dima_zel

Introduction

Teledyne (NYSE:TDY) was founded in 1960 by Dr. Henry Singleton and George Kozmetsky. Dr Henry Singleton is not just anyone, he turns out to be a very good investor and executive. An investor who invested in Teledyne from 1963 to 1990 had achieved an annual return of 20.4%. Warren Buffett called Dr. Henry Singleton one of the greatest capital spreaders of all time.

What can we learn from Dr. Henry Singleton?

- Buy low and sell high.

- Repurchase shares at a low price, and issue shares at a high price.

- When Teledyne’s share price was flying, use it as a currency to make acquisitions.

- When Teledyne’s share price was sinking, repurchase them.

- No option awards.

- Teledyne paid no dividend because the marginal dollar of corporate cash was more productive on the company’s books than in the shareholders’ pockets.

- Choose the right managers aligned them with the proper incentive structure and impose strict capital allocation on their operating companies.

Other companies also repurchase shares, but do so when the share price is high, and issue shares when the share price is low.

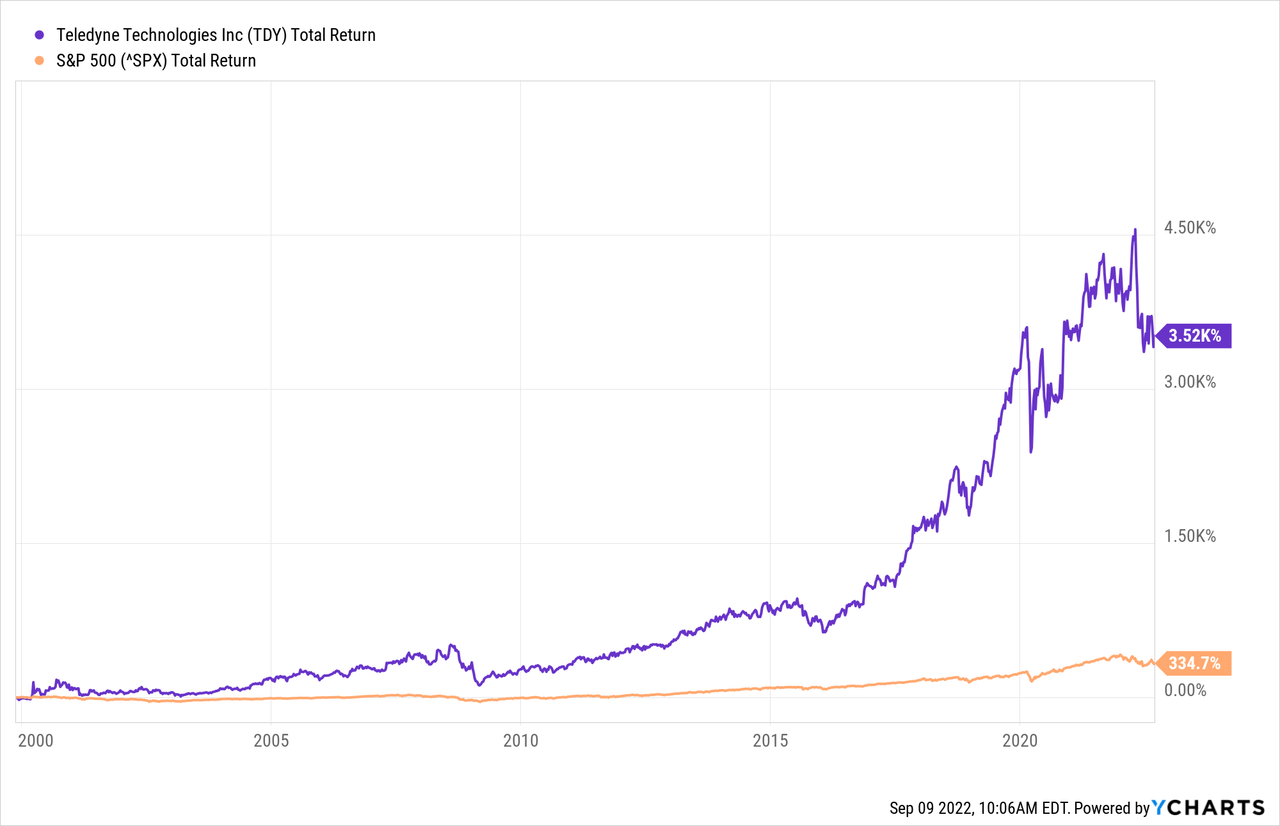

Teledyne has unfortunately moved on without Dr. Henry Singleton, but Dr. Henry Singleton has chosen the right executives to help the company grow. It worked; the stock price has risen 3520% (CAGR 16.9%) since 1999 compared to the S&P500 (CAGR = 6.6%).

The company is growing strongly through organic growth, but also through acquisitions. For example, it recently bought FLIR for $8 billion in 2020. Still, I think the stock is overvalued and from experience I often see the stock fall after a major acquisition. I’d like to see the stock in my portfolio, but I’m waiting. The stock is a hold.

Company Overview

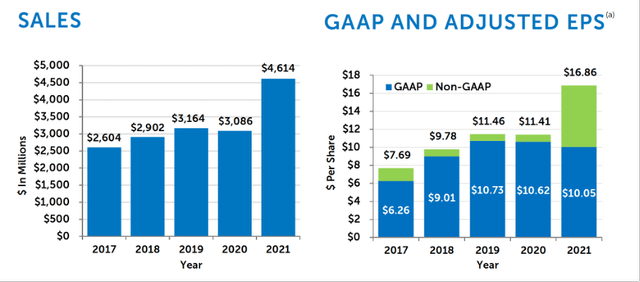

Teledyne is growing both organically and through acquisitions. Teledyne is growing rapidly as a result, with sales growing at a CAGR of 15.4% over the past 4 years and adjusted EPS growing at a CAGR of 21.7%.

Teledyne’s Sales and Adjusted EPS (2Q22 Investor Presentation)

The ethos of Dr. Henry Singleton has kept the management strong. Teledyne’s management carefully determines which capital allocation strategy is best for the company. It acquires highly profitable companies and divests companies that exhibit weaknesses or that do not fit within Teledyne’s core business.

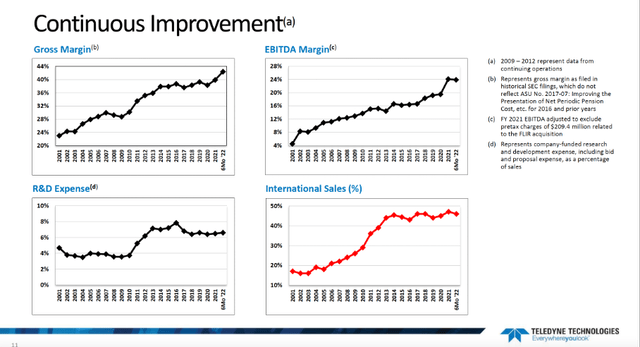

Continuous Improvement (Teledyne’s 2Q22 Investor Presentation)

Thanks to their strategic M&A policy, Teledyne has been able to significantly increase its EBITDA margin, from approximately 4% in 2001 to almost 24% in 2022, while increasing relative R&D costs. The company is highly dependent on the latest technologies, which is why it must continue to invest well in R&D.

Teledyne is divided into the following segments:

- Digital Imaging (52% of consolidated sales)

- High performance sensors, cameras and systems within the visible, infrared, ultraviolet and X-ray spectra

- Used in industrial, government and medical applications, as well as unmanned aerial and ground systems.

- Instrumentation (25% of consolidated sales)

- Test and measurement, monitoring and control instrumentation, and power and communications connectivity devices

- For marine, environmental, electronics and other applications.

- Test and measurement, monitoring and control instrumentation, and power and communications connectivity devices

- Aerospace & Defense Electronics (14% of consolidated sales)

- Sophisticated electronic components, subsystems and communications products, including defense electronics, commercial avionics and harsh environment interconnects.

- Engineered Systems (9% of consolidated sales)

- Innovative systems engineering, manufacturing and specialized products

- For government, space, energy and industrial customers.

- Innovative systems engineering, manufacturing and specialized products

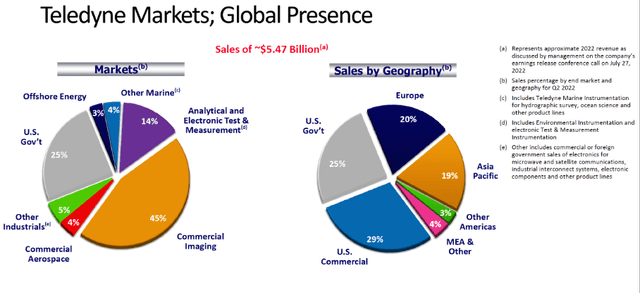

Teledyne Markets; Global Presence (Teledyne 2Q22 Investor Presentation)

About 25% of sales come from US government contracts. The US government is a financially strong customer, but politics influences government spending.

Furthermore, a large part of the revenue is generated from commercial imaging. This segment has grown strongly since 2010, when it only represented 7% of consolidated sales.

What makes Teledyne unique is that their imaging segment offers a total solution for different markets. Teledyne offers optics with imaging capabilities across the full spectrum of light waves, from deep sea to deep space imaging.

Upcoming Catalysts

ISS (Teledyne Brown Engineering)

Teledyne recently announced that it has been awarded a $596 million International Space Station Support Contract. Teledyne Brown Engineering specializes in the most advanced engineering and manufacturing solutions in the aerospace, defense, energy and maritime industries. For the ISS Support Contract, Teledyne Brown Engineering is responsible for the Mission Operations and Integration (MO&I) component. This includes mission preparation, crew and flight controller training, and real-time spaceflight operations, as well as maintaining support infrastructure.

Cited from the SA Press Release:

Teledyne Brown Engineering has supplied over 175,000 hours of round-the-clock support for the ISS. The company has played a major role in supporting NASA’s science research aboard the ISS by integrating more than 3,000 payloads, providing crew training activities for these payloads, developing experiment procedures, and delivering real-time support to science teams from around the world.

MOSSI II is a performance-based, cost-plus-award-fee contract that has a potential mission services value of $596.5 million and a maximum potential indefinite-delivery/indefinite-quantity value of $85 million over eight years. The contract begins around September 9, 2022.

The contract is significant as Teledyne’s consolidated revenue in 2021 is $4.6 billion. In 2021 and 2020, the largest contract with the US government was the MO&I contracts. These subsequently constituted 1% and 1.5% of their total turnover respectively. NASA’s continued commissioning of Teledyne Brown Engineering indicates their confidence in Brown’s knowledge and expertise.

Valuation

The stock valuation is also important to estimate the right moment to buy. Teledyne recently acquired FLIR in 2020 for $8 billion. I often notice that the share price of the company drops after such a large acquisition, which was also reflected in the share price of Kraft Heinz (KHC).

Teledyne also suffered from this, the share price peaked in May 2022, after which the share fell by 20%. Is this a buying opportunity now?

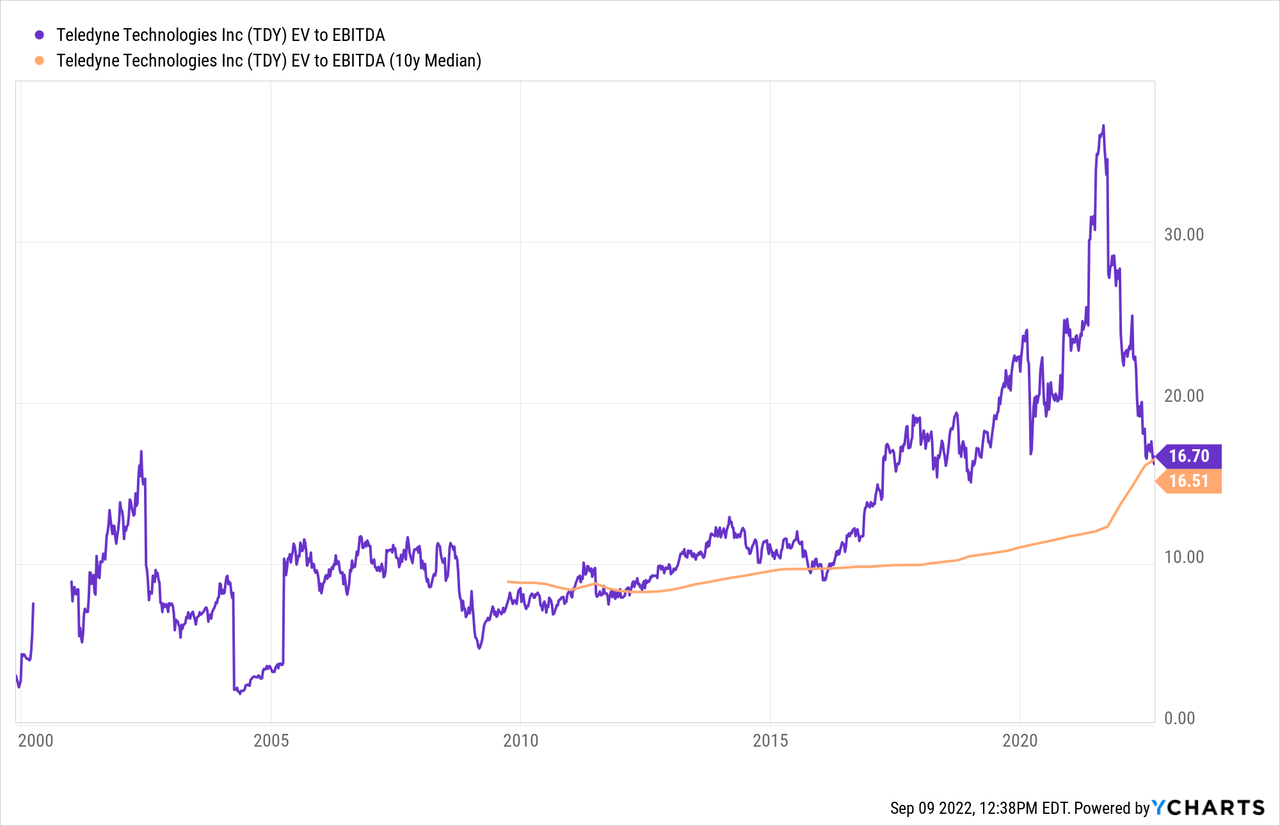

Because of the recent acquisition, I’m looking at the EV/EBITDA chart. This gives a good picture because their debts and cash on the balance sheet are also taken into account. The chart shows that the EV/EBITDA ratio is 16.7, close to the 10-year average of 16.5.

As I mentioned before, their EBITDA margin has increased from 4% in 2001 to almost 24% in 2022. Their EBITDA margin is now reasonably in line with that of competitors. Take for example the EBITDA margin of MKS Instruments, which is 25%. I therefore see few opportunities to improve their EBITDA margin.

Analysts on the SA TDY ticker page expect revenue to grow about 5% annually. Assuming the EBITDA also grows 5%, then the EV/EBITDA ratio of 16.7 seems on the high side compared to their historical ratios.

Conclusion

Teledyne was co-founded by an outstanding investor and executive named Dr. Henry Singleton. Warren Buffett called him one of the greatest capital allocators of all time.

Under the current management, the company has grown strongly through organic growth and acquisitions. In 2020, for example, it acquired FLIR for $8 billion.

Through their strategic policy, Teledyne has increased revenue at a CAGR of 15.4% over the past 4 years, and adjusted EPS grew at a CAGR of 21.7%. About 52% of sales come from the digital imaging segment. This segment offers total solutions in the full spectrum of light waves, from deep sea to deep space imaging.

Teledyne Brown Engineering recently won a $596 million ISS support contract to support mission preparation, crew and flight controller training, real-time spaceflight operations, and support infrastructure maintenance.

The strong growth of Teledyne, and the strategic policy of the management makes Teledyne a suitable candidate to invest in. However, the valuation of the stock shows that the company is highly valued compared to their historical 10-year averages. I would like to see the stock in my portfolio, but the high valuation prevents me from buying the stock. The stock is a hold.

Be the first to comment