Not Seen At META HQ

Frazer Harrison/Getty Images Entertainment

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

So, NOW Is It All Over?

In our note earlier today on Meta Platforms (NASDAQ:META) – here – we noted the big selloff in the stock and said that a stop around $120ish, just below the 2018 lows, would be in order for someone starting to buy into the name. Well, if you followed this and set your stop? We hope you remembered to make it GTC and also tick the “outside regular hours” box because right now the stock has crashed through that $120 zip code in post-market hours and is currently sitting moribund at $107, a huge 22% dump on yesterday’s close.

All the points we made in our earlier note remain true. This is a company shape-shifting its business model in full view and in real time. The Metaverse vision is to still serve its core customers – advertisers – but to do so in a way that has the potential to have ongoing relevance in the next generation online environment.

As one of the comments on that note observes, product cycles in tech have to be respected, and if not careful, companies can become simply a function of the product environment in which they were born. When the paradigm shifts, the companies born in that paradigm are upended and new names enter the fray. This is precisely the risk that META is staring down the barrel at right now.

What you choose to do with META reflects your view of how META will respond to the paradigm shift. The ad spend hit has accelerated in 2022 probably faster than the company expected and that has put still more premium on moving to matters Metaversial. Zuckerberg will now find himself under colossal pressure particularly given the removal of Sandberg from the board.

Our best judgment remains that this company achieves a recovery. Technically the stock remains above the 78.6% retrace since its post-IPO lows, meaning that at this largest of large degrees you can argue that this is a generational correction reflecting the task at hand – as when Netflix (NFLX) moved from DVDs to streaming – or indeed as when NFLX is moving from user-pays toward user-and-advertiser pays – and that the stock can yet move back up toward the highs.

We have some money in the ground in this thing here in staff personal accounts, a modest allocation; it’s likely to be under water for some time but it’s not money we need so we’re happy to just sit and wait and see what happens. The valuation remains absurdly cheap and at these levels we’re happy just to kick back in the basement with our stock certificates to see what happens.

Numbers, valuation and chart follows.

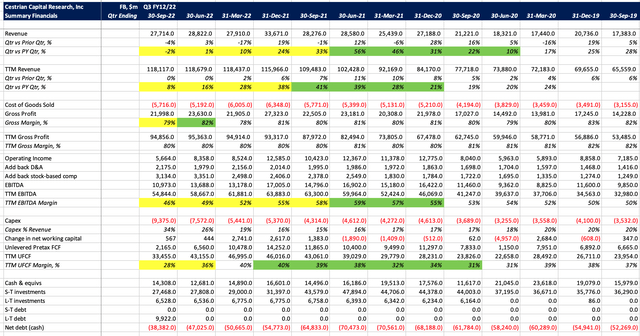

Numbers:

META Financials (SA)

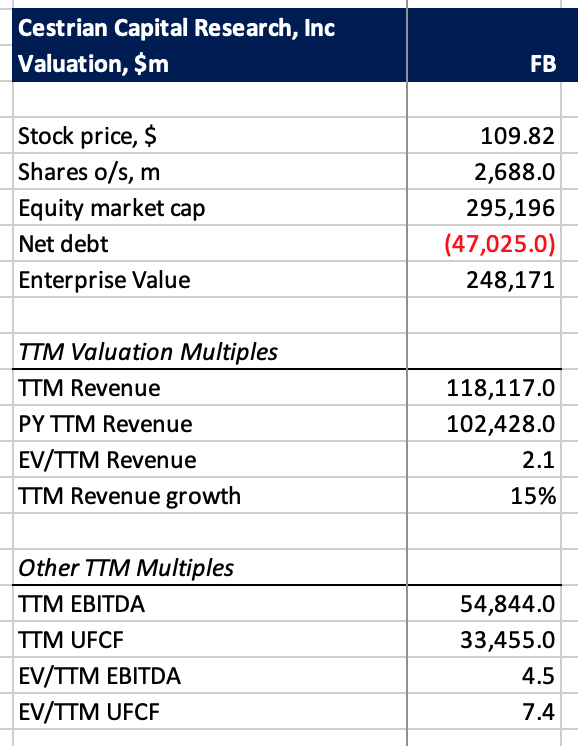

Valuation:

META Valuation (SEC filings, Cestrian Capital Research, Inc. )

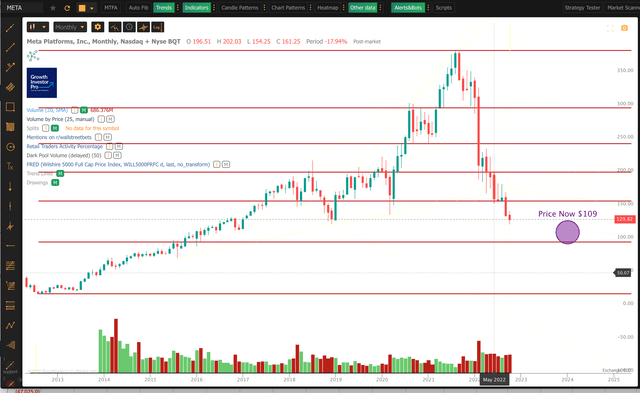

Chart: (Full page version, here).

META Chart (TrendSpider)

We see META as option value at this point. Either it finds support in the region of that 78.6 retrace – in which case we can see a major Wave Three up develop the stock, or it doesn’t, in which case we would be as surprised as Zuck himself. A stop below $100 can help protect you against any further self-immolation.

Cestrian Capital Research, Inc – September 2022.

Be the first to comment