Elecstasy/iStock via Getty Images

Timing the Market subscribers got early access to this article.

Retail stocks have done pretty well this year. However, I believe a cyclical shift is looming. Inflation has led to a decrease in consumer demand and the need for companies to raise prices.

As I look over the potential retail short plays, one sticks out as a clear winner. The stock is Dollar Tree (NASDAQ:DLTR), which reports its Q2 2022 earnings on August 25:

Nasdaq

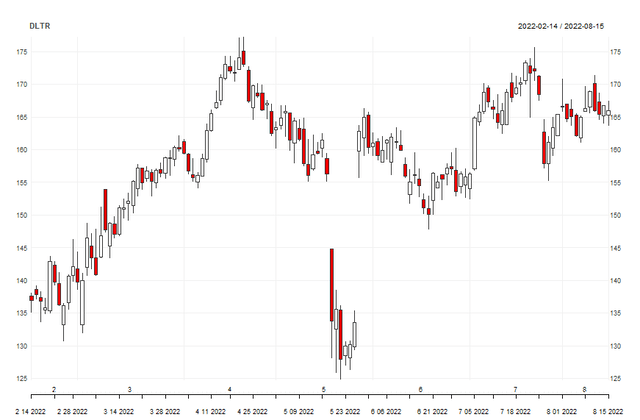

One reason I like DLTR as a short target is its trading region. It’s currently trading near its highs but has shown a strong capacity for pulling back double-digits on bad news:

Damon Verial

Moreover, the macro environment is particularly tough on Dollar Tree due to the company’s focus on keeping its products at the price point of $1 for several decades. In an inflationary environment, most businesses pass some of that inflation back to the customer via way of raising prices. For Dollar Tree to raise its prices, it necessarily must accept upsetting its customer base.

The price hike to $1.25 was rolled out last quarter, and we’ll be able to see this quarter just how much damage it did in terms of sales. I think it will be more than analysts expect, not just because Dollar Tree has done away with its unique selling proposition, but because expectations about consumer demand remain too high, in my opinion. I think in the coming quarter, we are going to see consumers greatly decrease their discretionary spending, and that’s going to lead to an inventory buildup, which is a bearish catalyst for most retail stocks.

Note that the expected EPS, $1.57, for DLTR this quarter is 28% higher than the actual EPS for Q2 2021. A blind Bayesian starting point could be 25%, if you assume that the 25% hike rise is pure earnings. But then consider the 9% year-over-year inflation, which not only eats into that profit but reduces consumer spending by a proportional amount. Even with that starting point, I’d subtract 9% for cost increasing and another 9% for consumer spending cutting, putting the expected EPS at 7% higher, or $1.32, all things being equal. I’m not actually predicting an EPS of $1.32 but pointing out that inflation and demand changes have not likely been factored into the prediction accurately. The truth is that DLTR almost always beats its EPS estimates for Q2 2022 and will likely do so again. A statistical analysis leads to better predictions. Accounting for past patterns, I found that the most likely actual EPS is between $1.75 and $1.80, which equates to a 13% EPS surprise, a percentage unlikely to impress enough investors to where a rally will result.

The stock is likely to slip even with a positive EPS surprise if DLTR does not provide a strong forecast for Q3. So far, the price increase hasn’t seemed to add much to the company’s bottom line, so the question in many analysts’ minds is likely what Dollar Tree management has planned in the case of sustained inflation and decreasing consumer demand. Further price hikes are unlikely to be perceived as valuable to investors. I think many investors will believe they are seeing peak EPS – at least for now – and likely to walk away with whatever earnings they’ve made on the stock in the past few months. It seems logical to place your capital in other areas, and investors have good alternatives to DLTR if they want to stay in the retail sector.

Remember that when we play earnings, we are playing the gap between reality and expectations. The reality is that the macro situation is quite bearish, yet expectations for many companies that are more vulnerable to these macro issues remain bullish. If you are like me and believe that DLTR is trading too high given the current situation, follow me with my short trade, which I will be opening next week, before DLTR reports.

My idea is to sell far-out, slightly out-of-the-money calls because of their high vega, which will lead to loss in their value (profit for us) due to the volatility crush that tends to occur after earnings. Shorting calls has the same risk profile as a pure short position but also benefits from not only the volatility crush (meaning we profit even if the stock doesn’t move) but also time, provided we continue to hold the position. I like the January 20 $170 calls for this.

I know a lot of earnings traders prefer long puts because the risk is capped at the debit. In that case, consider the August 26 $180 puts, which are so deep in the money that they mimic the upside of a short play, while only exposing you to around $1400 loss. Just know that time works against you, and you’ll lose money if DLTR trends sideways on earnings, while the above short call play would give you profit under the same circumstances.

Let me know what you think about these plays in the comments section below.

Be the first to comment