Abu Hanifah/iStock via Getty Images

When it comes to the REIT space, investors are given tremendous flexibility in how they invest. The different asset classes and regions that different prospects focus on make diversifying a portfolio rather easy. One prospect that serves as a diverse player in the REIT market, with ownership over office, retail, multifamily, and mixed-use properties is American Assets Trust (NYSE:AAT). In addition, the company focuses on a few key markets, namely California, Oregon, Washington, Texas, and Hawaii. Fundamentally, the company has done well in these markets, successfully growing the enterprise’s top and bottom lines over an extended timeframe. Having said that, shares today do still strike me as being more or less fully valued. So while the company may be a quality operator with attractive long-term potential, I would make the case that there are still better prospects on the market to be had today.

Assessing updated performance

Back in October of 2021, I wrote my last article on American Assets Trust. At that time, I had shifted my position for the company, changing from being bullish about it to being neutral. I felt as though, despite the company generating fundamentally attractive figures, its overall upside in the near term was limited. Since then, shares have performed more or less as I would have anticipated. In all, they have achieved investors a profit of just 0.6%. That compares to the 5.4% return achieved by the S&P 500 over the same window of time. Make no mistake. This was not the first time that I wrote about the company. It was, in fact, my third. In my very first article on the company, published in February of last year, I came out recommending the stock as a ‘buy’ prospect. From that date through this writing, shares have seen a return of 38.3%. That’s more than double the S&P 500’s 17.5% return over the same window of time.

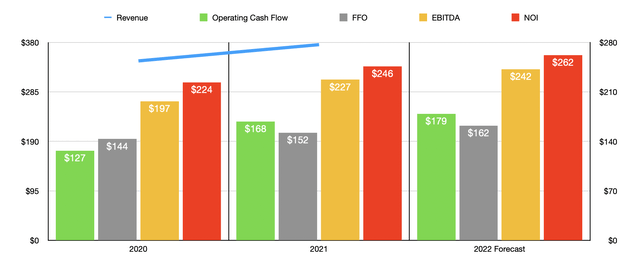

Author – SEC EDGAR Data

Although the company has failed to keep up with the market recently, this is not to say that fundamental performance has suffered. In fact, the company has been doing quite well for itself. For the full 2021 fiscal year, revenue came in at $375.8 million. That compares to the $344.6 million generated the same time one year earlier. This is where the beauty of a diverse REIT comes into play. Even though the company saw the occupancy rate of its office properties drop from 93% at the end of 2020 to 90.4% at the end of 2021, it saw its occupancy rate for other assets improve. For its retail properties, the improvement was from 90.7% to 92.6%. For the mixed-use properties, the increase was from 89.2% to 89.6%. The biggest improvement, however, came from its multifamily assets. This number surged, rising from 86.2% to 96%. Investments management made into their operations also paid off. The latest such investment came in early March of this year when the company acquired, for $45.5 million, Bel-Spring 520, an office campus boasting 93,000 square feet of space.

Operating cash flow also fared quite well, rising from $127 million to $168.3 million. That implies a year-over-year increase of 32.6%. There are, of course, other profitability metrics to consider. One of these is FFO, or funds from operations. In 2021, this figure came in at $152.3 million. That represents an improvement over the $143.5 million generated one year earlier. NOI, or net operating income, expanded from $223.5 million to $246.1 million. And EBITDA for the company grew from $196.9 million to $227.4 million.

When it comes to the 2022 fiscal year, management has offered some guidance. At present, they anticipate FFO per share of between $2.09 and $2.17. Given the company’s current share count, this should translate to FFO $162.2 million. If we apply the same year-over-year growth rate of 6.5% to the company’s other profitability metrics, then we can anticipate operating cash flow of $179.2 million, NOI of $262.1 million, and EBITDA of $242.2 million. All of this allows us to effectively price the company as it stands today.

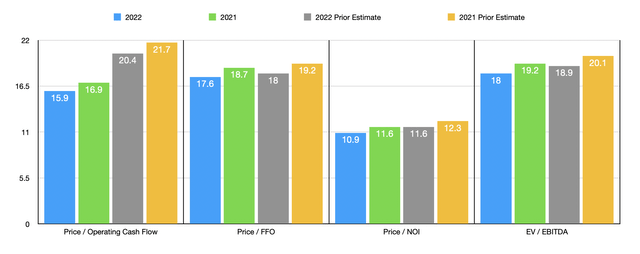

Author – SEC EDGAR Data

Using the company’s 2021 results, the price to operating cash flow multiple with the business should be 16.9. This drops to 15.9 if we rely on 2022 estimates. The price to FFO multiple of the firm would be 18.7, dropping to 17.6 if we use the 2022 estimates. Meanwhile, the price to NOI multiple should improve from 11.6 to 10.9. And the EV to EBITDA multiple of the company should go from 19.2 to 18. It is worth noting how these valuations stack up against my estimates when I last wrote about the firm. As you can see in the chart above, on a price to FFO basis, as well as on a price to NOI basis and on an EV to EBITDA basis, the company has gotten cheaper irrespective of whether we use the 2021 figures or the 2022 figures. But these improvements have been only marginal. The only area of significant improvement was when using the price to operating cash flow multiple. For instance, using our 2021 figures, this number dropped from 21.7 to 16.9. For the 2022 figures, it dropped from 20.4 to 15.9.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 13 to a high of 24.3. Three of the five companies were cheaper than American Assets Trust. I then did the same thing using the EV to EBITDA approach, resulting in a range of 14.8 to 30.7. In this case, three of the five companies were cheaper than our prospect as well.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| American Assets Trust | 16.9 | 19.2 |

| Essential Properties Realty Trust (EPRT) | 17.9 | 22.0 |

| Washington Real Estate Investment Trust (WRE) | 24.3 | 30.7 |

| Broadstone Net Lease (BNL) | 14.7 | 17.9 |

| Alexander & Baldwin (ALEX) | 13.7 | 19.3 |

| Empire State Realty Trust (ESRT) | 13.0 | 14.8 |

Takeaway

All things considered, I do believe that American Assets Trust remains an interesting company and its continued growth likely means that it will create some upside for investors at some point in time. But I also feel, just as I did in October of last year, that shares have become more or less fully priced. If I were judging this based solely on the price to operating cash flow multiple, my opinion would be different. But seeing the other three improve only marginally makes me feel confident in my stance. In short, while the company has offered strong returns over the past year or so, I do believe that the easy money has been made.

Be the first to comment