jetcityimage

Investment Thesis

Most investors know Costco Wholesale Corporation (NASDAQ:COST) operates as a membership warehouse and offers, at wholesale prices, just about anything you could want or need. They have an exceptional business model. Costco is unique in that its membership dues account for nearly 80% of its net income. Costco would likely be profitable even if it sold merchandise at cost. I don’t know many businesses that could make that statement. In fiscal 2021, Costco’s membership fees totaled $3.9 billion, all of which rolled to the bottom line.

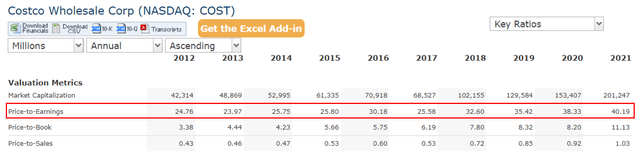

In recent years and likely exacerbated by Covid-19, the market has taken notice of Costco’s unique operating model and has placed a premium on shares. Since 2018, Costco’s P/E has consistently ranged above 30 and often times above 40. As of this writing, Costco’s P/E is 43. However, from 2012 to 2017, Costco’s P/E typically ranged in the mid to upper 20s. What has changed in the business to warrant such a jump?

COST Historical P/E (Quickfs.com)

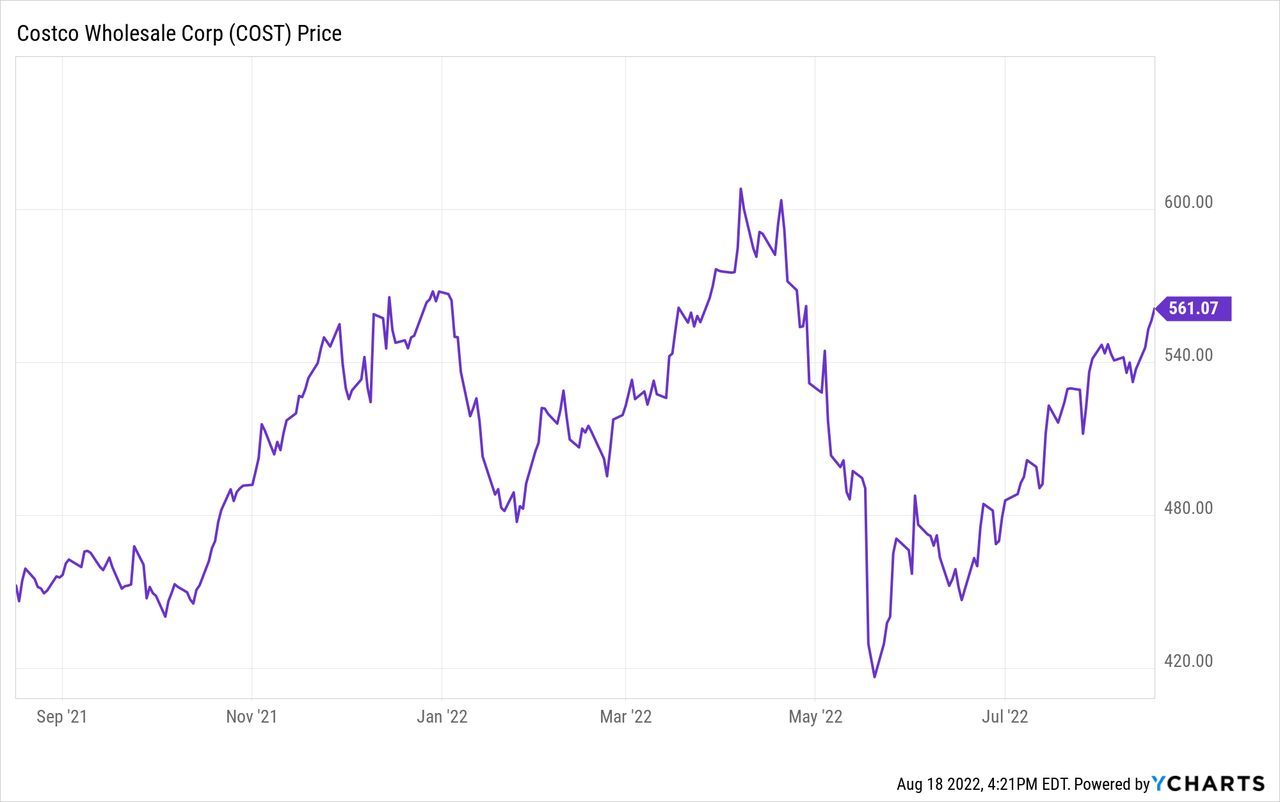

As a value-oriented investor, I simply cannot rationalize Costco’s valuation from a P/E or DCF perspective. I also have a hard time rationalizing additional multiple expansion. How much higher could it get? Is a short squeeze going to push the P/E to 80? I’m not counting on it. To me, multiple compression is a greater probability than multiple expansion. As a result, I think investors are better off putting their money elsewhere or holding off on taking up a new position. I’d be interested at less than $500, but at $560, no thanks.

A Snap Of The Fingers

Costco could increase its earnings by $325 to $650 million annually with a simple snap of the fingers. They could accomplish this by raising annual membership fees by $5 to $10 per year per household. Currently, Costco has 64.4 million household members, so increasing by $5 nets $325 million and increasing by $10 nets $650 million. That’s a bit insane if you think about it. Costco leadership could wake up tomorrow and say, “Sure, let’s add another half a billion to the income statement.” If that’s not earnings power, I don’t know what is.

In the past, Costco has raised its annual membership fees about every 5 years or so, the last of which occurred in June 2017. So, Costco is just beyond 5 years since their last increase and management has hinted at another potential hike. During their Q3 2022 earnings call, Bob Nelson, senior vice president of treasury, planning and investor relations, had this to say:

Historically, we’ve raised fees every five to six years with the last three increases coming on average about the 5.5-year time frame,

And that …

there would be more discussions.

Personally, I don’t think Costco members would bat an eye at a $5 to $10 increase. In fact, they’re probably wondering why they haven’t done it already or why they don’t increase fees more frequently. Realistically, a member is going to save well over $5 to $10 in a single grocery trip by shopping at Costco. Did I mention Costco also sells fuel at wholesale-like prices? The return on investment is a no-brainer for members.

But Is It Worth The Premium?

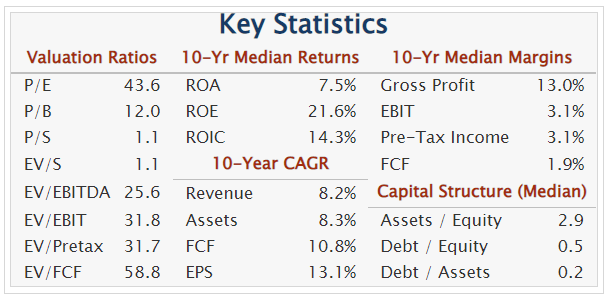

Yes, I believe a premium is warranted due to earnings and staying power, but how much of a premium is the question. Over the past 10 years, Costco has grown EPS at a respectable 13.1%. If you’re in the camp that believes a stock should trade at double its earnings growth, then that puts Costco’s target P/E at 26. And that’s being generous because the 33 Analysts covering Costco are only calling for 9% EPS growth in 2023, so a realistic P/E may be closer to 20.

COST Financial History (Quickfs.com)

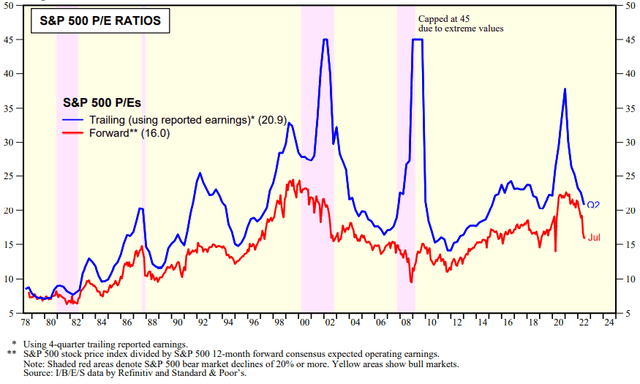

Personally, I could justify a P/E in the low 30s. That’d be about a 60% premium to the S&P 500 which seems reasonable given the phenomenal economics. But at a P/E of 43, I just can’t rationalize it, no matter how bad I want to.

S&P 500 P/E Ratio (Yardeni Research)

Then What’s A Fair Value?

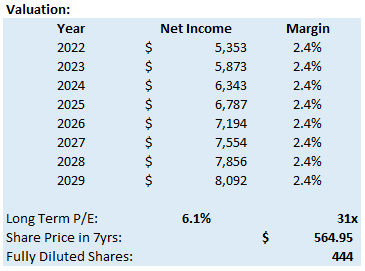

Using the market multiple approach (P/E), I arrive at a 2029 fair value of $565 for Costco, which coincidentally, is only slightly above today’s price of $560. For the valuation, I included dividends, assumed a 5.8% revenue CAGR, net margins of 2.4% (5YR average), no dilution in shares outstanding, and a long-term P/E of 31.

Market multiple valuation (Author’s personal data)

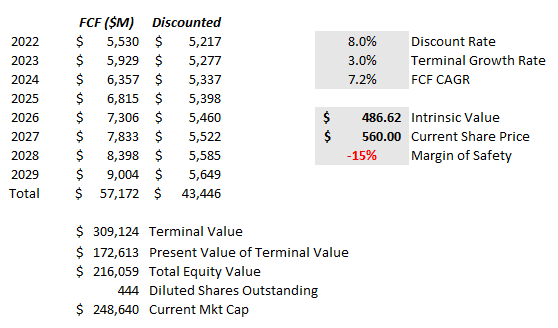

Using the DCF approach, I arrive at an intrinsic value of $487 for Costco. I used an 8% discount rate and 3% terminal growth rate. I assumed a 7.2% FCF CAGR, slightly below the 10YR average of 10%, and no dilution in shares outstanding. From a DCF perspective, Costco appears to be 15% overvalued at current prices.

DCF valuation (Author’s personal data)

Both valuations result in the same conclusion, Costco is just too expensive at $560 per share and leaves little meat on the bone for investors, in my opinion.

What Would Change My Mind?

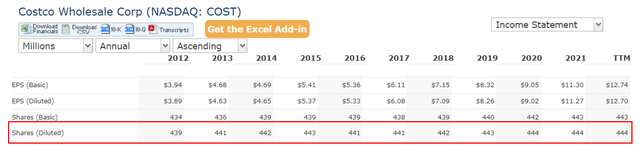

For me, the low hanging fruit I’d love to see Costco weave into their capital allocation strategy is share buybacks. Over the past 10 years, Costco has actually been diluting shareholders, if ever so slightly. Costco has nearly $12 billion in cash & equivalents sitting on the balance sheet and consistently generates over $3 billion in annual FCF. If there’s nowhere else to invest it, why not invest in their own stock?

If Costco invested $3 billion in share buybacks each year, that’d put an additional 7% in shareholders pockets on top of the organic EPS growth. I’d love to see Costco lean into share buybacks like Apple (AAPL), Walmart (WMT), or Lowe’s (LOW). This would make Costco much more enticing for me.

COST Shares Outstanding (Quickfs.com)

Conclusion

Costco is a phenomenal company, no doubt about it, but I simply cannot rationalize its current valuation given my value-oriented approach. In my opinion, EPS growth isn’t large enough to warrant a P/E of 43 and I cannot rationalize taking up a position based on a share buyback program that doesn’t exist. At current levels, multiple compression is a real risk and likely a higher probability than multiple expansion. At $560, I think investors are better off sitting on the sidelines of Costco. If you hold a position, you may consider taking some profits or closing altogether. Perhaps a pullback is in the cards where you’ll have a chance to repurchase shares at less than $500.

Be the first to comment