sshepard/iStock Unreleased via Getty Images

Thesis

Bank of America Corporation (NYSE:BAC) stock has recovered remarkably from its July lows. In a late June article, we cautioned investors to hold their buy trigger first, as we posited that BAC was not undervalued given the prevailing macro conditions.

However, the resilience of its July bottoming process convinced us that BAC has likely bottomed out for the medium term. Following our assessment of the market’s bottom in July, we are confident that BAC should recover robustly from its July lows.

Notwithstanding, BAC has nearly lost most of its August gains from the recent downside volatility. Therefore, we postulate that it’s an opportune moment for investors who missed the July lows to add more exposure.

We are optimistic that BofA should lap easier comps from Q3, further lifted by robust net interest income (NII) growth. Coupled with what we believe is an easier environment for investment banking and wealth management moving ahead (given the market bottom), we postulate that BAC should be re-rated.

Therefore, we revise our rating on BAC from Hold to Buy. Investors should consider using the near-term downside volatility to add more positions.

BofA’s Solid NII Helped Stem The Weakness In Fee Income

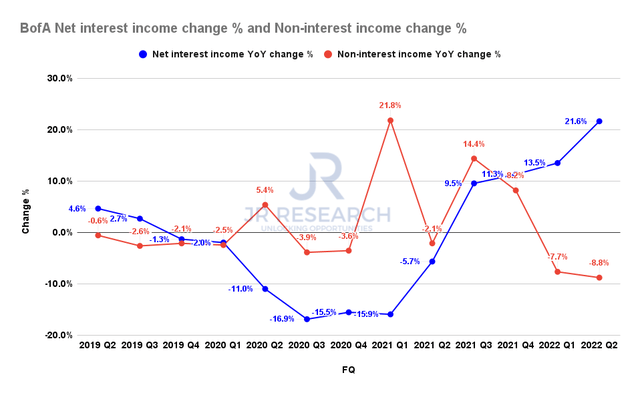

BofA net interest income change and non-interest income change % (Company filings)

As seen above, BofA posted an increase of 21.6% in NII, following Q1’s 13.5% growth. Notably, it has also helped stanch the marked weakness seen in non-interest income as investment banking and wealth management revenue were discernibly weaker.

Therefore, BofA’s well-diversified operating model is instrumental in helping maintain the resilience in its earnings quality and visibility, as management guided to even more robust growth in NII for Q3 and Q4. CFO Alastair Borthwick articulated:

We can see NII in Q3 increase by at least $900 million, possibly $1 billion, versus Q2. And then we expect it to grow again at a faster pace on a sequential basis in the fourth quarter. And the way we think about those NII increases, given the expense discipline that we have, is we expect the majority of that to fall to the bottom line for shareholders. (BofA FQ2’22 earnings call)

As a result, we are optimistic that BofA should see a solid earnings recovery from Q3 as it laps challenging comps, including a significant reserve release. Accordingly, it should help support our thesis of a sustained July bottom, lifting buying sentiment on BAC moving ahead.

BAC Investors Should Expect Better Days Ahead

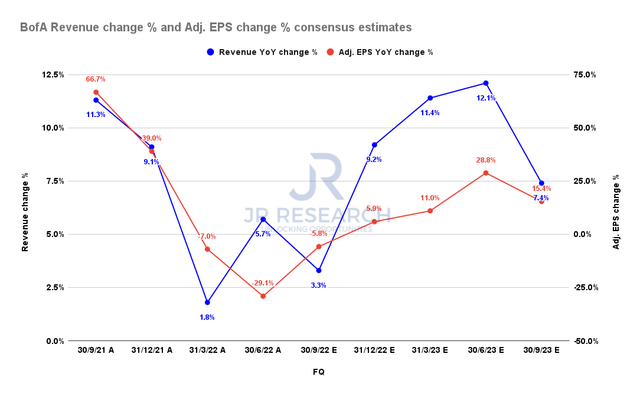

BofA revenue change % and adjusted EPS change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that BAC’s revenue and EPS growth should bottom out in Q2/Q3 before recovering remarkably through FY23. However, analysts on the call were concerned whether BofA considers the worsening macro headwinds as having a marked impact on its revenue and earnings visibility.

However, management assured investors that it continues to observe a strong loan book, with resilient credit quality and robust consumer spending. Therefore, even though capital markets were discernibly weaker over the past two quarters, the underlying growth in BofA’s well-diversified segments remains robust. CEO Brian Moynihan accentuated:

Our Consumer Banking segment continued to see good momentum as we grew loans at the fastest quarterly pace in nearly three years. It is also worth noting the strong credit quality. Most asset quality metrics improved again this quarter. Consumers continue to spend at a healthy pace even as quite some time has passed since the receipt of any stimulus. Also, look at elevated payment rates on credit cards. That means people [are] paying off their debt at a good clip. So, in the end, despite the worries of a slower economy and other global issues, client activity remained good this quarter, NII has improved quickly, and our customers’ resilience and health remain strong. (BofA earnings)

BAC’s Valuation Is Still Reasonable

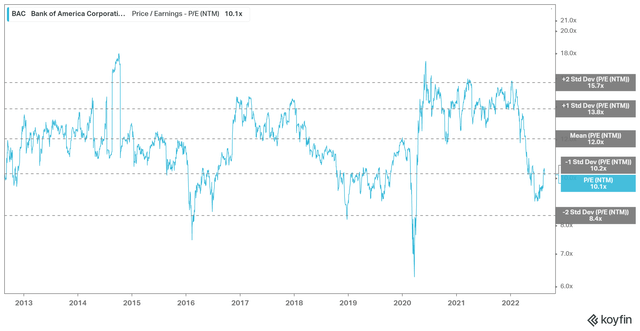

BAC NTM normalized P/E valuation trend (koyfin)

As seen above, BAC traded closer to two standard deviations below its 10Y mean at its July lows. It’s critical to note that buying support in that zone has been robust over the past ten years.

While BAC didn’t reach that level at its recent bottom, we are confident its valuation is still reasonable since the market has bottomed out for the medium term. Notably, BAC remains at least one standard deviation from its 10Y mean.

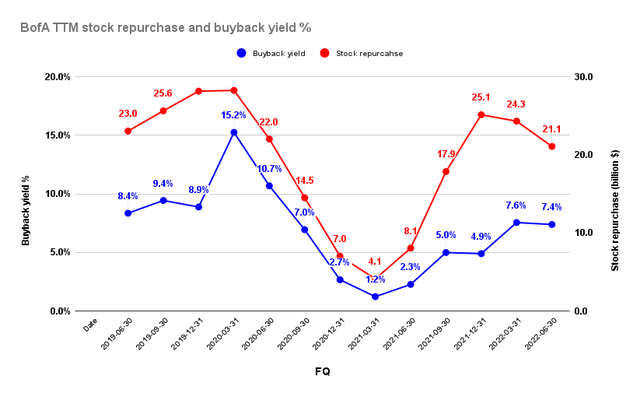

BofA stock repurchase and buyback yield % (S&P Cap IQ)

Furthermore, BofA has been buying back shares aggressively over the past four quarters. It posted a TTM buyback yield of 7.4% in Q2, just below Q1’s 7.6%. Therefore, we posit that management sees value in its stock, given the marked collapse from its January 2022 highs.

Is BAC Stock A Buy, Sell, Or Hold?

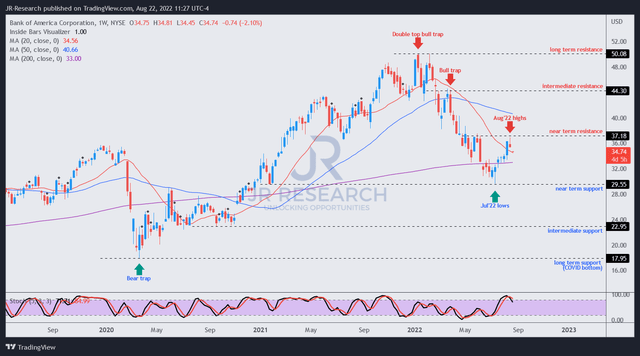

BAC price chart (weekly) (TradingView)

As seen above, BAC has recovered robustly from its July lows, which we are confident should hold over the medium term. Notwithstanding, the market is likely digesting its recent gains, given the price action seen at its August highs.

However, we are confident that BofA’s earnings visibility should improve further, lending credence to a re-rating in BAC. Therefore, investors should capitalize on the current downside volatility to add exposure.

Accordingly, we revise our rating on BAC from Hold to Buy.

Be the first to comment