bjdlzx/E+ via Getty Images

iShares Global Energy ETF (NYSEARCA:IXC) is an exchange-traded fund that enables investors to get exposure to companies that produce and distribute oil and gas. In a sense, IXC is almost like the antithesis of the ESG theme. That is not to say that companies within IXC are governed in an irresponsible way, but oil and gas companies have been shunned by ESG funds generally, owing to environmental (and broader social) concerns. IXC has performed well recently, perhaps in part due to investors being under-weight energy stocks previously, but also because of surging commodity prices generally.

Commodity prices are almost impossible to predict, all you can really think about are likely bounds and then extrapolate based on a present earnings base to gauge forward earnings streams, and discount those earnings back to present value to get a vague impression of fair value. Then, you can get an idea of whether a security is priced with implicitly high or low uncertainty. The higher the uncertainty, the greater the implied equity risk premium, and thus the higher the return going forward (providing your base-case earnings stream is achieved). This always requires some degree of guesswork.

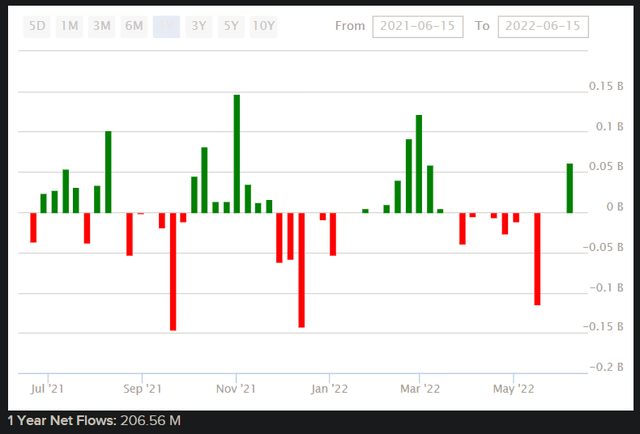

IXC is supposed to track the performance of its chosen benchmark, the S&P Global 1200 Energy Sector Index. The expense ratio of the fund is 0.43%, which is not cheap, but in line with many other iShares funds with specific strategies. IXC had assets under management of $2.265 billion as of June 15, 2022, and that followed positive albeit tepid net fund flows over the past year of about $207 million in aggregate.

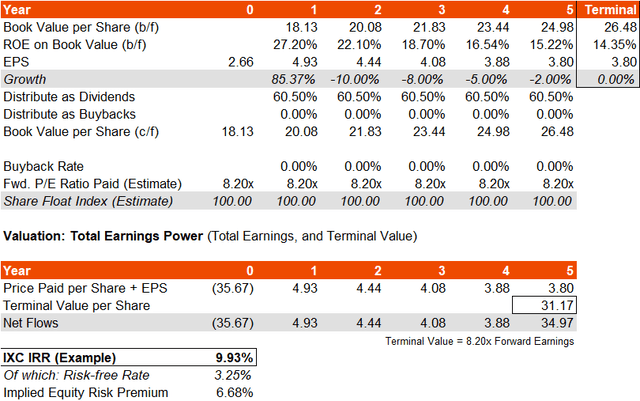

YTD performance is reported by iShares themselves as being positive 38.65% for IXC to June 15, 2022. A recent factsheet from S&P Dow Jones Indices for IXC’s benchmark index, which I use as a proxy for the IXC portfolio itself, revealed trailing and forward price/earnings ratios of 15.2x and 8.2x, respectively, with a price/book ratio of 2.23x (as of May 31, 2022). The indicative dividend yield was 3.98%. Just like IXC itself, there were 47 constituents as of this date. From this data, we can derive an implied forward return on equity of 27.2%, and a distribution rate of earnings into dividends of 60.5% (excluding any buybacks). The price/earnings ratios also imply a forward one-year earnings growth rate of about 85%; likely a one-time surge with commodity prices having risen rapidly.

Morningstar‘s reported three- to five-year average earnings growth rate projected for IXC’s portfolio in aggregate is 12.56%. Bear in mind, if we assume 0% earnings growth after the first year, but keep our projected 85% earnings growth rate in “year one”, our five-year average is still 13.14%. So, implicitly, the market is probably projecting negative earnings growth to some degree in the future. I think this is probably fair, as commodity prices do tend to move in cycles; I don’t think pricing in a pullback in earnings over the next few years is at all conservative.

For example, let’s assume in the second year, earnings pull back from their highs by 10%, and then we continue the negative cycle through to year 4, until earnings stabilize and finally reach 0%, with no long-term earnings growth rate assumed (assuming that the oil and gas industry is in long-term decline, in inflation-adjusted terms). My average earnings growth rate is now about 7.40-15.35% (over three and five years), which is roughly in line with Morningstar’s number.

Let’s also assume that the distribution rate remains constant at 60%, since oil and gas companies may want to retain more earnings through tougher times going forward. Let’s also assume no buybacks on the basis that we value IXC’s portfolio on its underlying earnings power only. Holding the forward price/earnings multiple constant at 8.20x finally gives us the following IRR gauge (the current U.S. 10-year yield is used as the risk-free rate to compute the implied equity risk premium from the IRR; currently 3.25% at the time of writing).

The implied equity risk premium is 6.68% on an IRR of 9.93%. Bear in mind that IXC’s five-year beta (calculated on a monthly basis) is 1.31x. A fair mature market equity risk premium is anywhere from 4.2% to 5.5%, depending on broader risk sentiment. So, applying a beta of 1.31x gives us a fair range of roughly 5.5-7.2% for IXC’s ERP. With a current ERP of 6.68%, IXC is right within a fair value range based on earnings growth base case. It doesn’t matter if my earnings stream projection is especially accurate or not; it is a simplistic model of a potential outcome which roughly matches consensus estimates on average over the next few years.

IXC’s portfolio might out-perform if commodity prices remain high and elevated, or the outcome might be even worse than I anticipate. In any case, given IXC’s beta and in light of consensus estimates, I would say IXC is fairly priced. Based on my ERP analysis, the fair value range might be in the range of +15% to -5% or so, which does imply a positive skew on IXC’s potential. Still, I can’t say that IXC looks “cheap”, so I would remain neutral, especially given commodity prices have risen so high and could unexpectedly drop, which could drive risk sentiment to lows and thus expand the equity risk premium even beyond a fair upper bound.

The forward price/earnings multiple of 8.20x is interesting, though. Inverting this gives us a forward earnings yield of 12.2%. Subtracting a risk-free rate of 3.25%, gives us an implied “risk premium” of 8.95%. If a fair upper bound is, say, 7.2% (as discussed above), that means that the market is pricing in a long-term drop in earnings of the difference, of about -1.75% to perpetuity (on average). IXC is indeed priced as if it is a declining long-term industry. But if long-term inflation is circa 2%, that suggests a “real” drop of -3.75% per year, which does seem like an aggressive assumption. I would not buy IXC for potential earnings multiple expansion, but I would say that while I would recommend taking a neutral stance on IXC, there is probably positive skewness in the potential near-term outcomes for the fund’s market value.

Be the first to comment