monsitj/iStock via Getty Images

Investment Thesis

Flowserve’s (NYSE:FLS) stock price has corrected along with the broader markets since my previous article. While my thesis that the company will benefit from strong oil and gas demand did prove correct, and the company saw an increase in bookings, supply chain constraints negatively impacted backlog conversion, resulting in declining sales and margins. However, looking forward, I am optimistic about the company’s backlog composition and the steps management is taking to improve the company’s revenue. In the second half of 2022, supply chain and logistics constraints are expected to ease, which should also help the company to improve its backlog conversion rate. Also, the company has implemented a second price increase in 2022 to offset the inflationary costs. The current Russia-Ukraine situation and several countries moving away from Russian oil and gas should also act as a tailwind for Flowserve.

Flowserve – Revenue Growth Outlook

The company faced significant challenges in the first quarter of 2022 as the global operating environment deteriorated and inflation accelerated. Flowserve’s Chinese operations and a large portion of its supply chain were negatively affected by the recent Covid lockdowns in China. The company has a significant supply chain presence in China and other parts of Asia. The combination of supply chain constraints, logistics disruptions, labour availability headwinds, and significant inflation drove the backlog conversion performance significantly below historical levels. In the last quarter, the conversion fell to 41% compared to the backlog conversion average of 46% in 2021.

Despite the revenue decline, the company was able to take advantage of the improving demand environment in the last quarter, winning several midsized project awards and reaching its highest bookings level of $1.11 billion since Q2 2019. Bookings in Q1 2022 increased 15% Y/Y to $1.09 billion and were up 12% sequentially from Q4 2021 ($969.1 million), which was the highest bookings quarter in 2021. Bookings in the aftermarket increased 18.6% year over year to $542 million, driven by strong MRO activity during the quarter. In the aftermarket, this was the highest quarterly bookings level since 2014.

Flowserve’s booking (Company data, GS Analytics Research)

Flowserve’s backlog (Company data, GS Analytics Research)

Original Equipment bookings increased 11.5% year over year to $544 million, attributed to the company’s efforts to capitalize on market opportunities and its 3D (Diversify, Decarbonize, Digitize) strategy. The strategy is focused on diversifying end markets, assisting its customers to decarbonize, and leveraging technology to grow the company. We have discussed this strategy in our previous article. In Q1 2022, the company was also awarded several midsized projects worth $30 million each, as well as a larger award worth $50 million. These projects spanned the company’s traditional end markets of LNG, nuclear power, and mid-and downstream oil and gas.

Following disappointing first-quarter results, the company is repositioning and expanding its supplier base to reduce increased lead times and increase predictability in customer delivery. To restore revenue and overall margins, the company is holding various meetings, forming tiger teams for problematic categories, improving planning capabilities, and speeding up the recruitment process. The supply chain situation should stabilize and improve modestly in the second half of 2022, resulting in shorter lead times and a higher backlog conversion rate. Furthermore, shipping conditions are expected to improve at Chinese ports. This should help the company convert its backlog of $2.2 billion into revenue in the near term at a normal backlog conversion rate.

The company should benefit from the sanctions imposed on Russia, as the desire for energy independence has accelerated in both traditional and cleaner energy markets. This has resulted in an increase in LNG demand, which the company saw in its order pipeline in the first quarter and expects to continue in the second half of 2022. In the first quarter of 2022, the LNG order pipeline alone was worth over $300 million.

FLS Margin Outlook

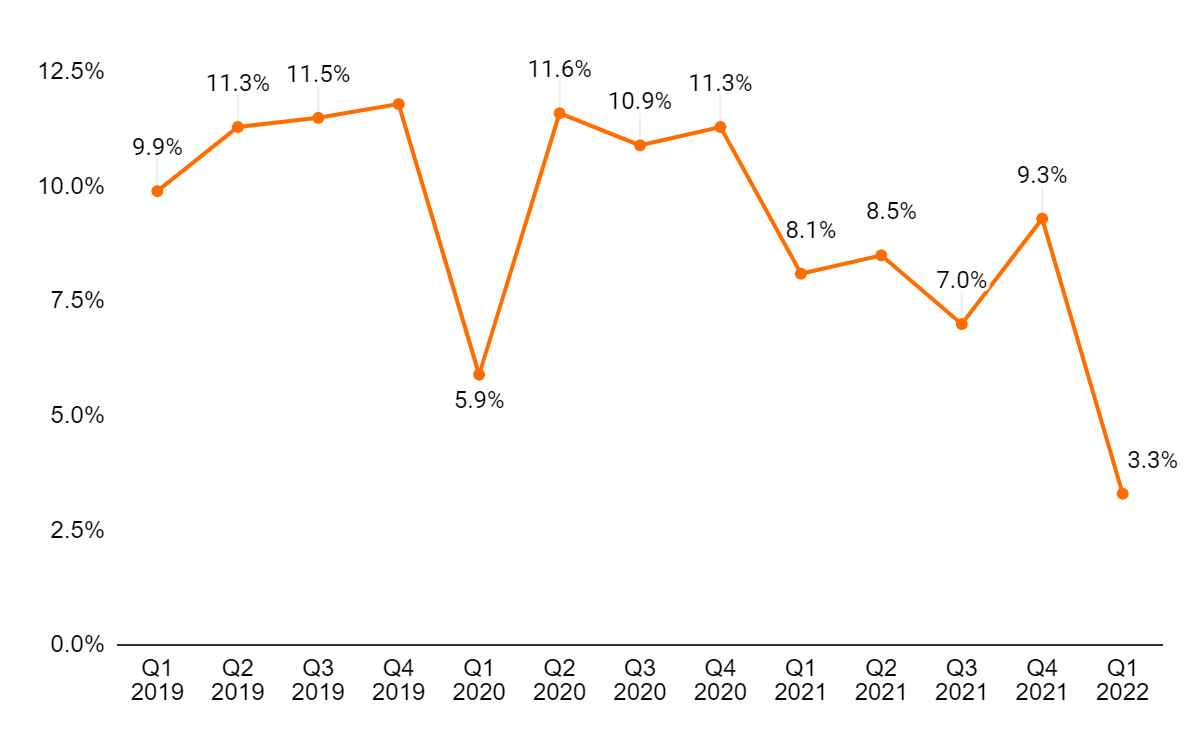

The adjusted operating margin of the company has been under pressure since early 2021 due to the lower revenue generation, which led to increased under-absorption. The same situation occurred in the last quarter i.e., Q1 FY22 which dragged the margins down. The adjusted gross margin fell 370 basis points Y/Y to 26.7%, primarily due to $26 million in under-absorption, inflationary costs, and frictional costs associated with minimizing customer disruption. Because of the lower revenue level, adjusted SG&A increased 130 basis points Y/Y as a percent of sales to 23.9%. In Q1 2022, adjusted operating margins fell 480 basis points year over year and 600 bps sequentially to 3.3%, due to a drop in adjusted gross profit.

Adjusted operating margin (Company data, GS Analytics Research)

In addition to under absorption, inflation is also a big headwind for the company. At the end of 2021, the company was roughly price/cost neutral but with the rapid inflation in early 2022, the 5% price increase that the company implemented at the beginning of the year was not able to cover the increases in incremental costs. The company recently announced and implemented its second price increase in 2022 which should help it reach the price/cost neutrality. This price increase is expected to flow through the sales in the third quarter. The mix of the projects should also help margins as the recent bookings like LNG, nuclear and other types of work are higher-margin projects.

For the projects done under a cost-plus model or long-term agreements, the company has shortened its project quote validity substantially so that it can adjust the pricing for the projects if things change on a general basis. Also, the company is putting inflationary metrics into those quotes on large projects. This should help the company offset the inflationary costs. On the aftermarket side, the shorter cycle of the projects and good margin projects should also underpin the margin improvement. The company is working towards eliminating the frictional costs associated with the delivery to its customers, which could also drive higher margins in 2022.

Valuation & Conclusion

FLS stock is currently trading at 19.85x FY22 consensus EPS estimate of $1.55 and 14.65x FY23 consensus EPS estimate of $2.10 which is lower than the five-year average adjusted P/E (fwd) of 23.19x. The stock price has corrected due to the disappointing results and broader market correction. However, the demand outlook, the bookings and backlog are stronger than the historical levels which should underpin the revenue growth looking forward as the constraints in the supply chain and other parts of the business stabilize. The headwinds experienced by the company are short-term in nature and expected to subside moving forward. This should not only improve revenues but also the margins. Hence, I believe investors can look beyond the current transitory headwind and use the recent correction as a buying opportunity.

Be the first to comment