Daniel Balakov

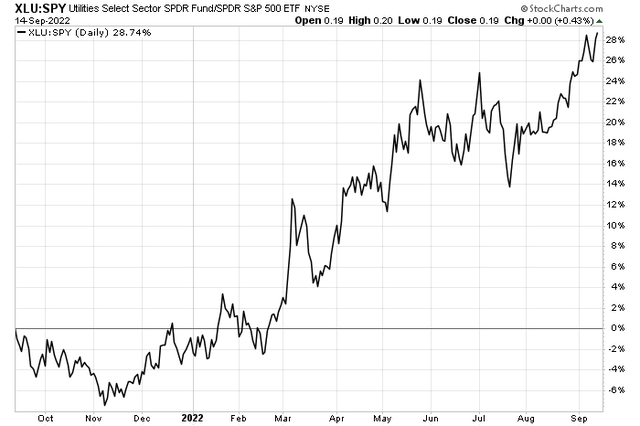

Utilities stocks keep working. The Utilities Select Sector SPDR ETF (XLU) broke out to fresh all-time relative highs versus the S&P 500 Trust ETF (SPY) earlier this week. The low-volatility, high-yield niche of the market, just 3.1% of the total U.S. stock market, according to iShares, has been a source of safety and even positive returns this year. XLU is up 9% in 2022 with dividends reinvested. One water utility company, however, is down more than 10% and trades at an expensive valuation.

Utilities Spike To Fresh Relative Highs

According to Bank of America Global Research, Essential Utilities (NYSE:WTRG) is a regulated water/gas firm providing water or wastewater services to 3 million customers in the states of PA, OH, TX, IL, NC, NJ, IN, and WV, with PA segment being the largest contributor to net income – along with a natural gas presence through the recently acquired Peoples Gas providing distribution services to 740,000 customers in PA, WV, and KY. BofA notes significant acquisition risk and the chance of poor regulatory developments.

Moreover, a lower valuation could be warranted based on the firm’s diversification into the natural gas space. Upside risks include the potential for more value-add acquisitions and positive changes to the highly-regulated Utilities sector.

The $12.3 billion market cap Water Utilities industry company within the Utilities sector trades at a high 27.5 trailing 12-month GAAP price-to-earnings ratio and pays just a 2.4% dividend yield, according to The Wall Street Journal.

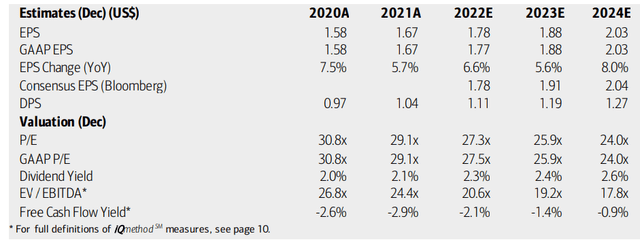

On valuation, analysts at BofA see earnings climbing at a steady rate through 2024, about in line with Bloomberg’s consensus forecast. WTRG’s dividend should rise commensurate with profit gains. Unfortunately, the valuation remains pricey on a forward-looking operating earnings basis. With moderate earnings growth and a high P/E, the stock’s PEG ratio is quite high. Its EV/EBITDA multiple is also at nosebleed levels while free cash flow is negative.

Essential Utilities: Earnings, Valuation, Dividend Forecasts

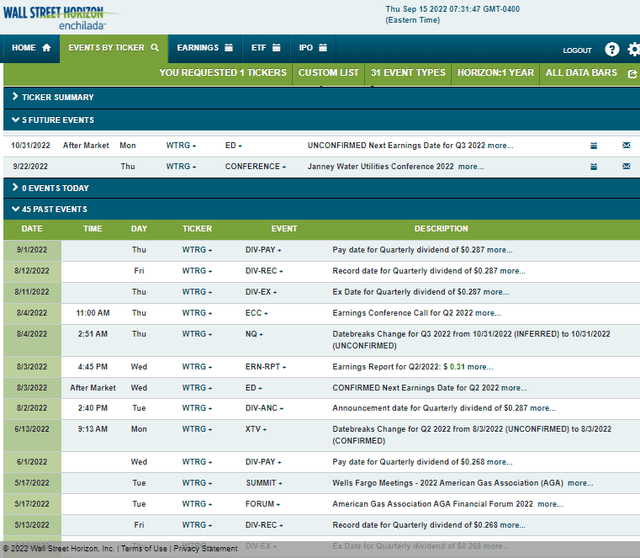

Looking ahead, WTRG is scheduled to present at the Janney Water Utilities Conference 2022 on Sept. 22. Essential Utilities’ management team is slated to speak, and share price volatility could come about next Thursday. Wall Street Horizon’s corporate event data also show an unconfirmed Q3 earnings date of Monday, Oct 31 AMC.

Corporate Event Calendar: Conference & Earnings

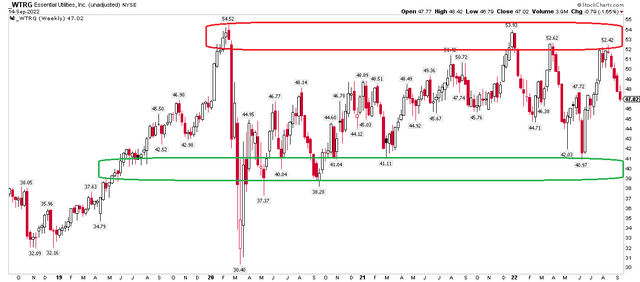

The Technical Take

Essential Utilities had been in a strong uptrend since the Great Financial Crisis. As a steady stock in a stable industry, investors were rewarded with a low-beta bullish company that also paid a decent yield for the times. Now, though, WTRG has simply traded sideways after while price action before and during the Covid Crash. Moreover, its dividend yield is now far below the rate on a 10-year U.S. Treasury note.

I see resistance in the $52 to $55 area, with support from $38 to $41. Investors should be mindful of this range. For now, buying on dips and selling into rallies looks like the wise play. Should the stock see a bullish breakout above $55, a measured move price objective to about $69 would trigger. On the downside, we can take that same range and subtract it from a breakdown point should that occur – the target would then be about $25.

WTRG Stock: A Stubborn Trading Range Within A Strong Sector

The Bottom Line

Investors should steer clear of Essential Utilities. An expensive valuation with unimpressive growth prospects makes for a bad fundamental combination. The technical chart also shows a pause in the stock’s uptrend. Meanwhile, a higher yield environment makes its 2.4% dividend rate paltry.

Be the first to comment