Andrey Mitrofanov/iStock via Getty Images

Investment Thesis

ConocoPhillips (NYSE:COP) is a play on oil with a very attractive total yield. There are a lot of different considerations to be mindful of, least of all around demand destruction, which is clearly a negative aspect weighing on the stock.

Meanwhile, for my part, I explain why I don’t see demand destruction as a likely scenario that could seriously kill this trade. Ultimately, I discuss why I’m bullish on COP.

What’s Happening Right Now

I believe that there’s a bullish scenario, yet the oil price appears to be overly focused on negative headlines.

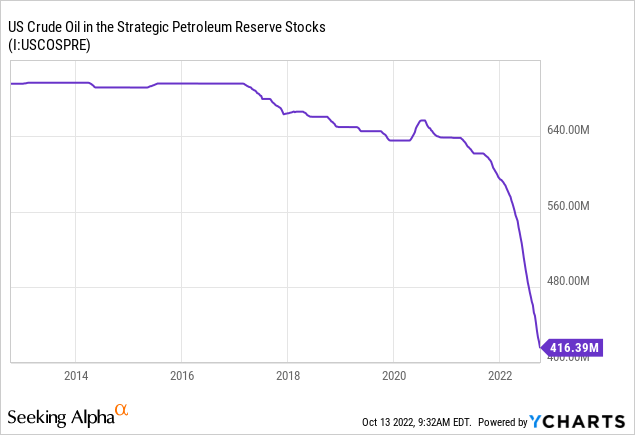

The graph above shows the US’s Strategic Petroleum reserves. The government has been pumping out a significant amount of oil into the economy in an attempt to stabilize oil prices. And whatever side of the aisle you are on, the fact is that oil prices clearly have come down. From President Biden’s Administration’s side, this effort clearly paid off.

But that reserve will need to be replaced too, which will support near-term oil prices.

Meanwhile, there’s so much pervasive fear about demand destruction. It’s nearly as if we are not an oil economy!

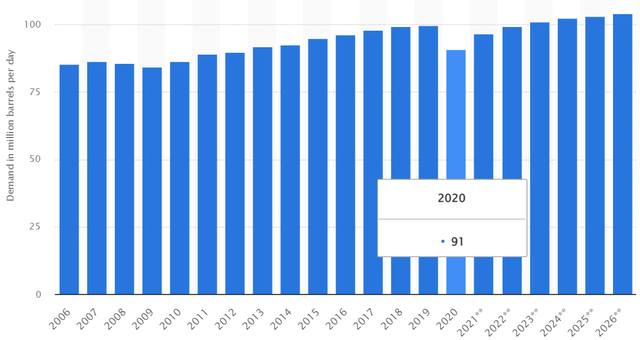

This leads me to my next point, what you see is that aside from 2020 when the world went into widespread shutdowns demand for oil typically stays very close to 98 to 99 million barrels per day.

Even in a global slowdown, it’s difficult to imagine that oil demand will go substantially below this range of 98 to 99 million per day.

Then, my final point is that China, the biggest oil-importing country, for now, continues to entertain lockdowns, thereby dampening oil demand. These lockdowns may not continue for too much longer, and there are already suggestions being floated that China could consider reversing this stance.

I believe that these 3 critical bullish considerations are being drowned out by minor negative headline risks.

Some people have put forward the suggestion that we are more likely to see $110 or even $120 WTI than we are to see $60. I obviously have no idea. What I can say is that one doesn’t need $90 or even $100 WTI for COP to be a compelling investment.

This investment is already compelling right now.

COP’s Near-Term Prospects

Let’s now consider what analysts are expecting for COP over the coming few quarters.

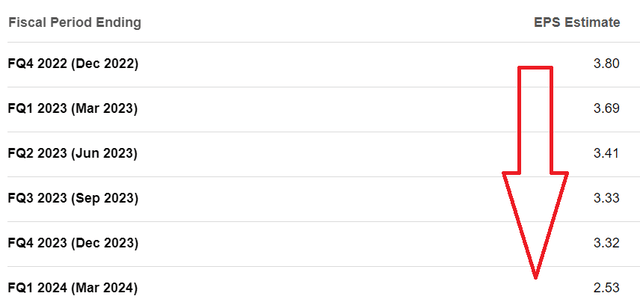

What you see for COP’s EPS estimates is that analysts have EPS earnings peaking in Q4, before EPS estimates turn lower. And I find this extremely interesting.

To illustrate my point, we know that COP is buying back shares. So even if its earnings stayed roughly unchanged, simply from COP buying back shares, that would mean that EPS figures should continue to move higher, or at least stay roughly the same.

But for Q4 2023 to be expected to be down 10% compared with this year’s Q4, strikes me as nonsensical. Indeed, we know that COP is paying down debt. For Q2 2022, COP paid down $1.9 billion of debt, which helped them reduce interest expenses when combined with interest on cash, by up to $100 million for Q3 2022.

Again, with less debt, and more share repurchases, on the back of roughly the same income, EPS figures should slowly trickle higher, not lower, as analysts forecast.

With this prelude, we’ll turn our focus to COP’s capital return program.

10% Total Yield, But Is It Sustainable?

When asked during the call in Q2 about how investors should think about COP’s shareholder return, this is what CEO Ryan Lance said,

That cash return portion as we think about the market and think about where the company is positioned. But I think roughly what you see this year is probably something closer to a 60-40 split between buybacks and cash [meaning dividends].

Recall, COP stated that it intended to return $15 billion back to shareholders, or 10% total yield.

And this takes straight to the heart of the bull case. Why would investors want to get a 10% total yield, which may or may not be sustainable, when they can get a 4% coupon on government debt, which is practically guaranteed?

For two reasons. Firstly, there’s a lot of reason to expect WTI prices to remain stable around this range of $70 to $90. Despite a slowing global economy.

Secondly, if investors become more confident around the sustainability of this 10% total yield, investors could soon flock to oil stocks, as they would perceive the risks of this total yield coming down to be small enough to back a large-cap oil company, such as COP.

The Bottom Line

Investing in oil companies is always difficult. There are good periods and bad periods. Stocks go down as well as up. That’s why oil companies are cheap, with amazing total yields, way above the risk-free rate.

And what’s the excuse for investing in tech? Hasn’t that been difficult in 2022? I don’t believe that anyone can today make the argument that only commodity companies are cyclical.

At least with commodities, the risks are explicit and that’s why they are cheap. And that’s likely why Warren Buffett is buying into the sector. Because these are known risks. While with tech stocks, it’s just as cyclical, we just didn’t fully realize it.

Be the first to comment