wepix/E+ via Getty Images

Just because there’s tarnish on copper, doesn’t mean there’s not a shine beneath. – Laurence Yep

The United States Copper Index Fund (NYSEARCA:CPER) is an exchange-traded fund (“ETF”) that tracks the SummerHaven Copper Index; the latter is structured to capture the returns of a portfolio of copper futures contracts on the COMEX exchange. The tracking index is rebalanced monthly, and one of the advantages of pursuing a product of this sort is that it attempts to maximize backwardation and minimize contango whilst utilizing liquid portions of the futures curve.

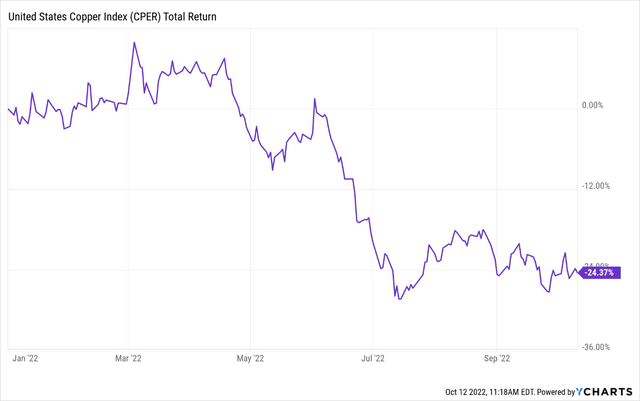

Nonetheless, on a YTD basis, CPER has faced a rough journey, delivering significant negative returns of -24%, even as the Bloomberg Commodity Index has delivered positive returns of ~18%.

Besides, as recessionary conditions across the globe gather pace, I can also understand investors’ apprehensions in pursuing a product of this ilk, particularly as copper is widely perceived to be a barometer of the health of the global economy.

Copper conditions

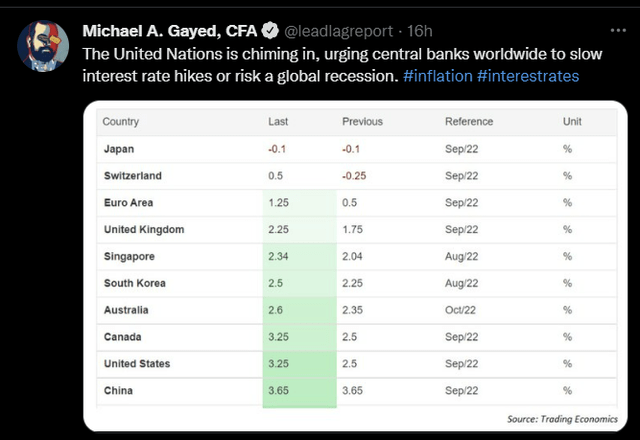

Much of the weakness in copper over the last few months has been primarily driven by demand-side conditions. As central banks the world over have tightened aggressively, excess liquidity has gone out of the market and this has weighed adversely on a host of base metal prices including copper. You could argue the ferocity and pace of rate hikes have caught a lot of stakeholders off-guard, and as noted in The Lead-Lag Report, the United Nations has been recently forced to step in and voice its concerns.

I believe people have been attaching too much importance to the demand side without considering what’s happening on the supply side, which, to me, appears to be a larger source of concern over the long term. This could well make copper a promising bet at these levels.

Firstly, with copper prices where they are, you will inevitably find reduced investments in this field as it becomes unsustainable.

Also note that regulatory uncertainties in two of the largest copper-producing countries – Chile and Peru – have dampened output, and the desire to make future investments. This is so because the regulatory regime in these nations has been looking to extract a greater proportion of profits from mining companies to help distribute wealth and reduce inequalities in their respective regions.

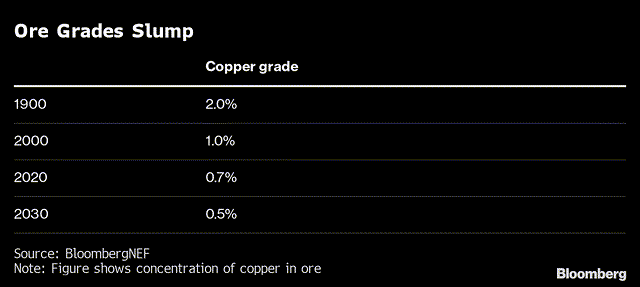

Further, copper mining investments are the need of the hour, as the quality of ore at mature mines has been fast-declining over time, as shown in the image below; declining ore quality would also mean that more rock would need to be broken down to produce the same quantity as before, dampening the economic incentive of mining even further.

Inflation too has left its mark on the cost of production involved in mining, reducing the prospect of further output. According to Goldman Sachs, the average incentive price to make mining more attractive is roughly 30% higher than what it was in 2018.

And it’s not as if near-term production is moving at full tilt, either; recently, the world’s largest copper producer – Codelco – cut its production outlook for the year from 1.61million tonnes to 1.49m-1.51m tonnes. Also consider that copper exports from the world’s largest exporting nation are currently down by 23%!

If new mines are not going to come on board, production appears to be stalling. You have this relentless pace of electrification, particularly in Europe, which is looking to wean itself off Russian dependence. You could face a significant deficit, particularly as bringing on board new supply is not something that can be addressed in a short period of time, and something that will likely takes decades. Indeed, according to S&P Global, we could be looking at a supply deficit in the copper market of 1.6m metric tonnes by 2035!

Conclusion

Those who follow The Lead-Lag Report Twitter account would note that I’ve been talking up the prospect of a potential melt-up move, and I suspect the dollar could be one of those chief candidates who may take it on the chin. Needless to say, this would do a world of good for copper, the currency in which the metal is priced.

Separately, also consider that since early August, the VIX has almost doubled from levels of 19 to relatively high levels of almost 35 currently. In 2020, my award-winning whitepaper explored the thesis of using the VIX to generate alpha by using passive sectors; in that paper, I’ve highlighted how rotating into cyclicals during periods of high volatility produced significant long-term alpha. Given where the VIX is currently, I believe rotating into something like CPER wouldn’t be a bad bet.

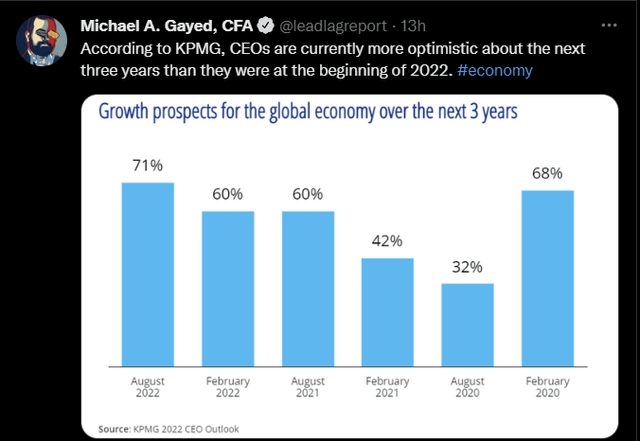

Besides, whilst currently, it may appear to be all doom and gloom, I put out some content on the timeline of The Lead-Lag Report highlighting how global growth prospects over the next three years look a lot more promising than what they did at the start of 2022. If central bank rate hiking endeavors go off the boil, and you see some form of QE come back to the table, that would be music to the ears of Doctor Copper.

Be the first to comment