VTT Studio

With a looming U.S. recession now considered 100% likely according to Bloomberg Economics model projections, investors need to begin to carefully consider their moves, as their next investment could be one they need to ride through some tough times.

Opportunities, or at least “safe bets,” certainly exist throughout the market, and they can be identified thanks to lessons history has taught us, but for those with a little more risk appetite and a hunger for outsized returns, there are some very noteworthy options available.

Today we’ll be assessing multi-line retail firm Kohl’s Corporation (NYSE:KSS). Founded in 1988, the firm now boasts a market capitalization of $3.16B, making it an “average-sized U.S. listed firm” at the 56th percentile of market caps compared to this “All US Stocks” Seeking Alpha Screener.

We’ll be looking at the firm’s financial health to give us a base rating of the firm’s sustainability, give it a valuation attractiveness score, attempt to find a pricing mechanism for the firm, and finally discuss some of the major risks investors would need to consider.

(Data & prices correct as of pre-market 5th November 2022. The “All US Stocks” list referred to in this article can be found on this Seeking Alpha screener.)

Kohl’s Base Financial Health

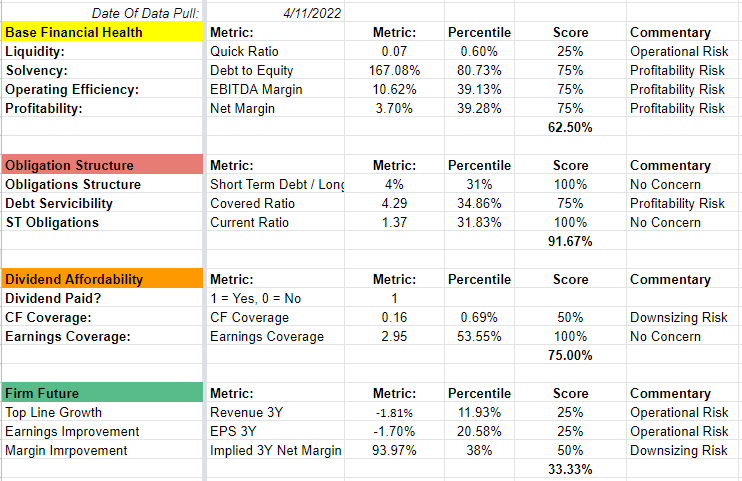

Starting with the firm’s basic financials, we want to carefully consider liquidity, solvency, operating efficiency, and profitability to assess how effectively this firm makes profits, and whether there are major risks to its balance sheet.

Next, we’ll look at the firm’s obligations and how they’re serviced, take a peek at the dividend and assess its sustainability, and finish with considering forward estimates of revenue and earnings.

We can immediately see a concerning red flag with the “acid-test” quick ratio metric coming in at 0.07, which alarms us that in a “worst-case scenario,” the firm is not prepared to cover its current obligations and liabilities. While these are typically low-likelihood events, it gives us a peek into how financially safe the firm is.

A 167% debt-to-equity ratio is not extreme, but it does show that the firm is highly leveraged, and in the event of an insolvency, shareholders would be unlikely to see their invested capital returned to them. Further, Kohl’s margins are very narrow, and the firm’s profits are driven by scale rather than efficiency. With that said, gross profit margins for KSS are around 40%, while selling and general administration costs consume 30% of revenues.

Despite large debts and narrow margins, Kohl’s obligations are relatively well-structured, with only a tiny 4% of debt being short term. Interest repayments are currently well covered 4 times (though given the leverage size and rising interest rates I have marked this down slightly to 75%), and short-term obligations are currently well-serviced at 1.37.

The dividend, however, does present a challenge, as while they are currently well covered by earnings, free cash flow to the firm only covers 0.16 of the dividends.

Finally, we see analysts are not optimistic about the firm’s future financial performance, giving negative single-digit outlooks to both revenue and earnings. With that said, earnings aren’t expected to fall as significantly as revenues, implying that margins are likely to improve, which gives us hope.

Author

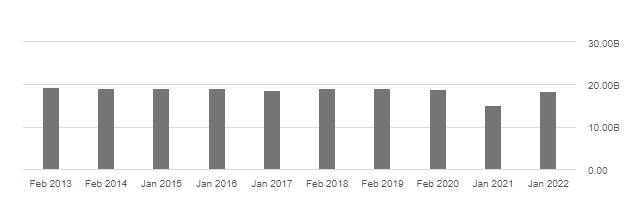

If we look backward in time at revenues, we can see KSS has had largely extremely stable sales in the past 9 years, save for the impact of COVID in 2021. Unfortunately, there is not much of a growth story in the firm’s past, but let’s look deeper.

Seeking Alpha

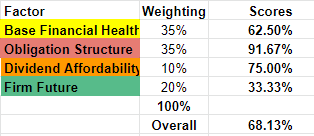

Tallying these scores and applying weights rounds KSS’ financial health to 68.13%. This shows the firm has quite significant challenges in its future outlooks and its base financial health metrics, but its debts are well managed and provide hope to investors.

Author

Assessing Kohl’s Pricing Attractiveness

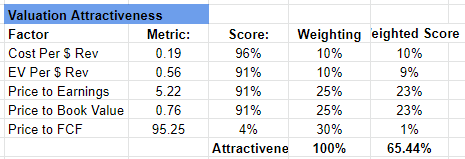

Next, we look at how KSS is priced vs. the comparison group of the “All US Stocks” Seeking Alpha screener.

The positive news here is that the firm appears to be trading at quite a significant discount across the board compared to the peer group, and provides us with a weighted score of 65.44% valuation attractiveness compared to the peer group.

Note that this is an attractiveness rating, not a valuation metric.

Author

Finding An Appropriate Valuation Method For Kohl’s

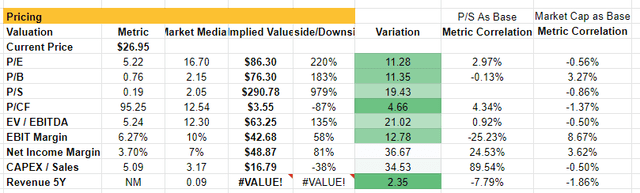

Using the peer group as our guide, we will consider a number of normal (and some non-standard) valuation methods for the firm, assess each metric’s “noisiness,” correlation with P/S and Market Cap, before settling on a few key metrics to lean on.

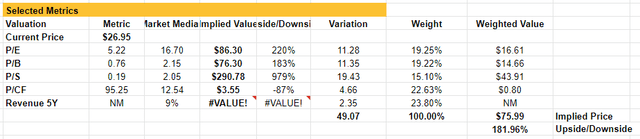

Having short-listed the metrics we want to use, we can see that investors have undervalued Kohl’s compared to the wider market, and this gives us an argument to see a very significant upside risk potential should the narrative for the firm improve.

Headwinds & Risks

The firm is clearly not without significant risks and headwinds.

Firstly, as far as investor sentiment goes, there is a very large short interest in the stock (13.12%) with 3.32 days to cover. The flip-side of this risk is that if news or results improved, and with some positive earnings surprises, a short-squeeze could very well be on the cards if investor opinions improved.

Next is the double-whammy risk of rocketing interest rates combatting surging inflation, which is sending the U.S. head-first into a recession. This represents a triple threat to the firm to navigate:

-

The firm must first be able to manage its debts carefully as costs of borrowing increase, though note that much of the debt is from bond issuances with fixed interest rates.

-

With rising costs of borrowing and increased inflationary pressures, consumer spending is likely to see a drop-off, creating a top-line challenge for the firm.

-

Lastly, when a recession is finally declared confidence is likely to be battered, mass layoffs will be in the cards and a further decrease in discretionary spending is to be expected.

The flip side to this risk is that Kohl’s has an Altman Z score of 3.22, which gives an objective rating of the firm’s insolvency risk that suggests that insolvency is not likely. And with the vast majority of long-term debt being fixed interest rate bonds debts (with coupons as low as 3.25%), interest rate rises won’t have a direct effect on the bottom line, nor the firm’s debt serviceability.

Conclusion

It’s clear that KSS is a stock with some financial and forward-looking challenges. But the market has over-sold these risks and offers investors a ~$18B established firm at a discount of 80% of market cap to revenues.

I give Kohl’s a Buy rating, with a valuation of at least a par-to Price/Book value to the market of $76.30 (183% upside), but I would consider this a risk-on trade with a careful eye on consumer spending. Further, I’d really like to see EBITDA margins improve regardless of the growth story in order to provide safety around the dividend.

With that said, it would be irresponsible of me not to point out that this analysis is limited in its scope to just a quantitative peer analysis. While we do look at the firm’s financials, it does not go searching for detail and context that one might find reading earnings transcripts. Further, the analysis is of the market as a whole but does not consider the specific industry the firm operates in and does not break down a near-peer comparison. Investors should use this analysis as a base-line for their analysis, but spend time looking at the firm’s qualitative aspects to further inform their thinking.

Be the first to comment