aquaArts studio/E+ via Getty Images

By James Stack

Consumer optimism improved quickly coming out of the COVID-19-induced recession in 2020 as the economy was steadily recovering and multiple rounds of stimulus checks were distributed… but that outlook has since changed.

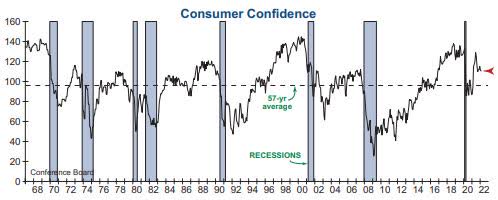

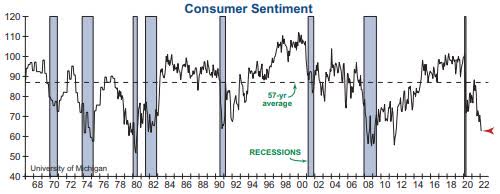

Among the most surprising developments of 2021 was the collapse in consumer confidence and sentiment survey results amidst the strong post-pandemic recovery. As inflation pressures climbed meaningfully higher, both Consumer Confidence from the Conference Board and Consumer Sentiment from the University of Michigan dropped below their post-pandemic highs.

The Consumer Confidence survey generally reflects how consumers assess the state of the broader economy. Confidence peaked in June of last year but is still well above its 2020 recessionary low, as the abundance of job openings and a tight labor market have kept this indicator at a historically strong level. Yet, concerns have started to emerge over how long this economic strength will last.

Consumer Confidence (Author)

On the other hand, Consumer Sentiment has plunged to a level typically only reached during recessions, as inflation is weighing very heavily on how consumers feel about their personal financial situation. Sentiment is now far below its pandemic lows, and that’s a potential warning shot across the bow for the U.S. economy.

Consumer Sentiment (Author)

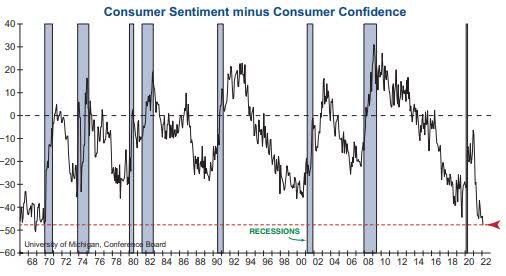

While both surveys are trending lower, the graph below reveals a historical significance when the measure of Sentiment falls far faster than that of Confidence – as it has today. The differential between Sentiment and Confidence is now at the third-most negative reading on record, exceeded only by a two-month period in 1968 when inflation was also surging higher.

When this differential has fallen to such an extreme level, a recession has ultimately followed, with the eventual confirmation typically marked by a big drop in Confidence (sending the differential to a less-negative level).

Consumer Sentiment Minus Consumer Confidence (Author)

There is no telling how much larger this differential could become or how long this dynamic could last before it reverses. However, this is clear evidence that the risk of recession is rising.

Originally published on MoneyShow.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment