only 3 concrete changes here: 1) the number of vehicles produced in 2030 is now reduced by 0.9 million units (-10.5%); 2) the WACC is increased by 0.2% (8.7% vs. 8.5%); and 3) the exit EBITDA margin is increased from 20% to 21%. This applies directly to the main revenue stream (Core Tesla Auto business) – the assumptions for the other parts are not disclosed (I assume the WACC has been applied to them as well, considering that Tesla Mobility’s DCF has decreased by 12.5% without any visible adjustments in inputs).

That is, broadly speaking, the entire decline in the target price (the top rightmost column above) is due to A) a slight slowdown in operations, and B) a slight 0.2% increase in WACC. At the same time, a new, more positive improvement in business margins has by no means kept the target price for TSLA from correcting. In my opinion, the WACC was not raised high enough by analysts and should have been raised by more than 1% instead of 0.2%. Why do I think so?

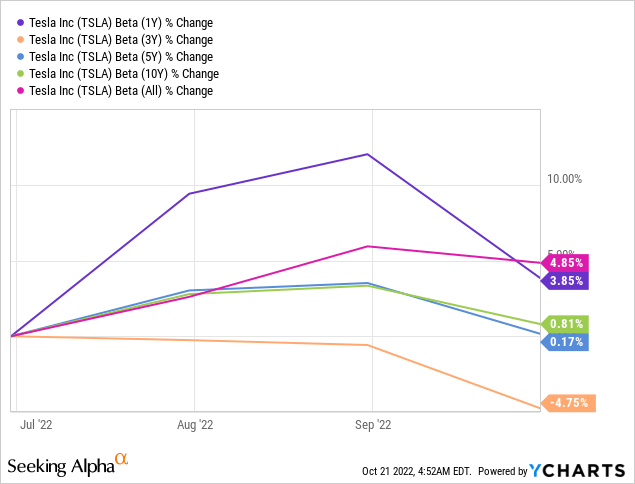

First, the analysts had to account for higher betas, that mostly increased since their previous call (June 16, 2022):

Higher beta – higher WACC. Of course, it is possible that they took a 3-year coefficient, but then it would be cherry-picking. It is unlikely that the Morgan Stanley analysts did this (I really hope so).

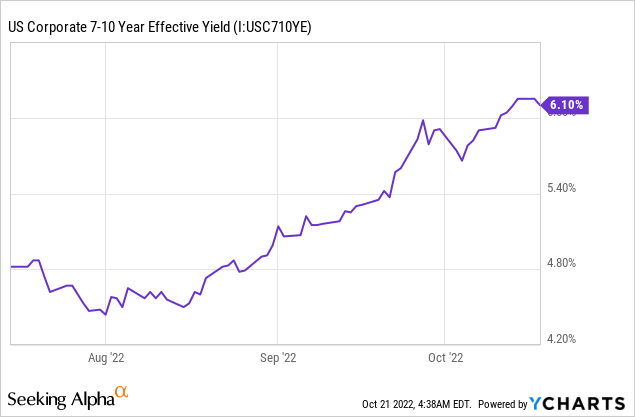

The second is the rising risk-free rate, which mostly corresponds to 10-year Treasuries yield, which (theoretically) have no credit risk. The rate has risen since June 15, 2022, from 3.292% to 4.274% at the time of writing. Effective 7-10 year yields on corporate bonds have jumped even higher since then:

The third point that analysts may not have taken into account in their WACC calculation is the slowdown in economic growth in China and globally, which should have been reflected in the discount rate in the form of an additional premium. Since mid-June 2022, the geopolitical situation in the world has only gotten worse (in my opinion), and the forecast for global economic growth was just recently lowered by the IMF. Therefore, this premium should have been larger, if it was included in their calculations at all.

If a minor 0.2% increase in WACC has led to such severe corrections in price targets for the company’s various businesses, imagine how long the analysts’ model should run – apparently they predict all segments to 2030, using huge growth rates in their models. Even a slight deviation from these rates will cause the model to collapse. In my opinion, this is a serious risk for those who want to rely on the DCF calculations of Morgan Stanley’s analysts.

JPMorgan – Trim Estimates and Price Target After Softer Trend in 3Q Volume & Pricing [October 20]

Analysts Ryan Brinkman, Rajat Gupta, CFA, Manasvi Garg, et al. stick to an oppositional opinion concerning the other two banks above. They are Underweight Tesla with a price target of $150/share, revised down from $153/share, having the following reasoning:

We are lowering our estimates and price target after Tesla reported modestly softer than expected 3Q22 results Wednesday after the close, featuring lower-than-consensus margin on lower-than-expected revenue. Average transaction prices rose strongly y/y, but to a level that was lower than expected, driving a -3% revenue miss given that deliveries were previously disclosed. The results will likely add to debates about demand destruction that ensued after 3Q deliveries tracked -5% below company-compiled consensus. Management itself reined in near-term growth expectations, now looking for just less than its original target of more than +50% unit growth this year vs. previous indication only that the target would be more difficult to achieve. We continue to see risk to guidance for +50% annual unit volume growth over time (in some years more, in some years less), including given higher prices, higher interest rates, an increasingly tapped-out consumer, and given the paucity of new model introductions, with Tesla’s lineup essentially the same as at the start of 2021 after the last Model S & X refresh, with the Cybertruck (originally slated for 2021) still on tap. Automotive gross margin of 26.8% missed Bloomberg consensus of 27.7%, with management citing persistent inflationary pressures, including higher logistics costs. We remain cautious on valuation, particularly in the context of lofty unit volume growth expectations, and continue to see material downside risk to our December 2023 price target, which declines today to $150 from $153, on account of unchanged target multiples applied to our slightly lower estimates, which decline primarily on flow-through of 3Q’s softer-than-expected trend in demand expressed in the form of lower transaction prices.

Source: JPMorgan’s TSLA report, October 20

Their price target methodology is less sophisticated than Morgan Stanley’s one (and more reasonable, in my opinion, than that of BofA) and is predicated upon a 50/50 blend of DCF and 2025E-based multiples analysis (itself a blend of P/E, EV/EBITDA, and price-to-sales).

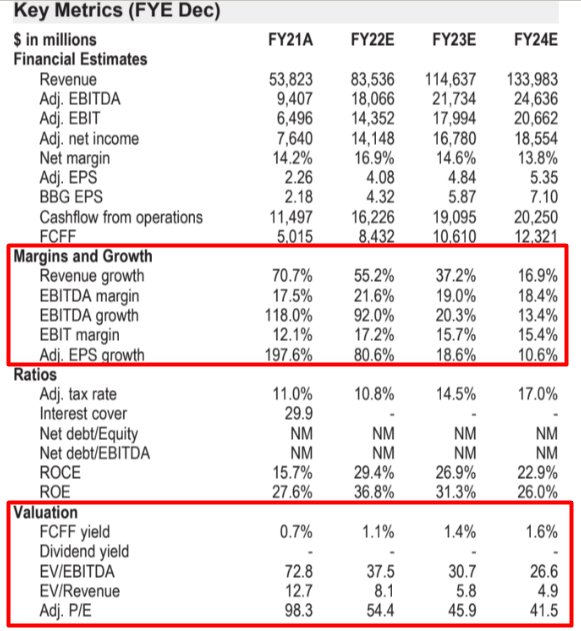

And if you take a look at JPM’s Key Figures table, theirs seem much more realistic – at least the analysts take into account a more reasonable multiple and margin contractions as Tesla expands its business and matures:

JPMorgan, TSLA report, October 20

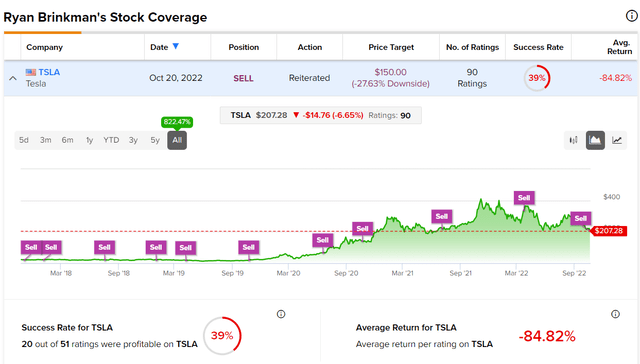

They propose to focus on equal weighting of 3 coefficients to find fair value (50% of the model) and DCF calculations for the remaining half. If they had focused solely on DCF, they would have received $129 per share on exit – and against a backdrop of rapidly growing FCF. However, FCF-based valuation has shown in practice how indifferent the market is to it concerning Tesla – just take a look at the stock rating history from Ryan Brinkman, the lead author of the above JPM report:

TipRanks, Ryan Brinkman, October 21

I am not saying Ryan is wrong this time either – “past performance is no guarantee of future performance” applies in reverse as well, let us not forget that. However, I am skeptical about FCF as a driver for determining Tesla’s intrinsic value – it is much more correct to look at multiples and their compression over time. The current state of the company’s valuation is more in line with JPMorgan than BofA or MS – given the increasing risks of Tesla losing its 50% growth rate in 2023 and 2024, I think we are in for a bumpy ride, and the only opportunity for buy-and-hold investors, if you consider yourself one, is to hedge.

GLJ Research – the numbers TSLA reports are LIKELY NOT REAL [October 20]

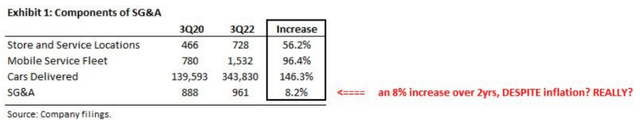

One risk that has long been talked about and is unlikely to be taken seriously by experts is the possibility of falsified reporting. More and more people keep doubting that Tesla can grow such volumes based on sub-ten percent OPEX and CAPEX growth (you may have noticed that this was one of Morgan Stanley’s bullish arguments).

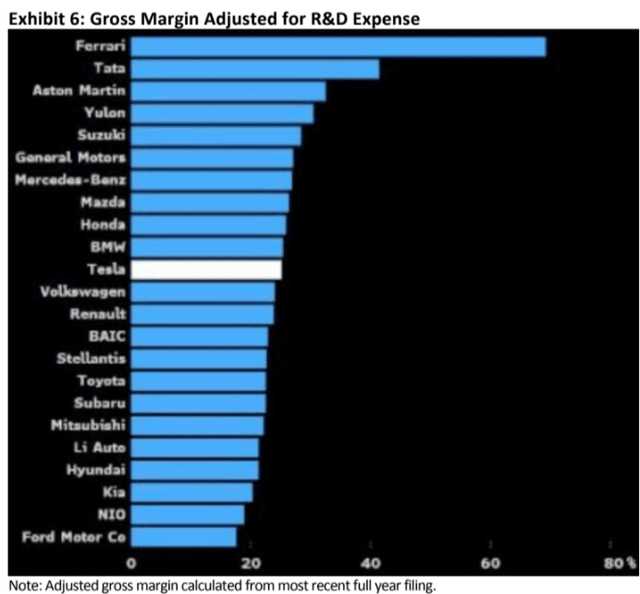

Gordon Johnson from GLJ Research – ranked by Bloomberg among the top stock pickers in the steel, iron ore, graphite electrode, electric vehicle, and solar spaces since initiating coverage in 2008 – writes, that with 2 of its 4 plants operating at just ~10% capacity, TSLA’s gross margins expansion from 25.0% to 26.61% (per Bloomberg) is not possible.

In short, we believe the numbers TSLA reports are largely “fiction,” resulting from aggressive accounting applied via the Shanghai plant, among other “tricks” used. And, given modeling numbers that are “fiction” is impossible, this time (i.e., for 3Q22), we aren’t going to even try (we see LARGE incentive for E. Musk to be as aggressive as possible, from an accounting perspective, given he has ~$15B-$20B worth of shares still left to sell to close the Twitter buyout… by our calculation). That is, using one example of TSLA’s many accounting shenanigans, while pretty much every other automaker includes R&D in the gross profit they report, TSLA pushes this metric below the gross profit line, allowing it to claim industry leading margins; yet, when adjusting R&D out of COGS for TSLA, TSLA’s margins rank 11th among global automakers according to Bloomberg.

Source: Gordon Johnson from GLJ Research

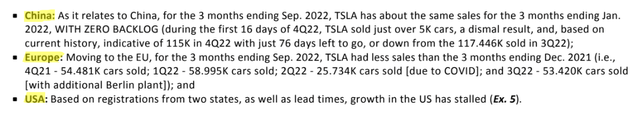

Mr. Johnson warns us – demand today is quite meager on all fronts, as evidenced by the company’s own preliminary statistics and official government sources:

GLJ Research’s analysts give 5 reasons to believe TSLA is artificially boosting its revenue numbers:

- Revenues up 56% (YoY) amid expenses up only 2% (YoY);

- CAPEX is flat (YoY) when construction of Berlin and Austin is done, which seems impossible. TSLA may be capitalizing more expenses than it should on the balance sheet, thus possibly overstating margins;

- TSLA’s SG&A is still running at $1B/qtr, roughly the same as two years ago, despite selling 2x as many cars;

- Gross margins staying up with 2 new factories open, making just a fraction of their vehicle capacity;

- Inventory is up 98% (YoY) while sales up 56%. Inventory should keep pace with sales, not outpace it – unless you capitalize raw materials for inventory which you can’t move and don’t impair so as not to take a profit hit.

All this looks strange, but it looks even stranger that no one can clearly refute these arguments that support TSLA’s balance sheet fraud. If you can – I am really interested, please share your take in the comments.

Bottom Line

In this article, I took a closer look at the banks’ recent analysis and reaction to Tesla’s latest quarterly report. After reading and analyzing everything I had on hands, and also examining the banks’ methods of calculating their price targets, I conclude that JPM has come closest to the truth with a reasonable estimate of the multiple and margin contractions over the next 5 years.

Yes, JPM’s history of “sell” ratings looks depressing – but what if they are right this time? What if Tesla is actually fudging its books to inflate margins and boost net income above consensus?

The risks to the company are increasing, and while I do not think Tesla is going to repeat Enron’s story, I understand those who think Tesla is an overvalued company. However, it is far from the only company in the market, nor is it the most overvalued. Given the support from retail investors, and assuming that the company’s operational growth continues (if it is a reality), I believe that long-term investors need to hedge against growing risks anyway. Methods can vary – selling puts, pair trading ideas like the one I wrote about earlier, tactical positioning, etc. Waiting and watching as the price is exposed to the consequences of multiple contractions – which are logical today – does not look optimal, in my view.

This time, I rate Tesla stock as Hold.

Be the first to comment