sx70/iStock Editorial via Getty Images

Investment Thesis

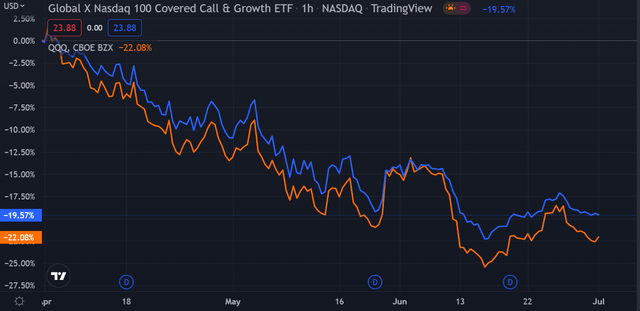

In my last article on the Global X Nasdaq 100 Covered Call & Growth ETF (NASDAQ:QYLG), I pointed out that inflation was a real threat for high-multiple stocks. Since then, QYLG has lost ~20% vs. a loss of ~22% for the Nasdaq 100 and slightly outperformed the benchmark thanks to its covered call strategy.

Despite the recent sell-off, investors should expect further downside pressure in major US equity indices and shouldn’t be tricked by the occasional bear market rallies. The economic data paints a bleak picture of the reality in which many companies will find themselves in the second half of the year. I see two factors that will lead to lower equity prices. The first one consists of downward margin revisions to reflect higher input costs for businesses. The second one is related to lower earnings estimates adjusting to the increased odds of a recession. As a result, I believe we’re nowhere near a bottom at the moment, although we will have short-term lived rallies in-between when sentiment gets extremely negative.

What Has Happened Since My Last Article

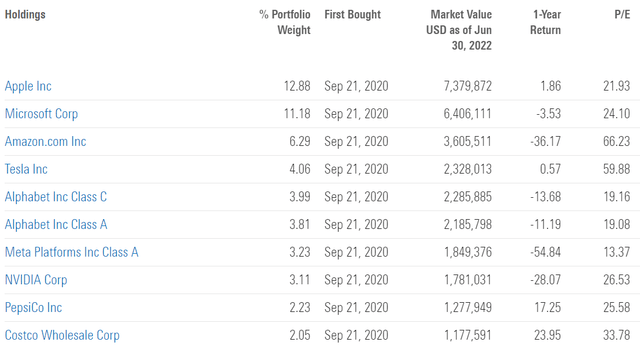

QYLG implements a covered call strategy, where the Fund acquires Nasdaq-100 Index stocks and sells call options on roughly half of the portfolio. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

I concluded my previous article with the following statement:

That said, there are a number of red flags in the macro outlook that would make me think twice before buying QYLG. Valuations are still high despite excellent corporate earnings and record-high margins. I personally believe that inflation is likely to negatively impact margins going forward and as a result, it will put pressure on profits and ultimately on valuations.

While we haven’t yet seen the impact of inflation on earnings, we have definitely seen the results of an aggressive monetary policy tightening in the markets. Fighting inflation has become the main goal of the Federal Reserve and the recent rate hikes have taken many market analysts by surprise, pushing them to readjust their expectations. I believe July and August 2022 will be decisive for corporate profits as companies start reporting earnings for the second quarter of the year. I expect to see some cracks in the profitability data stemming from inflationary pressures.

QYLG wasn’t spared by the poor performance of the markets. I have compared it to the Invesco QQQ ETF (QQQ) over the last 3 months to assess which one was a better investment. Since my previous article, QYLG lost nearly 20% compared to a loss of ~22% for QQQ.

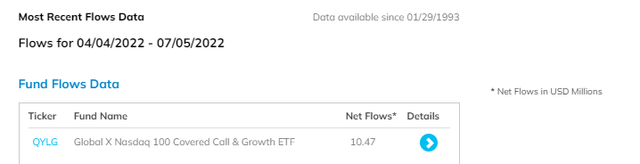

Investors are piling up in this fund with the hope of getting a good deal in light of the recent sell-off. QYLG registered $10.5 million in inflows since early April 2022, which represents nearly 18% of the fund’s latest net assets. This market behavior leads me to believe that investors have not yet transitioned from a buy-the-dip mentality to a risk-off approach, which would be far more appropriate in this volatile market environment.

EPS Revisions Are A Major Risk For Stocks At This Point

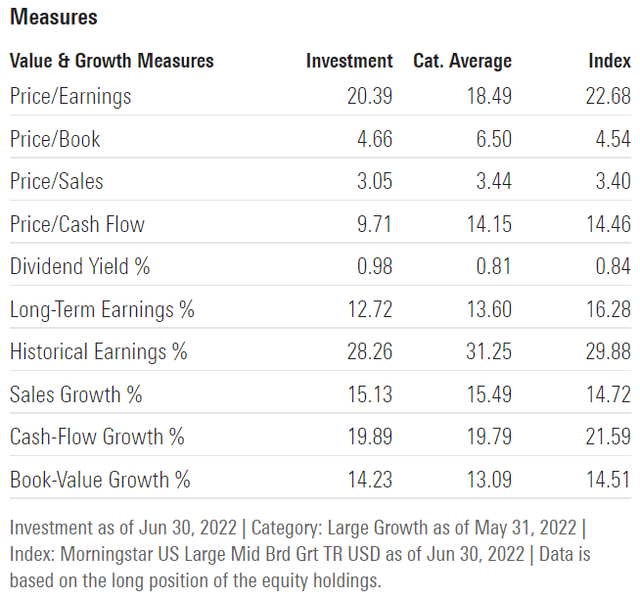

Despite the recent selloff, QYLG continues to trade at over 20x earnings and nearly 5x book value. These multiples are high in the context of elevated inflation and higher rates. The market is expecting companies to deliver another record year both in profits and margins.

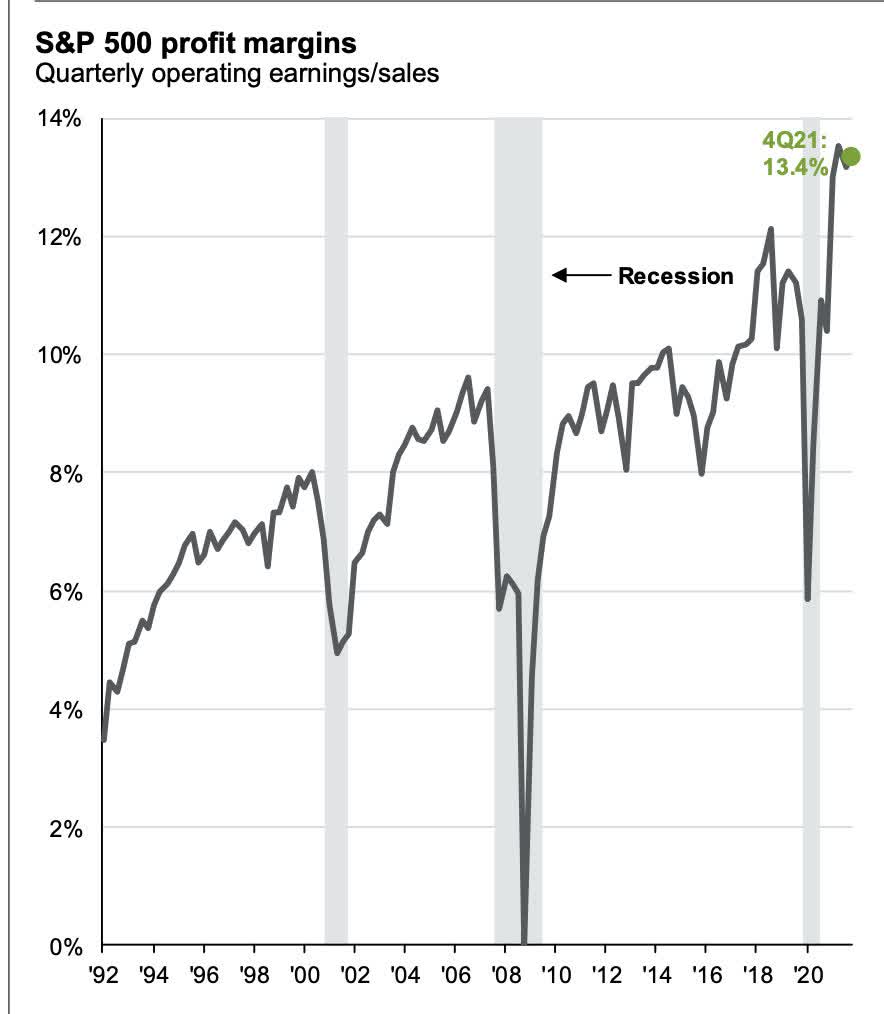

However, I believe that profit margins peaked in Q1 2022. It’s important to note that recent profit margins have been above the average of the last decade and investors should be skeptical of similar results in the near future. 2020 and 2021 were extraordinary years thanks to the amount of fiscal and monetary stimulus but profit margins are mean-reverting. As liquidity is being removed from the system while inflationary pressures continue to lead to higher costs for companies, it wouldn’t surprise me to see downward margin revisions over the next 9 months.

JPMorgan

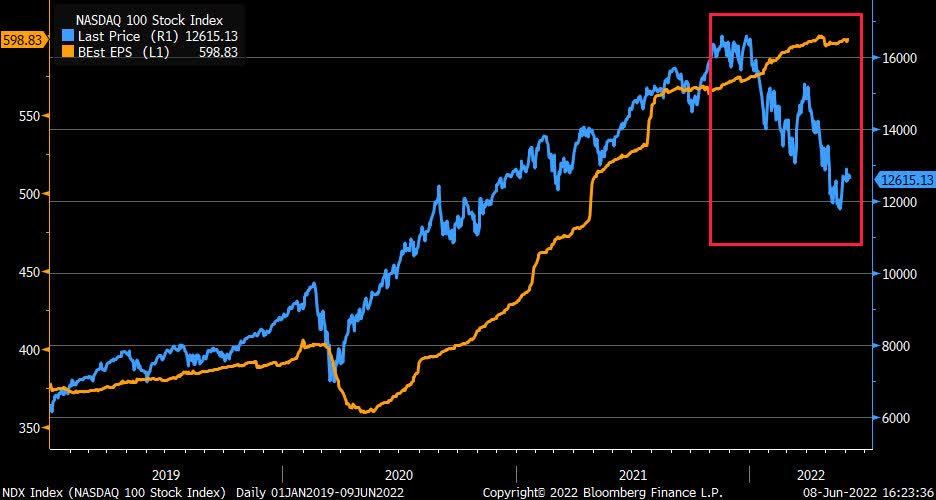

Analysts have been discarding the consequences of inflationary pressures and a potential recession on EPS estimates. With a few exceptions, they have so far failed to readjust estimated earnings and are expecting profit growth to remain unscattered. I have to disagree with this argument since lower profit margins are likely to lead to lower EPS. At the same time, the odds of a recession have increased dramatically over the last couple of months, which is another factor that could negatively impact EPS growth.

Bloomberg

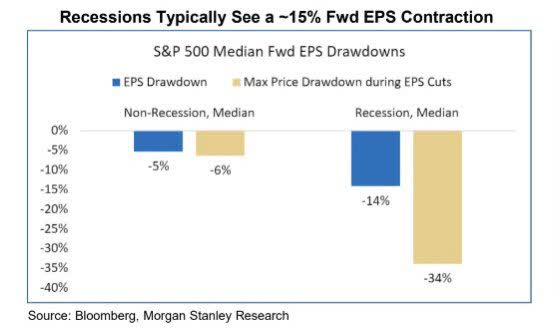

Earnings have always been adjusted downwards during recessions. The median adjustment has been ~15%, representing a more than 20 percentage points difference compared to 2023 forecasts. EPS cuts during recessions have led to a median drawdown of ~34%, which is something investors should keep in mind.

Bloomberg, Morgan Stanley

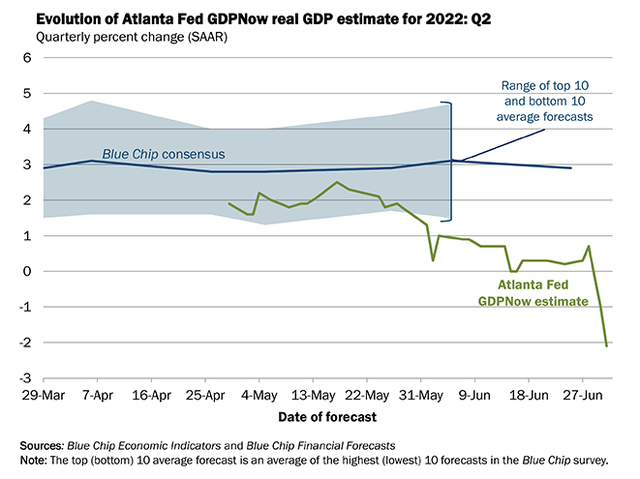

I believe there are many reasons why a recession has become a reasonable outcome. The Atlanta Fed’s most recent GDPNow figures support the recession hypothesis. The main takeaway from the data is that GDP growth expectations have been gradually declining over the last two months, and their model predicts Q2 GDP growth to be close to -2%. If Q2 GDP turns out to be negative, that would mean the US is in a technical recession (two consecutive quarters of negative GDP growth).

Key Takeaways

Investors should expect more downside pressure in major US equity indices and should not be fooled by bear market rallies. The recent economic data confirms that US stocks will continue to face headwinds in the months ahead. Two factors will lead to lower equity prices in the near future. The first consists of downward margin revisions to reflect higher business input costs. The second is related to lower earnings estimates as a result of the increased likelihood of a recession. As a result, I believe we are still far from a bottom, though there will be short-term rallies in between when sentiment becomes extremely negative.

Be the first to comment