imaginima

The estimated value of Continental Resources’ (NYSE:CLR) stock has come down a bit due to the decline in oil prices. I haven’t changed my outlook on long-term oil prices (which I am maintaining at roughly $70 WTI oil). However, Continental has no oil hedges, so the decline in nearer-term (such as 2H 2022 and 2023) oil prices reduces the additional cash flow it could deliver at strip compared to $70 oil.

I now estimate Continental’s value at approximately $76 to $77 per share in a scenario where commodity prices follow current strip until the end of 2023 and then end up at long-term prices of $70 WTI oil and $4.00 NYMEX gas.

Harold Hamm’s non-binding offer to take Continental private at $70 per share will likely keep Continental’s price from falling much further unless the outlook for oil prices craters (resulting in an increased chance of Hamm pulling the offer). A situation where oil prices drift moderately lower would likely result in the special committee supporting the $70 offer or attempting to negotiate a modest increase to that offer.

Hedges

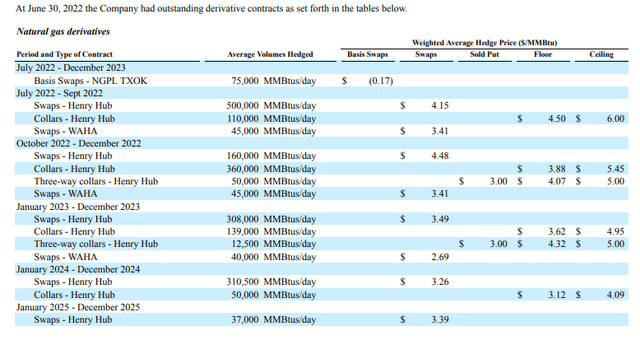

Continental is unhedged on crude oil (except for NYMEX roll swaps). It does have the majority of its 2H 2022 natural gas production hedged, as well as around 43% of its 2023 natural gas production and 31% of its 2024 natural gas production hedged (based on 2H 2022 production levels at least).

Continental’s 2H 2022 hedges have around negative $325 million in value at current strip, while its 2023 to 2025 hedges have around negative $441 million in value at current strip.

Continental’s Hedges (Continental Resources – Q2 2022 – 10Q)

2H 2022 Outlook

The strip for the second half of 2022 has come down considerably, to around $84 for WTI oil (including actuals to date) and $7.50 for Henry Hub gas. At those prices, Continental is projected to generate $4.92 billion in oil and gas revenue for the second half of 2022 before hedges. It expects increased production in the second half, with oil production around 213,500 barrels per day.

As noted above, Continental’s 2H 2022 natural gas hedges have around negative $325 million in estimated value.

| Units | Price Per Unit | Revenue ($ Million) | |

| Oil (Barrels) | 39,284,000 | $81.50 | $3,202 |

| Natural Gas [MCF] | 212,888,000 | $8.00 | $1,703 |

| Net Service Operations | $15 | ||

| Hedge Value | -$325 | ||

| Total | $4,595 |

Continental has around $1.48 billion left for its capital expenditure budget for 2022, which leads to a projection that it could generate $1.945 billion in positive cash flow in the second half of 2022 before dividends (around $203 million at $0.28 per share per quarter).

| $ Million | |

| Operating Costs | $310 |

| Production Tax | $380 |

| Cash SG&A | $95 |

| Cash Interest | $135 |

| Cash Taxes | $250 |

| Capital Expenditures | $1,480 |

| Dividend | $203 |

| Total Expenditures | $2,853 |

Continental is now projected to end 2022 with $4.034 billion in net debt, assuming there are no further share repurchases or acquisitions.

Notes On Valuation

In a scenario where oil and gas prices follow the current strip until the end of 2022 and then revert to long-term prices of $70 WTI oil and $4.00 Henry Hub natural gas, I’d estimate Continental’s value at approximately $74 to $75 per share. I’ve bumped up my outlook on long-term gas prices to $4, so that helps Continental’s value, although the decline in near-term cash flow (with lower oil prices) offsets that benefit.

If oil and gas prices follow current 2023 strip as well (around $74 WTI oil and $5.55 Henry Hub gas), then Continental’s value would increase to approximately $76 to $77 per share in a long-term (after 2023) $70 WTI oil and $4 gas scenario.

Conclusion

Continental Resources is unhedged on its oil production, so it is fully affected by swings in near-term oil prices. Thus, while my outlook on long-term oil prices is unchanged (at $70 WTI oil), Continental’s lowered near-term cash flow projections trims its value a bit.

I still believe that Continental is worth more than Harold Hamm’s $70 per share offer, although the gap has closed due to weaker oil prices. At long-term $70 WTI oil and $4 Henry Hub gas, I estimate Continental’s value as being in the mid-$70s per share.

Be the first to comment