DNY59/E+ via Getty Images

The Fed has just committed the biggest policy error ever

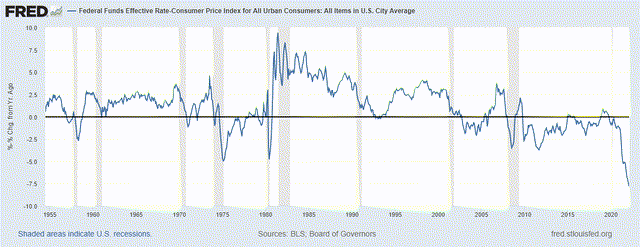

The data on Effective Federal Funds rate starts from 1954 on FRED. Since 1954, the Effective Federal Funds rate has been on average 1% higher than the annual inflation rate CPI. In June of 1981, the Federal Funds rate was almost 10% higher than CPI inflation rate. There were several episodes when the Federal Funds rate was below the CPI inflation (during the recessions of 1958, 1975, 1980, after the 2000 dotcom bubble, and during and after the great financial crisis of 2008). In each of these cases, the difference never went below -5%. Currently, the Federal Funds rate is around 7.8% below the CPI inflation – this is the lowest point in history! Here is the chart:

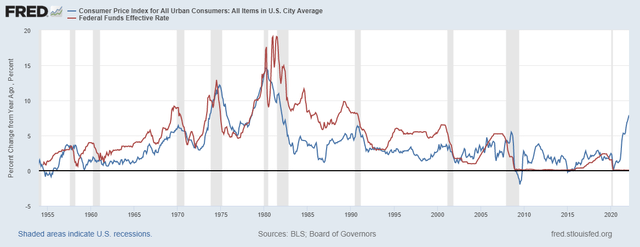

The chart below shows the historical co-movement between the Federal Funds rate and the CPI inflation. Obviously, the correlation is positive and high – the Federal Funds (red line) rate closely tracks the CPI inflation (blue line), and the red line is usually above the blue line. Here is the chart:

The difference between the Federal Funds rate and the CPI inflation can be used as a measure of the real interest rate, but also it can indicate the Fed’s miscalculation of inflation, and thus, point to the possible Fed’s policy error. Here is the brief analysis of each episode on negative real interest rate.

The cases of 1958, 1974, 1981

The previous episodes when the Federal Funds rate was below the CPI inflation were during the recessions of 1958, 1974, 1981 when the Fed correctly predicted a falling inflation and lowered the Federal Funds rate below the CPI inflation to create a temporary negative real interest rate to kick-start and boost the post-recession recoveries.

Prior to the recessions of 1974 and 1981, the Fed hiked the Federal Funds rate far above the CPI inflation to lower the inflation expectations, which in-fact caused the recessions, and thus, subsequently the Fed lowered the Federal Funds rate below inflation rate. However, it could be argued that a temporary negative interest rate in 1974 contributed to an even larger spike in inflation leading to the 1981 recession. Similarly, the Fed interest rate cuts below the CPI in 1981, possibly contributed to an even larger inflation spike and recession in 1982. Thus, both of these cases are possible Fed errors, which led to an even higher inflation, and a recession.

Consequently, the Fed had to raise the Federal Funds rate for almost 10% above inflation after the recession of 1982 and keep the spread positive for more than 10 years to “slay the inflation dragon” and fix the previous Fed policy errors.

The post-2000 recession Fed policy error

The Fed committed the obvious policy error after the 2000 recession when it kept the Federal Funds rate below the CPI inflation for a long period, which contributed to the housing bubble and caused the great financial crisis of 2008, also the commodity price bubbles, and a weaker US dollar. Yet, during the period, the CPI inflation was stable, which provides some justification of the Fed’s “patience”, as the FF-CPI spread never went below the -2% level.

The post-2008 recession Fed (even bigger) policy error

Similarly, the Fed kept the Federal Funds rate near 0% and below the CPI inflation after 2008 recession for almost 10 years, which was an even bigger Fed policy error, as it caused the everything-bubble. However, during this period the CPI inflation was low, and even reach the deflationary levels, which could possibly justify the Fed’s determination to boost inflation by keeping the negative real interest rate for longer. The FF-CPI spread never went below the -3.5% level.

The (biggest ever) Fed policy error post-2000 recession and during covid19

The 2020 recession was in cards even before the covid-19 crisis. However, in response to the pandemic related crisis, the Fed lowered the interest rates to 0%, and engaged in Quantitative Easing program, which essentially prematurely ended the 2020 recession and artificially prolonged the liquidity-based cycle from 2008.

The pandemic has created a very specific shock because it is both a supply-side shock that causes a higher inflation, and a demand-side shock that causes lower growth. The Fed chose to boost the demand, while anticipating that the supply-side problems will be transitory, and thus allowing for inflation to rise until supply side pressures ease. As a result, the CPI inflation kept rising to over 7%, while the Fed kept the interest rates near 0% and still injected liquidity via QE.

The Fed misjudged the rising inflation as simply pandemic-related and transitory. The US-China trade war before pandemic started the global race for the semiconductors as well as other critical resources, accelerating the trend of de-globalization. De-globalization by definition increases inflation as trade barriers increase. De-globalization also increases domestic wages as some jobs return. Further, anti-immigration policies reduce the labor force.

As a result of this historic policy error, the Fed is now facing the largest spread between the Federal Funds and CPI inflation ever, in an environment of rising long term inflation expectations and possibly slower growth. If the Fed is serious about re-anchoring longer term inflationary expectations, it might have to hike far above the CPI – like in 1980s. The Fed did signal an “aggressive” hiking cycle, with the terminal rate at only 2.8% – but this is not nearly enough unless CPI miraculously falls, which is exactly what the Fed is hoping for.

The Fed’s credibility

It appears that after the 2000 recession, the Fed kept repeating the same mistake, and each policy error was bigger and more systematically dangerous. The stock market learned to depend on the Fed’s support, and the Fed is terrified of disappointing the stock market, or the Fed has a “secret” primary mandate to support the stock market, hoping for a positive wealth effect.

Given the Fed’s currently expected hiking cycle, the bond market has started to price in the recession, by inverting the yield curve. Yet, the stock market does not believe the Fed will actually execute it, and it still lingering near all-time highs, after bouncing from the 13% correction. In other words, the Fed’s credibility has been tarnished. The Fed has either failed in forecasting inflation, or it’s consumed with protecting the stock market at all costs. How else can one explain the Fed’s policy of injecting liquidity in March 2022 via QE with inflation at 7.9%?

Implications for investors

I was bullish on S&P 500 (SPY) as recently as January 28th, when I recommended to buy the dip. However, the stock market fundamentals significantly changed since, and I recently recommended to sell stocks. Note, the recommendation to sell stocks is really once in a decade event (on average), and it’s usually due to the policy error and a consequent recession.

At this point, the Fed is behind inflation the most ever, with the spread between the Federal Funds rate and CPI inflation below -7%. The Fed and stock market bulls can only hope that CPI would decrease as the pandemic-related supply side pressures subside. However, de-globalization, which has been accelerated first via US-China trade war, second via pandemic, and finally via Russian invasion of Ukraine, presents longer term inflationary (stagflationary) pressures without a quick-fix transitory solution.

If the Fed is serious about restoring credibility, it will have to hike Federal Funds rate much higher than the currently anticipated 2.8% terminal rate, which will inevitably cause the next recession, and the next bear market in stocks, which is possibly underway already. Due to the Fed’s biggest policy error ever, now is that rare opportunity to actually sell stocks, and wait for the Fed to catch up with inflation.

Be the first to comment