Ranimiro Lotufo Neto/iStock via Getty Images

Note:

I have previously covered Diamond Offshore Drilling (NYSE:DO), so investors should view this as an update to my earlier articles on the company.

On Wednesday, leading offshore driller Diamond Offshore Drilling (“Diamond Offshore”) made its comeback on the Big Board after the company failed to sell itself following its emergence from bankruptcy.

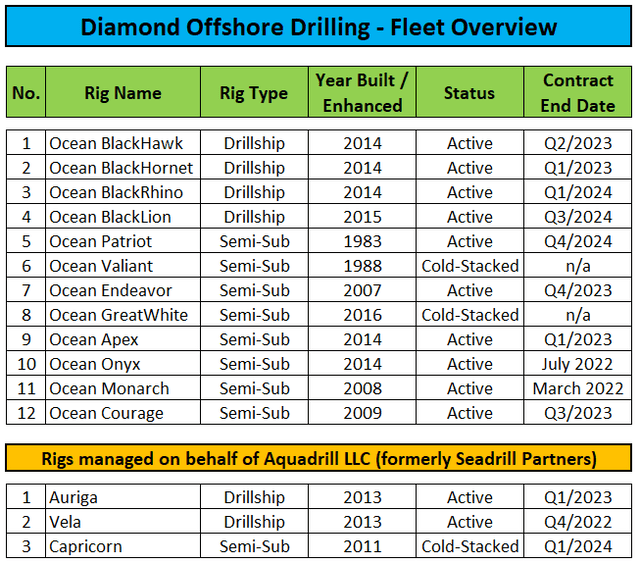

After retiring three additional semi-subs last year, Diamond Offshore’s fleet is down to just 12 rigs:

Fleet Status Report

In addition, the company is managing three rigs for Aquadrill LLC which most investors likely know under its previous name Seadrill Partners after the company cut ties with former parent and sponsor Seadrill. Diamond Offshore expects $10 to $15 million in cash flow contribution from the Aquadrill management contracts this year.

Adjusted for the Aquadrill contracts, Diamond Offshore’s backlog at the beginning of the year calculated to $1.1 billion.

With most of the company’s fleet working on long-term contracts, only two semi-subs currently operating offshore Myanmar and Australia, respectively, will become available later this year thus providing limited short-term upside for the company.

That said, two of Diamond Offshore’s high-specification drillships with a decent track record in the red hot Gulf of Mexico will become available in the first half of next year. Depending on contract duration and assuming no crash in oil prices, I could easily envision the dayrate for these rigs to approach $400,000.

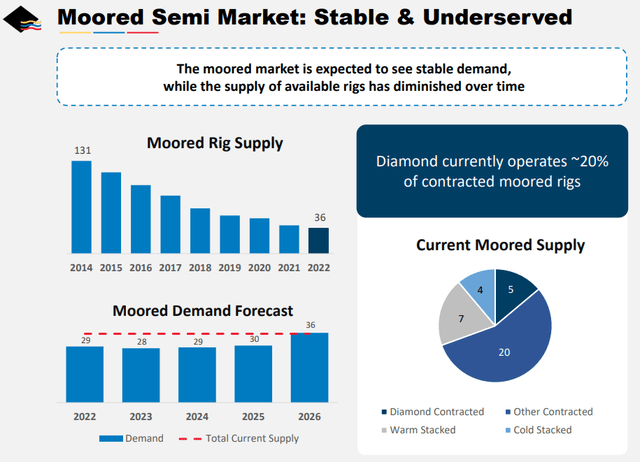

Diamond Offshore is also widely known for its stronghold in the moored semi-submersible market but rates for this niche asset class are lagging behind the drillship segment which has recently been boosted by strong demand in the Gulf of Mexico.

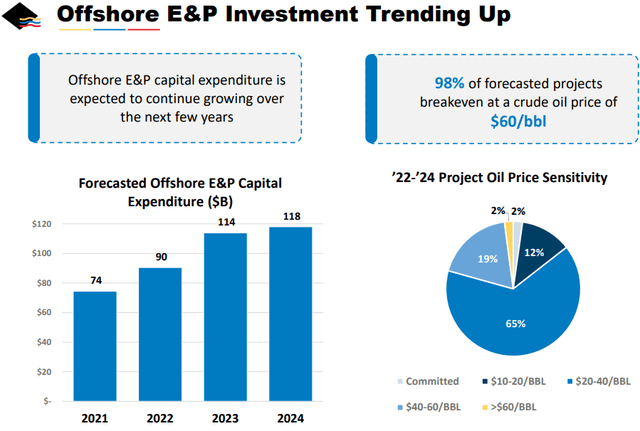

But even without recent geopolitical tailwinds, the industry has been preparing for offshore drilling demand to pick up considerably over the next couple of quarters with an increase in new projects likely to result in balancing demand and supply in the floater market with some regions likely to approach 100% utilization sooner rather than later.

Company Presentation

While supermajors have reiterated their commitment to capex discipline there are signs of increasing demand in West Africa and the North Sea. Activity in South America is already decent and should increase further going forward.

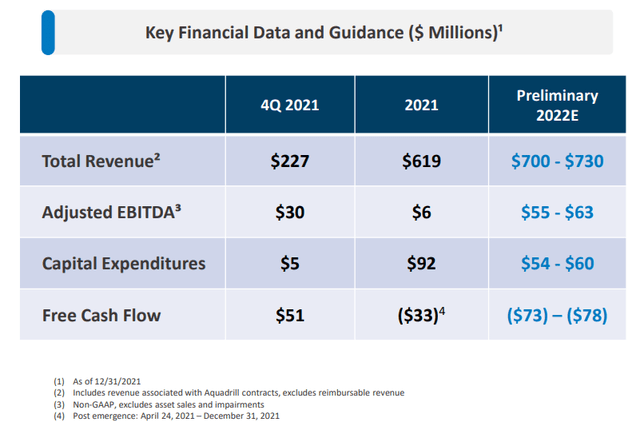

Looking at the company’s financials, the balance sheet shows a little over $200 million in net debt at the end of Q4.

With $38.4 million of unrestricted cash on hand and almost $300 million available under the company’s revolving credit facility, Diamond Offshore won’t face any near-term liquidity issues despite expectations for another year of negative free cash flow:

Company Presentation

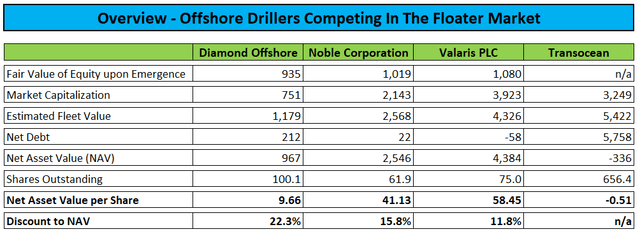

From a valuation perspective, Diamond Offshore looks like a bargain as shares are trading considerably below the assumed fair value of the company’s equity upon emergence from bankruptcy in late April:

SEC-Filings, Yahoo Finance

To provide a comparison: Recently restructured peers Noble Corporation (NE) and Valaris (VAL) are trading substantially above their respective fair equity value estimates at the time of emergence from bankruptcy.

The discrepancy is likely the result of investors basing their assessment mostly on current net asset value (“NAV”) but even when considering Diamond Offshore’s rather low fleet value, the company trades at a material discount to peers.

Also keep in mind that estimated fleet values have not been adjusted for contract backlog which makes industry leader Transocean (RIG) appear much worse than it really is.

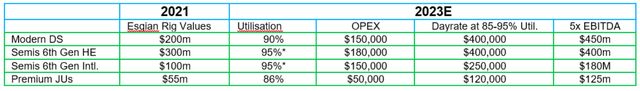

Moreover, Esgian Rig Analytics recently forecasted drillship values to more than double from 2021 levels next year:

Esgian Rig Analytics

With demand for moored semi-submersible rigs expected to remain largely stable for the next couple of years, value appreciation will likely be limited to the company’s drillship fleet with the currently stacked 6th-generation harsh environment semi-submersible “Ocean GreatWhite” providing some decent optionality.

Should Diamond Offshore manage to get the rig back to active work at a sufficient dayrate, this particular asset should see a very substantial increase in value.

To be fair, competitors like Valaris, Noble Corporation and particularly Transocean offer much higher drillship exposure thus resulting in even better value appreciation potential. That said, a good chunk of Transocean’s idle drillship fleet has been cold-stacked for many years already which will make reactivation more costly or even prohibitive.

While the discount to larger peers is somewhat understandable given lack of scale and near-term optionality as well as expectations for negative free cash flow this year, Diamond Offshore remains a prime buyout candidate. The company’s best-in-class drillship fleet would make a great addition for competitors while the moored semi-sub assets should see improved demand from 2025 onwards:

Company Presentation

For my part, I would expect Diamond Offshore to end up in the hands of Noble Corporation next year after the company has completed the integration of Maersk Drilling. That said, with asset prices expected to rise substantially over the next couple of quarters and strong geopolitical tailwinds, other competitors might also consider taking a second look at Diamond Offshore.

Bottom Line

While Diamond Offshore Drilling is back on the Big Board for now, I firmly expect the company to be acquired by one of its larger competitors in the not-too-distant future, given the company’s best-in-class drillship fleet and expectations for a substantial increase in asset values going forward.

Despite the likelihood of a buyout, the company is trading at a discount to larger peers likely because its lack of scale and near-term optionality as well as expectations for negative free cash flow this year.

With two of its high-specification drillships becoming available in the first half of 2023, I firmly expect the company to start generating free cash flow next year.

With recent geopolitical events providing another long-term tailwind, I remain positive on the entire offshore drilling industry.

Get long Diamond Offshore Drilling given discounted valuation and the very high probability of a medium-term buyout.

Be the first to comment