RiverNorthPhotography

Earnings of Community Trust Bancorp, Inc. (NASDAQ:CTBI) will most probably dip this year as provisioning for expected loan losses will approach a more normal level. On the other hand, mid-single-digit loan growth will lift earnings. Further, slight margin expansion is likely to support the bottom line. Overall, I’m expecting Community Trust Bancorp to report earnings of $4.41 per share for 2022, down 11% year-over-year. Compared to my last report on the company, I’ve slightly increased my earnings estimate as I’ve favorably tweaked all income statement line items. For 2023, I’m expecting earnings to grow by just 1% to $4.44 per share. The year-end target price suggests a small upside from the current market price. Based on the total expected return, I’m maintaining a buy rating on Community Trust Bancorp.

Strong Regional Economies to Sustain Loan Growth

The rate of loan growth slowed down to 1.2% (4.9% annualized) in the second quarter from 3.2% (12.6% annualized) in the first quarter of this year. I’m expecting a further deceleration in the growth rate because the second quarter’s rate was a bit higher than the historic norm despite the decline. Further, high borrowing costs are bound to dampen credit demand, especially for residential loans which make up around a quarter of total loans.

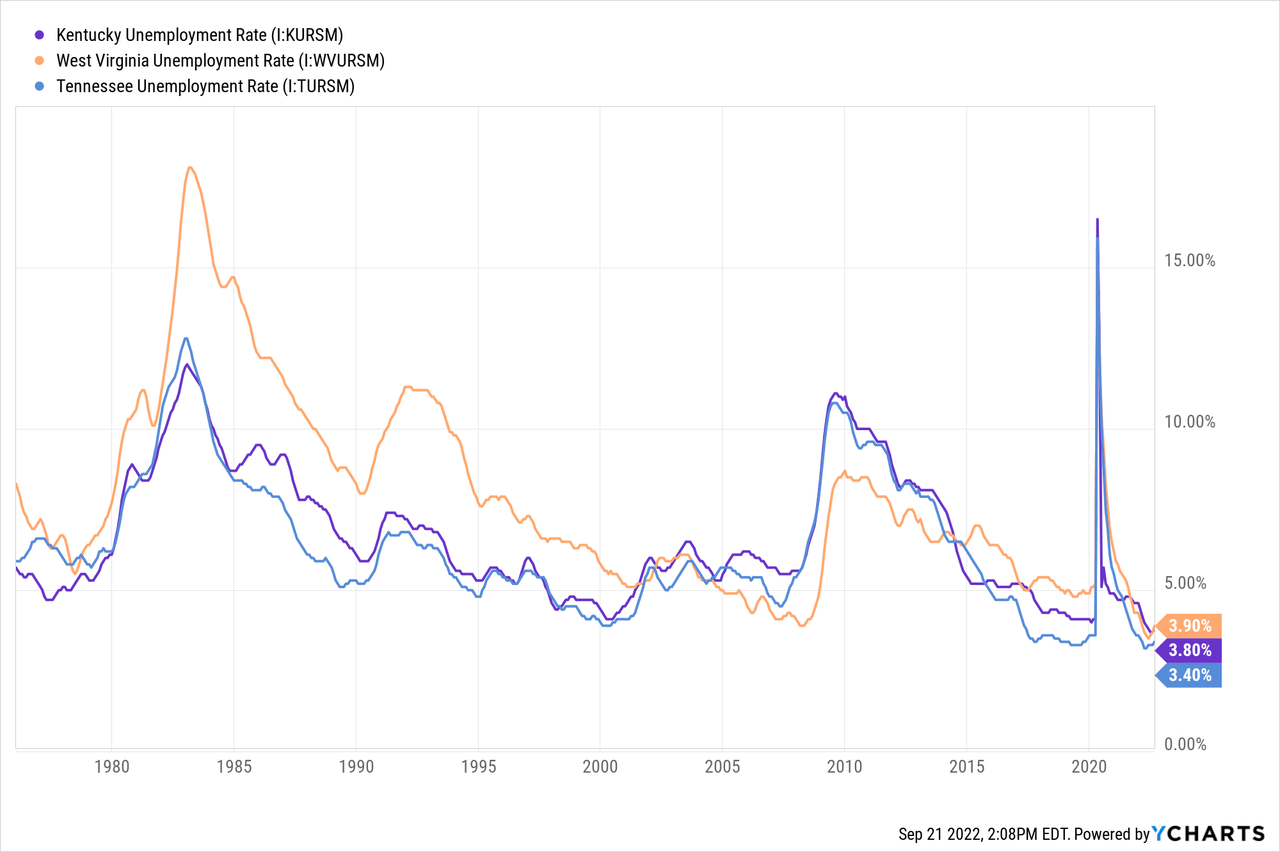

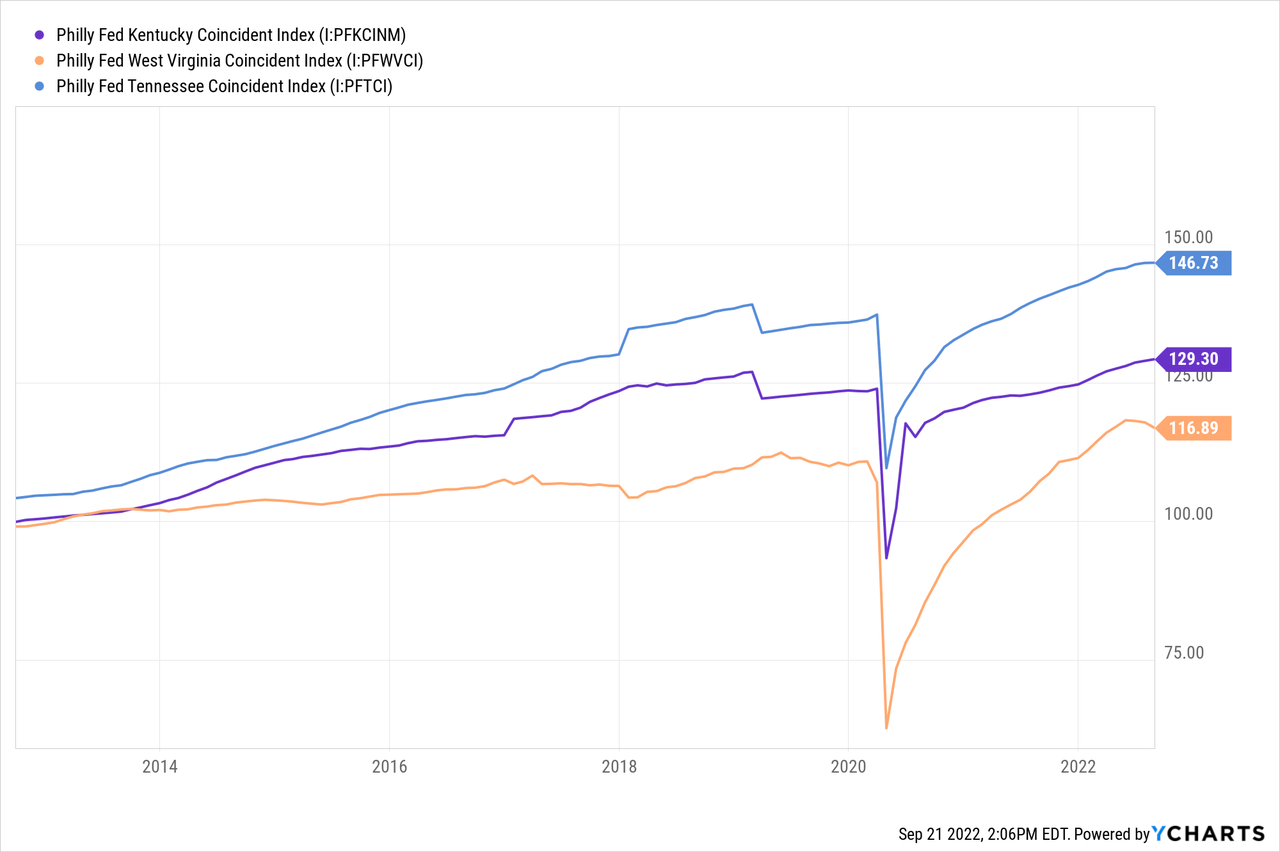

However, unlike previous years when loan growth remained in a low-single-digit range, I’m expecting future loan growth to be in the mid-single-digit range. This is mostly because of strong regional economies. Community Trust Bancorp operates mostly in Kentucky with a limited presence in West Virginia and Tennessee. All three states have recovered well from the pandemic. Their unemployment rates are near historic lows and their coincident indices show that their economies are improving rapidly.

Considering these factors, I’m expecting the loan portfolio to grow by 1% every quarter until the end of 2023. Further, I am expecting deposit growth to match loan growth. However, the growth of other balance sheet items will likely trail the rate of growth of loans and deposits. The equity book value will, in particular, grow by only a small amount because of the effect of rising interest rates on the market value of available-for-sale securities.

The equity book value per share has already dropped to $35.32 per share at the end of June 2022 from $39.13 at the end of December 2021. This fall was largely attributable to bloated unrealized mark-to-market losses on available-for-sale securities. Further pressure on the equity book value is likely because of the ongoing monetary tightening. However, I’m expecting a rate cut in the second half of next year, which will reverse some of the unrealized mark-to-market losses. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Financial Position | ||||||||

| Net Loans | 3,173 | 3,214 | 3,506 | 3,367 | 3,587 | 3,732 | ||

| Growth of Net Loans | 2.8% | 1.3% | 9.1% | (4.0)% | 6.5% | 4.1% | ||

| Other Earning Assets | 679 | 810 | 1,307 | 1,726 | 1,559 | 1,591 | ||

| Deposits | 3,306 | 3,406 | 4,016 | 4,344 | 4,563 | 4,748 | ||

| Borrowings and Sub-Debt | 294 | 308 | 429 | 331 | 313 | 319 | ||

| Common equity | 564 | 615 | 655 | 698 | 655 | 702 | ||

| Book Value Per Share ($) | 31.9 | 34.7 | 36.9 | 39.1 | 36.7 | 39.3 | ||

| Tangible BVPS ($) | 28.2 | 31.0 | 33.2 | 35.5 | 33.0 | 35.7 | ||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

Balance Sheet is Only Slightly Asset Sensitive

Variable rate loans made up 67% of total loans at the end of June 2022. Therefore, the average earning-asset yield is quite rate-sensitive. Unfortunately, the liability side is also quite rate-sensitive. Around 60.86% of liabilities will reprice within six months, according to details given in the September presentation. In fact, far more liabilities than assets will mature/reprice in the short term. As mentioned in the presentation, the one-year asset-liability maturity gap made up 18.39% of total assets at the end of June 2022.

On the plus side, Community Trust Bancorp will have more pricing power on the deposit side because of the high liquidity in the industry following the pandemic-related government payments. Therefore, asset repricing will most probably outweigh liability repricing even though more liabilities than assets will mature in the short term.

The results of management’s interest-rate sensitivity analysis given in the latest 10-Q filing show that a 200 basis points hike in interest rates can boost the net interest income by 4.03% over one year, and 9.88% over two years. Considering the factors given above, I’m expecting the net interest margin to increase by ten basis points in the second half of 2022. I’m expecting the fed funds rate to start trending downwards in the second half of 2023. Nevertheless, I’m expecting the margin to remain unchanged next year because of the lagged effect of interest rate hikes in 2022.

Higher Provisioning Expenses Likely Due to Inflation

Provisioning for expected loan losses continued to remain at an unsustainably low level during the second quarter of 2022. Non-performing loans made up 0.39% of total loans, while allowances made up 1.19% of total loans at the end of June 2022. This coverage of around 3x appears barely comfortable given the high-inflation environment and the resultant financial stress for borrowers. Moreover, loan additions will require further provisioning for expected loan losses. Therefore, I believe provisioning will likely increase in the second half of the year towards a more normal level.

Overall, I’m expecting the net provision expense to make up around 0.21% of total loans (annualized) every quarter till the end of 2023. In comparison, the net provision expense averaged 0.20% of total loans from 2017 to 2019.

Expecting Earnings to Dip by 11%

The higher provisioning will likely be the biggest contributor to an earnings decline this year. On the other hand, mid-single-digit loan growth and slight margin expansion will likely support the bottom line. Overall, I’m expecting Community Trust Bancorp to report earnings of $4.41 per share for 2022, down 11% year-over-year. For 2023, I’m expecting earnings to remain almost flattish at $4.44 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Income Statement | ||||||||

| Net interest income | 142 | 145 | 151 | 163 | 165 | 173 | ||

| Provision for loan losses | 6 | 5 | 16 | (6) | 5 | 8 | ||

| Non-interest income | 52 | 50 | 55 | 60 | 58 | 57 | ||

| Non-interest expense | 117 | 118 | 119 | 119 | 120 | 124 | ||

| Net income – Common Sh. | 59 | 65 | 60 | 88 | 79 | 79 | ||

| EPS – Diluted ($) | 3.35 | 3.64 | 3.35 | 4.94 | 4.41 | 4.44 | ||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

In my last report on Community Trust Bancorp, I estimated earnings of $4.31 per share for 2022. I’ve now slightly increased my earnings estimate following the second quarter’s results. The upward revision is not attributed to any big changes in any line item of the income statement. I have slightly tweaked all line items.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Moderate Total Expected Return Warrants a Buy Rating

For more than a decade, Community Trust Bancorp has increased its dividend every year in the third quarter. Based on my earnings outlook, I’m expecting Community Trust to increase its dividend by $0.02 per share in the third quarter of 2023, leading to a full-year dividend of $1.80 per share. My earnings and dividend estimates suggest a payout ratio of 41% for 2023, which is the same as the last five-year average. The dividend estimate suggests a forward dividend yield of 4.2%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Community Trust Bancorp. The stock has traded at an average P/TB ratio of 1.32 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 28.2 | 31.0 | 33.2 | 35.5 | ||

| Average Market Price ($) | 47.3 | 42.1 | 34.4 | 42.3 | ||

| Historical P/TB | 1.68x | 1.36x | 1.04x | 1.19x | 1.32x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $33.00 gives a target price of $43.50 for the end of 2022. This price target implies a 1.3% upside from the September 20 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.12x | 1.22x | 1.32x | 1.42x | 1.52x |

| TBVPS – Dec 2022 ($) | 33.0 | 33.0 | 33.0 | 33.0 | 33.0 |

| Target Price ($) | 36.9 | 40.2 | 43.5 | 46.8 | 50.1 |

| Market Price ($) | 43.0 | 43.0 | 43.0 | 43.0 | 43.0 |

| Upside/(Downside) | (14.1)% | (6.4)% | 1.3% | 9.0% | 16.7% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.1x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.35 | 3.64 | 3.35 | 4.94 | ||

| Average Market Price ($) | 47.3 | 42.1 | 34.4 | 42.3 | ||

| Historical P/E | 14.1x | 11.6x | 10.3x | 8.6x | 11.1x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.41 gives a target price of $49.10 for the end of 2022. This price target implies a 14.4% upside from the September 20 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.1x | 10.1x | 11.1x | 12.1x | 13.1x |

| EPS 2022 ($) | 4.41 | 4.41 | 4.41 | 4.41 | 4.41 |

| Target Price ($) | 40.3 | 44.7 | 49.1 | 53.5 | 57.9 |

| Market Price ($) | 43.0 | 43.0 | 43.0 | 43.0 | 43.0 |

| Upside/(Downside) | (6.2)% | 4.1% | 14.4% | 24.6% | 34.9% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $46.30, which implies a 7.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 12.0%. Hence, I’m maintaining a buy rating on Community Trust Bancorp.

Be the first to comment