Olemedia/E+ via Getty Images

One of the worst performing stocks so far this year has been Coinbase (NASDAQ:COIN). The cryptocurrency firm has seen its shares lose roughly 80% with the fall in many virtual coins coinciding with a shift away from previously fast growing names. The latest leg down for the stock came after the company’s awful Q1 earnings report, but this particular drop has been caused by more than just investors exiting their positions.

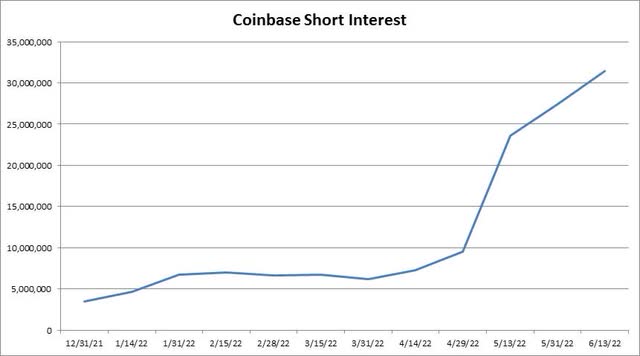

Coinbase reported a large revenue miss for the first three months of the year, and its sizable GAAP loss was a major surprise. With the company issuing weak trading guidance for Q2 and many cryptocurrencies seeing pain in recent months, investors have been placing huge bets against the name. In the chart below, you can see how short interest has surged so far this year, with the majority of this increase coming since that Q1 earnings report in the first third of May.

Coinbase Short Interest (NASDAQ)

At the end of April, there were roughly 9.5 million shares short, but just three bi-monthly updates later, the number was more than 31.4 million. As a reminder, the company’s latest 10-Q filing stated that as of May 3rd, there were roughly 173.7 million shares outstanding. Thus, more than 18% of the stock was short at the latest NASDAQ update, but that percentage rises to more than 23.5% if we look at float data.

For a company that was worth tens of billions of dollars earlier this year, that’s an incredible rise in short interest in such a short amount of time. Of course, it’s not hard for shares outstanding to rise when a stock drops like this, but let’s look at the big picture here. The dollar value of shares short was $1.635 billion at the mid-June update, up from $1.073 billion at the end of April, and nearly double the $885 million figure from the end of last year. Not only is the number of shares short surging currently, but more new money is betting against the stock.

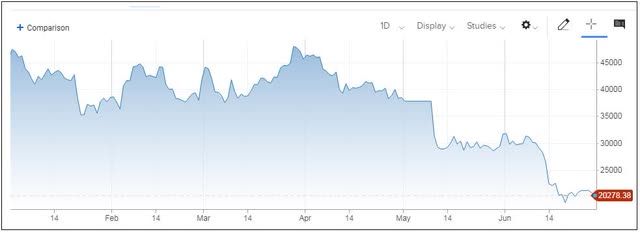

The interesting thing here is that while Coinbase warned of a weak Q2, that guidance was given before Bitcoin (BTC-USD) really dropped. As the chart below shows, the cryptocurrency was holding around $38,000 until that Q1 Coinbase report. However, not only did a leg down come then, but another one happened in the middle of this month. Bitcoin did fall below $20,000 recently, and it has been struggling to hold that level on Tuesday.

As bad as Bitcoin has done, there have been other virtual coins that have fallen even more from their highs. It would not surprise me to see even more pain in the crypto space in the coming months, as the Fed really starts to work on its quantitative tightening process. The market is expecting another 75 basis point rate hike at the July meeting, and the Fed has barely started to get its balance sheet down from its near $9 trillion peak. As that money gets pulled from the system, we could easily see Bitcoin drop again, especially if holders and firms that are leveraged to cryptos experience more pain.

This week, Goldman Sachs (GS) cut its rating on Coinbase to sell, while slashing its price target from $70 to $45. That price target that came out Monday morning implied around 28% downside from last Friday’s close, although the stock’s drop this week has narrowed that to about 12% on Tuesday. At one point in April 2021, the average price target on the stock was more than $501 per share, but that number currently sits at just $123. With revenue estimates plunging as seen in the graphic below, it would not surprise me to see more price target cuts come, especially once the company reports its Q2 results.

Coinbase Revenue Estimates (Seeking Alpha)

In the end, short interest in Coinbase has surged to new all-time highs in the past month and a half. Between a weak Q1 report and the continued fall in Bitcoin, investors are placing big bets against the name. It remains to be seen how weak the company’s quarter will actually be, especially if Bitcoin can’t hold the $20,000 level, but the June fall will also pressure early numbers for the Q3 period. With more Fed tightening coming up, it wouldn’t surprise me if shares tested their recent lows again, especially as we get more analyst estimate and price target cuts.

Be the first to comment