Galeanu Mihai/iStock via Getty Images

Dear readers,

When dark clouds and thunderstorms rage across the market, I sit in the midst of the storm ‘neath my umbrella of fundamentals, dividends and value. Add diversification into 45+ businesses into this, with no single position (mostly) above 3.5%, and you get a portfolio that, even with this sort of market, is still actually in the green for the full year.

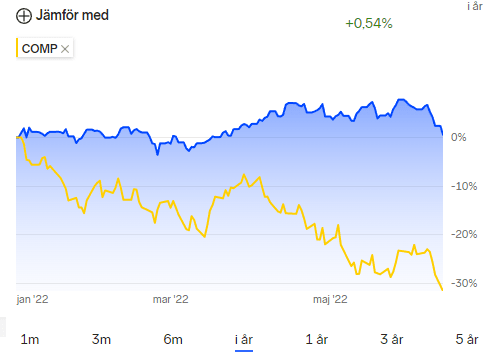

Author’s Portfolio, YTD (Nordnet)

If we look exclusively at my EUR/USD portfolio, that climb is still above 18.5% next to a 30%+ Nasdaq decline. This is made possible through what I mentioned above – razor-sharp focus on fundamentals, value, and making sure that dividends keep flowing to offset some of these drops. I don’t fully expect to offset the drops that we’re likely to keep seeing in the market, given where things seem to be going on a macro level.

So, in this article, we’ll go through where my top buys are, and how they’re going. I’ll also look at the total upsides for the companies I consider to be the best opportunities on the market today.

While some may follow the approach of trying to time the market in order to ensure that they hit that sweet spot when it doesn’t fall any further, or “much” further, I follow the approach of putting capital to work at a steady pace – perhaps somewhat more if it drops more. I’ve put over $20,000 into the market since this downturn began, and I’m preparing to put more in.

Where? These companies I’m presenting here – in no particular order of appeal.

All of them are:

- BBB rated or above.

- 4%+ Yields (with one exception)

- An Upside of over 15% annually, and over 40% until 2024E

- I own 2.5%+ in all of these companies in my portfolio.

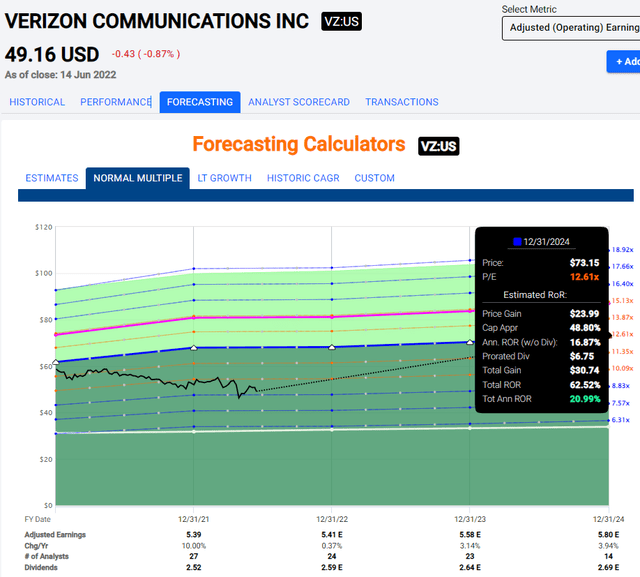

1. Verizon Communications (VZ)

Yeah, you might expect my perceived appeal for Telcos to continue – and at 9X P/E for one of the largest on earth and a 5.21% yield, I believe this should be the first position an investor might want to look at filling. Verizon, even if they trade below 9X P/E in 2024, will generate returns of 18% under today’s forecast. The realistic upside to a 5-year average is almost 63%, or 21% per year, for a BBB+ rated telco.

The company’s cash-flows are recession-resistant, and the business is one of the few businesses that can effectively increase their pricing with very little pushback given their market position and the universal need of their services. What would you do if your telco charged $4-$5 more? If all did? Not much you can do, really.

Even at a single-digit EPS growth rate, this company is worth your consideration – so consider it, is my stance. Here’s what I view as the realistic upside.

Verizon Upside (F.A.S.T. graphs)

Over 3.5% of my portfolio is Verizon. I’m considering buying more. Verizon is a “BUY” here.

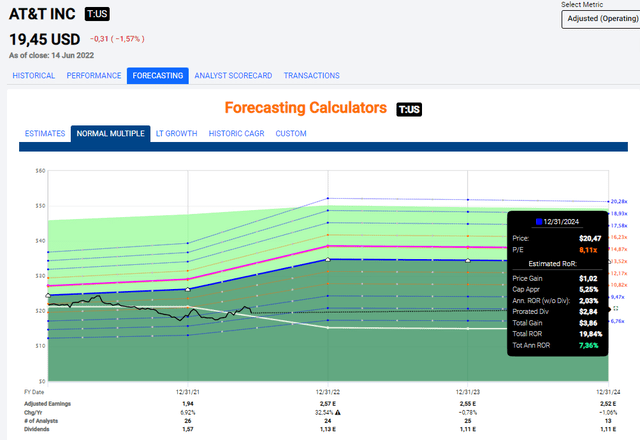

2. AT&T (T)

Yeah – you might be tired of hearing about Telco’s like AT&T – but that doesn’t mean that AT&T isn’t a potentially great investment to have. After the WBD split, this company is a very pure-play telco with one of the greatest infrastructures in North America. Much like Verizon, the fundamentals here are absolutely stellar, and following the dividend readjustment, the company’s dividend is very well-covered.

To compare, the company is expected to generate earnings of no less than $2.5 this year, while the dividend is consuming no more than $1.13 for this year, which is less than a 50% payout ratio. This gives the company ample room to pay off debt and invest in the business.

The upside to a 12-13X P/E based on the current valuation of 8.75X is no less than 28% annually, and over 90% RoR in less than 3 years until 2024E. The company could theoretically and severely underperform here, and still provide alpha. Even at an 8X forward P/E, you’re still making 7.5% per year, which means you’re far from losing money.

The upside for AT&T, even if it keeps dropping, is simply very good. Investing until you have a full position in the company is, as I see it, a good idea. The company’s cash flows are incredibly safe and resistant to downturns.

I’m making sure to keep a full position in AT&T, and I have a 3.5% portfolio stake in the company at this time.

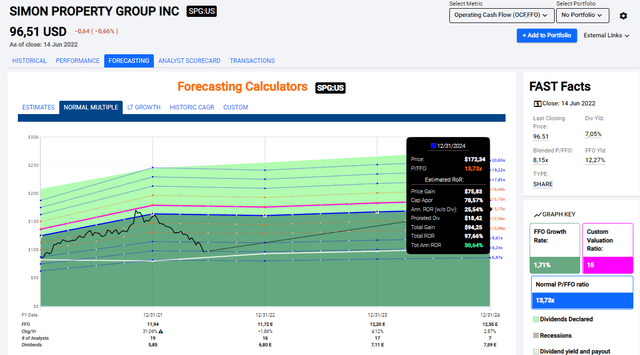

3. Simon Property Group (SPG)

REITs, including A-quality ones like SPG, have been dropping very nicely for the past few weeks, and the company currently trades below $100/share for the SPG ticker, meaning we’re looking at a 7%+, A-rated yield with a conservative upside of 15.4% annually to a 9X P/FFO, or a 30%+ annual upside to a 13.7X P/FFO upside, or almost 100% in less than 3 years as expectations currently are.

Risks? Issues? None are readily apparent. As late as early May, SPG guided for a significantly better 2022 than earlier expected. It also increased the dividend, and its stock buyback program and expects continued positivity despite all of the already-known headwinds we’re seeing. I believe SPG and similar REITs are being unfairly punished at this time and should trade far higher – but I’m happy buying in the weakness here, as long as I don’t have a full position in the business just yet.

Simon Property Group Upside (F.A.S.T. graphs)

I have over 3.5% in my portfolio in SPG, and I consider it a “BUY” here. It’s a great company to have, because, in the end, I believe its cash flows will only be marginally affected contrary to the implied effect of the share price.

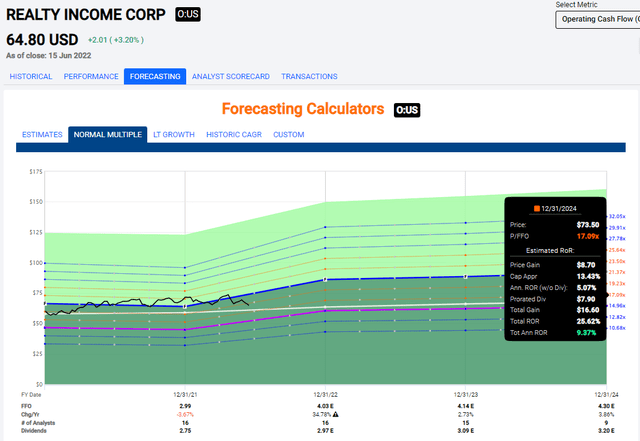

4. Realty Income (O)

I’m not getting an article like this published without mentioning the great company that is Realty Income, one of the safest monthly dividend payers out there. As of this crash, the company trades below $65/share, which means that the conservative upside on a P/FFO basis is actually 18.5% annually, or 54% in less than 4 years based on a P/FFO premium of 21.3X. Even if we consider this premium flawed for what is an A-rated conservative, REIT, we still can, on a 15-17X P/FFO, expect a return on an annualized basis of 9.5% or 25.6% total.

Realty Income Upside (F.A.S.T. graphs)

Realty income, to me, is the gift that keeps on giving. Month in and out, that dividend keeps coming, and that dividend is very well-covered with just the company’s recurring cash flows. The company’s quality in terms of its portfolio assets is incredibly high, making it, as I see it, a superb choice for both conservative DGR investors, as well as income investors wanting yield.

Realty Income is the best of two worlds – and there is no portfolio I have seen where I would say that O couldn’t be a benefit to it.

O is a “BUY” to me – and I own over 4% of my portfolio in the company.

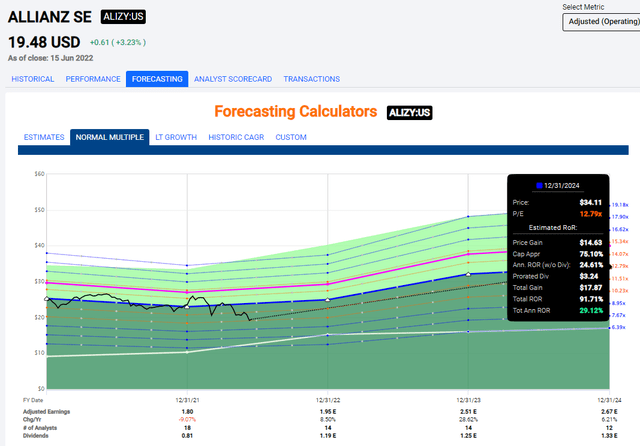

Insurance and reinsurance companies are a bit of my “ball game”, so to speak, and Allianz is currently at the top of that list. I really do not care how low this company goes given its titanic (that’s the original meaning of the word, not the ship) fundamentals, with AA credit, and is one of the foremost asset managers in the entire world. The upside in Allianz based on no more than a 12.5X P/E is more than 29% annually, or 91% until 2024 based on current estimates. These estimates should be seen as relatively realistic, even if we might see some inflation-induced/interest pressures.

Still, the upside and the safety are very much there.

Allianz Upside (F.A.S.T. graphs)

You can argue against Allianz, but you really can’t argue against the fundamentals of the company and its valuation here. One issue we have is that the generality of this drop distorts even quality companies like Allianz. All I can say is that I believe quality will win out – and this is quality.

Allianz is a “BUY” to me – and I own over 3% of my portfolio in the company.

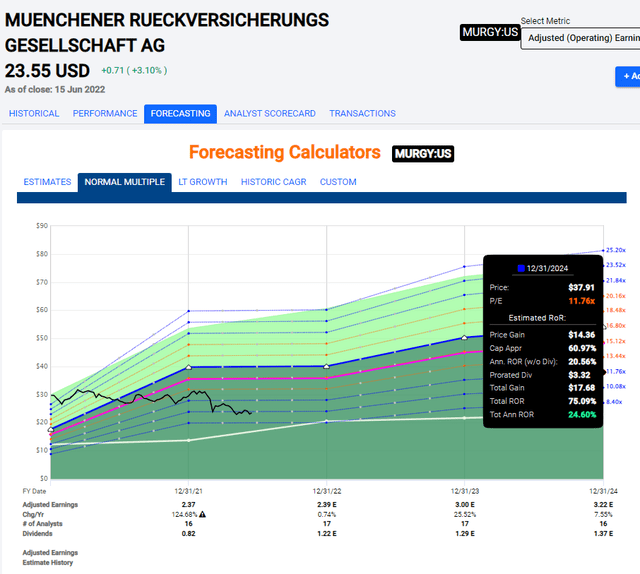

From insurance to reinsurance to my perhaps most interesting reinsurance play. Munich Re is the largest reinsurance business on earth, but these crashes haven’t been kind even to great businesses with AA- credit, which Munich Re has. The company has a yield in excess of 4%, and based on current expectations for EPS growth, will carry an upside of almost 145% split over a small number of years if it reverts back up to 16.8X P/E. We can moderate this down to 11X and below, and you’re still getting 24-25% annually, with RoR of 75% in a short time.

Munich Re Upside (F.A.S.T. graphs)

Again, you can argue risks here – but historically speaking, forecasts have usually been mostly solid, with a miss ratio of less than 35%, and that’s including pandemics, financial crises, and other major events where reinsurance has taken EPS hits. The trend is that reinsurance gets hit, then reverts a year later or so, and the company has stuck to this pattern pretty closely.

I view MURGY as a “BUY” with a significant upside, and I own over 2.5% in my portfolio.

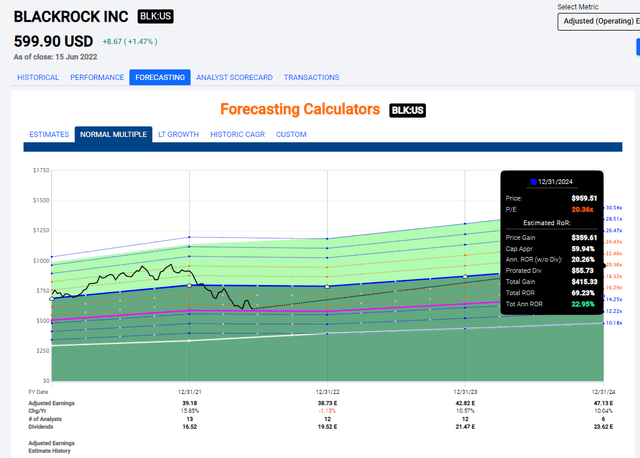

7. BlackRock (BLK)

BlackRock is the quintessential dividend/safety stock, with significant fundamental upside based not only on premium but on a pure 15X fair value multiple. I’ve recently written on the business and consider it to be perhaps one of the most significantly undervalued quality businesses on this list. The breadth and scope of their operations is hard to fathom.

If we accept a premium for the company’s earnings, which I firmly argue that we should, a 20X premium gives us an upside of almost 23% annually, or almost 70% over the course of 3 years – for investing in the largest asset manager on earth.

BlackRock Upside (F.A.S.T. graphs)

I have significant skin in the game with BlackRock, all established around $600/share, and am eager to load up more cheaper if the company will allow me to do so.

I consider this business a strong “BUY” and would buy more here – I already own over 3% of my TPV in the company.

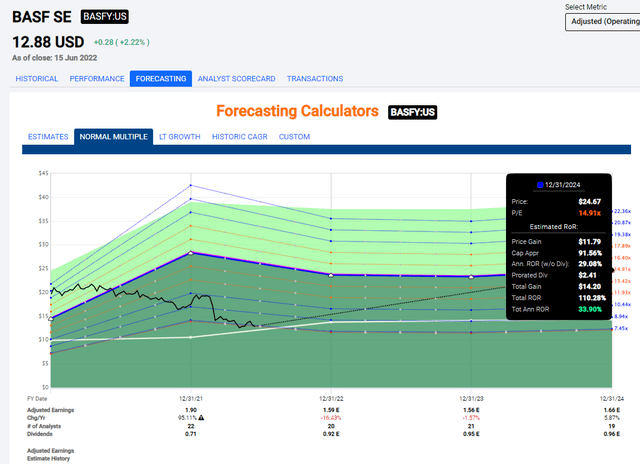

Yes, I’m fully aware of the negative sentiment against BASF due to its exposure to EU gas reliance – and my answer is still that the company’s fundamentals, non-European assets, and non-Gas-related industries are being severely underestimated. Do I care that my position is now somewhat underwater including FX (though not dividends)? No, not really.

Stocks go up and down – they’ve done so for over 100 years and will continue to do so. Quality endures – and BASF is most assuredly quality. I’ve bought them at a cheap price for the long term considering the value of its cash flows – and I’ll continue to push capital to work as long as my position is less than 4.5% – which, thanks to declines, it currently is.

BASF has an upside of no less than 110% to a conservative P/E of 14.9X. Even if it takes the company a few years to realize this, it will be an annualized RoR well worth waiting for in the end – and until then, I’m getting plenty of dividends from the company.

So – over 4% in my portfolio, a great yield, and an even better upside. I’m happy to wait and buy more here.

It’s a “BUY”.

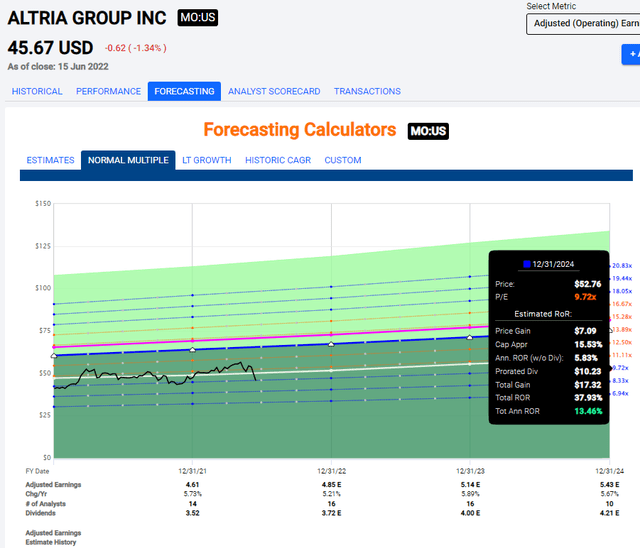

9. Altria (MO)

I’ve fielded anti-tobacco arguments before, so I won’t touch these here. Instead, I’ll focus on the fact that Altria is a BBB rated company with an amazing record, that’s currently trading at less than 10X P/E. It yields close to 8%, and even if it trades flat for 3 years, that well-covered yield from a recession-resistant product (like food, alcohol, and yes – tobacco) will give you returns of 13.5% annually, or close to 38% in 3 years, as long as you stick to buying the business at the “right” price. That right price is now.

Altria Upside (F.A.S.T. graphs)

Your upside in case of a more general reversal is well beyond 50% until 2024E. The role of Altria in your portfolio is income, and I consider it a valid play both for income seekers/retirees as well as safety investors, given the company’s fundamental appeal and safety. Altria isn’t going anywhere – anyone who’s ever argued or bet against the tobacco industry long-term for the past 100 years has gone home with losses in the end. Again, as long as you avoid times when the company trades at an insane valuation like it did in 2017.

MO is a “BUY” here – and I own 3.9% of my portfolio in the company.

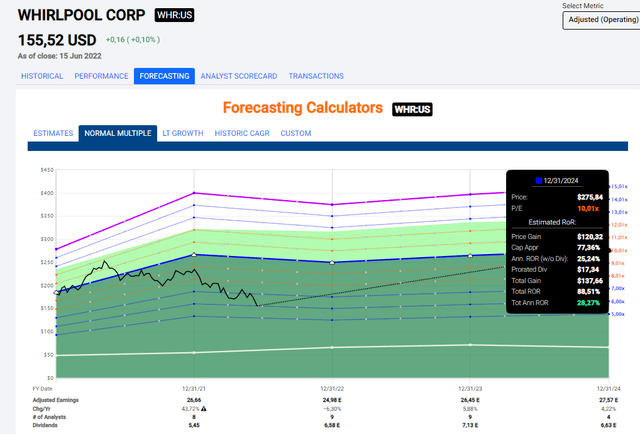

10. Whirlpool (WHR)

My tenth pick was the tricky part here. I have several Swedish, German, and EU stocks that warrant placement here, but in the end, I think Whirlpool does the job. At less than 6X P/E, this appliance giant is trading at a massive discount, and the upside even if the company doesn’t advance another inch in terms of valuation is in the double-digits.

If we see a reversal, that upside quickly balloons to beyond 85% total until 2024E.

Whirlpool Upside (F.A.S.T. graphs)

Let’s remember that the company has traded close to those levels less than 2 years ago. Whirlpool also presents us with a very impressive yield – no less than 4.5% at this time, well-covered by earnings and cash flows. It’s an appliance manufacturer, so there’s some cyclicality and input cost increases that come with it at this time – but I don’t believe these downsides are material enough to give pause.

This is my latest addition to my “large holdings” list. I’m at 2.5%, and I’m wanting more.

So I’m buying more.

Conclusion

For those unfamiliar with his writings, I recommend the words of Nicholas Taleb in his book “Antifragile”, with the quote “Become antifragile or die”. While it’s hard to argue that we as investors benefit from shocks, volatility, randomness, and disorder, there’s a core tenet I hold in that this is very healthy for us. Whether you view it as skin in the game, the path of Via Negativa (describing what the market is not), or any other perspective the author describes, is positive for investors.

Antifragility or resiliency to me, is a core part of my approach, as I see things from a very high level and in a very long time frame. Whether the market drops 5% today, goes up 10% tomorrow or we see a YTD 50% drop really isn’t all that interesting to me – beyond what it would do for the buying appeal for what I can invest in or sell.

The approach of a value investor means looking beyond temporary drawdowns – and by temporary, I do mean even downturns that last 1-2 years. Because in the end, what matters are time periods beyond 5-10 or even 15 years. Those are long-term market trends.

The approach of a dividend investor means that your downturns or drawdowns are relatively uninteresting because they, at least in theory, only represent “paper” losses. Your dividends are typically unaffected. Now, I’m not going to argue that at some point so-called paper losses shouldn’t be considered real if the company doesn’t recover – but I really do believe that downturns in stocks that even last 2-3 years really aren’t that interesting unless they’re based on fundamentals. If fundamentals and dividends are intact, there’s no real problem for me.

The magic happens when you manage to combine these two approaches and mentalities – combining knowledge of value investing with the surety of safe dividend investing.

The net result of such an approach, at least in theory, is income safety in the form of your continued dividends, and investment safety knowing you’ve bought your investments at a theoretically long-term appealing valuation. This should prevent sudden investment mistakes from occurring, or panic selling to happen.

This is part of my approach – perhaps one of the more core parts.

The way I view the current crash is with a sort of calculated distance. I don’t really mind if we continue down another 10-20%, or even more – but I’d want to have capital to invest, which is why I’m carefully planning my deployments for the foreseeable future.

These 10 companies, and keeping my positions in them topped up, is a core part of that plan. I don’t stray into much too riskier plays in markets like these.

I double down on quality.

These are quality.

Thank you for reading.

Be the first to comment