Alex Wong/Getty Images News

Let’s Begin At The Beginning

In order to fully understand why I have begun to buy options on Kraft Heinz (NASDAQ:KHC), I feel I must begin at the beginning, how I became interested in stocks and what led me to shares of Kraft Heinz in the first place. My career as a market watcher, investor, and blogger began on October 5th, 2005 when I attended a seminar I believe was titled “The 5-Step Method For Buying And Selling Stocks”. It was a very basic course, it only lasted a few hours and was intended as a sales pitch for an options course, but it opened my eyes to a whole new world.

The vibe in that room, the men and women in their flashy suits and eye-popping jewelry, opened my eyes to something I knew I had been looking for without knowing what it was. From that point forward I was dedicated to learning to trade and learning to trade options. Believe it or not, that didn’t turn out too well at all. Not at all. That cost me over $12,000 in an IRA I had at the time but the lessons I learned are more than worth it.

The number one lesson I learned was that options are hard to trade successfully. I went back time and again trying to make it work but never could do it. Along the way, I started writing for a newsletter and that is where my real education began.

Writing About The Market Helped Me Understand It

Blogging and writing about the market turned out to be a very educational experience for me. I knew a lot about technical analysis, it turned out, but not a lot about what makes the market move. Years of watching the news, tracking the economic data, and applying that to hundreds upon hundreds of earnings reports helped to clue me in on what makes a good company and a good stock and, as it turns out when you combine good companies with good-looking charts the signals work out a whole lot better.

- This is my first article on Seeking Alpha, published in September 2014 .. “We Are In A Secular Bull Market“.

During this time I was mostly interested in speculating the S&P 500 but I soon developed the beginnings of a personal strategy that will eventually lead me to Kraft Heinz. That strategy centered on dividend growth stocks and my first big win came with Cintas (CTAS). I first became interested in Cintas when it was trading in the $60 to $80 range and it has since climbed to the $400 range while paying an ever-increasing dividend.

- My first article on Cintas … “Cintas Is Growing, But Not Fast Enough For Its Value“

Eventually, I will add value to my criteria and that’s where Kraft Heinz comes into play. I was screening for stocks to write about here on Seeking Alpha and turned up Kraft Heinz. The stock was trading around 8X or 10X its earnings outlook while paying a 5% dividend that looked safe enough to me at the time.

The Kraft Heinz Turnaround Story

The reason Kraft Heinz was trading at such a low valuation is that the merger didn’t pan out the way it was supposed to, and there was a scandal. Accounting impropriety led to an SEC investigation, a shake-up in the C-suite, and a deep discount to share prices. Oh yes, a dividend cut should be included in the mess but this was all before my interest was piqued. The more I learned about Kraft Heinz the more convinced I was this was a major turn-around story that could lead not only to triple-digit capital gains but to dividend growth as well.

Where is Kraft Heinz now, 40 months after the market imploded? In much better shape than it was before. The company has been divesting itself of non-performing assets, shoring up the balance sheet, and investing for growth. Among the most noteworthy moves was the divestiture of large portions of the Natural Cheese business which was completed in late 2021. The deal is worth $3.2 billion including the license deal that allows Group Lactallis to continue producing the products Kraft built its name around.

Since then, the company has also sold its Planters Nuts business to Hormel, a good move for both companies, as well as purchasing or making deals with several growth brands. These include but are not limited to the acquisition of an 80% stake in Just Spices, the purchase of Brazil-based Hemmer (a condiment and flavoring company), and a deal with Simplot. The deal with Simplot includes the sale of Ore-Ida manufacturing capacity to Simplot while Kraft retains ownership of the brand.

Kraft Heinz Has Pricing Power

One of the many drivers of price action in shares of KHC over the past two years is the pricing power. The company was among the first to start hiking prices to fight inflation and it has managed to stay ahead of the curve by outpacing the consensus for revenue and earnings. That power was called into question following the last earnings report, however, but that is a factor in my decision to buy options.

Analyst Cody Ross at UBS downgraded the stock to Sell from Neutral on concerns of tightening margins. In his view, the stock is facing an increasingly inflationary environment and expects the company to take additional pricing actions to offset it. He says “We believe it will be difficult for KHC to pass through additional pricing next year and by that time, KHC will likely be battling trade-down pressure as consumers’ budgets are squeezed further.”

I don’t agree with the sentiment but my opinion isn’t what matters here so much as the backlash from the analyst’s community. At least two analysts including Bank of America analyst Bryan Spillane have come out in defense of the stock, Spillane saying it was “unduly maligned“.

In his view “Following [Walmart] (WMT) results in mid-May, consumer staple stocks took a turn and weakened due to a reaction from commentary on price increases pressuring households to trade down to private label,” he noted. “In our view, KHC is most insulated from this news as they were the fastest to raise price versus other companies in our coverage universe that potentially need to take another round of meaningful price increases.”

And BMO went so far as to upgrade the stock to Outperform citing the company’s strategic evolution. In their view, the stock’s turnaround is largely being ignored by the market presenting an attractive opportunity.

“Even after exceeding expectations for eight consecutive quarters, increasing its long-term growth algorithm to align with its peers, and reducing its leverage to just over 3x, KHC’s valuation discount to its peers actually expanded in 2022 with its stock underperforming its peers by more than 1,700 basis points over the past 12 months.”

And for the value? Kraft Heinz was and still is trading at a discount to its peers. The stock is trading at about 16X its earnings with not only revenue but earnings improvement in the picture while the highest valued stocks in the group trade at 25X their earnings or higher. Looking at other stocks in the Consumer Staples (XLP) group, Hormel (HRL), PepsiCo (PEP), and Coca-Cola (KO) all trade near 25X their earnings while The Hershey Company (HSY) trades at 27X and Clorox (CLX) at 33X. Even Mondelez (MDLZ), the original Kraft before the spin-off and merger with Heinz, trades at a higher 21X earnings and they all pay lesser dividends.

This Is Why I Started Buying Options On Kraft Heinz

I began buying shares of Kraft Heinz in late 2020. I made a follow-on purchase in early 2021, another in late 2021, and then again in early 2022. At this time, the stock is my single largest holding at nearly 23% of my account, not counting options, and I will buy more because this story has legs.

The key reason I began to buy options, however, is because of the technical picture and how it is aligned with the turnaround story. I wanted to buy more and more of the stock but my funds are limited and options provide leverage. In light of my history with options, the decision should have been a difficult one but it actually wasn’t and the chart is why.

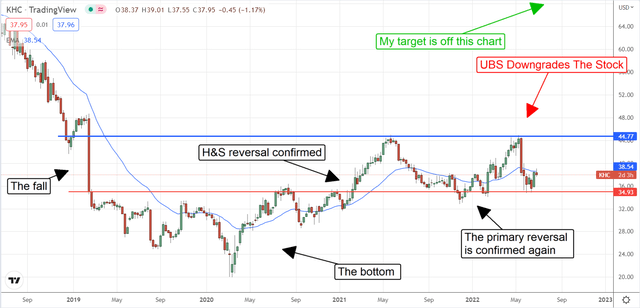

After nearly 20 years of watching the markets, the chart pattern developing in KHC was very compelling. By the time I began to buy options in early spring 2022 I had witnessed the fall, the bottom, and a rebound that had turned into a Head & Shoulders Reversal. The reversal picked up steam in the wake of all that COVID stimulus and spending and has since been confirmed again. When price action retreated to the neckline of the pattern at $35 I was a buyer and I bought again when that pattern developed into yet another Head & Shoulders that sent price action up to the multi-year high and well on their way to a break-out. And then UBS downgraded the stock and price action fell.

If there is one thing I have learned about the stock market is that you have to be ready for opportunities. You have to watch the market every day, at least every week, to understand what “normal” looks like so you can recognize the abnormal. The downgrade from UBS was, in my opinion, abnormal and out of alignment with the fundamental story so the 22% implosion in share prices could only be viewed as a buying opportunity. As bullish as I am, it only made sense to buy options because buying shares was wasting time.

This Is My Trade And End-Game With Kraft Heinz

To be fair, I am trading Kraft Heinz as much as investing in it but this is a long-term trade, not some flash-in-the-pan pop I am going after. My ultimate target is Kraft Heinz trading back at the pre-implosion levels driven by internal improvement, growth, earnings power, and an eventual return to dividend growth. I believe the company could easily begin raising the dividend this fiscal year but they may not, in favor of reinvestment in the business. Until then, I will be satisfied with the current 4.25% yield on any new shares I buy and the nearly 5.0% yield on the shares I already own. But, back to the charts.

My time horizon for this trade is nearly two years. I am targeting the January 19th, 2024 $40 calls which are currently out of the money. This strike carries the highest open interest of any strike for this expiry and the interest is on the rise. By the time expiry rolls around, I expect to see shares of the stock trading well above the $45 level and making a low to high-triple-digit return driven by what will ultimately become a price-multiple expansion.

Assuming the stock trades up even to the low-20’s a 20X multiple has it trading near the $43.50 level not counting the expectations for future earnings growth. An expansion to near 25X and in line with the highest-quality consumer staples stocks would another $5.50 or so to that outlook and put the stock in relatively new territory. The next major catalyst for the stock will come with the calendar Q2 earnings in late July and I think it will be a bullish one if results from staples companies like General Mills can be used as a guide. General Mills is another to raise prices proactively and it just beat consensus and issued favorable guidance.

A note: it is likely the move in Kraft Heinz will not be over at expiration which means I will either have to take profits and roll with it, or roll the options into a different strike and expiration.

The Technical Outlook And Risk Of Buying Kraft Heinz Now

The technical outlook for KHC is bullish but the market has pulled back to support and is in a wait-and-see mode. That mode may change with the release of earnings at which time I am expecting price action to rise. The risk is that results will not be as good as expected, or margins will contract, in which case shares may fall below the $35 level and eventually trigger my exit. Assuming the results are as I expect, price action may even break out to new highs in the wake of the results and trigger the next round of targets. At that time, I will be looking for the stock to move up $10 to the $55 zone which is equal in magnitude to the trading range price action is currently trapped in.

Be the first to comment