cherrybeans

The Safehold short thesis

While Safehold (NYSE:SAFE) is technically profitable with 2Q22 GAAP earnings of $22.7 million, I believe its economic earnings are negative $2.7 million. This makes it overvalued with out-of-control management compensation. The majority of their earnings come in the form of straight line rent which is unrealistic because it is pulling forward rental payments that occur as much as 99 years in the future. Using cash rent, earnings collapse to near zero and even negative in some quarters.

Ground leases are in many ways low risk, but they are also low return which means to make a ground lease REIT work, the company has to be run very lean. Excessive management compensation gobbles up such a large portion of revenues that there just isn’t much value left for shareholders.

At an enterprise value of $6.36B, SAFE is moderately overvalued relative to its assets and egregiously overvalued relative to its lilliputian cash flows.

I will begin with the cash flows of SAFE as a standalone company and follow with a discussion of the merger with iStar (NYSE:STAR). When everything is added up, the only entity getting enriched here is management.

SAFE cash flows vs. GAAP

As you know, REITs, like other companies are supposed to use Generally Accepted Accounting Principles (GAAP) in reporting their earnings. SAFE uses GAAP, and to the best of my knowledge, they report entirely properly with respect to SEC regulation and other governance bodies.

The challenge with accounting, however, is that it isn’t necessarily reflective of true earnings. GAAP is general purpose and fits most companies that have standard business models. It is much less applicable to companies with more unique business models.

Safehold is the self-proclaimed revolutionary in the field of ground leases. One need look no further than the front page of their website where they claim to be the “creator of the modern ground lease industry”

SAFE

I would challenge that claim a bit as ground leases are ubiquitous in Europe and parts of Asia.

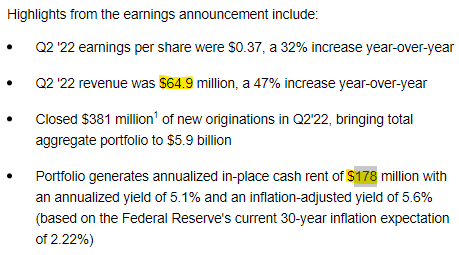

Nonetheless, they are doing something significantly different than what most GAAP accounting companies are doing, so it should not be surprising that GAAP numbers are misleading. Here are their GAAP numbers from 2Q22.

This looks pretty good. $0.37 per share of earnings easily covers their $0.1770 quarterly dividend and the year-over-year growth is phenomenal.

Annualizing the 2Q22 earnings SAFE has a run-rate of $1.48 annually. At today’s price of $45 that is a Price to Earnings multiple of just over 30X.

That is fairly high relative to the market, but perhaps could be justified by the strong growth rate that the numbers appear to show.

I think it is this measure of earnings by which the market is valuing SAFE. As a REIT, SAFE might also be getting valued on its Funds From Operations or FFO which is typical of the REIT industry and the metric is defined by NAREIT.

Using FFO of $1.74 which is the consensus estimate for forward FFO, SAFE is trading at 25.86X. This too is fairly expensive compared to the average REIT which is closer to 17X or the index at about 19X. Again, however, it could potentially be justified by the nominal growth rate displayed in the 2Q22 numbers.

Both GAAP accounting and NAREIT defined FFO share a particularly relevant commonality: Straight Line Accounting.

Consider a lease contract in which year 1 rent is $10, year 2 rent is $20 and year 3 rent is $30.

With cash accounting, earnings would get quite lumpy. Depending on whether that particular lease was in its early years or its late years the company’s earnings could look either bad or great compared to the true run-rate.

Straight line accounting looks at this lease when it is signed and sees $60 of rent over 3 years ($10 + $20 + $30). GAAP and FFO would record that as $20 of rental income in each of the 3 years.

For most REITs, straight-lining is a totally reasonable thing to do because it gives a cleaner picture of run-rate earnings. Most REITs have remaining lease terms ranging from 1 to 10 years so I tend to like using straight lining because I am not as concerned with what the REIT is earning in 2022 as I am about what it is earning in the medium term as a run-rate.

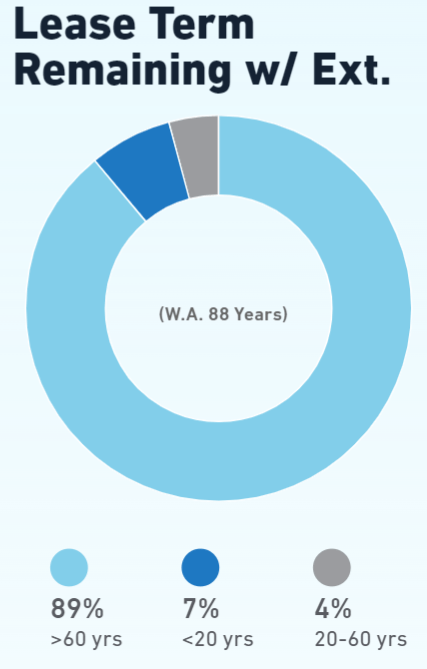

Safehold is quite different. Ground leases are frequently signed with 99-year terms and they have escalators throughout. SAFE’s 10K states that they sign ground leases with up to 99 years in remaining term and shows the weighted average remaining term is 88 years.

10-K

Thus, the year 1 income is far below the GAAP straight line income. Heck, even year 25 income is far below the GAAP straight line income.

SAFE is a young company with almost all of its leases in the very early innings of their nearly century-long terms. In the 10-K it describes its use of straight-line accounting.

“Operating lease income-Operating lease income includes rent earned from leases of land and buildings owned by the Company to its tenants. Operating lease income is recognized on the straight-line method of accounting”

As such, its cash earnings are dwarfed by its GAAP earnings. This isn’t something like the $10, $20, $30 lease where it will be made up for in a couple of years, rather SAFE’s cash earnings will underperform GAAP for the next 30 years.

Thus, I don’t think GAAP is in any way representative of true earnings. Due to time value of money, cash flows received 90 years from today are worth almost nothing. We should not be valuing SAFE based of cash flows from the next century. So, let’s look at the actual cash rent.

From the 2Q22 earnings release:

Earnings release

GAAP revenue annualizes to $259.6 million while cash rent is just $178 million per year. Or at the quarterly rate, $44.5 million cash revenues compared to $64.9 million GAAP revenues.

So what are earnings using cash revenues?

Well, GAAP net income was $22.7 million and cash revenues are $25.4 million less, so net income using cash rent is negative $2.7 million.

That is not a profitable company, and it becomes clear just how absurdly high the valuation is.

But what about the growth?

There are quite a few companies that are cash flow negative and yet have market capitalizations in the billions. Not all of them are overvalued because many will grow into the valuation. Based on Safehold’s 2Q22 numbers, they appear to be growing nicely so perhaps that justifies the valuation.

Well, the growth is illusory for the same reason as the earnings are. The growth only exists in the straight line accounting numbers because when a new 99-year ground lease is signed, the GAAP yield immediately reflects the weighted average rent. Here is the breakdown of their investment activity as provided by SAFE.

SAFE

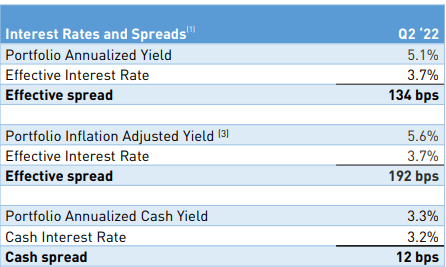

SAFE’s cost of financing is 3.7% and they are acquiring ground leases at 5.1% GAAP cap rates or 5.6% if you give credit to the inflation protection escalators. In GAAP accounting that is accretive to growth with a spread of 134 basis points or 192 basis points depending on which you use.

Since SAFE plans to invest billions in new ground leases, that ends up being quite a bit of GAAP accretion to earnings and therefore EPS growth.

However, the cash yield on their new investments is just 3.2% making it negative growth against the 3.7% cost of financing. SAFE attempts to make this look like a positive 12 basis point spread by suggesting that the cash interest rate of financing is 3.2%, but the debt is not 99 years in term. They will have to pay the full 3.7% cost of financing well before realizing the higher rent toward the end of the ground lease.

With where interest rates are today and the cap rates at which SAFE is investing today, each dollar invested in new properties takes their cash flows further negative. This is not a growth company and growth does not justify the high multiple.

Merger is a big payday for management

The recent merger with iStar was a massive payday for management in which they received the financial equivalent of nearly 5 years of dividends for all shareholders combined.

As of today, with iStar and Safehold being separate companies, iStar is the external manager of SAFE. In executing the merger, SAFE will internalize management and then become the external manager of the spin-off which will consist of iStar’s remaining assets along with $400 million in SAFE stock.

In consideration for the internalization, SAFE is paying STAR $150 million via the assumption of STAR’s preferred along with some new SAFE shares. That money technically goes to STAR shareholders so that is not part of what I am calling management’s big payday.

The payday is a result of an IPIP (individual-performance-incentive-plan) an LTIP (long-term-incentive-plan) and a new LTIP.

Each company (STAR and SAFE) has long-term incentive programs in place and the merger will cause these to pop.

The IPIP at STAR is the big one which will result in management getting somewhere between 3 million and 3.5 million SAFE shares as discussed by Jay Sugarman (CEO) on the merger conference call:

“I think all told it will probably be in the range of 3 million, 3.5 million shares out of the 42 million that iStar will own. So I think it probably provides the best continuing alignment of interest. The Board also has the ability to settle those in cash. But I think, obviously, settling in Safehold shares is a lot more aligning.”

Forgive me if I disagree with management being gifted 3-3.5 million shares as being aligning with shareholders.

On top of the IPIP, the LTIP already present at SAFE is likely to pop.

From the 10-Q

As of June 30, 2022, an aggregate of 698,500 shares remain available for issuance pursuant to future awards under the Company’s 2017 Equity Incentive Plan.”

So that would be 698,500 SAFE shares gifted to management on top of the 3-3.5 million.

Going with the lower, less egregious end of the range, that would be a total compensation of about 3.7 million shares. It is unknown what SAFE’s market price will be at the time of merger completion in 2023, but if we were to measure that at today’s market price of $45, that is $166.5 million.

The compensation doesn’t stop there

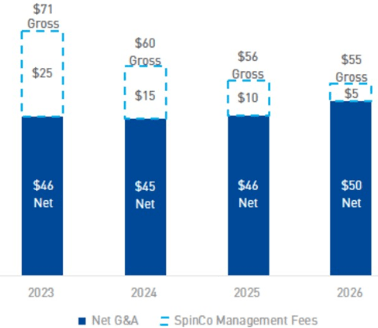

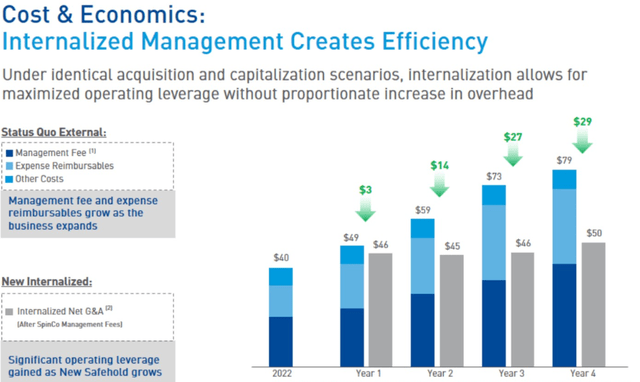

Once an internally managed company, SAFE intends to set up a new LTIP. This can be seen as they discuss the new expected G&A as an internally managed REIT in the merger presentation:

Presumably, there is going to be significant G&A savings as the internally managed structure has flat compensation at around $46 million annually as compared to the former external structure shown in blue above that scaled with the size of the company. Thus, as the company grows by billions as they intend to the G&A will eventually get lower using the internal structure.

That makes sense as that is mathematically how flat compares to linear scaling. Unfortunately for shareholders, that $46 million is not the true number. That is the number after using $25 million in 1-time revenue as a cushion.

See, the external management contract with the Spin-co which will now be a revenue source for SAFE has scaling down revenue as the company gets sold off. $25 million year 1, $15 million year 2 all the way down to $5 million in year 4.

The slide below illustrates that actual G&A in 2023 is set to be $71 million offset by the $25 million of fee revenues.

SAFE

So what is that extra $25 million in G&A above and beyond what they are calling the run-rate? Well, it is another LTIP as explained by Marcos Alvarado on the merger call:

“The higher first and second year cost also reflects higher stock-based compensation as new Safehold will put in place long-term incentive plans.”

This appears to be another $40 million in LTIP compensation to management on top of the $166.5 million of shares gifted in the merger.

One for you… 5 for management

I am of the belief that the lion’s share of value should go to those who have their capital at risk. Bondholders should be paid their contractual return and equity shareholders should get most of the return beyond that.

At SAFE, it appears management is absorbing most of the value with shareholders who are risking their capital only getting a slight fraction.

Safehold pays a $0.1770 quarterly dividend. Multiplying that by the 62,187,433 shares outstanding (as of 8/11/22) that is a $44.028 million annual dividend.

As compensation for the merger, via the LTIPs and IPIP, management is getting $206.5 million. That is 4.7 years of dividend paid to all shareholders combined. To make matters worse, that is merely the cherry on top of the already high base pay that management gets.

The $46 million dollar G&A run-rate proposed in the merger presentation represents 25.8% of cash revenues.

Most REITs have G&A around 5%-15% of revenues with those on the high end being the smaller REITs. As a multi-billion dollar company, SAFE is big enough that it should be able to have G&A around 8% of revenues.

Further, I want to point out that as a ground lease company, SAFE does not need to allocate as much G&A to property management/maintenance as most REITs. It is a passive investment vehicle.

Thus, the $46 million dollar projected internalized annual G&A strikes me as egregiously high.

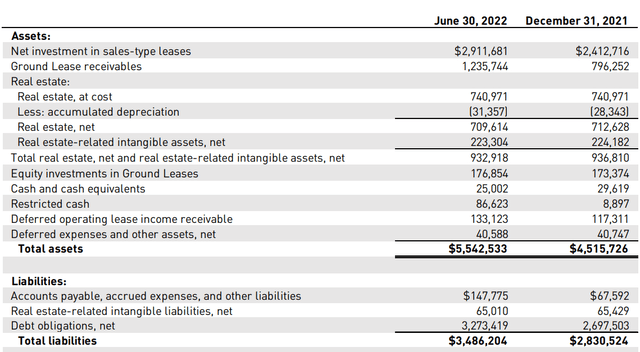

Value of assets

While it is probably clear that I am quite bearish on SAFE, I do like ground lease assets. The structure of ground leases is such that the revenues are quite secure and there is the potential for upside in the form of assuming ownership of the properties built on the ground.

As land assets, ground leases do not depreciate like other forms of real estate. I think SAFE neither overpaid nor got a better-than-market deal on their ground leases. As such, I suspect the asset value is approximately equal to book value (what was paid for the assets).

So while SAFE is drastically overvalued relative to its negative or weak cash flows depending on the period, it is only moderately overvalued relative to its assets. $5.54 billion in assets is 87% of the $6.359B liabilities plus market capitalization.

The challenge for shareholders, and why I think SAFE’s market price will drop substantially is that the assets are essentially encumbered by expensive management that is absorbing most of the cash flows leaving minimal return for shareholders. Even the paltry dividend is not being covered by cash flows.

With the minimal cash flows, I see fair value at under $20 as that is the market price at which it could become viable for an outside entity to take it over and put it in a much leaner overhead shell.

Risks to shorting Safehold

Beyond the normal risks to shorting such as the asymmetric risk inherent to any short position, I think the main risk to shorting SAFE is that it is somewhat susceptible to a short squeeze.

It has 11.34% short interest which is already somewhat elevated, but that is made even worse by the limited float. Most of the outstanding SAFE shares are owned by either STAR or management making the float quite small.

Small float with high short interest makes it ripe for a short squeeze. As such, it may be wise to keep the position size small and watch it like a hawk.

Be the first to comment