xavierarnau

Due to the increased demand for imported goods in 2021 and the first half of 2022, combined with the severe port congestions across the world caused by the COVID-19 restrictions, charter rates skyrocketed. Danaos Corporation (NYSE:DAC) stock price jumped from below $10 in October 2020 to more than $100 in March 2022. However, due to the falling demand for imported goods and easing port congestion, container freight and charter rates plunged and as a result, DAC’s stock price dropped to $55 per share. I do not expect charter rates to bounce back in the near term; however, even with the current rates, Danaos is well-positioned to remain profitable. The stock is a hold.

Quarterly highlights

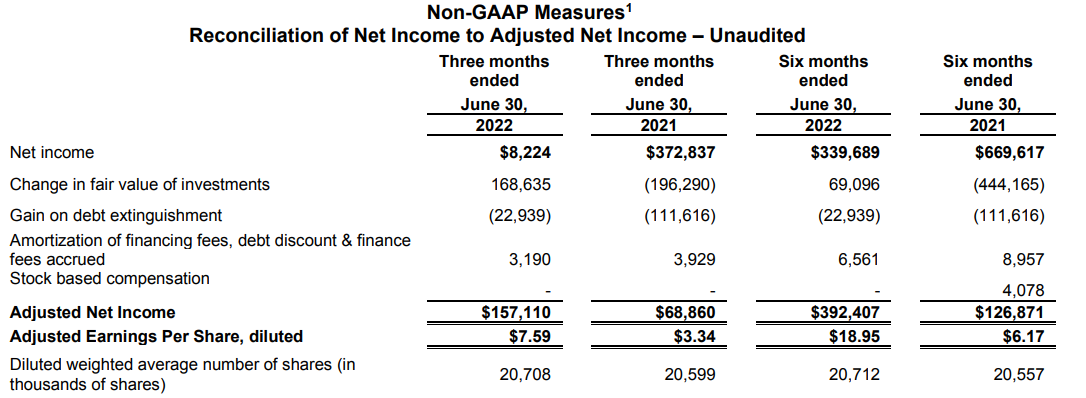

In its 2Q 2022 financial results, Danaos reported operating revenues of $251 million, compared with 2Q 2021 operating revenues of $146 million, driven by higher charter rates and incremental revenue generated by newly acquired vessels. DAC’s vessel operating expenses increased by 23% to $10.6 million, driven by the increased average number of vessels and increased average daily operating cost for vessels on time charter. The company’s net income dropped from $373 million in 2Q 2021 to $8 million in 2Q 2022. However, DAC reported an adjusted net income of $157 million in the second quarter of 2022, compared with $69 million in the same period last year. DAC has adjusted its net income in 2Q 2022 for the change in fair value of its investment in ZIM Integrated (ZIM), gain on debt extinguishment of $22.9 million, and non-cash free amortization of $3.2 million (see Figure 1).

“Danaos business model continued to generate strong results in the second quarter, more than doubling our adjusted net income compared with a year ago. Given our fixed charter coverage over the next 12 months, we expect these metrics to improve further. At the same time, however, we are closely following macroeconomic conditions and the potential impacts on our industry,” the CEO commented.

The adjusted EBITDA of the company increased from $104 million in 2Q 2021 to $192 million in 2Q 2022. DAC’s total contracted cash operating revenues were $2.3 billion as of June 30, 2022, and the remaining average contracted charter duration was 3.6 years. In the second quarter of 2022, the company made an early repayment of $434 million of debt and lease indebtedness and as a result, realized a $23 million gain. “We are also insulated from rising interest rates as we have reduced our floating rate debt to a level nearly equal to our cash and marketable securities,” the CEO explained. Finally, Danaos has declared a dividend of $0.75 per share of common stock for the second quarter of 2022. At the end of July 2022, the company repurchased 409200 shares of its common stock in the open market for $25.1 million.

Figure 1 – Reconciliation of net income to adjusted net income

2Q 2022 financial results

The market outlook

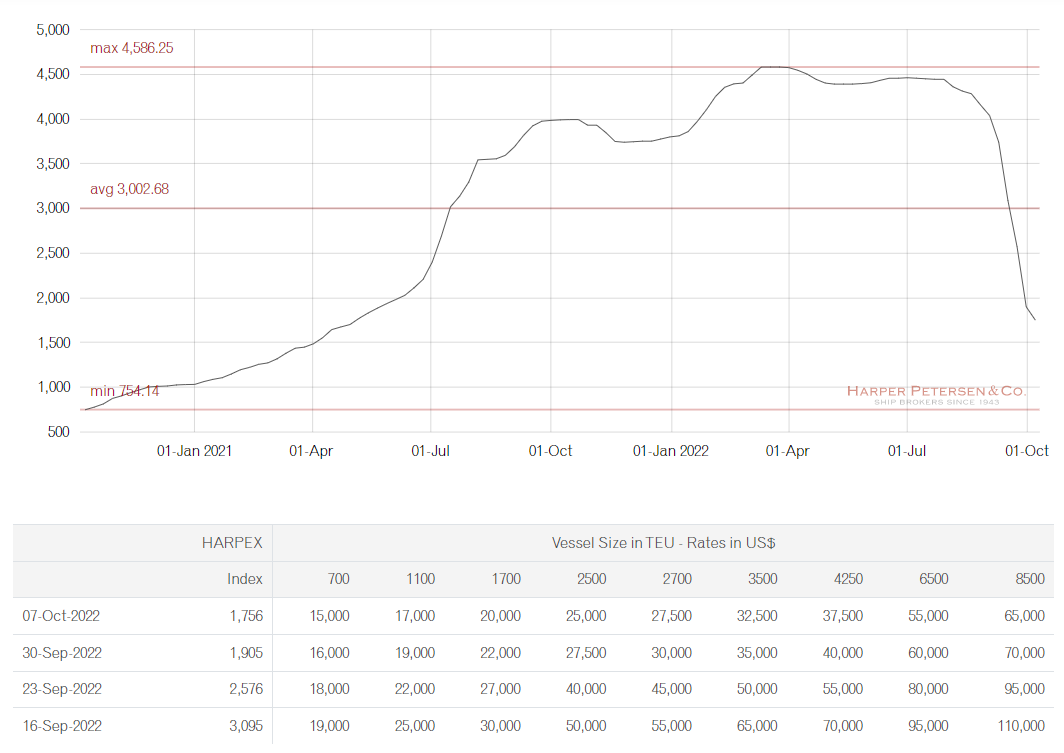

Figure 2 shows the Harper Petersen Charter Rates Index (HARPEX), reflecting the worldwide price development in the charter market for container ships. According to HARPEX, charter rates plunged during the third quarter of 2022. HARPEX has more than halved compared to October 2022. The demand for container vessels may decline further due to high inflation and increased interest rates that decrease the demand for imported goods. As a result of increased food and energy prices, consumers’ spending behavior has changed. Now, they spend more on food and gas and spend less on imported goods Also, the trade disruptions caused by the war in Ukraine, combined with the slow economic growth of China that continues to struggle with its zero-COVID policy, will limit the potential of container vessels charter rates to bounce back. Finally, due to the lower level of congestion, the container shipping capacity is increasing, making spot freight and charter rates decline further.

Figure 2 – Harper Petersen Charter Rates Index

www.harperpetersen.com

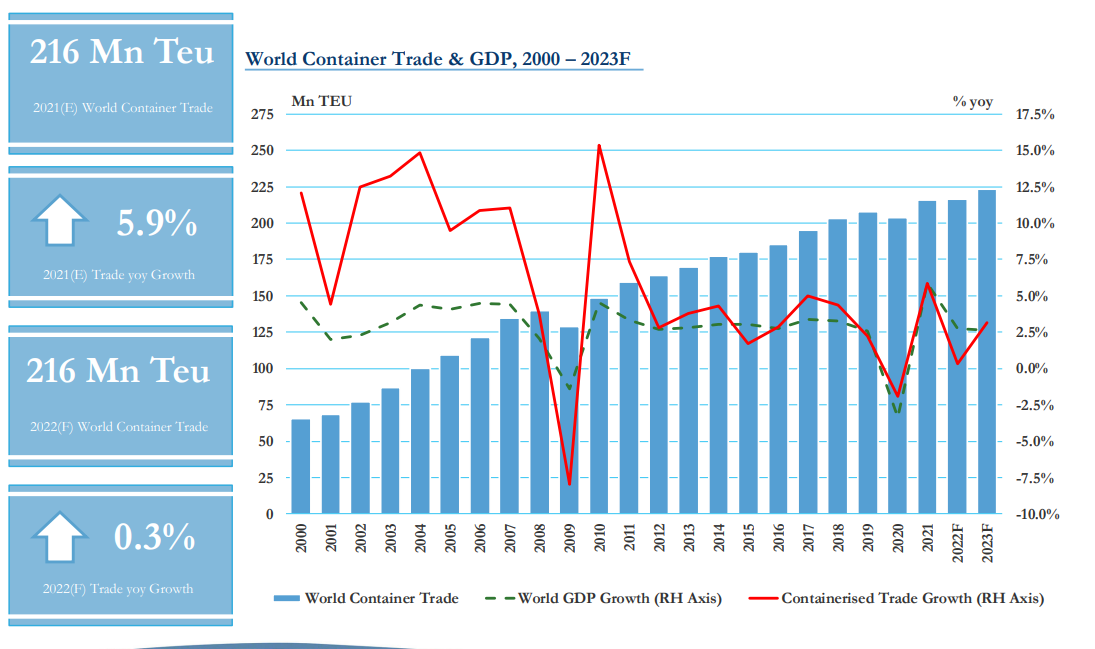

On the other hand, Geopolitical events, high energy prices, inflation, and the interest rate outlook, combined with supply chain disruptions, have decreased the pace of new vessel deliveries. Also, the new environmental regulations will restrict the capacity from increasing. Figure 3 shows Maritime Safety Information’s (MSI) estimation of the world container trade, the world GDP growth, and containerized trade growth in 2022 and 2023. MSI expects that in 2023, the world GDP growth rate and the containerized trade growth to be about 2.5%. Also, world container trade is expected to increase by 3.2% to 224 million TEU in 2023, from 217 million TEU in 2022. Thus, as much as I do not expect charter rates to increase to their high levels, I do not expect the rates to decrease to their levels in 2022.

Thus, in the short term, I don’t expect charter rates to increase to the levels they were six months ago. However, charter rates will stay higher than in 2020 and the first quarter of 2021. Container shipping companies can stay profitable with the current rates. With a charter backlog of $2.3 billion through 2028 and strong operating days contract coverage of 99% for 2022 and 80% for 2023, DAC is one of the most efficient operators in the container shipping industry. I believe that the company is able to stay profitable and financially healthy even with lower charter rates.

Figure 3 – Estimation of the world container trade

2Q 2022 presentation

DAC performance outlook

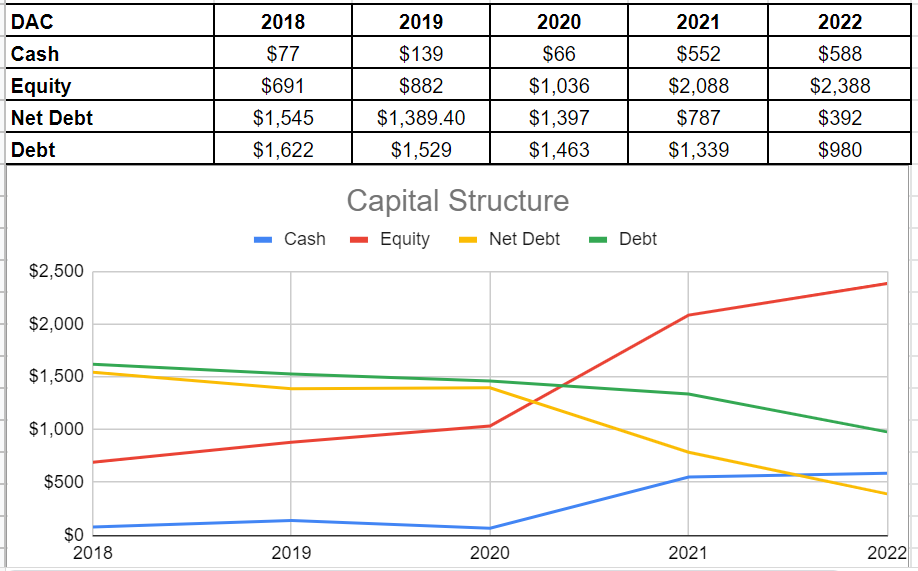

Since the end of 2021, the company’s cash and equivalents increased roughly by 6% to $588 million in TTM versus its amount of $552 million at the end of 2021. The company’s deep drop in its debt amount of $1339 million at the end of 2021 to $980 in TTM combined with a slight increase in cash generation has led to a deep decline in its net debt. DAC’s net debt plunged from $787 million at the end of 2021 to $980 million in TTM. Furthermore, DAC’s total equity improved by 14% to $2.388 billion in TTM compared with its previous amount of $2.088 billion at the end of 2021. Thankfully, the company’s net debt and total equity are well enough to tailor a scope of capacity to bring benefits for its shareholders and assimilate upcoming risks. Thus, DAC’s capital structure prospects a healthy position and enables the company to increase its distributions (see Figure 4).

Figure 4- DAC’s capital structure (in millions of USD)

Author (based on SA data)

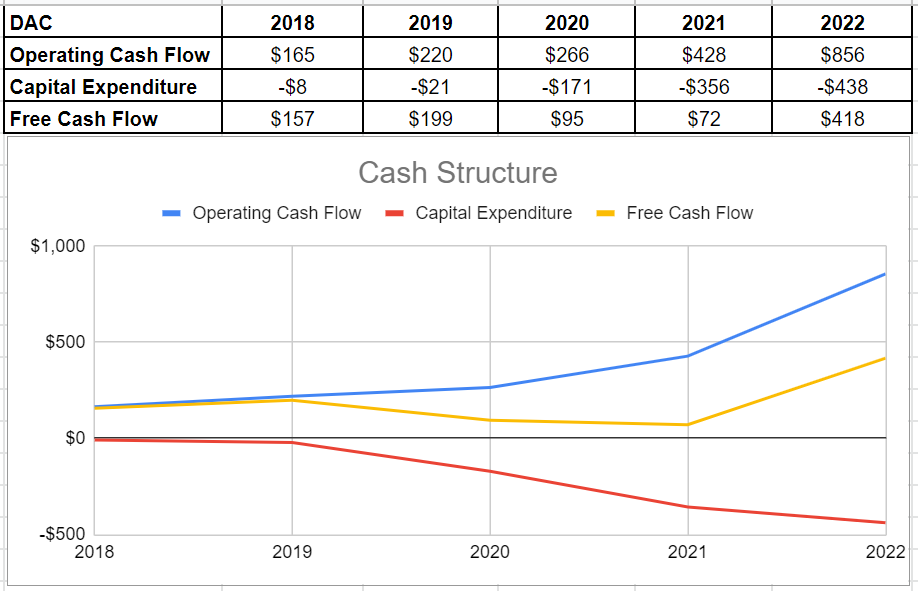

After the downturn of 2019 and 2020 due to the COVID-19 pandemic, the company has started the recovery process successfully. Its cash operation in TTM has twofold to $856 million compared with its amount of $428 million at the end of 2021. Danaos Corporation’s capital expenditure increased by around 23% to $438 million in TTM versus its previous amount of $356 million at the end of 2021. When all was said and done, the company ultimately generated $418 million of free cash flow currently, which indicates an amazing rise from its previous amount of $72 million in 2021. This is the highest amount of free cash flow that Danaos Corporation has had since 2018, which caters to a scope of capability for more reliable distributions in the future (see Figure 5).

Figure 5 – DAC’s cash structure (in millions)

Author (based on SA data)

Summary

The demand for container vessels has plunged in the past few months, and the market condition outlook for DAC is not good. However, my analysis shows that DAC is financially healthy. Its capital structure, free cash flow condition, and debt management help the company to remain stable even with lower charter rates. The stock is a hold.

Be the first to comment