Dr_Microbe/iStock via Getty Images

Human beings are born with different capacities. If they are free, they are not equal. And if they are equal, they are not free. ― Aleksandr Solzhenitsyn

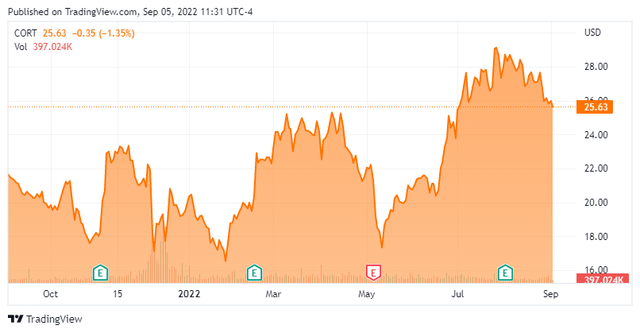

It has been just over a year since we last looked in on Corcept Therapeutics (NASDAQ:CORT). And given there has been no articles on Seeking Alpha around mid-cap biopharma name here in 2022, it seems to be a good time to revisit this name and update any potential investment thesis around Corcept Therapeutics. An analysis follows below.

Company Overview:

Corcept Therapeutics is based in Menlo Park, California. The company has one approved product on the market and is advancing several others in its pipeline. These candidates were created by focusing on the development of drugs that treat severe metabolic, oncologic, and psychiatric disorders by modulating the effects of the hormone cortisol. The stock currently trades around $25.50 a share and sports an approximate market capitalization of $2.75 billion.

Company Website

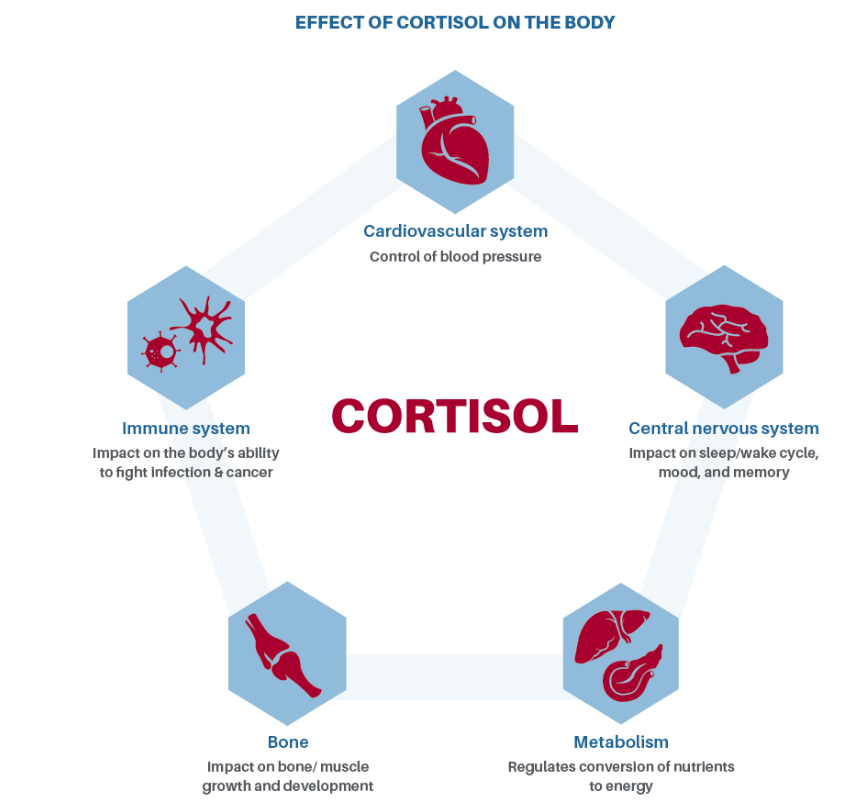

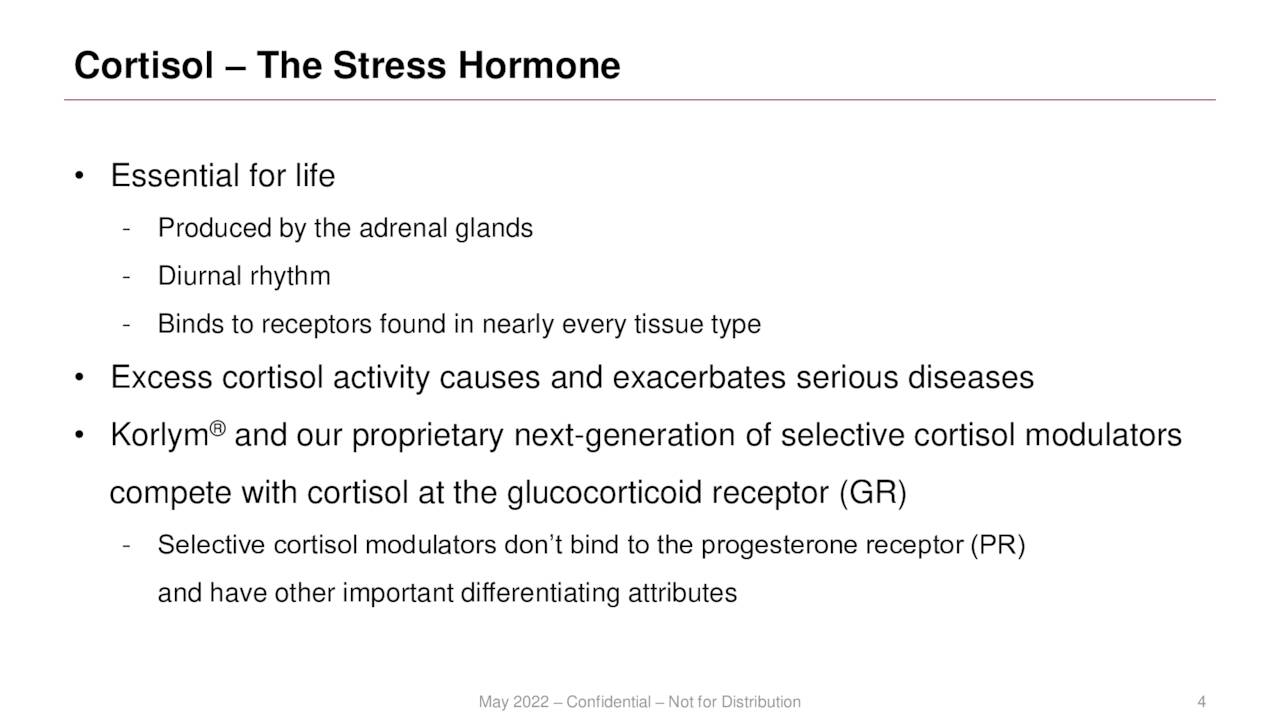

The company’s one approved drug is called Korlym (mifepristone). This compound provides for the regulation of cortisol levels and was approved a decade ago. Cortisol is a steroid hormone that plays a significant role in the way the body reacts to stressful conditions in many different areas of the body. Korlym is a once-daily oral medication approved for the treatment of hyperglycemia secondary to hypercortisolism in adult patients with endogenous Cushing’s syndrome who have type 2 diabetes mellitus or glucose intolerance and have failed surgery or are not candidates for surgery.

May Company Presentation

Second Quarter Results & Recent Developments:

The company posted second quarter results on August 3rd. Corcept delivered GAAP earnings per share of 27 cents as revenues rose 13% on a year-over-year basis to $103.4 million.

Korlym a few drawbacks. It can produce hypokalemia (low potassium) in patients. Also in women the compound has been known to cause endometrial thickening, vaginal bleeding, and in some cases pregnancy termination. The company is currently developing Relacorilant as an improved version of Korlym without these drawbacks.

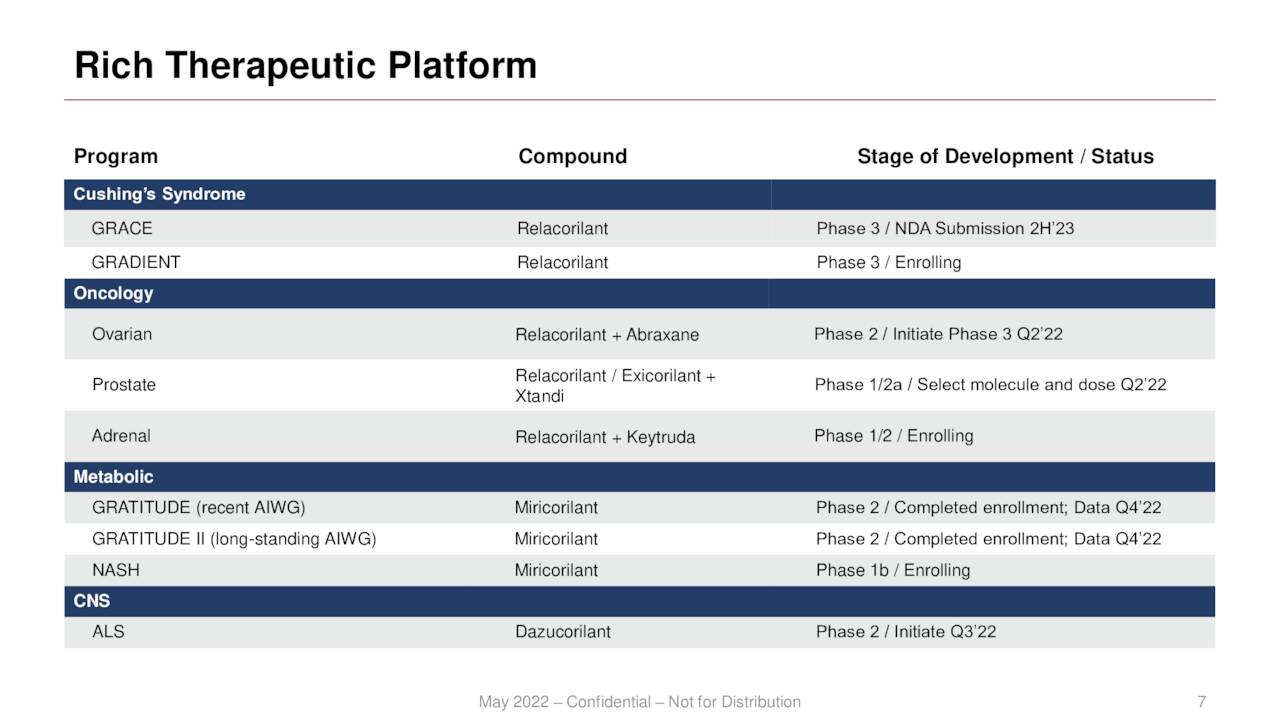

Enrollment continues in a Phase 3 ‘GRACE’ trial of relacorilant as a treatment for patients with all etiologies of Cushing’s syndrome. If successful, the company plans to be able to file an NDA by the second half of 2023 with the FDA. Enrollment also continues for Phase 3 ‘GRADIENT’ study of relacorilant as a treatment for patients with Cushing’s syndrome caused by adrenal adenomas.

May Company Presentation

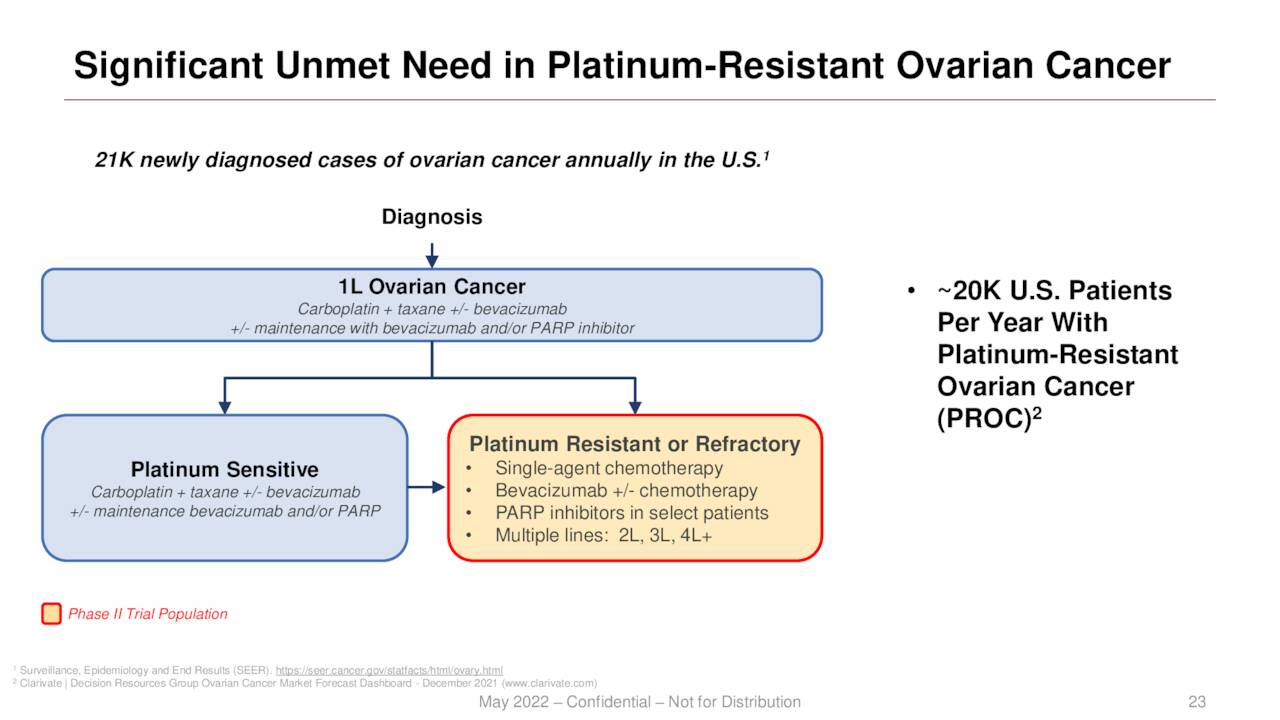

Relacorilant is also being developed as part of various combination therapies for different forms of cancer. The company recently initiated a pivotal 360-patient Phase 3 trial of relacorilant plus nab-paclitaxel, better known as Abraxane, in patients with recurrent, platinum-resistant ovarian cancer. Two much earlier stage trials as part of a different combination therapies are currently ongoing.

May Company Presentation

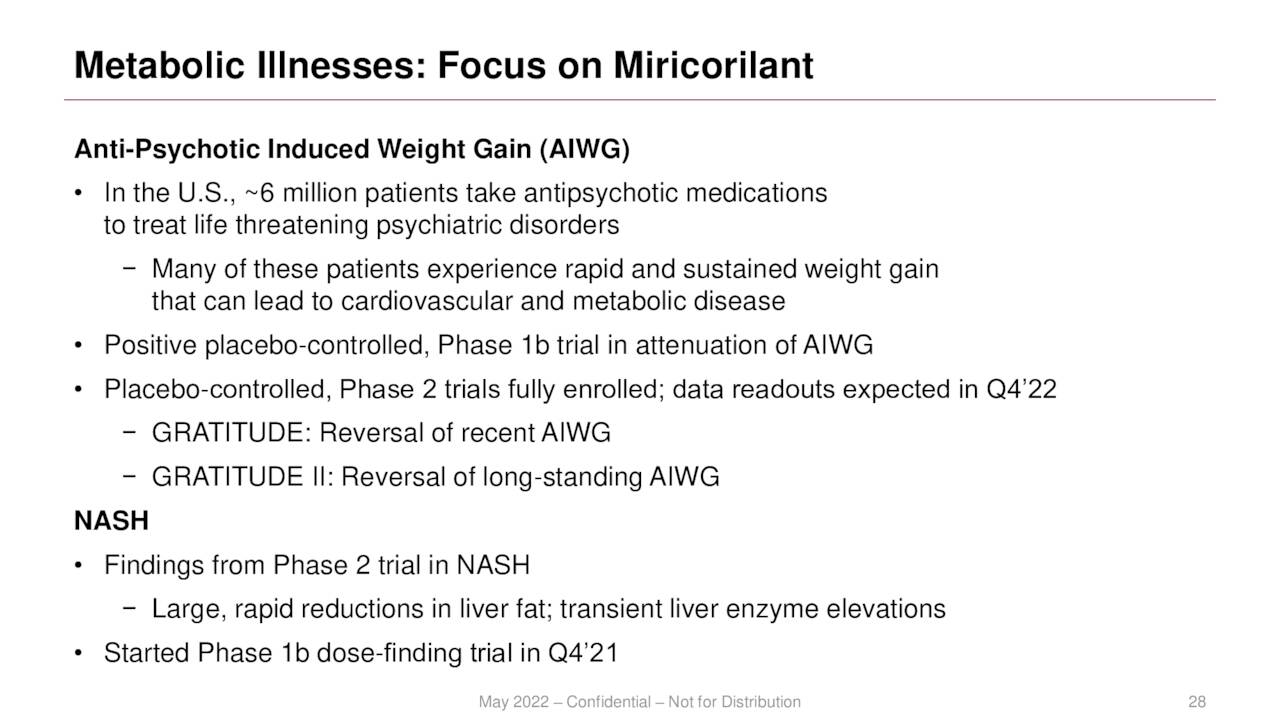

In addition, the company is also developing a compound called miricorilant, a cortisol modulator, for metabolic disorders. Two trials, GRATITUDE and GRATITUDE II, are currently ongoing. They are evaluating miricorilant to reverse recent and long-standing antipsychotic-induced weight gain. Data from both trials should be out before the close of this year. An earlier stage effort is targeting non-alcoholic steatohepatitis or NASH.

May Company Presentation

Finally, the company is advancing a compound called dazucorilant that is targeting ALS, commonly known as Lou Gehrig’s Disease. Dazucorilant is a selective cortisol modulator that crosses the blood-brain barrier that has shown promise in animal studies. A near 200-person Phase 2 study ‘DAZALS’ should kick off soon at sites in Europe and the United States.

Analyst Commentary & Balance Sheet:

Approximately one out of every five shares is current held short. Several insiders have sold shares in 2022. Total disposition of equity is just under $12 million in aggregate so far this year. The last insider purchase in this equity was late in 2020. After posting net income of $27.4 million, the company had cash and marketable securities of just north of $380 million on its balance sheet.

Since late June, four analyst firms including Jefferies and H.C. Wainwright have reiterated Buy ratings on CORT. Price targets proffered range from $33 to $45 a share. Here is the commentary from Canaccord Genuity’s analyst who maintained his buy rating on the equity and bumped up his price target four bucks a share to $34 on June 27th.

Korlym is a “highly effective drug,” inducing clinical improvement in patients with Cushing’s syndrome. Corcept is also developing relacorilant for advanced ovarian cancer, a tumor type in which cortisol pathway activity is elevated, says the analyst. The analyst believes the company’s pipeline offers upside potential in oncology and metabolic disorders and says the Korlym base business “provides a valuation floor.”

Truist Financial seems the lone dissenter in the shares at the moment. They downgraded Corcept Therapeutics to a Hold with a $30 price target on August 1st.

Verdict:

The current analyst consensus calls for the company to make 89 cents a share in profit in FY2022 as revenues rise some 14% to $416 million. Earnings are projected to grow to a $1.03 a share in FY2023 on sales growth of 11% to 12%.

There is a lot to like about Corcept the company. It has a rock-solid balance sheet and is nicely profitable. Corcept is delivering steady and consistent growth. Relacorilant has promise as well. The question is what valuation do these assets and sales/earnings growth in the low teens merit in an environment with rising interest rates? At some 30 times this year’s projected earnings, CORT seems more than fairly valued at current trading levels. If the stock pulled back in the high teens, I would probably be motivated to take a small position in the stock at that time.

Politics: the art of using euphemisms, lies, emotionalism and fear-mongering to dupe average people into accepting–or even demanding–their own enslavement. ― Larken Rose

Be the first to comment