Derick Hudson

The market’s tone for the rest of the year continues to be “cautiously optimistic.” Investors have let go of the initial shock of the Fed’s rate hikes, and though most companies are citing macro turbulence and cutting estimates for the remainder of the year, valuations have also come down proportionally to compensate.

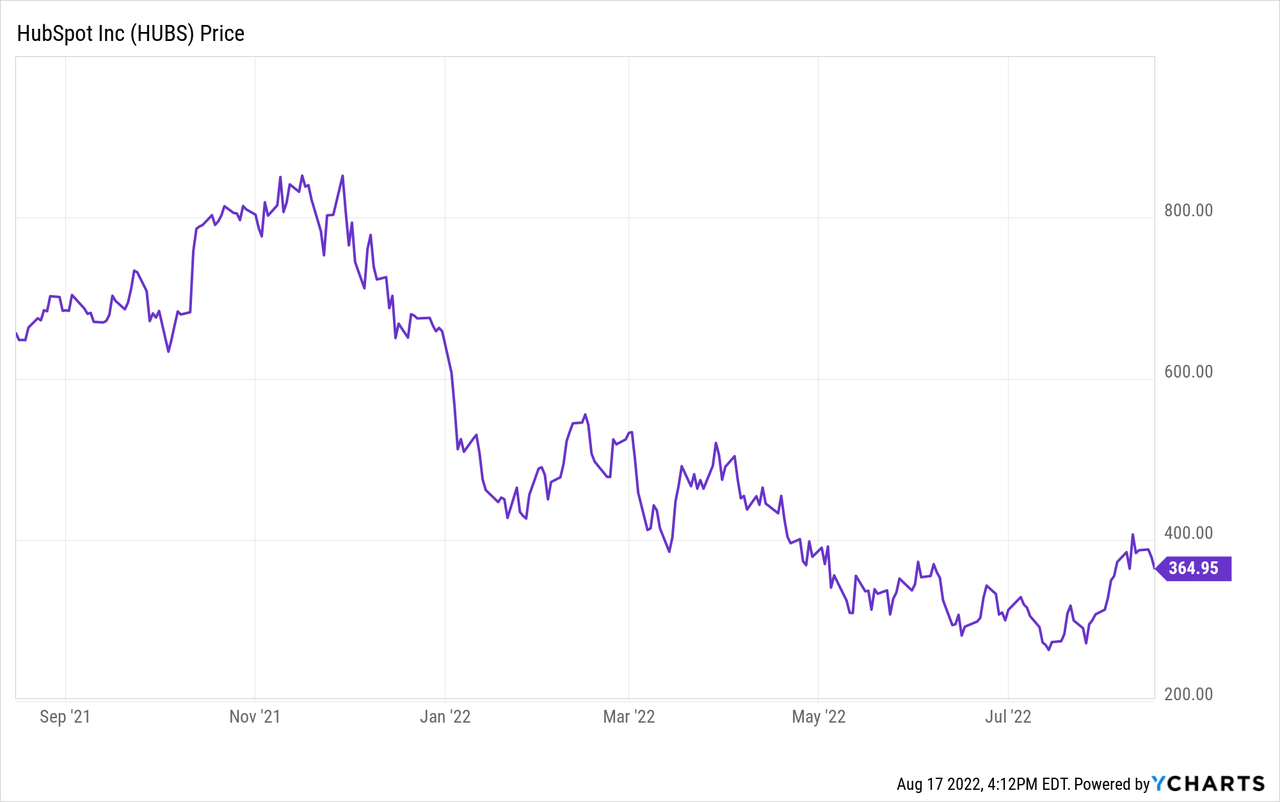

HubSpot (NYSE:HUBS), in particular, is one excellent rebound stock to look into. This powerhouse SaaS vendor, known for its sales and marketing software that focuses on “inbound marketing” (engaging with customers who have already expressed interest in a brand, rather than cold outreach), has seen its share price decline 40% year to date despite very little fundamental deterioration. As we continue to see choppy trading waters ahead, investors would do well to focus their stock-picking on high-quality names like HubSpot that are now trading at slashed valuations despite consistent performance.

I remain bullish on HubSpot, and I think its recent rebound above YTD lows in the ~$270s has further steam, especially as HubSpot’s valuation has room to come back up closer to historical norms.

For investors who are newer to the HubSpot category, what is most impressive about the company has been its commitment to product development throughout the years. Though purely an inbound marketing CRM at its IPO, HubSpot has grown its TAM to an estimated $87 billion through adding products for content management, operations, and customer service. It has managed this expansion with an organic mindset (whereas many portfolio software companies grow large through adjacent M&A) and while keeping bottom-line profitability at top of mind. HubSpot is also one of the best-known software platforms catering to SMBs (small and mid-sized businesses), which gives it a defensible niche against the larger software titans like Salesforce.com (CRM). Recall that the company has multiple tiers for each of its products to capture smaller customers all the way up to enterprise clients. In Q2, it also launched a free version of its content management (‘CMS’) product in an effort to drive new paid customer growth.

Here’s a refresher of what I view to be the key bullish drivers for HubSpot:

- Growth at scale. Typically, when a company hits over a >$1 billion revenue run rate, it will have run into saturation issues and its growth rates rarely exceed 20-30% y/y. This is not the case with HubSpot. Through strong sales execution plus success in cross-selling the various modules in its portfolio, HubSpot has managed to retain incredible >35% y/y growth.

- Inbound marketing will continue to grow in prominence. Companies are increasingly relying on soft marketing and social media experts to bring in customers versus direct sales (many salespeople got laid off during the pandemic and many aren’t returning). HubSpot’s shares of the overall CRM space will continue expanding.

- Nearly pure recurring revenue base. 97% of HubSpot’s FY21 revenue was subscription revenue. The fact that such a large degree of HubSpot’s revenue is already locked in gives the company plenty of revenue visibility.

- Sky-high subscription gross margins. HubSpot boasts ~84% subscription gross margins on a pro forma basis, which creates plenty of opportunities for operating leverage.

- “Rule of 40” member. HubSpot is generating >35% y/y revenue growth on top of ~10% pro forma operating margins, which is a truly rare profile in the tech sector. These days, 35%+ growth itself is hard to come by – and rarely is it accompanied by profitability.

HubSpot’s valuation doesn’t necessarily put it at bargain-basement value stock levels, but I think the quality and consistency of its results leave plenty of room for upside. At current share prices near $365, HubSpot trades at a market cap of $17.51 billion. After we net off the $1.41 billion of cash and $453.2 million of debt on HubSpot’s most recent balance sheet, the company’s resulting enterprise value is $16.56 billion.

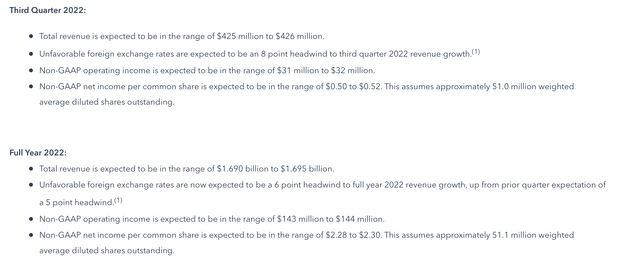

For the current fiscal year, HubSpot has lowered its revenue guidance to $1.69-$1.695 billion, representing 28% y/y growth (versus a prior view of 32-33% y/y growth), but this reduction was driven primarily by an update in unfavorable FX rates.

HubSpot outlook (HubSpot Q2 earnings release)

Against the midpoint of this revenue range, HubSpot trades at 9.8x EV/FY22 revenue. If we look ahead to FY23, where consensus is expecting HubSpot’s revenue to grow to $2.11 billion (+25% y/y; data from Yahoo Finance), HubSpot’s multiple condenses down to 7.8x EV/FY23 revenue.

For a Rule of 40 software stock, I think this is still quite a reasonable valuation that has upside. My year-end price target on HubSpot is $438, representing 9.5x EV/FY23 revenue and ~20% upside to current levels.

The bottom line here: If you’re looking to double down on beaten-down software stocks but are also looking for high-quality, safer names that are more insulated in the case of a macroeconomic meltdown, HubSpot fits the bill perfectly.

Q2 download

Let’s now discuss HubSpot’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

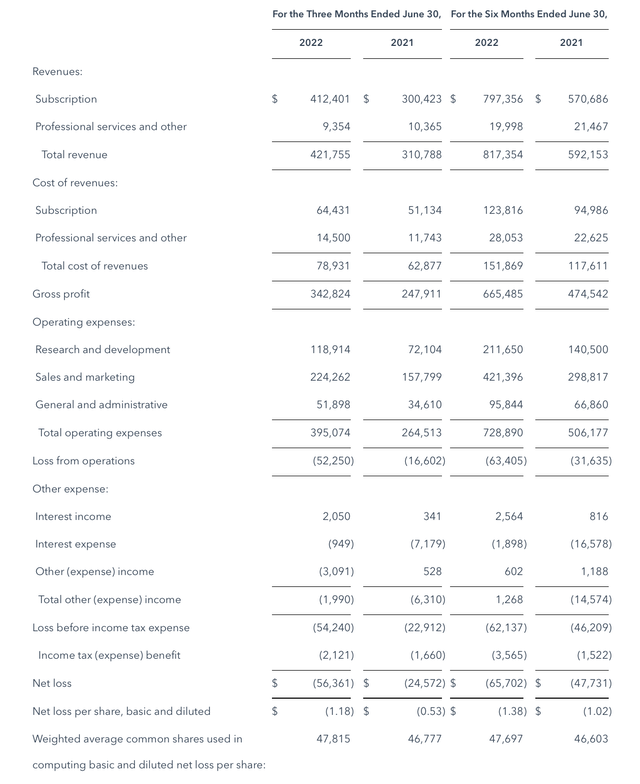

HubSpot Q2 results (HubSpot Q2 earnings release)

HubSpot’s revenue in Q2 grew 36% y/y to $421.8 million, beating Wall Street’s expectations of $409.4 million (+32% y/y) by an impressive four-point margin. Now, revenue growth did decelerate five points versus 41% y/y in Q1, but the major driver here is increased FX pressure. On a constant-currency basis, HubSpot noted that its revenue growth would have been 41% y/y.

Management noted healthy end-customer metrics to boot. It added an impressive 7,100 net-new customers in the quarter and raised its overall customer base by 25% y/y to over 150k customers. Average revenue per customer rose 14% y/y on a constant-currency basis, and the company reported strong upsell and cross-sell activity within the existing base. Also, international revenue growth of 49% y/y outpaced domestic revenue growth at 35% y/y.

We note as well that HubSpot reported $433 million in billings for the quarter, building up its deferred revenue base. Again excluding FX impacts, this grew 39% y/y on a constant currency basis – indicating that HubSpot’s natural revenue growth isn’t set to slow down anytime soon.

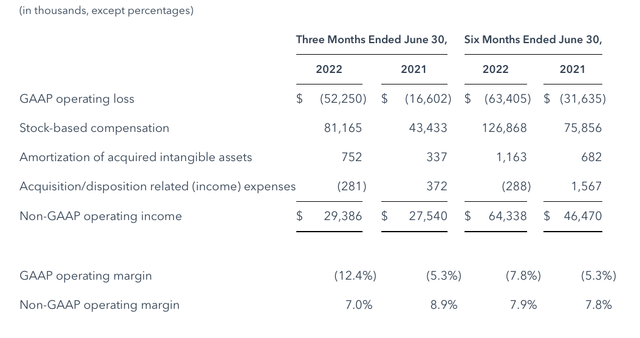

Management noted, however, that it started noticing elongating deal cycles in July, with more approvers involved in the customer process. It is incorporating the economic chill into its year-to-go guidance. It is also focusing on expense management. Impressive to note here is that HubSpot retained its “Rule of 40” status with a 7.0% pro forma operating margin in Q2, down only 190bps versus the second quarter of 2021 (many other SaaS companies reported much worse profitability hits).

HubSpot Q2 operating margins (HubSpot Q2 earnings release)

Here’s some commentary from CFO Kate Bueker on the company’s reaction strategy for a potential downturn, taken from her prepared remarks on the Q2 earnings call:

In light of this increased macroeconomic pressure, we are taking several actions to drive a continued balance between growth and profitability. We had a strong first half of hiring and have a talented team in place to execute against our strategic goals, which gives us the opportunity to slow our hiring in the second half of the year.

We will continue to maintain investments in product and engineering and grow revenue generating sales headcount in the second half, but we will moderate headcount growth in other areas of the business.

In addition, we are taking steps to pullback T&E facilities and other discretionary expenses in the second half of 2022.

HubSpot continues to expect to pro forma operating margins in the ~7% range for Q3, which I think will be a key distinguisher against other growth stocks.

Key takeaways

Still down ~40% year to date and far from its historical valuation multiples in the low-teens against forward revenue expectations, I continue to view HubSpot as a solid rebound play. So far, even though management has started to warn of lengthening deal cycles, constant-currency revenue and billings growth rates have held up, as well as bottom-line profitability. Give HubSpot the benefit of the doubt and stay long here.

Be the first to comment