rypson/iStock Editorial via Getty Images

For airlines as well as its consumers these are extremely interesting times, and not always for the good reasons. While demand has been sky-high for air travel as travel restrictions eased, other challenges emerged. Airports have been dealing with staffing shortages forcing airlines in Europe to drastically reduce their capacities and airlines themselves also are facing issues getting and training pilots fast enough and in the quantities needed to translate high demand into revenues to the fullest. The pressures on the airline industry sent average fares significantly higher, but high energy prices also provided a significant cost burden. So, there’s a lot going on and recently we’re also seeing that there are concerns on softening air fares and on consumer side there are concerns about inflation.

In a series of two articles, I will be picking two low-cost airlines and two major airlines names that stand out for me and explain why I prefer those airlines over others in the current macro-economic landscape.

Airline Bookings Are Under Pressure, Concerns On Global Economy

In a recent news item by Seeking Alpha it was highlighted that weekly data showed that airline bookings had come under pressure in August being 23.6% lower compared to 2019 and pricing was 0.1% lower. It’s not an immediately reason for concern as in 2019 there might have been a bump in bookings due to an approaching hurricane. That means that if there’s a suitable way to normalize for this, data could have shown that more moderate declines and at the same time in the comparable week in 2019 pricing might have been elevated due to the increase in travel demand for that week. So, while it’s hardly possible to make an apples-to-apples comparison because of the evolving nature and complexity of travel patterns and airlines operations, you could say that without a hurricane bookings and pricing would have been softer.

However, I do believe that airline investing is not for the faint hearted. Surely, there are profits to be made but airlines are navigating an extremely tough environment at present. On the operations side, training and staffing has resulted in capacity recovery being somewhat slower than airlines initially desired. This sent fares up significantly as travel restrictions have started easing globally. This in turn was offset or partially offset by higher energy prices. So, there’s an extremely challenging environment with a web of interdependencies.

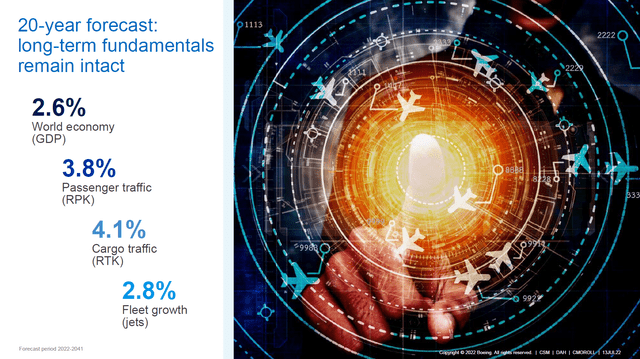

GDP growth and passenger traffic growth (The Boeing Company)

Next to that we have to watch the state of the global economy as well. The slide above is from Boeing’s 20-year forecast on GDP and traffic and fleet growth. Obviously a 20-year forecast figure does not tell you much about the near term. However, one thing to keep in mind is that at 2.6% annual GDP growth, the expectations for GDP growth have come down from forecasts of up to 3% in previous years. However, more interestingly is the coupling between traffic growth and GDP growth. In previous years we saw that for each percent in GDP growth traffic would grow by 1.65%. Applying that to the 2.6% annual growth rate, we would see around 4.2% in traffic growth. The traffic growth has often been around 4.5% to 5% and so the current GDP outlooks really seems to be putting a damper on traffic growth, and for every percent in GDP growth, traffic is now only growing by 1.46%.

So, it’s that coupling that has weakened and could be a cause for concern. Obviously in the GDP numbers a lot of elements are packed. Think about supply chain issues, economic damages from lockdowns, inflation and the current energy prices. That brings us to some elements that will cause doubt on financial performance for airlines.

First, as inflation has skyrocketed to more than 8% there are inflationary cost pressures on staff and items like airport handling. That means higher costs for airlines, and with interest rates going up to battle that inflation, interest expenses also will grow for debt financing, a non-operational cost item for airlines. Then we have high oil prices, which are expected to account for 24% of the costs. This is similar to previous years but at a higher cost basis for fuel. So, overall costs have grown.

That brings us to the consumer side. Over the course of the pandemic, consumers had the possibility to save money. The government was actively supporting companies so employees could keep getting paid and money was stacking up since there was simply nothing open to spend the money on apart from online shops, which saw logistical challenges. So, as travel markets reopened everybody wanted to travel and since they stacked money for basically the past one or two years paying elevated prices to recommence traveling was the norm. So, the airline cost growth was captured by the premium that the traveler paid and one can wonder whether that will remain the case. What we are seeing is that inflation is still very high and that also hurts the consumer. Whereas they might already have spent their money on more expensive trip, they are now confronted with day-to-day life having become more expensive. Prices at the gas station are still high and energy bills in Europe are skyrocketing. There are plenty of cases where the energy bill has doubled and consumers can expect and likely at the end of the year many households can expect an additional levy that would triple the energy bill. What this means is that savings evaporate or the ability to save up declines and willingness to commit to those more expensive airfares might be on the decline.

I’m not saying that airlines are going to go belly up tomorrow, but changes in savings and for consumers might be providing less support to bookings and airfares in the future.

LCC Stocks Could Be Providing A Solution

Southwest Airlines Boeing 737 (Southwest Airlines)

I believe that really no airline is insulated from the reality of reduced consumer purchasing power and airline cost challenges. However, as budgets for air travel might tighten again, I do believe that low-cost carriers or LCCs might have a favorable position. There are a couple of reasons for that. The first one is that LCCs have it in their core of business to keep costs low often at the expense of service. The second reason is that as budgets tighten, LCCs who can offer lower fares are in the spotlight for air travelers. So, there might indeed be people that can no longer afford to fly even on LCCs due to the current cost environment, but I believe there’s a bigger group who would like to keep traveling and will opt for traveling on an LCC instead of a mainline carrier. There of course also is a group that will opt to fly less either on LCCs or on mainline carriers, but overall I do believe that the way LCCs manage their business offers opportunities as travelers grow more cost conscious. During the pandemic, LCCs also have worked on adding to their ancillary products which actually further allows travelers to buy in the services they require. Having these blocks of services and comfort that can be purchased allows people to keep traveling even in a challenging environment, giving them the options to buy what they desire. It won’t match a mainline experience, but giving travelers some freedom in making things as expensive or cheap as they want is key here.

So, which airlines are worthy of investment? That’s what I will lay out in this report. So, first of all I want to focus on the US low-cost carriers. Europe has a good number of LCCs as well, but I also would say that in Europe there’s a lot more concern on how consumers are going to cope with rising prices of day-to-day living to the extent that affording the primary needs becomes a challenge and even people with well paid jobs are feeling the pain.

The list of US LCCs part of this analysis are:

- Frontier Airlines (ULCC)

- Southwest Airlines (NYSE:LUV)

- JetBlue (JBLU)

- Sun Country Airlines (SNCY)

- Spirit Airlines (SAVE)

- Hawaiian Airlines (considered a low-cost carrier by some) (HA)

- Allegiant Travel Company (NASDAQ:ALGT)

Ruling Out Two Airlines

From the list of seven airlines, I will already rule out two airlines from the start. These airlines are JetBlue and Spirit Airlines. JetBlue is an airline that really hasn’t been able to manage their capacity problems well, I would say, and apart from that, the share prices of these two low-cost carriers are driven by their merger agreement which could take a long time to be finalized.

Which Airline Stock Has The Best Papers?

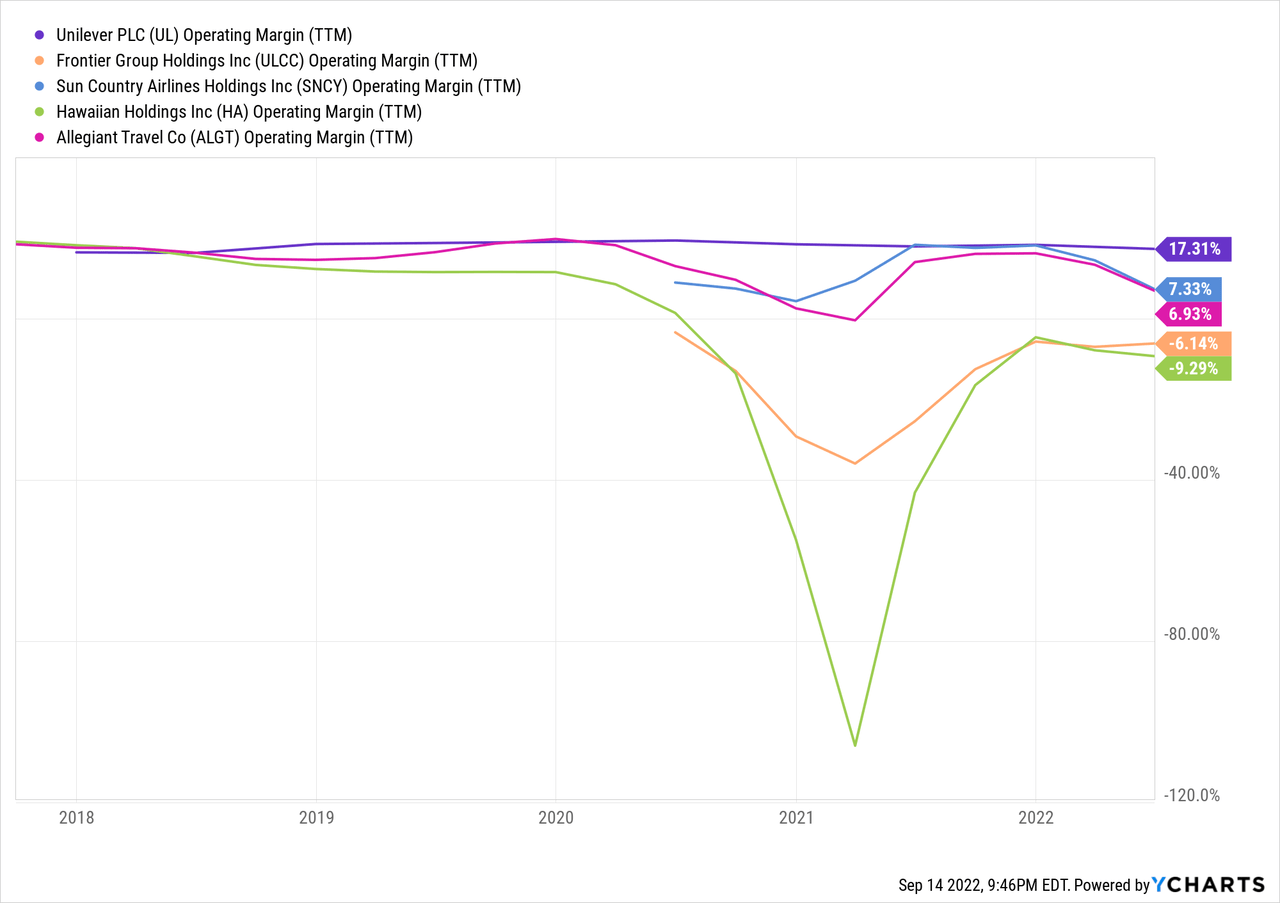

So, we are left with five airlines that we’re going to be reviewing on various metrics. The first of those metrics are the operating margins. It gives us insight in how profitable the airlines are now with past quarters experiencing unprecedented demand as well as pre-pandemic performance.

Margins pretty much show the V-shaped recovery that we have heard much about during the pandemic and this was most visible with Hawaiian Airlines. Prior to the pandemic the top three low-cost players in terms of margins were as follows:

- Allegiant Travel Company

- Southwest Airlines

- Hawaiian Airlines

Sun Country Airlines and Frontier Airlines started trading publicly during the pandemic, so there’s no pre-pandemic comparison there. In the recovery phase, things look as follows:

- Southwest Airlines

- Sun Country Airlines

- Allegiant Travel Company

So, we see that Allegiant Air Travel as well as Southwest Airlines have proven themselves prior to the pandemic as well as in the recovery phase. Sun Country Airlines also performed well in the recovery phase and the company benefits from a diversified business model including e-commerce driven freighter operations for Amazon (AMZN). Hawaiian Airlines did not make it into the top three and that can be attributed to the specifics for the airline. Tourism is big for Hawaiian Airlines and especially flights to and from Japan, and Japan has been a tough market as entry requirements were strict with a ban on individual tourists and a daily cap on incoming passengers. Relying a bit more on international travel, Hawaiian Airlines has lacked somewhat in the recovery but should definitely not be seen as the lesser airline.

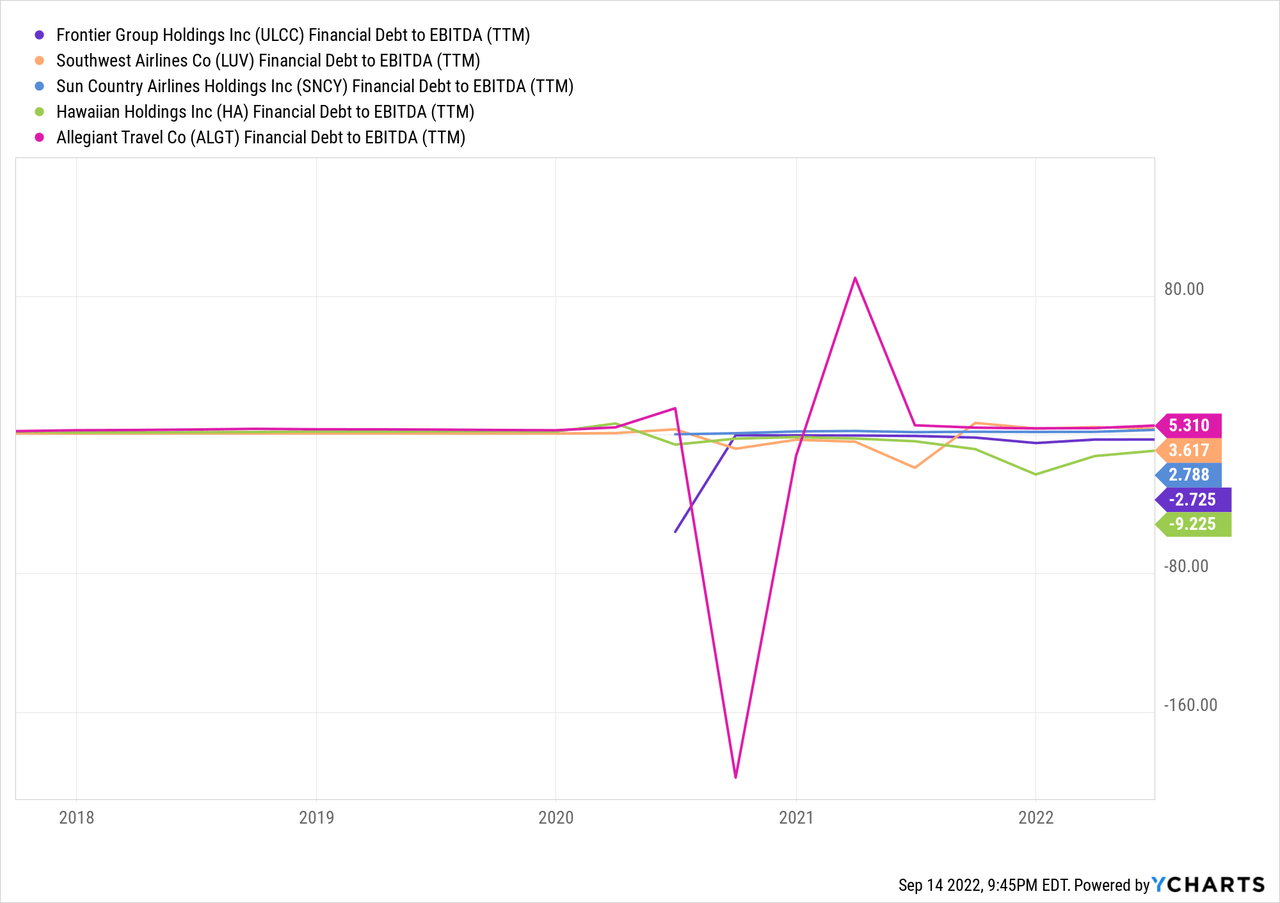

The next metric I find useful to take a look at is the debt-to-EBITDA. You could look at just the total debt levels, but that doesn’t take into account the scale of the airline. The debt-to-EBITDA tells us in an inverse way how much profit a company generates per unit debt or for the non-inversed metric how much debt a company has per unit earnings.

The five-year charge is a painful one to look at because Allegiant Travel Company stretches the axis in both directions, but prior to the pandemic the top three looked as follows (ranked from best to worse):

- Southwest Airlines

- Hawaiian Airlines

- Allegiant Travel Company

In the recovery phase things look as follows:

- Sun Country Airlines

- Southwest Airlines

- Allegiant Travel Company

In the pre-pandemic era Southwest Airlines was the only airline having a debt-to-EBITDA ratio lower than one and a debt-to-EBITDA up to roughly 1.5x or 2x is what I would consider to be good for airlines. Southwest Airlines and Hawaiian Airlines are the only airlines that would perform up to standard and in the recovery phase we see that metrics have deteriorated for obvious reasons as airlines increased debt to survive. The top three airlines are all having debt-to-EBITDA ratios in excess of 2.5 now, but the bottom two airlines are not even generating provides yet in the twelve-month trailing metric.

The next thing I want to have a look at is the credit rating:

|

Airline |

Fitch Rating |

|

Southwest Airlines |

BBB+ (Negative) |

|

Frontier Airlines |

N/A |

|

Hawaiian Airlines |

B- (Stable) |

|

Sun Country Airlines |

N/A |

|

Allegiant Travel Company |

BB- (Stable) |

It’s somewhat unfortunate that we have not been able to find a rating for Frontier Airlines and Sun Country Airlines. However, what’s clear is that Southwest Airlines is the only investment grade airline in the list. Hawaiian Airlines and Allegiant Travel Company both have non-investment grade ratings.

If we look at metrics, there’s one airline that consistently makes it into the top three in the pre-pandemic era as well as the recovery phase. That airline is Southwest Airlines. The airline that does not make it to any of the top three lists is Frontier Airlines. So, we can narrow the list from five airlines to four. The big question is which airline is going to be taking the second spot. I included Hawaiian Airlines in my assessment. Reality is that the airline has a bit of an identity crisis and doesn’t know whether to present itself as a low-cost carrier or not. So, I’m having somewhat of an issue with keeping Hawaiian Airlines on the list as well as it basically is an airline solely focused on Hawaii for tourists, which obviously in case of inflation and global economic challenges could negatively affect demand for what Hawaiian is primarily in business for. The nice thing about Sun Country Airlines is that’s a diversified business operating leisure-focused flights, cargo flights and special charters. Allegiant Travel Company focuses on the leisure travelers as well, but unlike Hawaiian Airlines it has a broader focus and not as diversified as Sun Country Airlines.

Winning Strategies or Not?

So, one thing that’s not completely captured is the airline strategy and exposure. That an airline scores well on the aforementioned metrics says something about the success of its strategy. So, I would say it’s not odd that we see Southwest Airlines in there. In previous reports, I already marked Southwest Airlines as one of the underappreciated airlines. The airline had the clearest plan on getting crews from the hiring process into the cabin and flight deck, which to me showed that the company knows what it’s doing and that the company knows what it’s doing is clear given its size unlocking scale advantages that other airlines do not have and might possibly never have.

The tougher choice is between Sun Country Airlines and Allegiant Travel Company. Personally, I’m charmed by the strategy from Sun Country Airlines which has a diversified business that also generates revenues from e-commerce growth via its cargo operations for Amazon. In Q2, I found the company’s choice to prioritize schedules services over contract charters a bit disheartening as the contract charters allow high fuel prices to be passed on to the contracting party, but given the high demand for air travel it’s also defendable.

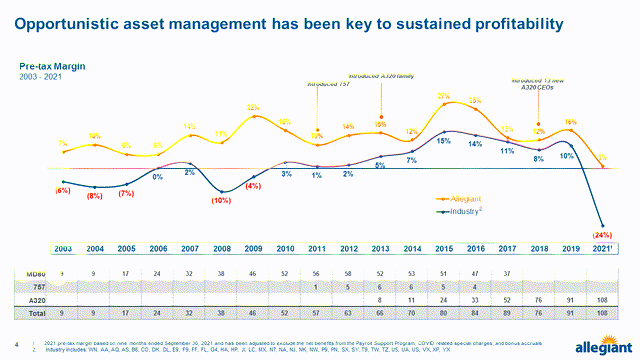

Allegiant Air Travel Fleet Strategy and Margins (Allegiant Air)

Allegiant Travel Company also serves the leisure market, and there are a couple of things I like about the company. The first thing I liked about the company is that it used the pandemic to grow capacity and that has enabled them to operate above pre-pandemic levels. The second element that I was particularly impressed with is its fleet strategy. The company is an all-Airbus operator and in the past has been quite cost efficient when attracting aircraft from Airbus. With each introduction of a new type of aircraft to its fleet it saw pre-tax margins improve significantly. The carrier selected the Boeing 737 MAX for its next leg of growth and cost efficiencies, which is a bold move given it’s an all-Airbus operator, but I have reviewed the company’s presentation on that end and the way Allegiant Air put that fleet decision together was nothing short of impressive. I’m invested in both jet makers, so I couldn’t care less about which jet maker Allegiant would select, but the process of how they got to their decision deserves credit and also to me shows that the airline is managed extremely well, which is what I’m looking for because the pressures faced today require skilled management. Additionally, Allegiant Air’s parent company will be opening a resort in 2023 solidifying its position as a leisure travel company and not just an airline.

Conclusion: Southwest Airlines and Allegiant Travel Company Are Winners on Strong Management Execution

Selecting airlines for investment with the current pressure faced on the global economy and in the airline industry itself is difficult. So, if you’re looking for investment in airline names you do need to take note of what is currently playing or might unfold in the future. I believe that low-cost carriers do offer an attractive high-risk/high-reward opportunity as travelers might be pushed to more cost-conscious airlines. What we’re currently facing and will be facing in the future requires strong past and current performance as well as skilled management. Southwest Airlines is the name that checked the boxes on all three and Allegiant Air Travel, despite its non-investment grade rating, also made it to the top of the list and its management is very capable in attracting the right aircraft at the right price to fit their business.

Initially, I was also charmed by Frontier Airlines. However, the company does not even make it into the top five of tested metric once.

Be the first to comment