FG Trade/E+ via Getty Images

Novavax (NASDAQ:NVAX) stock is highly volatile. The stock traded at $4 a share in January 2020, and $330 a share in February 2021. That is a volatile stock! Novavax is a COVID fighter, a vaccine biotech with one of the few COVID vaccines on the market.

Right now, the stock trades for about $20 a share, so we’re approaching maximum negativity on this company (i.e., a bottom). I’m very bullish on Novavax, and I believe this company is worth a lot more than the market says it is. Here’s why I own shares in this company.

The market opportunity for Covid vaccinations remains huge

If you look at a chart of Novavax, it looks like Mount Everest. The stock soared 3,000% in 2020 because of optimism about the company’s COVID-19 vaccination program. The high point was reached in February 2021, in the days after the company reported amazing data from its phase 3 trial. What crashed the stock? Manufacturing delays. The biotech upstart was having issues with its contract manufacturers, and could not get its purity issues resolved in time for the first wave of COVID vaccinations.

So Moderna (MRNA) and Pfizer (PFE) won the vaccine race, while Novavax was late to market. By the time the little biotech finally received its emergency use authorization (EUA) from the FDA this year, just about anybody who wanted to be vaccinated was already vaccinated. This limited demand for Novavax’s vaccine when it first hit the market.

That’s about to change, however. The FDA just gave an EUA for Novavax’s jab as a booster shot. And it’s getting similar authorizations around the globe. So while Novavax missed the first wave of vaccination, it can now compete for the follow-up shots. Almost 5 billion people have been vaccinated for COVID-19. And none of these shots is one-and-done. COVID-19 is a mutating disease, and many people are going to vaccinate again and again.

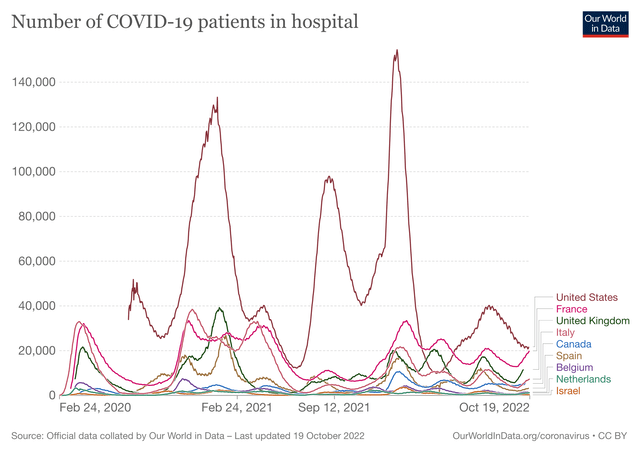

Novavax’s vaccine was reported to be 100% effective in preventing moderate-to-severe disease. COVID hospitalizations tend to spike in winter, so it’s likely we’ll see an uptick in demand during the cold months.

The price is right

The market for Novavax shares is a fire sale right now. The biotech is sitting on $1.4 billion in cash, and its market cap is $1.4 billion. Novavax’s price-to-sales ratio is 1, and its forward price-to-sales ratio is 0.70. A lot of bad news has already been priced in.

This cheap price reminds me of Novavax’s dark days in 2019. At the time, Novavax was fighting off a possible bankruptcy. The company had no drugs on the market, and it had to do a 20-for-1 reverse split just to keep its shares trading on the Nasdaq. The only bright spot was the company’s flu vaccine, NanoFlu, that was beating the various Sanofi (SNY) vaccines in head-to-head trials. Investors who bought in the face of all that negativity made out like bandits. (I know because I was one of them).

So far it’s been a bad year for the stock in 2022, and the price has fallen, and fallen, and fallen some more. In its Q2 conference call, Novavax management reported just $186 million in revenues, a dramatic shortfall in expectations. So that crashed the stock. But CEO Stan Erck also announced $400 million in revenue in the first month of Q3. And the company projects at least $2 billion in revenue for the whole year.

For a tiny small-cap, that’s a remarkable amount of sales. Novavax’s COVID vaccine is already a blockbuster drug, and all the pre-orders have already put $1 billion plus in the bank account. If and when the market starts giving a reasonable P/S ratio to this stock – say the 2.5 ratio that Moderna enjoys – this biotech would have a market cap around $5 billion, more than three times where the stock is today.

What about profitability? Novavax saw profits in Q1, when it reported $700 million in revenues and $200 million in earnings. It’s still early days, and the company doesn’t give quarterly estimates or earnings estimates. Right now, revenues are lumpy and unpredictable, and can dramatically shift from quarter to quarter.

Novavax burned about $700 million over the last year, as its bank account went from almost $2.1 billion to $1.4 billion. Much of that was due to its manufacturing build-out, as Novavax invested in its own facility so that it could produce its vaccine in-house. That investment addresses the company’s greatest vulnerability. While the burn rate is high, it will shrink dramatically over time. (In Q1, the company’s first positive quarter, it had no burn rate).

Management missed on expectations

Part of the reason Mr. Market refuses to give Novavax a fair multiple is that the company whiffed so badly on expectations in 2022. In its Q4 conference call, CEO Stan Erck forecasted $4 billion to $5 billion in revenues this year. Six months later, the biotech had to cut those estimates in half.

What happened? Novavax has multiple supply agreements in place around the world. Many countries had pre-ordered hundreds of millions of vaccine doses. But the actual demand has been wildly unpredictable. The customers are whole nations. So if one customer delays an order – as the U.S. has done – revenues for the quarter will dramatically miss. (That’s what happened in Q2).

Similarly, revenues can dramatically spike higher when a country orders a large number of booster shots. That’s likely why Novavax’s sales spiked a lot higher in the first month of Q3.

Ultimately, the market for COVID vaccinations will shrink. Large numbers of people will never vaccinate. Others will vaccinate once and hope for the best. But a sizable number of people will vaccinate on an annual basis. Moderna CEO Stephane Bancel estimates that the annual market opportunity for COVID vaccinations in the private market will be about $13 billion, just in the U.S.

Now that Novavax has gotten EUAs for its jab around the world, I expect the company to take a nice share of revenues in the booster arena. While its vaccine has a similar efficacy/safety profile to the mRNA jabs, Novavax has advantages in ease of use. Its shot can be stored at room temperature for nine months. Moderna’s shot has to be kept frozen. Once it’s thawed out, you have 30 days to use it.

Novavax leads in the race for a COVID/flu combo shot

Right now, only two biotech companies, Novavax and Moderna, are pursuing a COVID/flu combination vaccine. It makes a lot of sense as both viruses mutate, and both viruses appear to be seasonal (i.e., worse in winter). Of course, medical authorities still believe that COVID is the more dangerous of the two diseases. And while COVID hospitalizations seem to peak in the cold months, it’s possible that new dangerous variants could appear around the year.

While Moderna’s mRNA technology gives it a speed advantage in finding new molecules, the company lags Novavax on the flu side. Thus, the smaller biotech was able to beat its larger competitor in getting a combo shot into clinical trials.

Novavax just reported positive phase 1/2 data, and the company plans for a confirmation phase 2 trial to start in a couple of months. Moderna has finished enrolling its first human trial for a combo shot.

Now is a great time to open a position

While the market is highly negative on Novavax stock right now, I see a lot of positives. Novavax’s stock is very cheap relative to its strong cash position. The market values Novavax as essentially worthless as a drug company, since its market cap and its cash balance are the same number.

This negativity overlooks the fact that Novavax has a blockbuster drug on the market, one that’s already brought in over $1 billion in revenues (and put all that cash in the bank). While I hope that COVID-19 disappears into nothing, in reality, I suspect that we will be vaccinating against this threat for years to come.

Novavax’s future revenues will be higher than they are today, with money coming in from COVID boosters, the flu vaccine, and then the COVID/flu combo shot. Over time, this will emerge as a highly profitable vaccine biotech.

Be the first to comment