guvendemir

It’s not uncommon for long-time investors to have accumulated 40-50 stocks or even more. That’s because over the course of one’s investment life, opportune times come for various stocks and for buy-and-hold type investors, those stocks may stay in their portfolios indefinitely.

However, it’s highly unlikely that all stocks are evenly balanced in a portfolio, with 2-2.5% allocation to each of them. As with one’s association with friends, every investor has their favorite holdings that they view as being higher quality than the rest. These may be core holdings that one is overweight on.

This brings me to Lockheed Martin (NYSE:LMT), which may be one such core holding that can give investors comfort in good times and bad. This article highlights why LMT currently looks attractive for potentially strong long-term returns.

Why LMT?

Lockheed Martin is a global defense company that’s strategically headquartered in Bethesda, Maryland, sitting just north of Washington D.C. It has a leadership position in high-end military aircraft, including the signature F-35 fighter jet program. Beyond fighter aircraft, LMT’s other businesses include mission systems, including Sikorsky helicopters, missile defense, and space systems. Over the trailing 12 months, LMT generated $64 billion in total revenue.

In a world with increasing tensions, it comes as no surprise that leading defense contractors are in prime position to benefit from this trend. Moreover, unlike commercial customers that may be fickle in choosing vendors and partners, defense contractors like Lockheed benefit from very long contracts with the U.S. government. This, among other strengths, are noted by Morningstar in its recent analyst report:

We think Lockheed Martin’s exposure to the F-35 program, hypersonic missiles, and the militarization of space is well aligned with areas of secular growth in the defense budget. The defense budget is a political process, which is inherently difficult to predict. Therefore, we favor companies with tangible growth profiles through a steady stream of contract wins, ideally to contracts that are fulfilled over decades. Thankfully for defense investors, many programs are procured and maintained over decades. For instance, the F-35, which accounts for about 30% of Lockheed’s revenue, will be maintained through 2070.

Moreover, defense spending is set to continue growing, given the ongoing Russian-Ukraine war, in which the U.S. and partners have been placed on heightened alert and have supplied critical arms. This is reflected by the recently proposed 9%, $37 billion, increase in defense spending for fiscal 2023 by the House Armed Services Committee with strong bipartisan support. Plus, just this month, LMT and partners secured a large $5.1 billion contract with the US Navy for a variety of projects ranging from special missions to electronics monitoring equipment.

Notably, LMT did see a revenue decline with sales landing at $15.4 billion in the second quarter, down from $17.0 billion in the prior-year period. This was due primarily to supply chain impacts and timing of customer contract negotiations. Nonetheless, LMT continues to be a cash generating machine, as it produced free cash flow of $1.0 billion, enabling it to return $1.1 billion of cash to shareholders through share repurchases and dividends, in the last reported quarter. Plus, I see the aforementioned issues as being temporary and the contractual nature of LMT’s revenue streams are rightfully lumpy in nature.

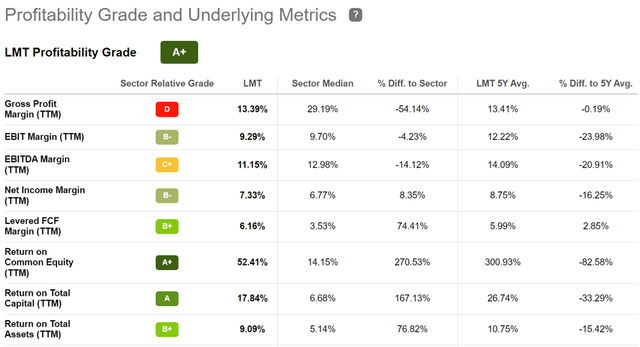

Plus, encouragingly, LMT’s cost savings initiatives are paying off, as its operating margin improved by an impressive 180 basis points YoY to 10.4%. This, combined with LMT’s sector leading return on common equity (due primarily to share repurchases throughout its history) has earned LMT an A+ rating for profitability as shown below.

LMT Profitability (Seeking Alpha)

Meanwhile, LMT sports a strong A- rated balance sheet and it recently raised its dividend by 7% to $3 per share. This brings LMT’s dividend yield to 3%, and the dividend is well protected by a low 45% payout ratio based on forward EPS of $26.74. Notably, LMT has a robust 5-year dividend CAGR of 9%.

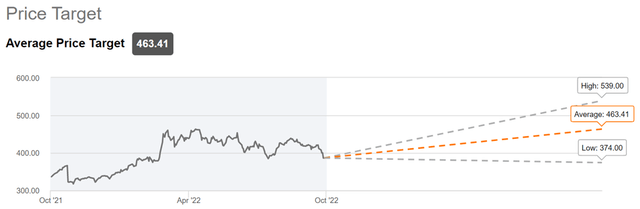

Lastly, I see value in LMT at the current price of $399.74, sitting well below its near-term high of $442 from as recently as August. While LMT isn’t cheap, I find it to be reasonably valued at a forward PE of 14.9, sitting below its normal PE of 16.8 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $463.41, translating to a potential one-year 19% total return including dividends.

LMT Price Target (Seeking Alpha)

Investor Takeaway

LMT has seen some near-term challenges, but I believe they are transitory in nature. Plus, it’s set to benefit from increased defense spending domestically and abroad. Given LMT’s strong competitive advantages, excellent growth prospects and reasonable valuation, I believe the stock is a compelling buy for long-term growth investors seeking both capital appreciation and income.

Be the first to comment