D3signAllTheThings

Compass Minerals International, Inc. (NYSE:CMP) expects to see increases in the price of some of its products. Also, management expects to develop even more products for its portfolio, which I believe could lead to an increase in revenue and EBITDA margins. With all these in mind, in my view, the most recent quarterly report figures and most recent guidance could be the beginning of a beneficial time for Compass Minerals. Other analysts did bet on better financial figures for 2023 and 2024, so I executed several financial models. I did appreciate the results I obtained.

Compass Minerals International

Compass Minerals International, Inc. provides essential minerals to clients all over North America. The company’s main segments are the salt business unit and the plant nutrition segment.

I am writing about the company because both business segments reported excellent sales growth in the most recent quarter. Besides, considering the guidance given by management, I don’t think that the current market price is sufficient.

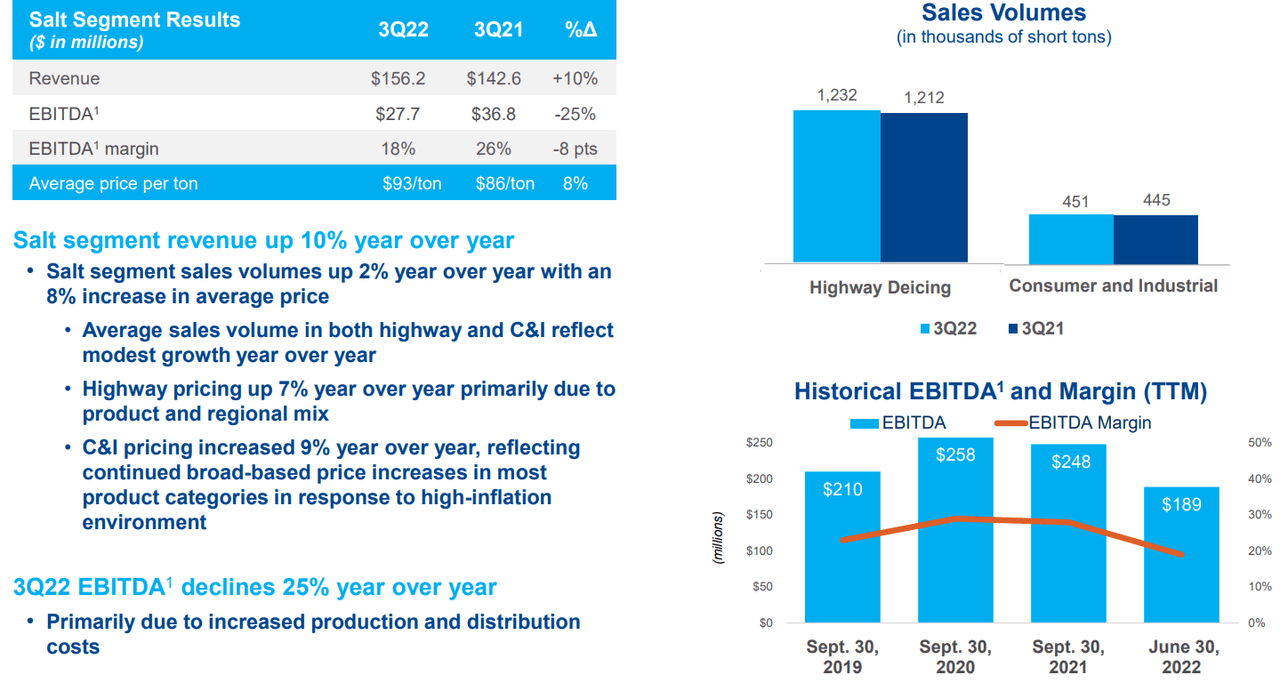

In Q3 2022, the salt segment included an increase of 10% in revenue as compared to the same period in 2021. Average sales volume and an increase in the price seem to explain the good results. It is also worth noting that in the last three years, the salt segment’s EBITDA margin was stable at around 20%-28%. I don’t give these numbers because I like assessing the past, but because I used similar figures for my financial models. In my view, making a forecast about future EBITDA and FCF results is easy in this case.

Fiscal Q3 2022 Presentation

With that about the past, let’s note that management is expecting a significant increase in the average contract price, approximately 14%. Hence, if the company is correct, we will most likely see an increase in revenue. The following lines show the most interesting information I found in the last quarterly release:

Approximately 75% of the company’s North American highway deicing bidding process for the 2022-2023 winter season has been completed. Based on season-to-date bidding activity, the company expects its average contract price for the upcoming winter season to rise by approximately 14%. As a result of its prioritization of a value-over-volume strategic focus, the company expects an approximate 13% decrease in total committed bid volumes compared to the prior season, depending on how the balance of this bidding season transpires. Source: Quarterly Report

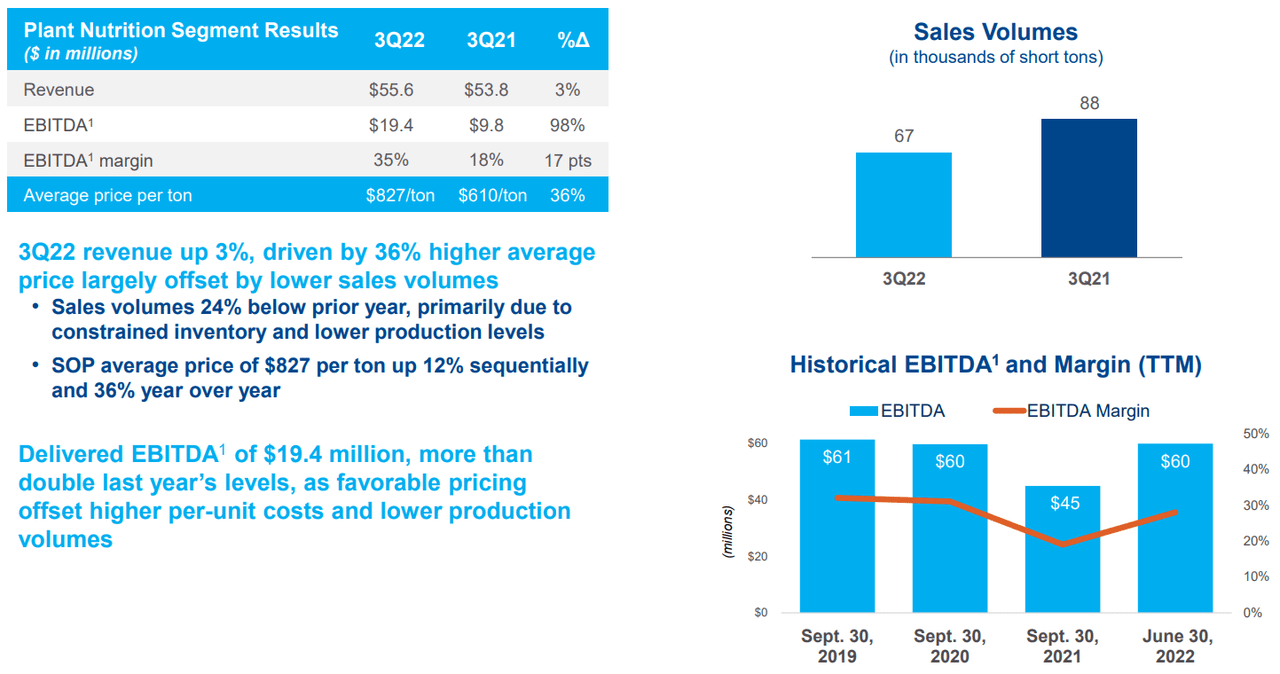

Revenue growth from the plant nutrition business segment was not as large as that of the salt business unit. The revenue didn’t increase at a double digit. However, the EBITDA margin stood at 35%, which is significantly better than that in Q3 2021. SOP average price increased by 36% y/y, but sales volume decreased. In my view, further increase in the SOP average selling price will likely bring significant free cash flows in the future.

Fiscal Q3 2022 Presentation

Guidance And Expectations From Investment Analysts

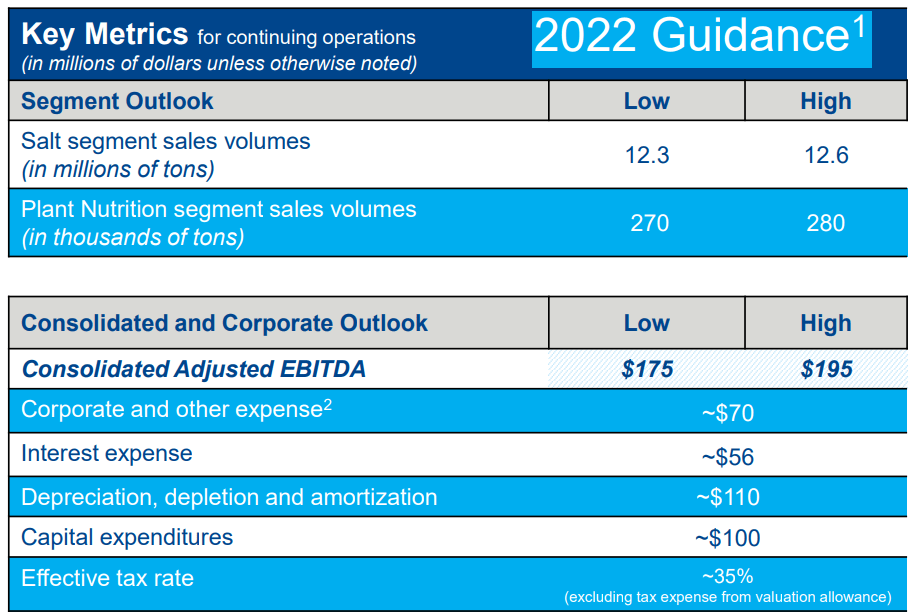

Apart from the recent increase in sales growth revealed in the last quarter, the guidance given by management is worth noting. The company believes that it may be able to deliver total EBITDA close to $175-$195 million, capex close to $100 million, and D&A around $110 million. My base case scenario included some of these figures, so I believe that including them in the article is beneficial for investors.

Fiscal Q3 2022 Presentation

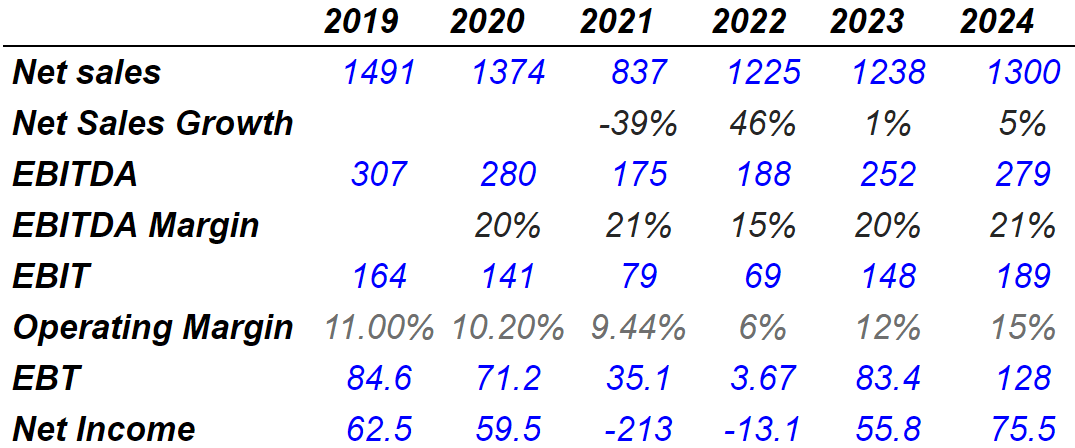

Investment analysts seem to be extremely optimistic about Compass Minerals. They believe that sales could grow to up to $1.2 billion in 2022, with sales growth of up to 46%. EBITDA margin would stay at close to 15%-20% in 2022 and 2023. Finally, analysts also expect positive and growing net income in 2023 and 2024.

MarketScreener

Balance Sheet

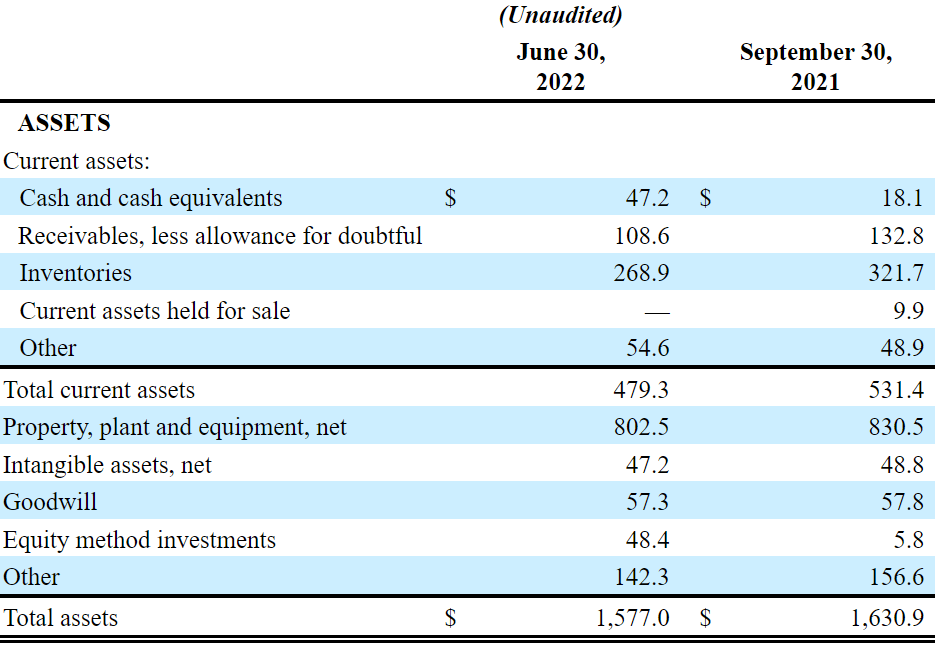

As of June 30, 2022, Compass Minerals reported $47 million in cash and $802 million in property, plant and equipment. With an asset/liability ratio close to 1x-2x, in my view, the financial situation does not seem worrying.

10-Q

Without short term debt, Compass reports long-term debt worth $885 million. Considering the total amount of property and equipment as well as cash, the net leverage appears under control. With that being said, it is beneficial that management is reducing its total amount of financial obligations.

10-Q

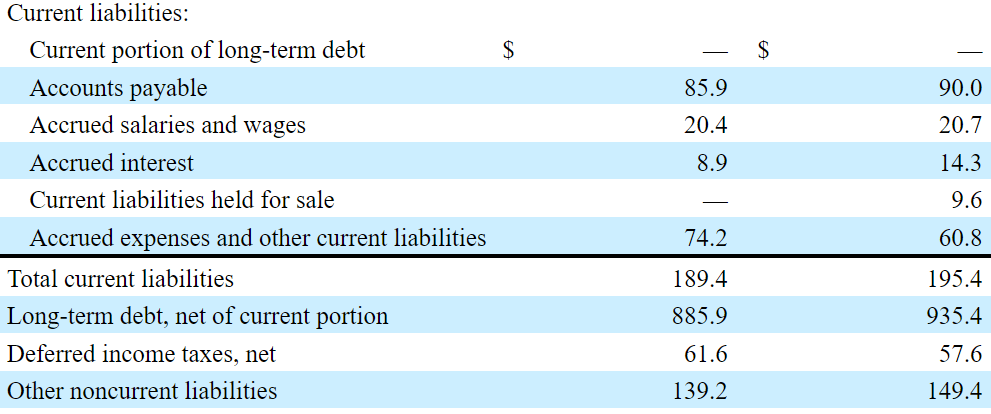

In the last presentation, Compass included a slide in which investors could see a significant decline in the net debt. It is worth noting that most debt matures in 2027. Compass seems to have a long time to generate free cash flow, and pay its financial obligations.

Fiscal Q3 2022 Presentation

Under My Base Case Scenario, Compass May Be Worth $54

Under normal conditions, I expect that Compass Minerals will continue to develop its portfolio of nutritional supplements. I also believe that developing the direct-to-farmer sales platform will most likely bring more revenue growth and larger FCF/Sales margin. Let’s keep in mind that the company counts with experienced in-house agronomic research teams and technical agronomic sales force.

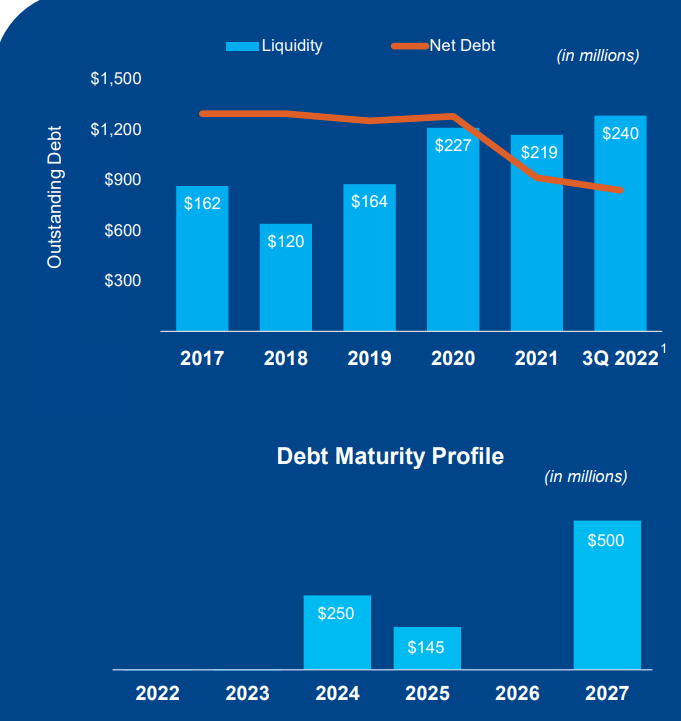

It is also worth noting that Compass owns large salt mines like that at Goderich in Ontario with a remaining mine life of 83 years. It means that Compass will have production for a long time, which will likely help negotiate with business providers. In my view, signing contracts with partners is way easier and more profitable because partners know that Compass Minerals will likely operate for many years. This fact explains why the company may have better margins than competitors, and may trade at larger EV/EBITDA multiple.

10-k

Compass Minerals signed several transactions to repay its debts. In April 2022, the company reported the sale of its South America chemicals business. I would be expecting future transactions in the coming years. I believe that less net debt will likely lead to diminishing cost of debt and less weighted average cost of capital. In sum, the future valuation will likely increase.

In April 2022, we utilized earnout proceeds from the 2021 sale of our South America specialty plant nutrition business and proceeds from the sale of our South America chemicals business, discussed in Dispositions above, to repay approximately $60.6 million of our term loan balance. Source: Quarterly Report

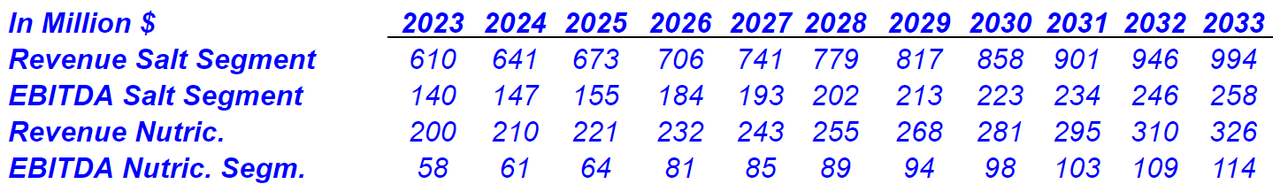

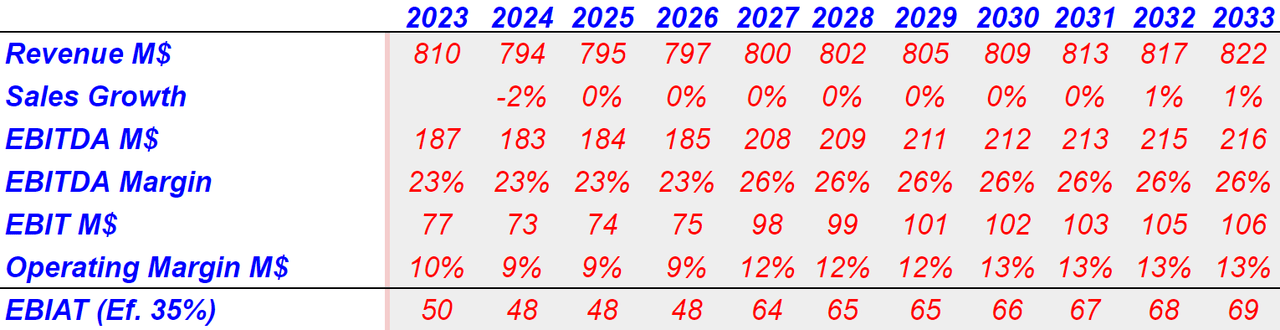

Under this scenario, I assumed that by 2033 the salt segment will report $994 million with an EBITDA of $258 million. I also believe that the plant nutrition segment could grow its revenue from $200 million in 2023 to $326 million in 2033. I assumed 2033 EBITDA of $114 million. Note that I included an increase in the EBITDA margin as economies of scale will likely help.

Arie’s DCF Model

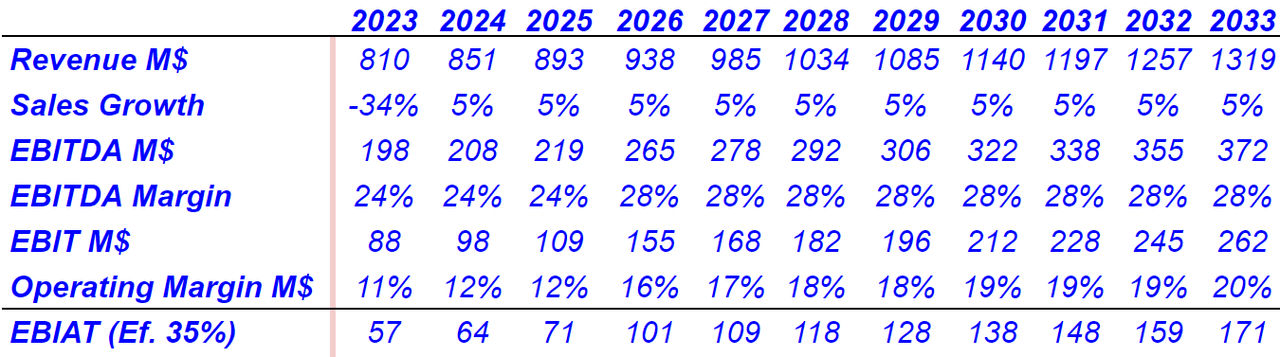

Putting everything together, I obtained an EBITDA margin of 24%-28% and an operating margin between 12% and 20%. With an effective tax of 35%, 2033 NOPAT would be $171 million.

Arie’s DCF Model

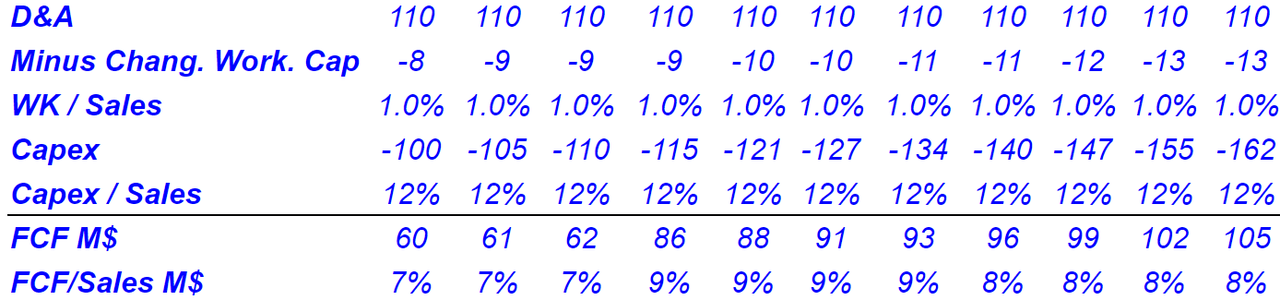

If we also include D&A of $110 million, capex/sales of 12%, and changes in working capital/sales of 1%, FCF/Sales would be close to 7%-9%. Finally, the FCF would grow from $60 million in 2023 to $104-$105 million in 2033.

Arie’s DCF Model

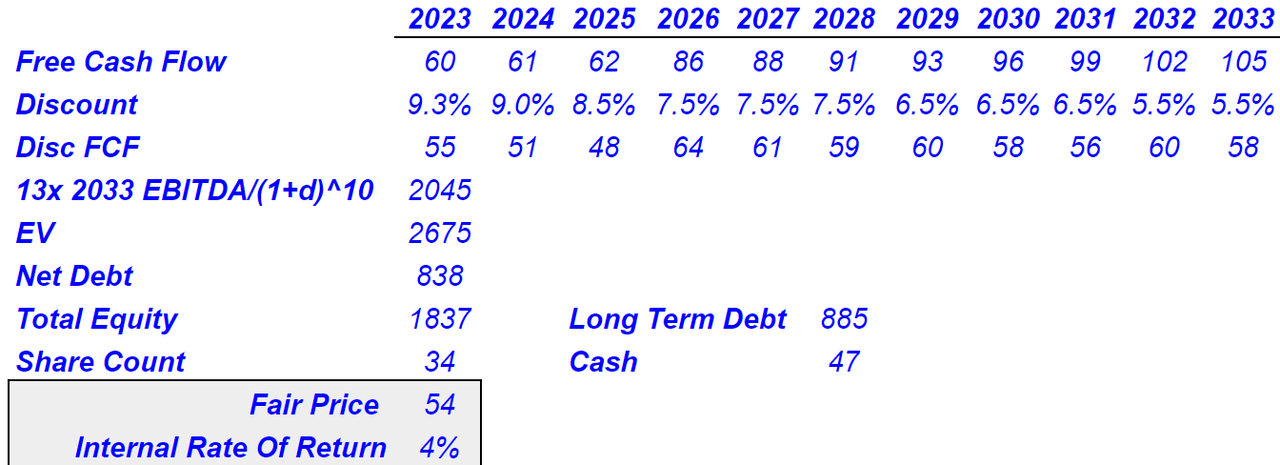

By using a discount of 9.3%-5.5% and an exit multiple of 13x, I obtained a valuation of $54 per share and IRR of 4%. In the light of my figures, I believe that the company appears undervalued.

Arie’s DCF Model

Risks Would Include Lower Production, Failed Geological Models, And Disruptions In Salt Mines Or Evaporation Plants

Compass Minerals runs mining operations, which means that production of salt and other components may be subject to mining risks. Water inflows and flooding, failed geological models, and lower mineral deposits than expected are among the risks for Compass Minerals. As a result, major declines in production or lower production would lead to a decline in free cash flow and valuation declines:

Unexpected geological conditions could lead to significant water inflows and flooding at any of our underground mines, which could result in a mine shutdown, serious injuries, loss of life, increased operational costs, production delays, damage to our mineral deposits and equipment damage. We have minor water inflows at our Cote Blanche and Goderich salt mines that we actively monitor and manage. Source: 10-k

Compass uses a number of production and distribution facilities in Brazil and the United States. If there is a single disruption or logistic issue in one of these facilities, a decline in production could occur. As a result, the company’s financials may suffer because of the decline in revenue. Perhaps, reputational damage may also affect the relationship of Compass with customers. Management noted some of these risks in the last annual report:

We conduct our operations through a limited number of key production and distribution facilities. These facilities include our underground salt mines, our evaporation plants, our solar evaporation ponds and facilities, certain facilities in Brazil used by our Plant Nutrition South America businesses and the distribution facilities, depots and ports owned by us and third parties. Many of our products are produced at one or two of these facilities. Any disruption of operations at one of these facilities could significantly affect production of our products, distribution of our products or our ability to fulfill our contractual obligations, which could damage our customer relationships. Source: 10-k

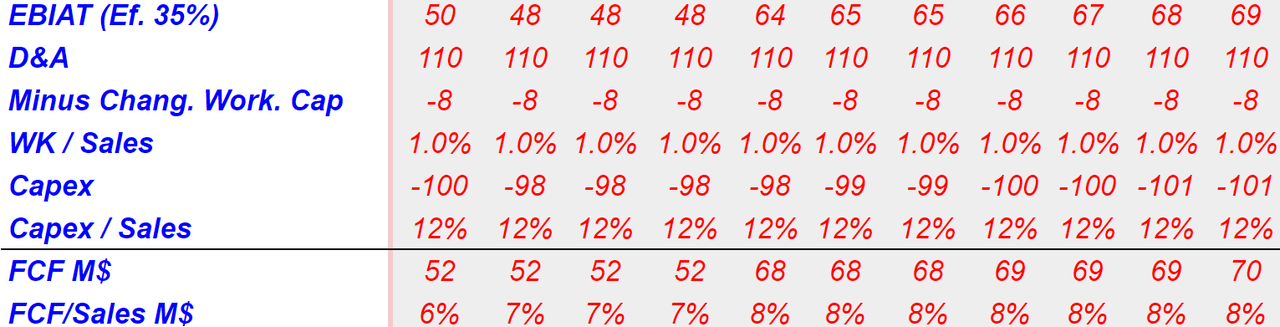

Under this scenario, I assumed total sales of almost $552 million in 2033 and an EBITDA margin around 23%-26%. The revenue from the salt segment and the plant nutrition segment would have less revenue and EBITDA than that in the previous case. The results would include 2033 EBITDA of $216 million and 2033 EBIAT of $69 million.

Arie’s DCF Model Arie’s DCF Model

With capital expenditures close to $111 million and changes in working capital close to $7 million and $9 million, FCF/Sales would be 7%-8%. My results include 2033 FCF close to $52.5-$70.5 million.

Arie’s DCF Model

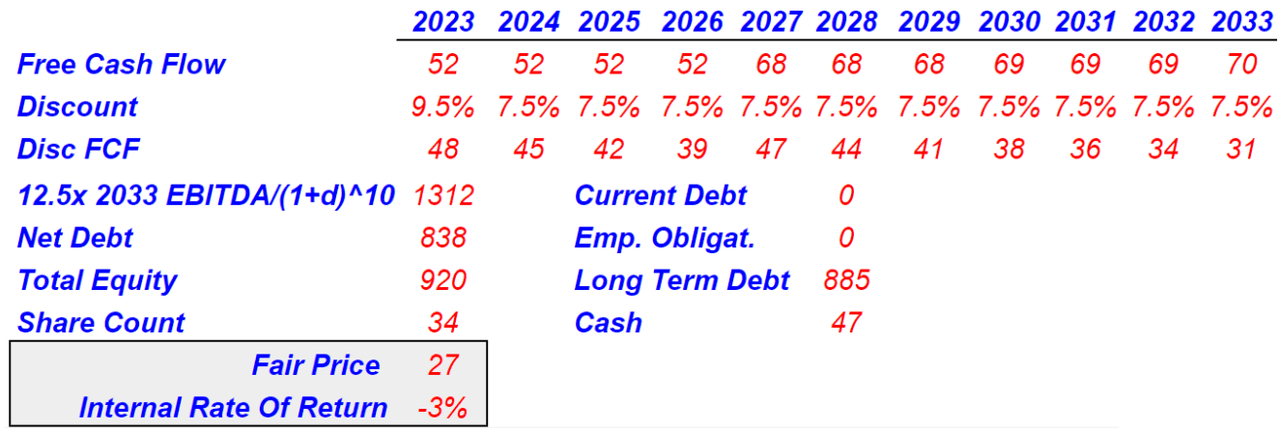

Next, with a weighted average cost of capital around 9.5%-7.5% and an exit multiple of 12.5x, I obtained a terminal value close to $1.35 billion and total equity worth $920 million. Finally, the implied share price would be close to $27.1.

Arie’s DCF Model

The New Agreement Would Most Likely Bring Revenue Growth Up

In my best case scenario, I believe that the company could be worth much more than that in the base case scenario. The company recently signed an agreement with two massive corporations to enter the lithium industry. If the deal is successful, Compass Minerals will be entering into a market that grows at more than 7% y/y. As a result, the company’s valuation would be larger because Compass Minerals operates inside markets that don’t grow that much:

Announced the signing of non-binding memorandums of understanding to supply LG Energy Solution and Ford Motor Company (F) with a battery-grade lithium product from the company’s lithium brine development project. Source: Fiscal Q3 2022 Presentation

The global lithium mining market is anticipated to surge at a CAGR of 7% over the decade. Source: Lithium Mining Market Size, Share, Industry Insights 2031

My Takeaway

Compass Minerals reported beneficial guidance for the year 2022, and many analysts are expecting significant improvements from 2023. In my view, further development of the company’s nutrient portfolio and reduction in the debt will likely bring enhanced financial figures. I expect that less cost of capital, efficiency, and economies of scale will likely bring better EBITDA margins and further improvement in the stock valuation. The new agreement to enter the lithium industry with large corporations could also push the stock price up. Yes, even considering risks from delays in mining production, Compass Minerals appears a company to follow carefully.

Be the first to comment