We Are/DigitalVision via Getty Images

Opportunity Overview

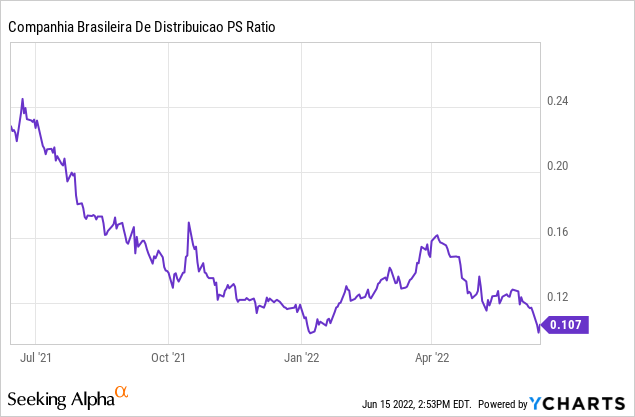

Latin American companies that are branching out into e-commerce/ an omnichannel approach are more likely to outperform other emerging market equities in the long run. Many of these companies are currently attractively priced. However, some of these companies’ stock prices have been on a downtrend since 2020. Companhia Brasileira de Distribuição (NYSE:CBD) (doing business as GPA), which is highly active in Brazil and Colombia, is currently attractively priced given its long-term growth prospects. I will continue accumulating during pullbacks that occur this year, as emerging markets increasingly come under pressure due to inflation, slower economic growth, and rising rates. I am extremely bullish on Colombia and Brazil in the long term, due to the strong commodity exposure, but both countries will likely experience setbacks in the short term, in line with other emerging markets.

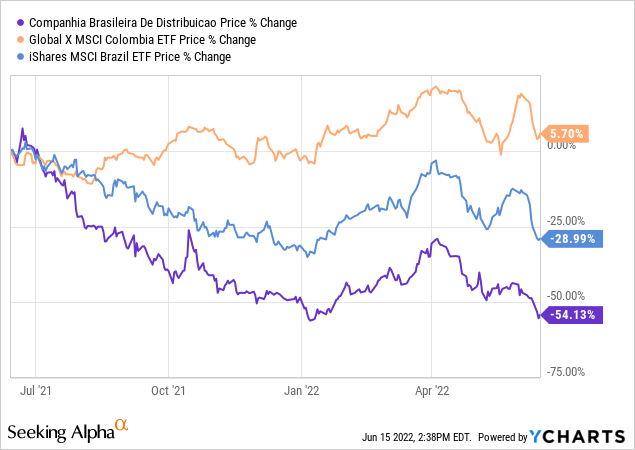

YCharts

GPA has significantly underperformed the Global X MSCI Colombia ETF (GXG) and the iShares MSCI Brazil ETF (EWZ), which largely occurred due to GPA’s relatively stronger performance in 2020-2021. Companies like GPA that embraced increased digital initiatives were able to stand out during 2020. GPA is an interesting name to consider if you are looking at Brazil and Colombia, and want to consider retail stocks in lieu of the ETF.

Latin American Consumers

Retail companies in Latin America are increasingly going digital to help boost their sales/market share, and COVID has accelerated this trend. Brazil has the largest e-commerce market in Latin America, and it is also ranked 10th globally. Ecommerce in Colombia grew by over 20% during 2021, and it is currently ranked 32nd globally in terms of e-commerce sales. Consumers are also increasingly open to embracing digital payments due to convenience.

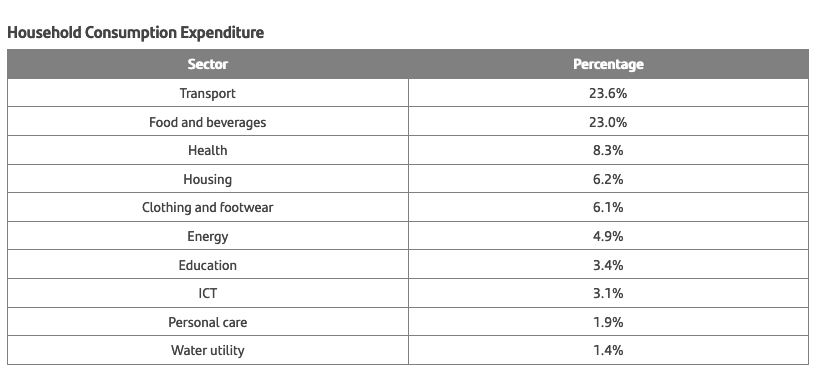

Even though consumer-themed investment may experience setbacks in the coming years due to slower economic growth and inflation, companies that are embracing digital initiatives may outperform. Inflation was most recently 12% in Brazil and 9% in Colombia, so many consumer confidence will likely decline in the coming years. However, there is still ample room for growth for companies that are targeting areas such as F&B and clothing, as this accounts for roughly 29% of consumption in Latin America.

Santander Trade

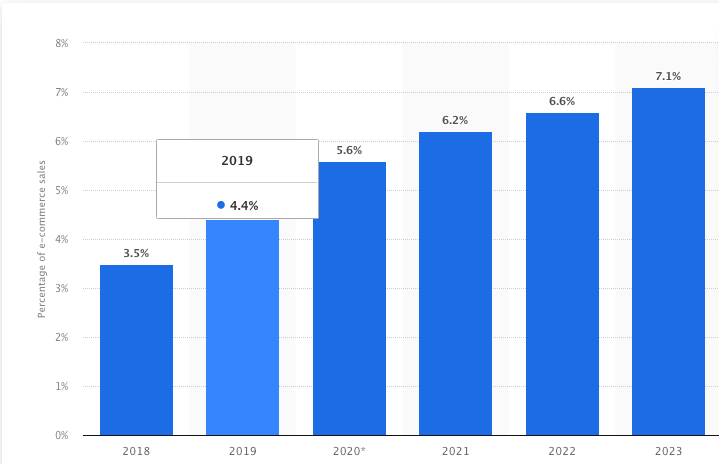

E-commerce in Latin America will be a significant theme in the future. Ecommerce represented less than 5% of revenue prior to COVID, and many companies will be able to move this figure up to the double digits in the coming years.

Statista

Brazil and Colombia, GPA’s two largest markets, are also ahead of the herd in terms of embracing commerce. Even countries in Uruguay have been experiencing double-digit growth in eCommerce sales.

Company Overview

Companhia Brasileira de Distribuição (known as GPA) is Brazil’s largest company involved in food/merchandise/electronics/appliances retailing. It operates a group of supermarkets, hypermarkets, and home appliances stores throughout Brazil and other countries. It is also the 2nd largest retail company in Latin America and the second-largest online retailer in Brazil. GPA has multiple leading brands in countries such as Brazil, Colombia, Uruguay, and Argentina.

|

Country |

# of Stores |

Revenue |

Market Share |

|

Colombia |

513 |

R17.1bn |

31% |

|

Brazil |

873 |

R28.3bn |

14% |

|

Argentina |

25 |

R1.2bn |

2% |

|

Uruguay |

91 |

R3.7bn |

43% |

GPA operates over 1,400 stores, has over 84,000 employees, and also has 28 distribution centers. This is essentially a pure play on Brazil/Colombia consumption, as the company derives around 85% of its revenue from these two countries. Companhia Brasileira de Distribuição is broken into two major businesses, including GPA Brazil and Grupo Exito.

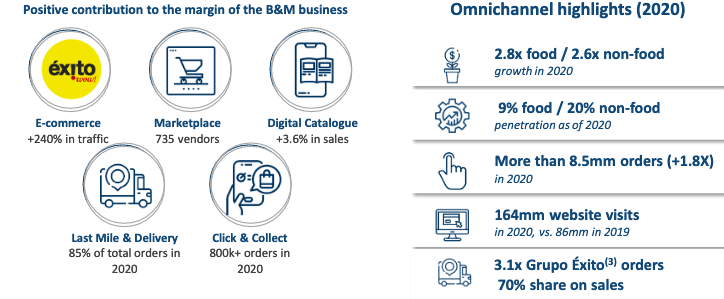

Growth During COVID: Pivot to Digital

GPA experienced respectable growth during 2020, although this has not been that uncommon among other regional consumer companies that have been expanding geographically and implementing an omnichannel approach. Its GPA Brazil segment grew by 6.3%, while Grupo Exito grew by 5.9%. Both segments were able to increase their digital penetration rate, which was a significant driver of growth. Moving forward, GPA can continue to deliver strong growth and improve its margins by focusing on its omnichannel approach, and shifting its focus to its most profitable segments. Digital sales for Grupo Exito have risen by 247.3% since 2019, while GPA Brazil’s digital sales rose by 362.8% during the same time period.

GPA Brazil Performance

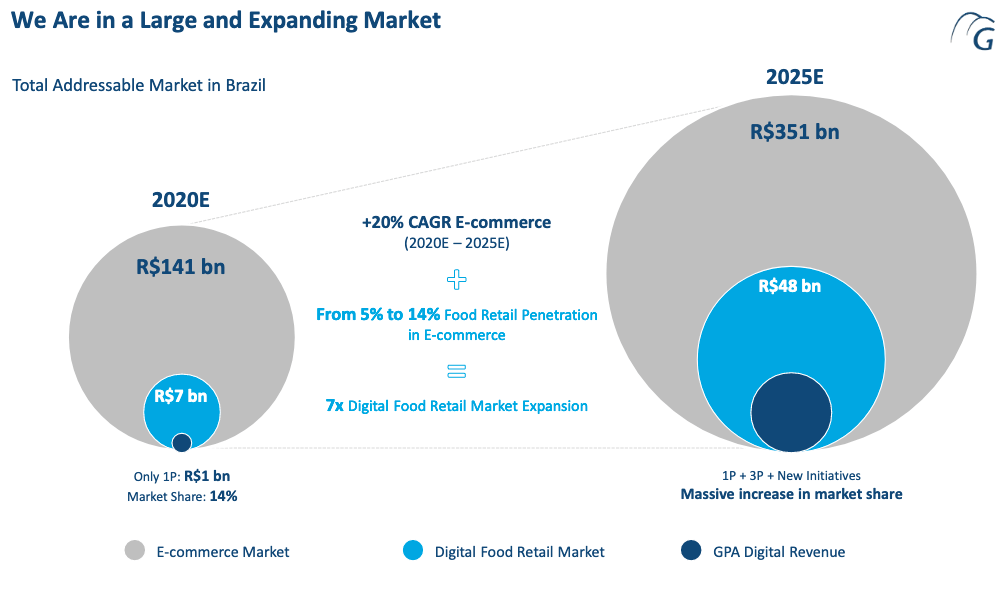

GPA Brazil operates in large and expanding markets in Brazil. Particularly its e-commerce segment will be able to deliver a 20% CAGR through 2025, and it will be able to increase its food retail penetration in e-commerce from 5% to 14%. These growth trends are partially in line with the growth of e-commerce that has been taking place in Latin America in the past few years (particularly in 2021).

GPA

The company has a variety of stores, and its top 5 stores account for around 87% of its revenue as of Q1 2022.

GPA Brazil has a strong customer base, as approximately 21 million customers are registered in its loyalty programs. There is still ample room for growth moving forward, as this only represents circa 10% of Brazil’s population. Its Omnichannel sales approach has also been a strong success, as the company’s average omnichannel sales have been 2.7x larger relative to the average Brazilian consumer’s spending in brick and mortar stores. The company also launched a loyalty program JV with RD (drug retail company) to help broaden its customer base by targeting a group of 55 million customers. This is a strategic move, as the two companies have little in common in terms of product offerings, and can enjoy synergies with this JV.

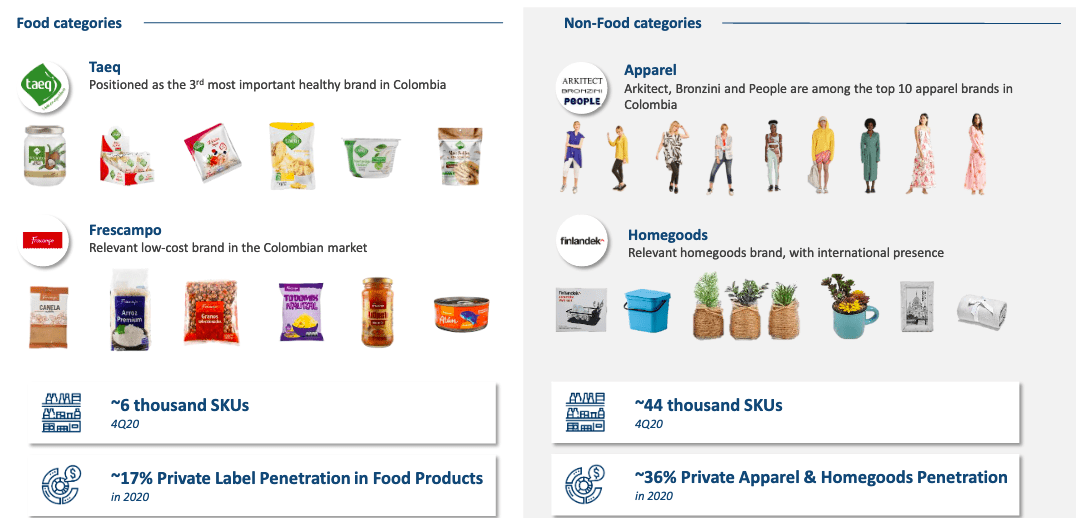

Grupo Exito

Grupo Exito is a food retail/clothing leader in Colombia and Uruguay.

|

Country |

Revenue (R billion) |

Market Share |

|

Colombia |

18.8 |

31% |

|

Uruguay |

4.4 |

43% |

|

Argentina |

1.4 |

2% |

Notably, its Argentina operations include its retail footprint (Libertad), as well as real estate (12% market share). Other expansions in Colombia include the launch of its hypermarkets in Colombia (11 stores), as well as its Carulla Freshmarket (14 stores). Grupo Exito also operates in other areas besides food, including apparel and Home goods.

GPA

The company’s Omnichannel sales grew by 2.7x during 2020, website visits nearly doubled, and it completed more than 8.5 million orders.

GPA

Most Recent Performance

The group’s total revenue increased by 2.3% YoY last quarter, and revenue was mainly derived from Colombia (46.9%) and Brazil (38.8%). GPA’s EBITDA margin was 6.5%, a 110bps decrease from Q1 2021. This was a result of selling, general and administrative expenses. However, these expenses only rose by around 3.2%, which was relatively low compared to regional inflation. It appears that its stores have had relatively larger pricing power so far, and have not been significantly impacted by inflation, but this could change during 2022 or 2023.

GPA recently sold 17 of its properties to Barzel Properties for around US$234 million ($1.2bn reals). It will receive R$3.2bn through 2024. This will help to boost its current cash position significantly and allow it to focus on its more efficient operations.

Outlook

Moving forward, divestments from less efficient businesses may be able to help GPA to boost its margins moving forward. The company recently decided to spin-off off its Assai wholesale operation, and as mentioned before, terminate its hypermarket operations in Brazil. Consequently, its performance in Colombia will likely be a key driver of growth, although Brazil will still always be its 1st/2nd largest market. Its digital initiatives will be the main growth driver moving forward, and there is ample room for growth given the relatively low levels of eCommerce penetration in Latin America.

GPA has a strong and loyal customer base and may be able to use insights gained during 2020-2021 to upgrade its product offerings. GPA launched a click-and-collect service (offered in Q3 2021), which allows customers to order online and pick up their purchases from more than 290 stores within 1 hour. This may also result in customers picking up additional items in-store, or visiting more frequently at later dates. GPA may also be able to gain more insight into its customer’s shopping habits through its loyalty programs and apps that were launched in 2021.

GPA is also continuing to invest heavily in future growth. GPA’s total capex increased by 7.2% during 2021, which was mainly driven by new stores and land acquisitions. GPA also continued to invest in IT/digital initiatives and renovations, although at a smaller amount relative to 2020. Around 67% of its capex is focused on helping it to boost its innovation, omnichannel approach, and digital transformation.

The main risk with this investment includes the risks associated with investing in Colombia and Brazil. Both countries are struggling with inflation and relatively slower economic growth, which may dampen consumer spending and particularly harm the relatively higher-end products that GPA offers.

I am comfortable accumulating at this price range, given the relatively lower valuation of this company. However, I am waiting for additional pullbacks due to macro and company-specific factors. Key emerging market-specific risks include Fed rate hikes, potential sovereign defaults, and deteriorating macroeconomic conditions. There is no indication that growth/inflation will improve in Latin America, so investors will have to rely on company-specific initiatives that allow these companies to outperform. It may be hard for GPA to rise above its relatively high successful base of 2020-2021. I have this stock listed as a hold specifically due to external factors and the high likelihood of a pullback in emerging market equities.

Be the first to comment