toondelamour

Demand for genetic testing is growing fast and furious now that respiratory and COVID-19 testing is slowing. We are bullish on the at-home testing healthcare market but bearish for retail value investors on Fulgent Genetics, Inc. (NASDAQ:FLGT).

We do not forecast bright revenue and earnings per share. This stock faces several headwinds. It is not a potentially valuable opportunity, in our opinion, worth the lack of dividend and risk after one year of surprising growth.

Testing Market

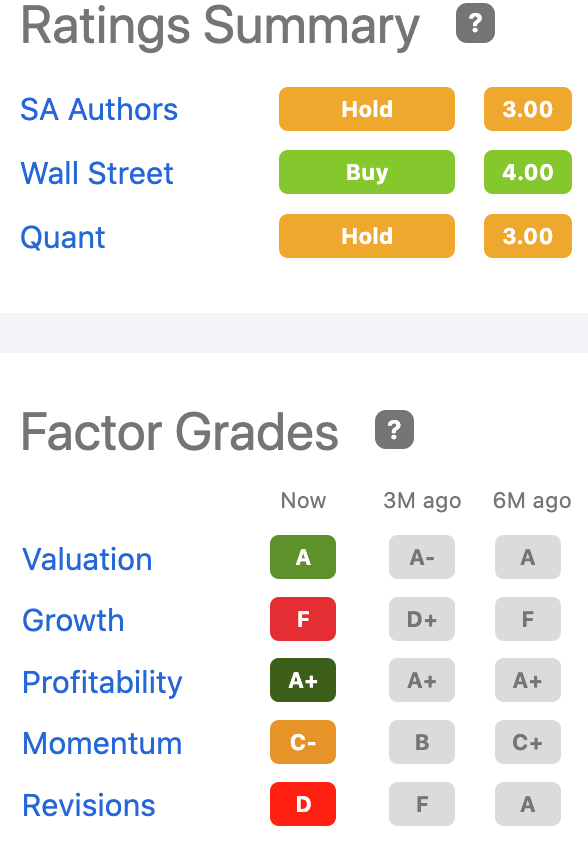

Fulgent Genetics might prove to be a long-term investment opportunity. Perhaps a larger firm sees Fulgent as an M&A opportunity wanting their proprietary scientific genetic testing advances? Growth potential seems limited by inadequate marketing to consumers. Seeking Alpha gives Fulgent relatively low grades for momentum and revisions.

The past year was profitable, but we do not expect future revenue and earnings per share to repeat FY ’21. The shares of other testing companies about which we wrote for Seeking Alpha, Trinity Biotech plc (TRIB), and EXACT Sciences Corp. (EXAS), are slumping, too.

Ratings and Grades (seekingalpha.com)

The genetic testing industry burgeoned when manufacturers produced and marketed rapid Medical Testing and Diagnostic Kits, or MTDKs, for at-home (and in medical offices) use. 2019 was one of its best years.

Individuals and medical personnel use MTDK tools to swab or take blood and DNA samples at home or in the office. They mail the samples to central labs. Results run through data banks. The data identify genetic links to unknown family members and for diseases, including malaria, HIV, cancer, and more. EXAS shares doubled in 18 months, hitting ~$95 in 2019. The shares skyrocketed to $154 in 2021.

Headwinds to Stock Growth

The market is highly competitive and dominated by pharma and biotech behemoths. Three headwinds slowed the rapid MTDK industry growth. The first is the shift in biotech business plans; stakeholders favor fast growth over building customer bases and long-term profitability. M&As by Exact Sciences contributed to a share price collapse; they tumbled down -65.6% to $32.16 near the time of this article.

Second, the pandemic brought a plethora of kits to market from heretofore unknown manufacturers. COVID test kits from China and elsewhere flooded the marketplace; many proved to produce unreliable results, increasing user skepticism about the disease and the kits. Lesser-known manufacturers and sellers offered them at giveaway prices. For example, Lloyds Pharmacy took to the Internet to advertise at-home kits for less than $2 each.

The third factor slowing the growth of the more costly but scientific-based testing industry was the rapid spread of the coronavirus. Labs focused on the disease that was killing millions; lab workers could not travel to work and they themselves got sick, and a lab worker shortage grew exponentially as the disease spread. Many never returned to work. Supply chain issues arose. Governments diverted resources and motivated manufacturers to develop C-19 rapid test kits at the expense of genetic testing kits and lab time for other diseases.

The Company

The genetic testing market is growing again at a CAGR of +10% annually. Genetic testing is growing concomitant with increasing attention and services to better healthcare and middle-class expansion. It’s projected that the genetic testing market will top $36B by 2030.

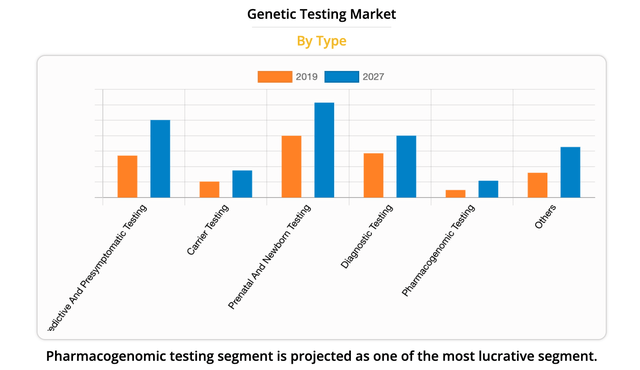

The primary markets for rapid MTDKs are:

· Predictive and pre-symptomatic testing

· Carrier testing

· Prenatal and newborn testing

· Diagnostic testing

· Pharmacogenomic testing

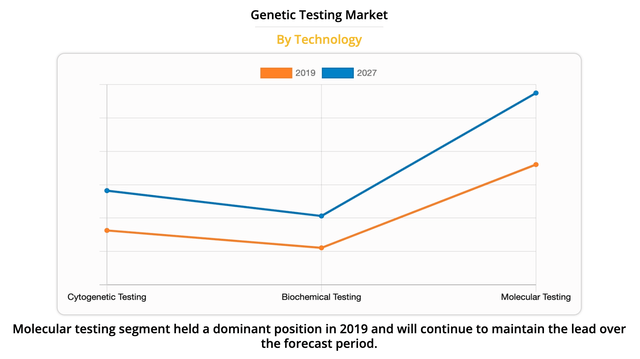

· Cytogenetic, biochemical, and molecular testing

· Cancer diagnosis, genetic disease diagnosis, cardiovascular diagnosis

Testing by Type (alliedmarketresearch.com) Testing Market (alliedmarketresearch.com)

Fulgent is a recent entrant into the genetic testing marketplace. Founded in 2011, Fulgent is now a full-service genomic testing company built around a foundational technology platform. Fulgent focuses on testing in oncology, anatomic pathology, infectious and rare diseases, and reproductive health. They have 7 certified labs in the U.S. and a slew of accreditations. Its most noteworthy accomplishment is that Fulgent was the first clinical lab offering copy number variation detection using NGS technology.

Valuation

Shares are down over 52% in the past 52 weeks despite having closed 2021 at around $100. From the peak, the share price steadily descended to about $36 in October ’22. Short interest rose to 6.31%, which we find uncomfortable.

Seeking Alpha authors recommend holding shares. SA’s Quant Rating calls for holding the stock. The stock status has been on hold for ten months, since early ’22. There are no expected events sparking much movement in the share price. Even the Beta rating is below market volatility, standing at 0.88.

We think a fair average price target for Fulgent Genetics’ shares over the next 12 months is a high of $41.00 if revenue and earnings beat forecasts. The company will likely continue to be profitable, but the looming recession might limit consumer healthcare-testing spending.

Fulgent debt is a mere ~$21M, while equity tops $81M. So far, the company reports strong operating cash flow and earns more interest than it pays. Cash and investments are $515.4M, receivables are $137.5M, and other assets +$808M. But the company does not pay any dividends, so holding for the long term in this market environment may cost money to investors.

Valuations from others range from $67 to $146, but we discount them. The company is young and historical multiples, past returns, and future growth estimates are based on uninspired guesswork in our opinion.

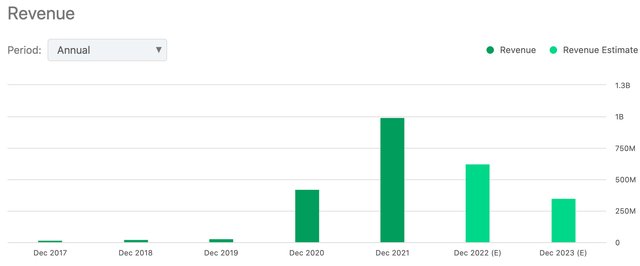

Revenue Chart (seekingalpha.com)

Concomitantly, corporate insiders have been unloading shares for a while. They sold shares worth about $240K in the last three months; they sold far many more shares over the past 11 months than corporate insiders bought. Hedge funds lowered their holdings by 1.4K shares last quarter. 24 funds held Fulgent stock at the end of last year, but only 18 funds hold shares today. The consensus is that 2021 was a banner revenue year ($992.58M).

Revenue estimates for 2022 are much lower, reaching $623.67M. We forecast the earnings per share to be about 5 cents in Q3 compared to $4.05 for the same quarter last year. Class action alerts are being issued against the company.

Takeaway

Fulgent Genetics is cash rich. The company has a healthy 73.7% gross profit margin. Their net income margin is over 42%. Management needs to build growth and momentum in order to build revenue and earnings. That means spending money on marketing to secure a loyal customer base.

We like that almost 30% of the outstanding shares are owned by insiders, but it is the CEO who owns 26% of the 30%. Another 44% are owned by institutions, which is surprising since Fulgent is a relatively small market cap company ($1.13B) for this owner class. A few influencers are most likely deciding the big issues at Fulgent.

They are in the right industry because this segment of healthcare is growing. Management should heed Mark Twain that growth is the most rigorous law of our being. Retail value investors might not want to risk money in Fulgent Genetics until growth and momentum are more robust.

Be the first to comment