jetcityimage/iStock Editorial via Getty Images

Quarterly earnings results are always important times for publicly traded companies, as well as for the investors who own stock in them. After all, earnings releases serve as something of a report card that help to gauge how that company has done over the relevant timeframe and how the company might do moving forward. One rather large player in the food industry that is slated to report financial results covering the first quarter of its 2023 fiscal year in just a few days is Conagra Brands (NYSE:CAG). With shares of the company trading on the cheap, especially relative to similar players, now might be a good time for investors to consider taking a stake in the firm if they don’t have one already. At the same time, investors should also be on the lookout for specific data points that could serve as barometers that will help to determine how the company is performing in the current economic environment and whether or not the picture is changing for the better, the worst, or remaining more or less the same.

Still a solid prospect

The last time I wrote an article about Conagra Brands was in early April of this year. That particular article served as an earnings preview for the third quarter of the company’s 2022 fiscal year. Heading into that time, I mentioned that the company was expected to continue growing its top line while posting weaker bottom line results year over year. But even with that factored in, I determined that shares were attractively priced at that moment. Ultimately, I ended up rating the company a ‘buy’, reflecting my belief that it should outperform the broader market for the foreseeable future. So far, the firm has done so remarkably well. Although investors in the business would be down by 2.6% since the publication of that article, that is significantly better than the 18.2% decline seen by the S&P 500 over the same timeframe.

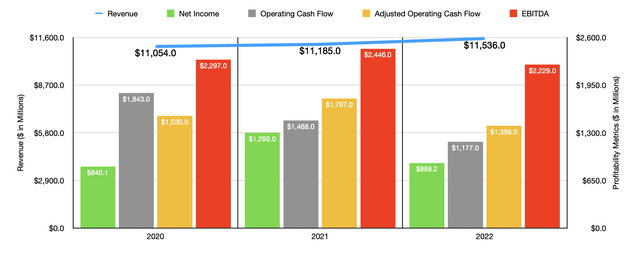

Since the publication of that article, Conagra Brands has gone on to report not only data for the third quarter of its 2022 fiscal year, but also the fourth quarter. For 2022 as a whole, the company generated revenue of $11.54 billion. That’s 3.2% higher than the $11.19 billion generated during its 2021 fiscal year. Even though that increase was nice to see, the firm’s profitability could have been better. Net income went from roughly $1.30 billion to just $888.2 million. For a business as large as Conagra Brands is, and considering the challenges facing the economy more broadly during this time, it should come as no surprise that there are a lot of working pieces that go into this profitability decline. The biggest, for instance, was a charge of $209 million, amounting to $159 million after taxes, associated with the impairment of some of the company’s intangible assets. What also hurt the company significantly seems to have been input cost inflation, higher inventory write-offs, and a variety of other issues like supply chain operating expenses. With many of these being non-cash in nature, the company’s other profitability metrics suffered in 2022. For instance, operating cash flow fell from $1.47 billion in 2021 to $1.18 billion in its 2022 fiscal year. If we adjust for changes in working capital, the decrease would have been from $1.77 billion to $1.40 billion. Even EBITDA took a beating, dropping from $2.45 billion to $2.23 billion.

When it comes to the upcoming earnings release, it’s interesting to note the analysts seem to be quite bullish. For starters, the expectation is for the company to generate revenue of $2.84 billion. If this comes to fruition, it would represent an increase of 7% over the $2.65 billion the company generated in sales during the first quarter of 2022. No doubt, some of this will be attributable to the company’s ability to push higher costs onto its customers. It’s also important to point out that this revenue growth would be stronger than the organic net sales growth that management is expecting for the entirety of its 2023 fiscal year. They currently think that organic sales growth should be between 4% and 5%.

From a profitability perspective, analysts are currently anticipating earnings per share of $0.51. On an adjusted basis, this moves slightly higher to $0.52 per share. To put this in perspective, in the first quarter of its 2022 fiscal year, the company reported earnings per share of $0.49. That translated to net income of $235.4 million. Should management deliver on analysts’ expectations, it would imply net income of around $245.8 million. While it’s entirely possible that management will deliver on this, investors should be cautious.

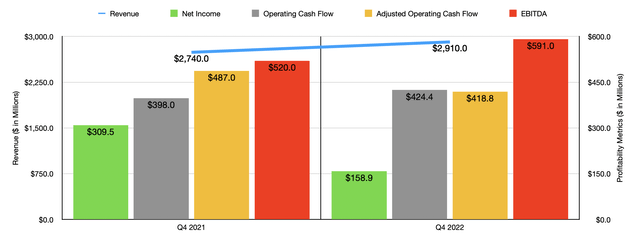

To see what I mean, we need only look at how the firm fared during the final quarter of its 2022 fiscal year. During that quarter, revenue came in at $2.91 billion. That’s up from the $2.74 billion reported for the final quarter of 2021. However, net income at the company actually fell significantly, plunging from $309.5 million to $158.9 million. At the same time, however, the company did end the final quarter of its 2022 fiscal year in strength from a cash flow perspective. Operating cash flow rose from $398 million to $424.4 million, while the adjusted figure for this dropped from $487 million to $418.8 million. Meanwhile, EBITDA for the company actually expanded, rising from $520 million to $591 million. For context, the first quarter of the 2022 fiscal year saw operating cash flow of $139.8 million, and adjusted operating cash flow of $314.2 million. EBITDA came in even higher at $501 million. Naturally, investors would be wise to keep an eye out on all of these metrics given their significance to the enterprise and in determining its health.

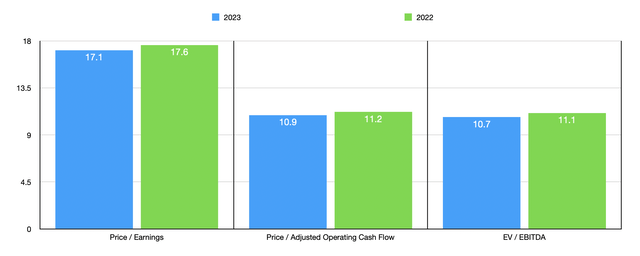

In terms of whether or not Conagra Brands makes for an appealing investment prospect, we should first consider that management is forecasting earnings per share growth this year of between 1% and 5%. At the midpoint, that would translate to net income of $914.4 million. No guidance was given when it came to other profitability metrics. But if we assume a similar growth for them as net income, then we should anticipate adjusted operating cash flow of $1.44 billion and EBITDA of nearly $2.30 billion. Given these figures, we would get a forward price to earnings multiple of 17.1, a forward price to adjusted operating cash flow multiple of 10.9, and a forward EV to EBITDA multiple of 10.7. These numbers are all lower than the 17.6, 11.2, and 11.1, respectively, that we get using data from the 2022 fiscal year.

In addition to shares looking affordable on an absolute basis, especially given the high-quality operation behind those numbers, shares also look cheap relative to similar companies. On a price-to-earnings basis, these companies ranged from a low of 19.1 to a high of 56. Using the price to operating cash flow approach, they ranged from a low of 12.2 to a high of 26.8. And using the EV to EBITDA approach, the range was between 12.5 and 21.6. In all three cases, Conagra Brands was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Conagra Brands | 17.6 | 11.2 | 11.1 |

| The J.M. Smucker Company (SJM) | 25.7 | 15.6 | 13.8 |

| Campbell Soup (CPB) | 19.1 | 12.2 | 12.5 |

| McCormick & Co. (MKC) | 28.6 | 25.9 | 21.6 |

| Lamb Weston Holdings (LW) | 56.0 | 26.8 | 20.9 |

| Hormel Foods (HRL) | 25.3 | 19.1 | 17.1 |

Takeaway

Although the economy is in a questionable state at this moment, and Conagra Brands has been pressed from a bottom line perspective because of inflationary pressures and other issues, I do believe that the long-term trajectory of the company is positive. This is a quality operator in the food space that continues to grow its top line year after year. On top of this, shares are looking awfully cheap at this time, especially relative to what you would expect from other players. Naturally, this upcoming earnings release will give investors another opportunity to re-evaluate the company. It is entirely possible that what data becomes available will prove damaging to shareholders. But for those focused on the long haul, any sort of near-term downside experienced will likely prove to be an attractive buying opportunity.

Be the first to comment